When you're buying a house, you'll hear the word "equity" thrown around a lot. At its heart, real estate equity is the portion of your property that you actually own. It’s the difference between what your home is worth today and the amount you still owe the bank.

Think of it as your financial stake in the property—a powerful asset that can grow substantially over time and become a cornerstone of your financial security. For new home buyers, understanding equity is the first step toward building long-term wealth through homeownership.

What Is Real Estate Equity

Equity is one of the most important concepts for any homeowner to understand. Imagine your home is a pie. The slice that belongs to the lender is your mortgage, and the slice you get to keep is your equity. As you pay down your loan and as your property's value appreciates, your slice of the pie gets bigger.

This isn't just a number on a spreadsheet; it's a tangible asset you can put to work. Understanding what equity is in real estate is the first step toward unlocking its potential for future investments, funding major renovations, or even consolidating other debts. It’s a key indicator of your financial health.

The Basic Formula for Equity

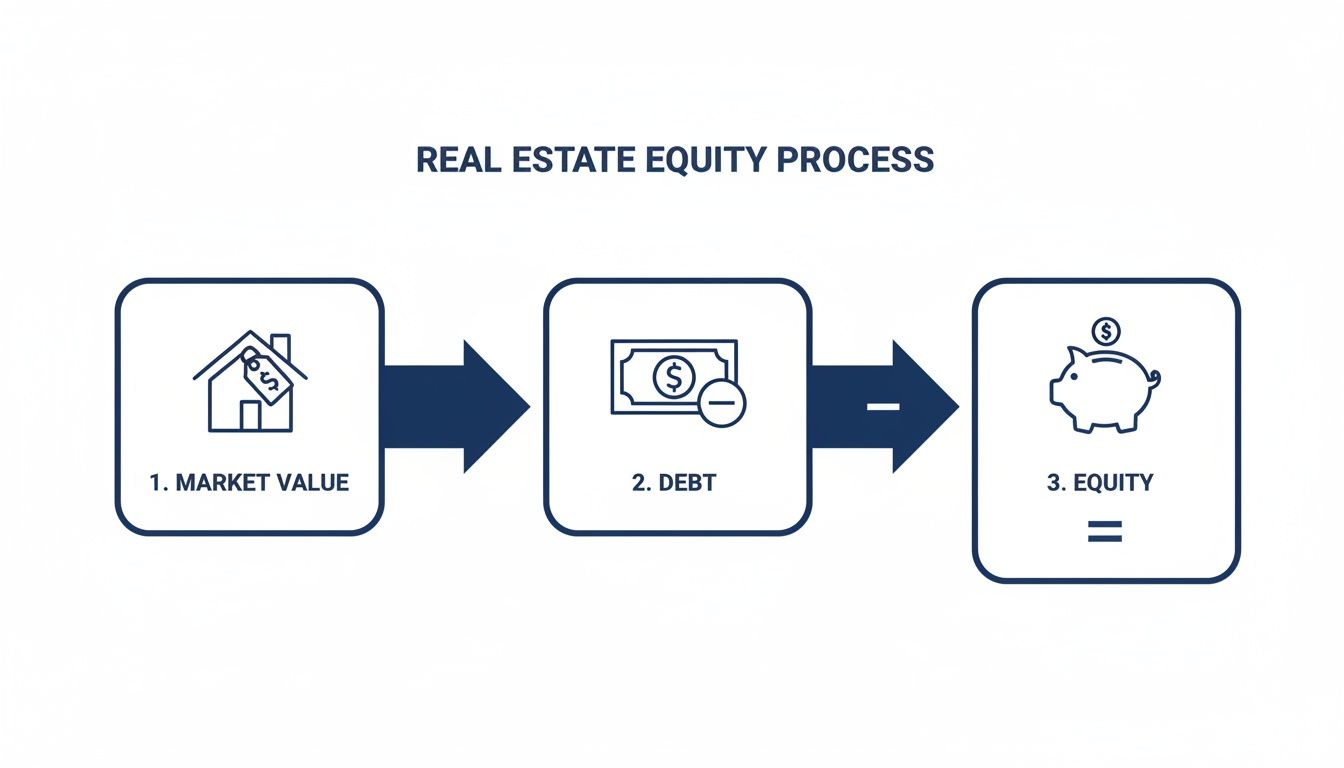

Calculating your home equity is refreshingly simple. You only need two key numbers to figure out where you stand:

- Current Market Value: What your property would realistically sell for in today's market.

- Outstanding Mortgage Balance: The total amount you still owe your lender.

The formula is as straightforward as it gets: Market Value - Mortgage Debt = Equity.

For example, if your home is valued at $400,000 and you owe $250,000 on your mortgage, you have $150,000 in equity. It's that simple.

The value of this equity has become more and more significant as property markets find their footing. After a rocky patch between 2022 and early 2024, the real estate sector has shown a strong recovery. In 2024, global real estate deal value grew by 11 percent to $707 billion, marking the first increase in three years. This rebound, driven by better financing options and solid returns, means equity positions for homeowners have grown nicely. You can read the full research on global private markets from McKinsey to learn more.

Understanding the Core Components

To truly master the concept of equity, it’s helpful to break down its main parts. Each piece of the puzzle plays a specific role in calculating your total ownership stake.

Here’s a quick look at the three essential elements that make up your equity calculation.

The Core Components of Real Estate Equity

| Component | Definition | Example |

|---|---|---|

| Market Value | The estimated price your property would sell for in the current real estate market. | Your home is appraised at $500,000 based on recent sales of similar homes in your neighborhood. |

| Mortgage Debt | The total outstanding balance you still owe to your lender, including principal and any accrued interest. | After several years of payments, your remaining mortgage balance is $300,000. |

| Equity | The portion of the property's value that you own outright, calculated by subtracting debt from value. | With a $500,000 market value and $300,000 in debt, your total equity is $200,000. |

Breaking it down this way makes it easy to see how paying down your mortgage or an increase in your home's value directly translates into more wealth in your pocket.

Calculating Your Home Equity Step By Step

Figuring out your home equity isn't just for Wall Street types; it's a practical number every single homeowner should have in their back pocket. The good news? It's surprisingly simple to calculate and gives you a real-time snapshot of your financial position.

At its core, the math only requires two numbers: what your property is worth today and how much you still owe on it.

Think of it this way: your equity is the portion of your property you actually own, free and clear of any debt.

This simple visual nails the concept. Your market value minus your debt is what reveals your true ownership stake in the property.

The Homeowner Equity Calculation

For a typical homeowner, the process is clean and straightforward. Let’s walk through it with a quick example.

Step 1: Determine Your Home's Current Market Value

This isn't what you paid for the house—it's what you could sell it for right now. There are a few solid ways to pin down this number:

- Professional Appraisal: This is the gold standard. A licensed appraiser gives you the most accurate valuation based on a physical inspection and market data.

- Comparative Market Analysis (CMA): A real estate agent can pull recent sales of similar homes in your neighborhood (known as "comps") to create a CMA. This is a very reliable method.

- Online Valuation Tools: Zillow and Redfin can provide a quick ballpark estimate, but take these numbers with a grain of salt. They're a good starting point, not a final answer.

A huge part of getting an accurate market value is finding free real estate comps, as these recent sales are what truly define your property's worth.

Step 2: Find Your Outstanding Mortgage Balance

This is the easy part. Just log into your mortgage lender's website or grab your latest statement. The number you're looking for is the remaining principal balance.

Step 3: Do the Math

Now, you just plug those two numbers into the fundamental equity formula.

Formula: Current Market Value – Outstanding Mortgage Balance = Home Equity

Let's put it into action. Say your home's current market value is $450,000, and you have $280,000 left on your mortgage.

- $450,000 (Market Value) - $280,000 (Mortgage Balance) = $170,000 (Your Equity)

Boom. In this scenario, you're sitting on $170,000 in home equity. It’s that simple.

The Investor Equity Calculation with ARV

For real estate investors, especially those deep in the fix-and-flip game, the calculation gets a bit more interesting. We don't just look at the current value; we project the future value. This is where the After-Repair Value (ARV) comes in.

ARV is the estimated value of a property after you’ve completed all the planned renovations. It’s the cornerstone of a successful flip. If you need a refresher, our guide on how to assess property value covers ARV in detail.

Here’s how an investor calculates their potential equity position:

- Estimate the After-Repair Value (ARV): Project what the property will sell for once the work is done.

- Calculate Total Debt: This isn't just the purchase loan. You have to add in the financing for the rehab costs, too.

- Project Your Equity: Subtract that total debt from your ARV.

Example for a Fix & Flip:

Let’s run the numbers on a potential deal.

- Purchase Price: $200,000

- Estimated Rehab Costs: $50,000

- Projected After-Repair Value (ARV): $325,000

- Total Loan (Purchase + Rehab): $250,000

Now, we calculate the projected equity, which is essentially your potential gross profit.

$325,000 (ARV) - $250,000 (Total Loan) = $75,000 (Projected Equity/Profit)

This forward-looking math is exactly how smart investors use platforms like Flip Smart to analyze deals. It’s not just about what a property is worth today, but what it can be worth tomorrow.

Exploring The Different Types of Real Estate Equity

Real estate equity isn’t some static number on a balance sheet; it’s a living asset that grows in a few distinct ways. Think of it like a tree—it grows from both its roots deep in the ground and its branches reaching for the sun. Your equity works the same way, expanding through your direct efforts and the market conditions around you.

Let's break down the four main types so you can see the whole picture.

Earned Equity: The Slow and Steady Builder

Earned equity is the simplest and most reliable type you'll build. It’s the portion of your property you own because you’ve paid down your mortgage principal. Every single month, when you make that mortgage payment, you're chipping away at the debt and boosting your ownership stake.

This is the foundation of your financial house. It isn't flashy, but it's rock-solid. As long as you keep making payments, you're building earned equity. It's a guaranteed process.

The best part? You have direct control here. You can accelerate its growth by making extra payments or switching to a bi-weekly payment schedule. This strategy pays off your loan faster and can save you thousands in interest over time.

Appreciation Equity: Riding the Market Wave

Appreciation equity, sometimes called market equity, is the value your property gains simply because real estate prices are rising in your area. This is almost entirely passive growth—you don't have to lift a finger on the property itself to earn it.

So, what drives this kind of growth?

- A Strong Local Economy: When jobs are plentiful and businesses are thriving, more people want to buy homes.

- Neighborhood Development: New schools, cool parks, or convenient shopping centers can instantly make an area more desirable.

- Supply and Demand: It's simple economics. When there are more buyers than homes for sale, prices naturally go up.

While appreciation can create some serious wealth, it's also the least predictable. Markets can and do shift. It's a powerful force, but it’s one you can't directly control.

Forced Equity: Creating Your Own Value

This is where you take matters into your own hands. Forced equity is the value you actively create by making smart, strategic improvements to your property. Unlike appreciation, which depends on the market, forced equity is a direct result of your own sweat and investment.

By renovating a dated kitchen, remodeling a bathroom, or adding a bedroom, you can increase the home's market value by more than what you spent on the project. That's the key.

Real-World Example: Let's say you spend $30,000 on a full kitchen remodel. An appraiser comes in and determines the new kitchen increased your home’s value by $50,000. You just successfully "forced" $20,000 in new equity.

This is the core strategy for any fix-and-flip investor. They buy undervalued properties, renovate them, and sell for a profit based on the forced equity they created.

Negative Equity: When You Owe More Than It's Worth

Finally, there's the one nobody wants: negative equity. This is when you're "underwater" on your mortgage, meaning your property's market value has dropped below what you still owe on the loan.

For example, imagine a housing market downturn. The home you bought, once valued at $400,000, is now only worth $350,000. If you still owe $375,000 on the mortgage, you have $25,000 in negative equity.

It's a tough spot to be in, making it almost impossible to sell or refinance without bringing your own cash to the closing table. This usually happens during sharp market corrections, but it’s not a permanent trap. Over time, as you continue to pay down your loan and the market recovers, you can climb back out.

Proven Strategies to Increase Your Property Equity

Knowing what real estate equity is marks the starting line; actively growing it is how you win the race. It's time to move from theory to action. You can use several proven strategies to build your ownership stake faster and take real control of your financial future.

Whether you prefer a hands-off approach or you're ready to get your hands dirty, there’s a path forward for you. These strategies range from simple financial discipline to smart property upgrades, each designed to kickstart your wealth-building journey.

Pay Down Your Mortgage Faster

One of the most dependable ways to pump up your equity is to simply pay down your mortgage principal ahead of schedule. Since equity is just the gap between what your home is worth and what you owe, every extra dollar you throw at the principal directly beefs up your ownership.

There are a few no-nonsense ways to make this happen:

- Make Bi-Weekly Payments: Instead of one monthly payment, split it in half and pay that amount every two weeks. This simple trick results in 13 full monthly payments a year instead of 12, which can literally shave years off your loan.

- Add a Little Extra Each Month: Even an extra $50 or $100 a month makes a huge difference over the life of the loan. Just make sure you tell your lender to apply the extra cash directly to the principal.

- Use Windfalls Wisely: Get a bonus at work or a tax refund? Instead of blowing it, apply that cash directly to your mortgage principal for a serious equity injection.

This method is so powerful because it builds earned equity in a methodical and predictable way, cutting down your debt and saving you a ton of money in interest over time.

Make Smart, High-ROI Home Improvements

While chipping away at your loan is a passive strategy, strategic renovations are how you actively create forced equity. The name of the game is choosing projects that add more value to your home than they cost to complete.

Heads up: not all renovations are created equal. Focus on the improvements that buyers consistently pay a premium for.

Gaining a clear handle on understanding kitchen remodel costs is a critical first step for planning an upgrade that actually grows your home's equity.

Pro Tip: Zero in on kitchens, bathrooms, and curb appeal. These are the areas that consistently deliver the highest return on investment, often getting you back a huge chunk—or even more than—what you spent when it’s time to sell.

High-impact projects that almost always pay off include:

- Minor Kitchen Remodels: Think new countertops, modern appliances, and refacing cabinets.

- Bathroom Upgrades: Swapping out fixtures, vanities, and old tile can make a dated space feel brand new.

- Curb Appeal Enhancements: A fresh coat of paint, some new landscaping, or an updated front door creates a killer first impression.

- Adding Square Footage: Finishing a basement or building a deck increases your usable living space, which is a direct value-add.

These improvements can directly boost your property’s After-Repair Value (ARV). For a deeper look into this crucial metric, check out our guide on what ARV means in real estate.

Be Strategic in a Shifting Market

Just waiting for the market to go up isn’t a strategy—but understanding market dynamics is. The real estate market is currently in what you might call a selective recovery. This means growing your equity now requires more active management than just sitting back and waiting for prices to rise.

While some sectors have cooled, value-add funds recently raised $24.6 billion from international investors. This is a massive signal that there’s a strong appetite for properties where investors can force equity through smart improvements. It proves that investors who strategically choose their properties and their projects are the ones best positioned to build wealth right now.

By combining consistent debt reduction with smart, value-adding improvements, you create a powerful one-two punch for building your property equity and securing your financial future.

How to Access and Use Your Real Estate Equity

Once you've built up some serious equity in a property, it stops being just a number on paper and turns into a powerful financial tool. It’s no longer just a measure of your ownership—it's a real asset you can tap into to fund other goals, whether that’s renovating your kitchen or buying another investment property.

Think of it as a savings account you’ve been building inside the walls of your house, ready to be put to work.

But accessing this wealth isn't as simple as withdrawing cash from an ATM. It almost always means taking on a new loan that uses your home as collateral. Understanding the different ways to do this is critical for making a smart financial decision that actually lines up with your goals.

Let's break down the most common methods available to homeowners.

Home Equity Line of Credit (HELOC)

A Home Equity Line of Credit (HELOC) functions a lot like a credit card. Instead of getting a lump sum of cash, your lender approves you for a revolving line of credit up to a certain limit based on your equity. You can draw funds as needed during a specific "draw period," and you only pay interest on what you actually borrow.

This flexibility makes a HELOC an excellent choice for ongoing projects with unpredictable costs, like a big renovation, or simply for having an emergency fund on standby.

- Key Feature: Revolving credit line you can borrow from and pay back repeatedly.

- Interest Rate: Typically a variable rate, meaning your payments can fluctuate.

- Best For: Ongoing expenses, home improvement projects, or a financial safety net.

Home Equity Loan

A Home Equity Loan, sometimes called a second mortgage, is much more straightforward. If you’re approved, you get the full loan amount in one single payment. You then pay it back over a fixed term with a fixed interest rate, which means your monthly payment never changes.

That predictability is its biggest advantage. Home equity loans are perfect for large, one-time expenses where you know the exact cost upfront, like consolidating high-interest debt or funding a down payment.

Quick Takeaway: A HELOC offers flexibility with a variable rate, while a Home Equity Loan provides stability with a fixed rate and a lump-sum payment. Choose the one that best matches how you plan to use the money.

Cash-Out Refinance

A cash-out refinance works a bit differently. Instead of taking out a second loan, you replace your current mortgage with a new, larger one. You then get the difference between the new loan amount and your old mortgage balance in cash.

For instance, if your home is worth $500,000 and you owe $250,000, you might refinance for a new $350,000 mortgage. You'd use $250,000 to pay off the old loan and walk away with the remaining $100,000 in cash. This can be a fantastic option if you can also lock in a lower interest rate on your new mortgage.

Comparing Your Options for Accessing Home Equity

Deciding which product is right for you depends entirely on your financial situation and what you plan to do with the money. Here’s a quick comparison to help you weigh the pros and cons of each method.

| Method | How It Works | Best For | Key Consideration |

|---|---|---|---|

| HELOC | A revolving line of credit you can draw from as needed. | Ongoing projects with uncertain costs (e.g., renovations, emergency funds). | Interest rates are typically variable, so payments can change. |

| Home Equity Loan | A one-time lump sum of cash paid back over a fixed term. | Large, fixed expenses (e.g., debt consolidation, tuition). | You get a predictable fixed interest rate and stable monthly payments. |

| Cash-Out Refinance | Replaces your existing mortgage with a new, larger one, and you get the difference in cash. | Accessing a large amount of cash, especially if you can get a lower mortgage rate. | You are resetting your mortgage term, which could mean paying for a longer period. |

Ultimately, the best choice connects directly to your goals. For unpredictable project costs, a HELOC offers unmatched flexibility. For a known, one-time expense, the stability of a home equity loan is hard to beat. And for accessing a large sum while potentially improving your mortgage rate, a cash-out refi is a powerful option.

Leveraging Equity for Investment Properties

For real estate investors, equity is the fuel for growth. A classic strategy is to pull equity from a stable, appreciated property to fund the down payment on the next one. This is the engine behind scaling a portfolio without having to save up a pile of cash for every new purchase.

It's a core component of powerful strategies like the BRRRR method. To see how that works in detail, you can learn all about what the BRRRR method is and how it works in our guide.

However, it's crucial to approach this with your eyes open. Using your primary residence or another rental as collateral absolutely introduces risk. If the new investment doesn't pan out, you could jeopardize your existing assets. Always run the numbers carefully and make sure the potential returns justify the risk you're taking on.

Why Home Equity Is a Cornerstone of Financial Security

Building equity in your home is way more than just a real estate checkbox—it’s one of the most fundamental pillars of long-term financial stability. Think of your equity as a personal wealth-building engine. Every mortgage payment you make and every bit your property value grows adds fuel to an asset that can genuinely shape your entire financial future.

This asset works as both a shield and a launching pad.

When times get tough, your home equity can be a critical safety net. It can give you access to funds for an unexpected medical bill or job loss, providing a cushion that other investments just can't offer. That security brings a peace of mind that’s hard to put a price on.

But beyond being a defensive tool, equity is an incredible vehicle for growth. You can tap into it to fund other major life goals, whether that's paying for a child’s education, starting a business, or even buying another investment property. It becomes a flexible resource you can deploy to jump on opportunities and build even greater wealth over time.

Tying It All to the Broader Market

Your personal equity story doesn't happen in a vacuum; it’s directly connected to the wider real estate market. A healthy property market reinforces your own financial position, creating a positive cycle of growth. And recent trends show that this connection is as strong as ever, with property values stabilizing and growing on a global scale.

In fact, global private real estate values have now climbed for five consecutive quarters, with returns turning positive across 21 countries in Q2 2025. This widespread stabilization gives property owners much more confidence when they look at their home's value and their own equity position. It’s a clear signal that now is a great time to understand your asset's true potential. You can dive deeper into these insights in Nuveen's 2025 global real estate trends report.

This positive market momentum means the equity you're building is supported by a stable and appreciative environment, which just amplifies the impact of every payment and improvement you make.

Key Takeaways for Building Your Financial Future

Understanding what equity is in real estate is the first real step on a powerful journey. Once you grasp this concept, you stop being just a homeowner and start becoming an active participant in building your own wealth.

Let’s quickly recap the essentials:

- What Equity Is: It’s your true ownership stake in your property—the market value minus whatever you still owe.

- How to Calculate It: Simply subtract your mortgage balance from your home’s current market value. Simple as that.

- How to Grow It: Keep making those mortgage payments, throw a little extra at the principal when you can, and invest in smart, high-ROI home improvements.

By mastering these principles, you transform your home from just a place to live into one of your most powerful financial assets. Equity is your tool for creating security, seizing opportunities, and achieving your most important life goals.

Frequently Asked Questions About Home Equity

We've covered the what and the how of real estate equity. Now, let's tackle the questions that pop up most often for new home buyers. Getting these answers straight will give you more confidence as you start your homeownership journey.

How long does it take to build a good amount of equity in a house?

There's no single magic number, but a common timeline to build a meaningful amount of equity is around five to seven years. In the early years of a typical mortgage, most of your payment goes toward interest, so you build equity slowly. As you get further into the loan, more of each payment goes to the principal, and your equity grows faster. Market appreciation is the wild card—if home values in your area rise quickly, you'll build equity much faster.

Can you lose the equity you've built in your home?

Yes, unfortunately, it is possible to lose home equity. The most common cause is a significant downturn in the housing market. If property values in your area fall, your home could become worth less than you owe on the mortgage. This is often called being "underwater" or having "negative equity." You can also reduce your own equity by taking on more debt, like a home equity loan or HELOC, which increases the amount you owe against the property.

What is a good loan-to-value (LTV) ratio for a homeowner?

A great goal for homeowners is to reach a loan-to-value (LTV) ratio of 80% or lower, which means you have at least 20% equity in your home. Hitting this 20% equity milestone is important because it's typically the point where you can request to cancel your Private Mortgage Insurance (PMI) on a conventional loan. Removing PMI can lower your monthly mortgage payment, saving you a significant amount of money.

To build equity, should I focus on paying my mortgage down faster or on home improvements?

This is a great question that depends on your personal goals and risk tolerance. Paying down your mortgage is the safer, guaranteed way to build equity. Every extra payment reduces your debt and saves you money on interest. Making home improvements has the potential for a higher, faster return—a smart renovation can add more value than it costs—but it comes with risks. If your primary goal is financial stability and becoming debt-free, focus on the mortgage. If you're comfortable with project management and want to increase your home's value quickly for a potential sale or refinance, strategic renovations may be the better choice.

Ready to stop guessing and start analyzing properties with precision? Flip Smart gives you the tools to calculate ARV, estimate rehab costs, and project your potential equity in seconds. Make your next investment your best one. Analyze your first deal for free at flipsmrt.com.