Figuring out what a home is really worth is the first, most critical step in the home-buying process. It’s about more than just a sticker price—it’s about digging into the data to determine a property's fair market value. This is your shield against overpaying and your sharpest tool for uncovering a great deal, ensuring you make a smart, confident investment.

Why Understanding Property Value Is Your Smartest First Step

Before you even think about making an offer, you need to understand property valuation. Getting this wrong could mean overpaying by thousands. Getting it right sets the foundation for a sound financial decision, whether it's your forever home or an investment property.

Think of it like looking at a property through three different lenses. Each one gives you a unique perspective on its true worth. Professionals don't just use one; they combine all three to build a complete, defensible picture of a property's value.

The Three Core Valuation Methods

The world of professional real estate appraisal boils down to three fundamental approaches. Once you get the hang of these, you'll be able to analyze any property with confidence.

The Sales Comparison Approach (Comps): This is the go-to method for residential homes. It answers a simple question: "What are similar homes in this exact area actually selling for right now?" You’ll pull recent sales of comparable properties—similar in size, condition, and location—to nail down a fair market price.

The Income Approach: For investment properties, this one is essential. It values a property based on its ability to generate rental income. Here, you're asking, "How much cash flow can this property generate?" This is crucial for duplexes, multi-family homes, or any property you plan to lease.

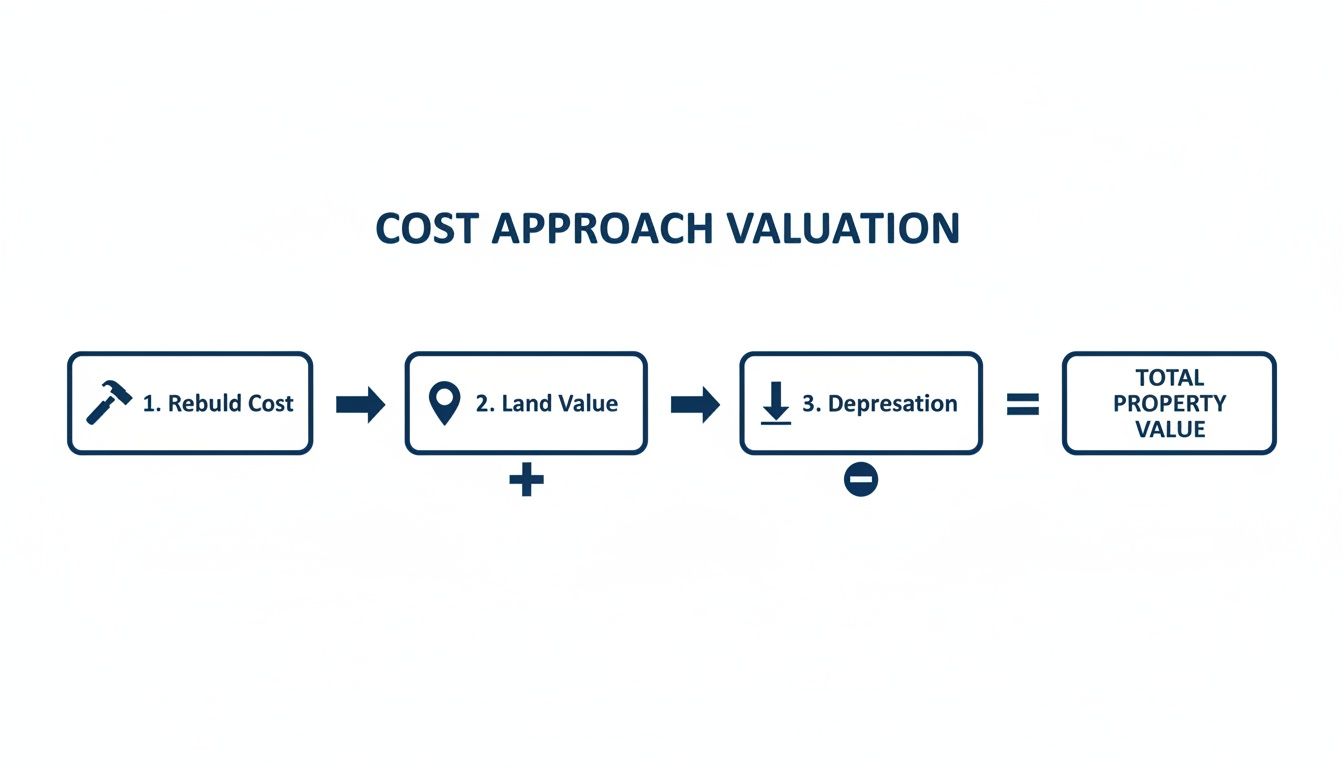

The Cost Approach: This method is most useful for new construction, unique custom homes, or properties needing a major renovation. It asks, "What would it cost to build this exact property from scratch today, including the land?"

Quick Takeaway: Relying on just one valuation method is like trying to navigate with a torn map. A solid assessment pulls insights from all three approaches, giving you a clear price range to guide your offer and strengthen your negotiations.

We’re about to break down each of these methods with practical, step-by-step guidance. You'll learn how to find and adjust comps like a pro, calculate potential rental income, and estimate rehab costs—transforming you from an uncertain buyer into an informed one.

Using Comps to Find a Home's Market Value

When you need to figure out what a home is really worth, the most reliable method is surprisingly straightforward: a property is worth what someone just paid for a similar one nearby. This is the core idea behind the comparable sales approach—or as real estate pros call it, "running the comps." It's the most direct way to get a pulse on the current market.

The process kicks off by comparing your target property to nearly identical homes that have recently sold nearby, then adjusting for any differences in size, condition, or features. This isn't just theory; it's how professional appraisers do it because it reflects what real buyers are willing to pay right now.

With real estate transaction volumes hitting $739 billion over the last year—a 19% year-over-year jump—there's a ton of fresh sales data out there. This buyer activity is exactly what appraisers and smart buyers use to nail down a property's value. To learn more about this process, you can find a helpful comparative market analysis template to guide your research.

Finding the Right Comps

Not every sold house is a good comp. To get a valuation you can actually trust, your comps have to be genuinely comparable. Getting this wrong can throw your entire financial picture out of whack.

Here’s a practical checklist for finding good comps:

- Location: The closer, the better. Stick to the same subdivision or neighborhood if you can, and almost never go more than a half-mile out. A house on the other side of a major road might as well be in a different city when it comes to value.

- Sale Date: Markets change fast. Only look at sales from the last three to six months. Anything older is history and doesn’t reflect what today’s buyers are thinking.

- Size and Layout: Find homes with similar square footage (within 10-15%), the same number of bedrooms, and the same number of bathrooms. A 1,500 sq. ft. ranch is not a good comp for a 3,000 sq. ft. two-story colonial.

- Age and Condition: A freshly renovated home is going to sell for a premium over a dated fixer-upper, even if they're next-door neighbors. Match the overall condition and age as closely as possible.

Your real estate agent is your best source for this info through the Multiple Listing Service (MLS), but you can also dig through public records on county assessor websites or major real estate portals.

The Art of Making Adjustments

You'll almost never find a perfect, apples-to-apples comp. This is where you have to make adjustments by assigning a dollar value to the differences between your target property and the sold comps.

Think of it this way: if your house has a two-car garage but a comp only has one, you need to add value to the comp's sale price to make it equivalent. Conversely, if a comp boasts a brand-new kitchen and yours is stuck in the 1980s, you need to subtract value from its sale price.

Pro Tip: Never adjust based on the cost of an upgrade. What matters is its market value. That $30,000 bathroom remodel might only add $15,000 in the eyes of a typical buyer. Your agent can help you understand the local market value of different features.

Let's run through a quick example. Say your target property is a 3-bed, 2-bath, 1,800 sq. ft. house. You find a nearby comp that just sold for $450,000.

- Comp Details: It's a 3-bed, 2-bath, but it's 1,900 sq. ft. (100 sq. ft. larger).

- Condition: The comp has a fully remodeled kitchen, while yours is dated.

- Features: It also has a screened-in porch, which your property lacks.

To make it a fair comparison, you have to subtract value from the comp's sale price for its superior features. If extra square footage is valued at $150/sq. ft. in that market, you’d subtract $15,000. A kitchen remodel might add $20,000 in value, and the porch another $10,000. So, the adjusted value of this one comp becomes $405,000 ($450,000 - $15,000 - $20,000 - $10,000).

While comps often focus on the house itself, don't forget curb appeal. Great landscaping can seriously boost a property's perceived value. For some modern ways to improve a home's exterior, check out these AI Landscape Design Ideas.

After adjusting at least three solid comps, you can average their values to land on a strong, data-backed estimate for your target property.

Valuing a Property Based on Its Income Potential

When you're buying a property to generate cash flow, the value isn't just about what similar homes sell for. It’s about how much money it can put in your pocket, month after month. This is where the income approach becomes your most important tool. For investors, this method is non-negotiable because it looks past the cosmetic appeal and assesses a property's worth based purely on its ability to make you money.

This valuation method is especially powerful right now. As the global house price-to-income ratio continues to climb—another 0.5% in the first quarter of 2025—more people are forced to rent for longer. This trend, coupled with a significant housing shortage, keeps rental demand strong and makes the income approach more relevant than ever.

Calculating Net Operating Income (NOI)

First things first: before you can value an income property, you have to figure out how much it actually profits in a year. This number is called Net Operating Income (NOI). It’s the total income the property brings in, minus all the day-to-day operating expenses—before you factor in your mortgage payment.

Think of NOI as the property's annual salary. The formula is simple:

Gross Rental Income - Operating Expenses = Net Operating Income (NOI)

Let's unpack those terms in simple language:

- Gross Rental Income: This is the absolute maximum rent you could collect if the property were 100% occupied all year long. You need to be realistic here, so research current market rents for similar units in the neighborhood.

- Operating Expenses: These are all the necessary costs to keep the property running smoothly. This bucket includes property taxes, landlord's insurance, property management fees (even if you self-manage, your time is worth something!), routine maintenance, repairs, any utilities you cover, and a vacancy allowance (typically 5-10% of gross income).

Crucial Tip: Never take the seller's expense numbers at face value. Always do your own research. Ask for copies of utility bills, tax statements, and maintenance records. Underestimating expenses is one of the quickest ways to watch a promising investment turn into a financial headache.

To see how this works in practice, let's look at a sample calculation for a duplex.

Sample Net Operating Income (NOI) Calculation for a Duplex

| Income/Expense Item | Monthly Amount | Annual Amount |

|---|---|---|

| Gross Rental Income | $3,000 | $36,000 |

| Property Taxes | $333 | $4,000 |

| Insurance | $125 | $1,500 |

| Vacancy Allowance (5%) | $150 | $1,800 |

| Maintenance & Repairs (8%) | $240 | $2,880 |

| Property Management (8%) | $240 | $2,880 |

| Total Operating Expenses | $1,088 | $13,060 |

| Net Operating Income (NOI) | $1,912 | $22,940 |

As the table shows, after accounting for all the real-world costs of owning the property, the duplex generates a profit of $22,940 for the year. This NOI figure is what we'll use to determine the property's value.

Understanding the Cap Rate

So, you have your NOI—the property's annual profit. How do you turn that number into a concrete valuation? That's where the Capitalization Rate (Cap Rate) comes in. The cap rate is essentially the rate of return you'd get on a property if you paid all cash.

Expressed as a percentage, the formula is:

NOI / Current Market Value = Cap Rate

A higher cap rate often signals a higher potential return, but it usually comes with higher risk. A lower cap rate, on the other hand, usually implies lower risk (like a well-maintained building in a prime neighborhood) but also a lower return. To figure out the right cap rate for your market, talk to local real estate agents, appraisers, and other investors active in the area. You can also dig deeper and learn more about how to determine the cap rate for a rental property.

Putting It All Together: A Duplex Example

Now we can connect the dots. By rearranging the cap rate formula, we can find the property's value based on its income.

Property Value = NOI / Cap Rate

Let's use the duplex numbers from our NOI calculation. Imagine each unit rents for $1,500 per month.

Calculate Annual Gross Income:

- $1,500/month x 2 units = $3,000/month

- $3,000/month x 12 months = $36,000

Estimate Annual Operating Expenses:

- Total Expenses = $13,060 (from our table above)

Calculate NOI:

- $36,000 (Gross Income) - $13,060 (Expenses) = $22,940 (NOI)

Determine Property Value:

- After checking with a few local agents, you learn that the average cap rate for similar duplexes in this neighborhood is 6% (or 0.06).

- Value = $22,940 / 0.06 = $382,333

This $382,333 represents the property's value based solely on its income-generating power. Now you have a hard number to compare against the seller's asking price and the value you got from your comps analysis, allowing you to make a truly data-driven decision. If you're managing short-term rentals, you can explore more advanced strategies in a comprehensive guide to vacation rental revenue management to maximize your income potential.

When to Use the Cost Approach for Valuation

What happens when you can't find any solid comps and the property isn't a rental? This is a common situation with one-of-a-kind homes, brand-new construction, or properties that need a complete overhaul.

The answer is the cost approach. This valuation method boils everything down to a single question: What would it cost to build this exact property from the ground up, today?

This is your go-to tool when other methods just don't fit. You'll find yourself relying on it for:

- New Construction: A brand-new home has no sales history. The most logical starting point for its value is what it cost to build.

- Unique or Custom Homes: Think about a home with unusual architecture or highly specific features. These properties almost never have direct comparables, making the cost approach essential.

- Major Fixer-Uppers: When you're looking at a property that needs a complete gut job, this method helps ensure your total investment doesn't exceed its future market value.

The cost approach is more relevant than ever in the current market. The core idea is simple: land value plus the replacement cost of the building, minus any depreciation. This is the bedrock formula for pricing new builds and estimating the after-repair value (ARV) on a flip.

With supply constraints expected to continue into 2025, a deep understanding of construction costs is vital. In fact, research from J.P. Morgan highlights that the number of new U.S. homes for sale is at its highest point since 2007—a full 50% above historical averages. This trend ties directly back to the importance of the cost approach. You can get more details from the U.S. housing market outlook from J.P. Morgan.

Breaking Down the Cost Approach Formula

At its heart, the formula is refreshingly logical. It’s just three parts added or subtracted to give you a solid valuation.

Value = Cost to Rebuild + Land Value - Depreciation

Let's pull each of those pieces apart so you can use this on your next deal.

Estimating the Cost to Rebuild

This is the biggest piece of the valuation puzzle. You need a realistic estimate of what it would cost—using today's labor and material prices—to construct a similar building on that lot.

Here’s where to get reliable numbers:

- Local Builders and Contractors: These folks are in the trenches every day. They can give you a real-world cost-per-square-foot estimate for different build qualities in your specific market.

- Cost Estimating Services: Companies publish detailed construction cost manuals that break down data by location, building type, and materials.

- Appraisal Data: Professional appraisers have access to sophisticated software that calculates replacement costs with a high degree of precision.

For a deeper look at all three valuation methodologies, be sure to check out our guide on the primary real estate valuation methods.

Determining Land Value and Depreciation

Next up, you have to figure out what the land itself is worth, as if it were an empty lot. The cleanest way is to find recent sales of vacant lots in the immediate area.

If there aren't any, find a comparable property with a structure, estimate the value of that building (using the rebuild cost method), and subtract it from the total sale price. What’s left is the implied value of the land.

Finally, you need to account for depreciation. This isn't just about wear and tear. It’s a catch-all for anything that makes the property less valuable than a brand-new version.

Depreciation comes in three flavors:

- Physical Deterioration: This is the obvious stuff—a leaky roof, peeling paint, a busted HVAC system. It's the physical decay of the property over time.

- Functional Obsolescence: This covers outdated designs or features that just don't work for modern living. Think of a five-bedroom house with only one bathroom or a commercial space with ceilings so low you can't stand up straight.

- External Obsolescence: This is a loss in value from factors outside the property lines. A new highway built right behind the backyard, a noisy factory opening up down the street, or a major local employer shutting down are all classic examples.

By carefully estimating these three components—rebuild cost, land value, and total depreciation—you can build a reliable valuation, even when comps are nowhere to be found.

Putting It All Together for a Confident Offer

Relying on just one valuation method is like trying to build a house with only a hammer—you might get something standing, but it won’t be sturdy. The smartest home buyers understand that each approach—comps, income, and cost—tells a different part of a property's story. By weaving their insights together, you get a complete, three-dimensional picture of its true worth.

This process, sometimes called triangulation, is your final and most critical step in assessing property value. It’s where you weigh the data from each method, zero in on a consistent value range, and build an undeniable case for the price you’re willing to pay. This comprehensive view gives you the confidence to make a solid offer without that nagging fear of overpaying.

Weighing Each Valuation Method

After running your comps, calculating potential cash flow, and estimating replacement costs, you’ll probably have three different numbers. This is completely normal. The real skill is knowing which number deserves the most weight based on the property type and your goals.

Your final valuation isn't a simple average of the three. It's a weighted conclusion based on what's most relevant.

- For a standard single-family home: The sales comparison approach is almost always king. It reflects what real buyers are paying for similar homes right now, making it the most direct measure of market value. I'd give this number the most weight, probably 70-80%.

- For a duplex, triplex, or small apartment building: The income approach should carry the most weight. Investors buy these properties for one reason: cash flow. Their value is intrinsically tied to their ability to generate profit, so this method might account for 60-70% of your final decision.

- For a new build or a unique property: The cost approach is your most reliable guide. When there are no comps and no rental history, what it would cost to build the property from scratch is the most logical starting point for its value.

By breaking the valuation into rebuild cost, land value, and depreciation, this method provides a foundational price floor for a property.

Creating Your Final Valuation Range

Let's walk through a real-world scenario to see how this works. Imagine you're analyzing a single-family home you plan to live in.

- Comps Value: Your adjusted comparable sales suggest a value of $415,000. This is your anchor.

- Cost Approach Value: You estimate the land is worth $100,000, the rebuild cost is $350,000, and there’s $40,000 in depreciation. This gives you a value of $410,000.

- Income Approach Value: The property could rent for a price that gives it an income-based value of $395,000.

Since this is a standard home for personal use, you'll lean heavily on the comps. The cost approach provides a strong secondary confirmation, while the income approach is less relevant but still good to know. Based on this, you can confidently establish a fair market value range of $410,000 to $415,000.

Key Takeaway: The goal isn't to find one perfect number but a defensible range. This range becomes your negotiation playground. It tells you where to start your offer, what your absolute maximum price is, and when it’s time to walk away.

Beyond the Numbers: A Final Sanity Check

Before you write that offer, take a step back from the spreadsheets. Your quantitative analysis is crucial, but it needs to pass one final qualitative check.

Ask yourself these critical questions:

- What are the market trends? Are prices in this neighborhood rising, falling, or flat? A hot market might justify offering at the top of your range, while a cooling market gives you more leverage to start low.

- Are there any external risks? Is the property in an area prone to natural disasters like wildfires or floods? Events like these can drastically lower a property's value and jack up long-term holding costs. For example, recent California wildfires caused an estimated $10 billion to $20 billion reduction in assessed values in affected areas.

- Does the property feel right? After all the data, trust your gut. Does the property actually align with your personal or financial goals? Sometimes the best deals are the ones you have the courage to walk away from.

By combining rigorous data analysis with this final layer of critical thinking, you move from simply estimating a price to truly understanding a property's value. This is how you negotiate from a position of strength and make an offer you won’t regret.

Frequently Asked Questions About Property Value

How is a professional appraisal different from my own assessment?

A professional appraisal is a formal, unbiased valuation conducted by a licensed appraiser for a lender. Its main purpose is to protect the bank's investment by ensuring the loan amount isn't more than the home's actual worth. Your own assessment uses similar methods but is for your personal use—it helps you decide if a property is a good buy and determine a fair offer price.

Can I trust online home value estimators?

Online tools like Zillow's Zestimate can be a helpful starting point for a ballpark figure, but they should never be used for a final decision. These automated systems can't account for a property's unique condition, recent renovations, or hyper-local market trends. Always follow up with your own detailed analysis or consult a real estate agent for a more accurate picture.

What's the single most important factor in property value?

Location, location, location. You can renovate a kitchen, add a bathroom, or finish a basement, but you can never change where the property sits. A home in a desirable neighborhood with good schools, low crime, and convenient amenities will almost always hold its value better and appreciate more reliably than a fantastic house in a less desirable area.

How much do I need for a down payment?

The down payment you need depends on the type of loan you get. Conventional loans often require 20% to avoid private mortgage insurance (PMI), but many programs allow as little as 3-5% down. Government-backed loans like FHA can require as little as 3.5%, while VA and USDA loans may require no down payment at all for eligible buyers. It's best to talk with a lender to see what you qualify for.

Should I get a home inspection before making an offer?

Absolutely. A home inspection is a critical step that protects you from buying a home with major, hidden issues. An inspector will check the home's structure, roof, plumbing, electrical, and HVAC systems. While you usually get an inspection after your offer is accepted (as a contingency), it gives you the power to renegotiate with the seller for repairs or walk away from the deal if significant problems are found.

Stop guessing and start analyzing. Flip Smart gives you the power to assess any property's value, estimate rehab costs, and calculate potential profits in seconds. Make your next investment decision with data, not doubt. Analyze your first deal for free at Flip Smart.