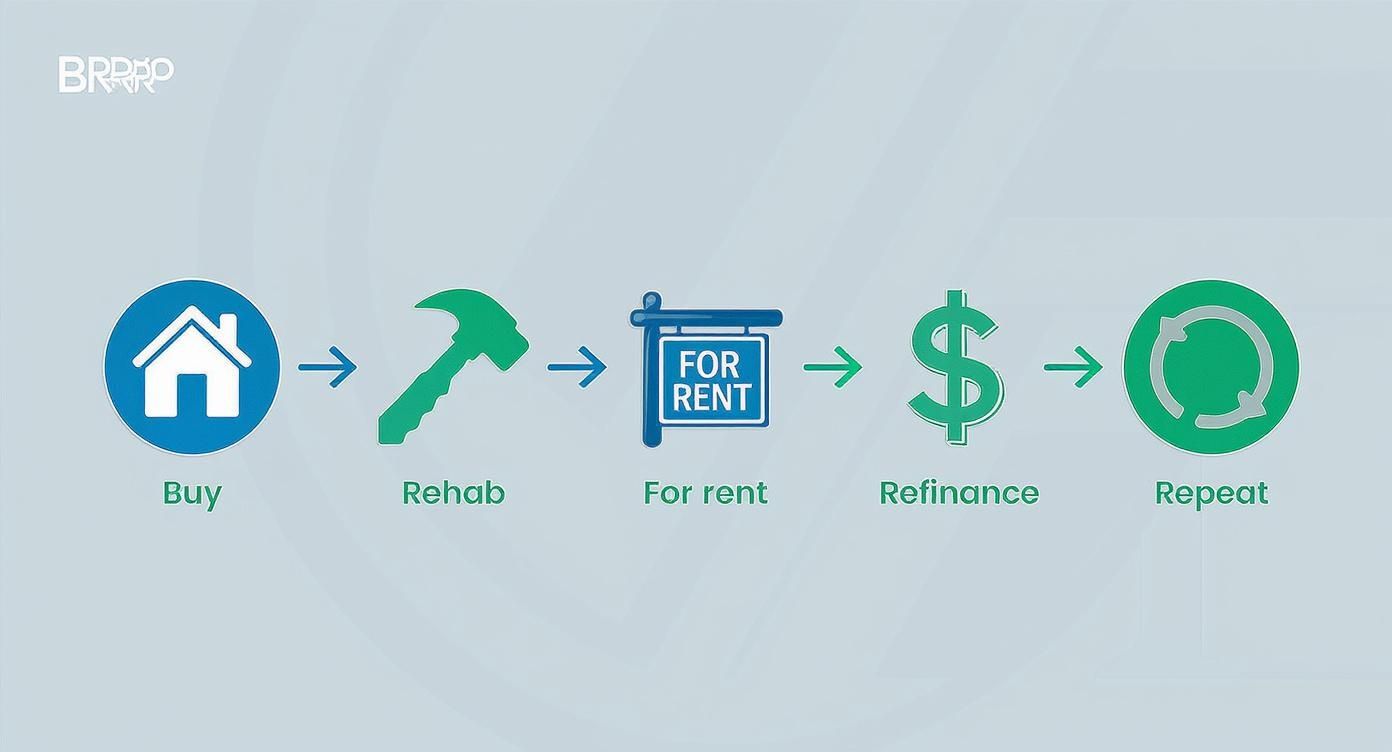

The BRRRR method is a real estate investment strategy that has become legendary for a reason. It stands for Buy, Rehab, Rent, Refinance, Repeat—a powerful cycle that lets savvy investors acquire multiple rental properties by recycling the same pot of money over and over again.

Instead of saving up a new 20% down payment for every single property, you use this system to pull your initial cash back out and do it all again. This is how investors build a portfolio of cash-flowing assets without needing millions in the bank. For anyone new to real estate investing, understanding this cycle is a game-changer.

Understanding the BRRRR Investment Cycle

Think of it like this: you have a single set of LEGOs. You could build one small house and stop. Or, you could build it, take a picture, carefully take it apart, and use the exact same blocks to build another house, and then another.

That’s the essence of the BRRRR method. You put your initial capital to work buying and improving a property, and then you pull that same capital back out through a refinance to repeat the entire process.

It’s a powerful strategy for investors who want to scale their portfolio without having to save up for years between deals. Each step isn't just a task; it's a critical gear in a larger wealth-building machine.

To give you a clearer picture, here’s a quick breakdown of how each stage fits into the bigger strategy.

The BRRRR Method at a Glance

| Step | What It Means | Primary Goal |

|---|---|---|

| Buy | Purchase a distressed or undervalued property well below its after-repair market value. | Acquire an asset with built-in equity potential. |

| Rehab | Renovate the property to increase its value and make it attractive to renters. | Force appreciation and significantly raise the property's market value. |

| Rent | Find qualified tenants and lease the property at market rates. | Generate consistent monthly rental income and stabilize the asset. |

| Refinance | Secure a new loan (typically a cash-out refinance) based on the new, higher appraised value. | Pull out your initial investment capital (and sometimes more). |

| Repeat | Use the cash from the refinance to fund the next property purchase. | Scale your portfolio by starting the cycle over again with the same funds. |

Now, let's dig into what each of those five stages really involves.

The Five Stages Explained

The BRRRR method isn't just a clever acronym; it's a disciplined, five-step process. Each stage builds directly on the last, creating a repeatable system for acquiring properties that pay you every month.

Buy: It all starts with finding the right deal. You're hunting for an undervalued or distressed property that needs work but has great potential. This is where you make your money.

Rehab: Next, you execute a strategic renovation to boost the property's market value. This is called "forced appreciation"—you're not just waiting for the market to go up; you're actively creating value yourself.

Rent: Once the dust settles, you place reliable tenants in the home. This crucial step turns your renovated asset into an income-producing machine, generating monthly cash flow.

Refinance: With a tenant in place and rental income flowing, the property is now "stabilized." You then work with a lender to get a cash-out refinance based on its new, much higher appraised value.

Repeat: This is the magic moment. You take the tax-free cash pulled from the refinance and use it as the down payment for your next undervalued property, kicking off the entire cycle once more.

The goal isn't just to own a rental property. The goal is to create a system where each property you buy finances the acquisition of the next one. It transforms a single investment into a portfolio-building engine.

Ultimately, the BRRRR method is a powerful strategy for generating long-term wealth through rental income and equity. Mastering it requires a solid understanding of cash flow, which is why a comprehensive guide to cash flow for real estate investors is essential reading. This cycle is what turns a passive homeowner into a serious, active real estate investor.

Breaking Down the Five Steps of BRRRR

The BRRRR method is a powerful cycle, but its magic lies in getting each of the five stages right. Think of it less like a checklist and more like a strategic roadmap where every step builds the foundation for the one that follows. Let's walk through how this all plays out in the real world.

The infographic below shows this isn't a one-and-done deal; it's a continuous loop.

This visual perfectly illustrates how the process is designed to be repeatable. The idea is to use the capital from one property to springboard into the next, letting you scale your portfolio.

Step 1: Buy the Right Property

The first step—Buy—is without a doubt the most important one. Seasoned investors know you make your money when you buy, not when you sell or refinance. The whole game is about finding a distressed or undervalued property you can snag for much less than what it could be worth after renovations.

This isn't just about hunting for the cheapest house on the block. A successful "buy" hinges on sharp analysis. You need a property in a solid location with strong rental demand—a place with good bones but enough cosmetic flaws that you can force appreciation.

Step 2: Rehab for Maximum Value

Once the keys are in your hand, the Rehab phase kicks off. This is where you physically manufacture value through renovations. The secret here is to focus on improvements that give you the biggest bang for your buck and drive up the property’s After-Repair Value (ARV).

Smart rehab projects always include:

- Kitchens and Bathrooms: These are the high-impact zones that appraisers and tenants notice first. A modern kitchen or bath can completely change the feel and value of a home.

- Curb Appeal: Never underestimate a first impression. Fresh paint, tidy landscaping, or even a new front door can make a world of difference.

- Modern Fixtures: Swapping out dated light fixtures, faucets, and doorknobs is a cheap and easy way to make the entire property feel fresh and new.

Getting your repair budget right is non-negotiable. If you underestimate your costs, the whole deal can fall apart. For a deeper look at this critical step, check out our guide on estimating repair costs for your real estate investment.

Step 3: Rent to Reliable Tenants

With the dust settled and the paint dry, it’s time to Rent the property out. The goal is to find high-quality, reliable tenants who pay on time and treat your newly renovated property with respect. This is the step that stabilizes the asset and gets the cash flowing.

Don't even think about skipping a thorough tenant screening process. You absolutely need to run background checks, verify their income, and call their references to avoid major headaches down the road. Once that lease is signed, your property officially transforms from a construction project into a cash-producing investment.

Step 4: Refinance to Pull Out Your Capital

The Refinance stage is the moment of truth—it’s where you unlock the equity you’ve worked so hard to create. After the property has a tenant and is generating income for a few months (a "seasoning period" in lender-speak), you apply for a cash-out refinance. An appraiser comes in and assesses the home's new, much higher value.

A lender will typically let you borrow up to 75-80% of this new appraised value. The goal is for this new loan to be large enough to pay off your original purchase and rehab loan, returning all—or most—of your initial cash investment to you.

Step 5: Repeat the Process

And now for the best part: Repeat. With the cash from your refinance back in your pocket, you’re ready to hunt for the next undervalued property. This is the engine that drives the BRRRR method. You can start the cycle all over again without needing to save up a whole new down payment, allowing you to scale your rental portfolio infinitely faster than traditional methods.

A Real-World Example of the BRRRR Method

Theory is one thing, but seeing the numbers in action is where the BRRRR method really clicks. Let's walk through a tangible example to see how an investor can build a self-sustaining engine for buying more properties from a single deal. This is the practical roadmap showing how the math works at each stage.

Imagine an investor, we'll call her Sarah, finds an outdated but structurally solid single-family home. It's in a great neighborhood but listed low because it desperately needs cosmetic work—the perfect BRRRR candidate.

The Initial Investment Breakdown

Sarah runs the numbers and sees a clear path to profit. She moves forward, tracking every dollar spent on the purchase and renovation.

- Purchase Price: $180,000

- Rehab Budget: $20,000

- Total Initial Cash Invested: $200,000

For this example, let's assume she paid with cash or a short-term loan that will be paid off completely during the refinance.

After the work is done, Sarah has totally transformed the property. The dated house now has a modern kitchen, updated bathrooms, and fresh paint, making it a top-tier rental in the area. Her all-in cost is a firm $200,000.

From Rehab to Rental Income

Next, Sarah lists the property for rent. She quickly finds a qualified tenant who signs a one-year lease, which is the crucial step that stabilizes the asset. This proves to lenders that she has a viable, income-producing property on her hands.

With rent checks coming in, Sarah’s investment is officially generating revenue. The goal here is simple: make sure the rent covers the future mortgage and still leaves a healthy profit margin.

This transition from a construction project to a cash-flowing asset is the heart of the BRRRR strategy. It's the proof that your initial investment and hard work have created a valuable, stable property.

The Cash-Out Refinance Math

After a few months of collecting rent—what lenders call a "seasoning period"—Sarah applies for a cash-out refinance. The bank’s appraiser visits the property and determines its After-Repair Value (ARV) is now $300,000. The smart renovations and strong local market paid off.

The lender agrees to give her a loan for up to 80% of this new appraised value. The math here is what makes the BRRRR method so incredibly powerful.

- New Appraised Value (ARV): $300,000

- Loan Amount (80% of ARV): $240,000

- Payoff of Initial Investment: -$200,000

- Cash Back to Sarah:$40,000

In this scenario, Sarah doesn't just get her entire $200,000 investment back; she walks away with an extra $40,000 in tax-free cash. She now owns a cash-flowing rental with $60,000 in equity ($300,000 ARV - $240,000 loan) and has her original capital back, plus a profit. This is exactly how investors use recycled capital to repeat the process, as detailed in this helpful BRRRR breakdown.

With her initial funds returned and then some, Sarah is ready to hunt for the next undervalued property and do it all over again, effectively using the same pot of money to build her real estate portfolio.

Why Investors Choose the BRRRR Strategy

So, why has the BRRRR method become such a staple for real estate investors? The answer is simple: it’s a powerful alternative to the slow, traditional slog of buying property. Instead of pinching pennies for years to save up a 20% down payment for a single rental, you can use BRRRR to get your initial investment back out and do it all over again.

This strategy transforms one pile of cash into a tool that can acquire property after property.

A huge piece of the puzzle is the concept of forced appreciation. You aren’t just buying a house and crossing your fingers, hoping the market goes up over the next decade. You’re actively creating value right now, during the rehab. Every smart renovation—from a modern kitchen to killer curb appeal—directly boosts the property's worth. You’re creating instant equity that you control.

Building Wealth Systematically

The real magic here is that BRRRR is a repeatable system. Once you complete one full cycle, you have a proven roadmap—and more importantly, the refinanced capital—to immediately start on the next one. This creates a kind of momentum that traditional buy-and-hold investing just can't match.

The BRRRR method isn’t just about buying one rental; it’s about building a sustainable, wealth-generating machine. You’re not just acquiring assets; you’re creating a system that acquires assets for you, with each property funding the next.

This philosophy challenges the old "save and wait" mindset. The strategy’s popularity exploded as financing options, especially cash-out refinances at 75-80% of the new appraised value, became more mainstream. This made it possible for everyday investors to pull their cash out and keep the velocity of their money high. You can discover more insights about this shift in thinking on Steadily.com.

Key Strategic Benefits

The appeal of the BRRRR method really boils down to a few core advantages that let investors grow their portfolios faster and more efficiently.

- Rapid Portfolio Growth: By pulling your initial investment back out, you can acquire new properties much faster than saving for a new down payment each time. It’s the difference between buying a property every few years versus every few months.

- Minimal Capital Tied Up: A well-executed BRRRR deal leaves little to none of your own money in the property long-term. This frees up your cash for the next opportunity.

- Control Over Value: You directly increase the property's value through renovations instead of just hoping for market appreciation. You are in the driver's seat.

Before you even think about making an offer, a critical early step is to decide whether to remodel or rebuild, as this choice fundamentally shapes the project's timeline, budget, and potential return.

Ultimately, the goal is to build a portfolio of cash-flowing assets. You can get a deeper understanding of how that works in our complete guide to cash flow for real estate.

Navigating the Risks of the BRRRR Method

The BRRRR method is a powerful engine for building a real estate portfolio, but just like any high-performance machine, it comes with risks. Knowing these potential pitfalls isn't about being negative; it's about being a smart, prepared investor. If you ignore them, a promising deal can quickly turn into an expensive lesson.

While the strategy looks clean on paper, every single step has its own unique challenges that can throw you off course. From surprise renovation costs to a property that won't appraise for what you need, awareness is your first and best line of defense.

Underestimating Renovation Costs and Timelines

One of the most common traps investors fall into is an unrealistic rehab budget. What you thought was a simple cosmetic update can spiral into complex, expensive fixes when you uncover hidden problems like old wiring or a slow roof leak.

A blown budget directly eats into your profit and can put the entire project in jeopardy. That’s why a detailed scope of work and a 15-20% contingency fund are absolutely non-negotiable.

On top of that, rehab projects almost always take longer than you think. Delays mean you're footing the bill for taxes, insurance, and loan interest for extra months. These carrying charges add up fast, making it critical to understand the full cost of holding a property before you even write the offer.

Appraisal and Refinance Hurdles

The whole BRRRR strategy lives or dies on the cash-out refinance. If the property appraises for less than your target After-Repair Value (ARV), you won’t be able to pull out enough capital to fund your next deal. Your money gets trapped.

A low appraisal is the financial roadblock of the BRRRR method. It can halt your momentum, leaving your initial investment stuck in a single property and stopping the "Repeat" step in its tracks.

To get ahead of this, you have to be conservative with your ARV estimates from day one. Run your own comparable property analysis and be ready to challenge a low appraisal with solid, undeniable data.

And don't forget the lending environment can shift. Interest rates might climb, pushing your new mortgage payment higher than you planned and shrinking your cash flow. Lenders could also tighten their requirements, making it tougher to even qualify for the loan you need.

Common Operational Risks to Manage

Even if you nail the rehab and the refinance, you’re not out of the woods. Managing the property as a rental brings its own set of challenges.

Here are a few key risks to plan for:

- Rental Market Risk: You might struggle to find a qualified tenant at your target rent. Sometimes, you have to lower the price just to fill a vacancy, which directly hits your projected cash flow.

- Tenant Issues: Even with great screening, you could end up with a tenant who pays late, damages the property, or needs to be evicted—a costly and soul-crushing process.

- Unexpected Repairs: Things break, even after a full renovation. The water heater could give out, or the HVAC system might need a major repair, creating big expenses that weren't in your original numbers.

Successfully navigating the BRRRR method means planning for the worst while working for the best. By anticipating these risks and building safeguards into your process, you protect your capital and ensure your investment engine keeps running smoothly.

How Market Conditions Affect Your Strategy

The BRRRR method is a powerful investment engine, but it doesn’t operate in a vacuum. Its success is directly tethered to the real estate market you’re in.

Think of it like this: the strategy is a high-performance car, but the local market is the road—complete with its own weather, speed limits, and surprise potholes. A great deal in a declining market can quickly turn sour, while even an average deal might shine in a booming area. You have to learn how to read the road ahead.

Why Local Market Analysis Is Crucial

Before you even dream of making an offer, you need to become a student of the local market. There are key indicators that will tell you whether an area is fertile ground for a BRRRR investment or a potential money pit.

Ignoring these signs is one of the fastest ways to lose your shirt in this business.

You're looking for areas with strong fundamentals that naturally push property values and rental demand upward. These are the green lights you need to see before hitting the gas.

Key market indicators to watch:

- Job Growth: A thriving job market pulls new residents into an area, and they all need a place to live. This is a direct pipeline for housing demand.

- Population Growth: Is the city growing? Steady population growth is one of the most reliable signs of a healthy, dynamic rental market.

- Housing Demand: Check the "days on market" for both sales and rentals. If properties are getting snapped up quickly, it’s a screaming sign of high demand.

The success of what is the BRRRR method truly hinges on finding markets where the After Repair Value (ARV) has a solid foundation and the demand lets you pull your capital out at the refinance stage. You can discover more insights about these market dynamics on ValianceCap.com.

The Impact of Economic Trends on Refinancing

Beyond the local neighborhood, broader economic trends play a massive role, especially when you get to the "Refinance" step. Nothing impacts this more than interest rates.

A sharp rise in rates can dramatically increase your mortgage payment, shrinking your monthly cash flow or even turning it negative overnight. It's the one variable that can derail an otherwise perfect deal.

When rates are low, borrowing is cheap, making it far easier to get great cash flow after a refinance. But in a high-rate environment, the numbers get much, much tighter.

Always stress-test your deal. Calculate your potential cash flow using an interest rate that is 1-2% higher than the current rate. If the numbers still work, you've got a resilient investment.

This simple step protects you from getting blindsided by economic shifts completely outside your control. Staying on top of both the local market and the bigger economic picture is what separates amateurs from pros and sets you up for long-term success with BRRRR.

Frequently Asked Questions About the BRRRR Method

1. How much cash do I really need to start with the BRRRR method?

The exact amount depends on your local market, but a good starting point is enough cash to cover the down payment for the property (typically 20-25% for an investment loan) plus the entire estimated renovation budget. It's also crucial to have a contingency fund of 15-20% of the rehab cost for unexpected repairs. The goal is to get all of this initial cash back during the refinance step.

2. What happens if the property appraisal comes in lower than I expected?

A low appraisal is a major risk because it can prevent you from pulling out all your initial capital. If this happens, you have a few options: you can challenge the appraisal with your own data on comparable sales and upgrades, apply for a refinance with a different lender to get a second opinion, or accept that some of your cash will remain in the deal, slowing down the "Repeat" step.

3. Is the BRRRR method a good strategy for a first-time investor?

It can be, but it’s more hands-on than simply buying a move-in-ready rental. BRRRR requires managing contractors, overseeing a renovation budget, and navigating two separate financing processes (the purchase and the refinance). For a beginner, success often comes down to building a great team, including a reliable contractor, an investor-friendly real estate agent, and a knowledgeable lender.

Ready to stop guessing and start analyzing deals like a pro? Flip Smart gives you the tools to calculate renovation costs, determine after-repair values, and assess profit potential in seconds, not hours. Find your next winning investment with Flip Smart today