When you hear investors talk about ARV, they're talking about After Repair Value. It’s a simple but powerful concept: the estimated market price of a property after you’ve finished all the renovations, not what it's worth in its current, beat-up state. Mastering this metric is the first step toward making smarter, more profitable investment decisions.

The Real Meaning of ARV in Property Investing

Think of ARV as the North Star for any real estate investor, especially if you're fixing and flipping houses. It’s a forward-looking number that predicts a property's future worth, and it should guide every single decision you make, from your initial offer to the final sale.

It's a lot like restoring a classic car. You don’t base your project budget on the rusty frame you just bought. Instead, you calculate its potential value once it's polished, tuned up, and running like a dream. ARV is that exact same logic applied to real estate.

Why ARV Is a Critical First Step

A well-calculated ARV is so much more than just a number—it’s the foundation of a successful project. It cuts through the guesswork and gives you a clear path forward.

Here’s why it’s non-negotiable:

- It Validates the Deal: Right away, ARV tells you if there's enough potential profit in the deal to even bother with it. No margin, no deal. Simple.

- It Unlocks Financing: Lenders, particularly hard money lenders, couldn't care less about the current purchase price. They almost always base their loan amounts on the ARV.

- It Sets Your Purchase Price: Knowing the potential end value helps you work backward to figure out the absolute maximum you can offer on a property while still protecting your profit.

The After Repair Value is the estimated worth of a property after it's been fully renovated. Investors use this number to figure out if the money they sink into buying and fixing a place is justified by what they can sell it for later.

Essentially, ARV is one of the most important tools in the world of real estate property valuation methods. It helps you draw a hard line in the sand for your purchase price and your rehab budget, making sure your project stays profitable from day one. Nail this one metric, and you're already ahead of the game.

How to Confidently Calculate After Repair Value

Calculating After Repair Value isn't some abstract theory—it's the single most important skill you'll master as an investor. Getting it right is what separates a profitable flip from a disaster. While the formula itself looks simple, the real work is in the details.

Current Property Value + Value of Renovations = After Repair Value (ARV)

Think of this less like a math problem and more like an investigative framework. Each part of that equation requires serious research and a dose of reality. Let's break down how pros nail each piece of this puzzle.

Step 1: Determine the Current Property Value

First things first: you need a rock-solid, unbiased number for what the property is worth right now, in its current "as-is" condition. This isn't a gut feeling. It's a number backed by hard market data.

There are two reliable ways to pin this down:

- Analyze "As-Is" Comps: Hunt down recent sales of similar homes in the immediate area that were also fixer-uppers. These are your best clues for what the market is actually paying for a project house.

- Get a Professional Appraisal: For a more formal take, an appraiser can give you an official "as-is" valuation. This gives you a highly defensible starting point for all your other numbers.

Nailing this initial value is crucial. It stops you from overpaying and killing your profit margin before you've even picked up a hammer.

Step 2: Estimate the Added Value of Renovations

This is where most investors get it wrong, and it can be a costly mistake. The absolute key is understanding that the value of renovations is not the same as the cost of renovations.

Just because you spend $50,000 on a new kitchen doesn't mean you've added $50,000 to the home's value. The market decides what your upgrades are worth.

To figure this out accurately, you have to do two things:

- Get Realistic Contractor Quotes: Don't guess. Get detailed bids from several contractors to find out the real-world cost of your planned scope of work.

- Analyze Renovated Comps: This is your secret weapon. Find recently sold houses in the same neighborhood that have been updated to the exact same standard you're planning. What did a similar home with that new kitchen and modern baths actually sell for? The price gap between it and an unrenovated comp tells you the true market value of those specific upgrades in that specific area.

A Practical ARV Calculation Example

Let's walk through a real-world scenario. You've found a distressed property you want to flip.

- Current Property Value: After digging into the "as-is" comps, you figure out the house is worth $200,000 today.

- Estimated Renovation Costs: Your contractors have quoted you $60,000 for the full gut job—kitchen, baths, flooring, the works.

- Value from Renovated Comps: Here's the magic. You find nearly identical, completely rehabbed homes nearby that recently sold for an average of $325,000.

Now, you plug in the numbers, using the market value of the renovations, not just your costs.

$200,000 (Current Value) + $125,000 (Market Value of Renovations) = $325,000 (ARV)

This straightforward process takes the guesswork out of the equation and turns it into a confident, data-backed projection. For any investor serious about their craft, mastering the full range of real estate math formulas is non-negotiable for making consistently smart decisions.

Using ARV to Get Funded and Lock In Your Profit

A solid, well-researched After Repair Value is way more than just a number on a spreadsheet. It’s the key that unlocks financing for your deal and the guardrail that protects your profit from day one. For any serious investor, the ARV is the anchor for every financial move you make.

This is especially true when you start applying industry frameworks like the 70% Rule. This guideline is a quick gut check to figure out your maximum offer on a property, making sure you leave enough room in the deal to cover costs, handle surprises, and still walk away with a profit. And it all starts with your ARV.

ARV is the Language Lenders Speak

When you're talking to lenders—especially private and hard money lenders—a credible ARV is everything. They aren't just lending you money against the beat-up house you're buying; they're lending against its future potential. When you show up with a data-backed ARV, you're proving you've done your homework and that the project is actually viable.

This future-focused number allows them to calculate the loan-to-value (LTV) ratio based on what the property will be worth, not what it's worth today.

Lenders use your projected ARV to determine the loan amount, often funding a huge chunk of both the purchase price and the renovation budget. This makes ARV the single most important metric in your funding application.

By mastering your ARV calculation, you build instant credibility. You're showing them you have a professional grasp of the market, which dramatically lowers their perceived risk. That's how you turn a potential "no" into an enthusiastic "yes."

How ARV Shapes Your Entire Investment Strategy

The strategic importance of ARV has only grown over the years. After the 2008 financial crisis, for instance, lenders started scrutinizing ARV accuracy like never before to protect their capital. Today, that level of diligence is standard practice.

Most rehab loans are tied directly to the post-repair appraised value, with lenders typically financing up to 70-75% of the ARV. This deep connection between financing and future value proves just how critical ARV is to keeping an investment on track. You can get more insight on how lenders use ARV from the experts at Rehab Financial.

This makes your ARV a powerful tool that goes way beyond just getting a loan. It helps you:

- Filter Deals Instantly: Quickly kill deals that don't have the numbers to meet your profit goals.

- Negotiate with Confidence: Walk into negotiations armed with a data-backed ARV to justify your offer.

- Plan Your Exit: You'll know your target sale price before the first sledgehammer ever swings.

Ultimately, a strong ARV calculation is your business plan for the property. It gives you the financial clarity to secure funding, manage your budget, and confidently maximize your return. It’s the difference between gambling on a property and making a calculated, professional investment.

Finding Accurate Comps to Bulletproof Your ARV

Your ARV estimate is only as solid as the data you build it on. Just one bad comp can throw off your entire calculation, potentially costing you thousands of dollars on a deal.

Think about it: a comparable property in a slightly less desirable school district could drastically understate your property’s true future worth. But when you find the right comps, you lock in confidence and make offers based on reality, not guesswork.

I like to think of "golden comps" as precision tools. They are nearly identical twins to your subject property in location, size, age, and style. Using these ensures you’re feeding the cleanest possible data into your ARV formula.

To find these A-grade comps, you need to get laser-focused on a few key criteria:

- Recency: The sale should have closed within the last 3 months. Anything older doesn't reflect the current market.

- Proximity: The comp must be within a quarter-mile radius of your property. Neighborhoods can change block by block.

- Similarity: Look for nearly identical square footage, lot size, and bedroom/bathroom counts.

- Condition: The comp should mirror the level of renovation you’re planning. You can't compare a gut job to a turnkey home.

Key Sources for Reliable Comps

Your best friend here is the Multiple Listing Service (MLS). This is the primary source of the freshest, most accurate sales data. If you're not an agent, build a relationship with one who can grant you direct access.

Public records are a decent free backup, especially when MLS data is thin for a specific area. These will give you sale prices, dates, and property tax info, which can help fill in the gaps.

Finally, platforms like Zillow and Redfin are great for supplementing your search. I use them all the time to cross-reference my MLS data and see if I missed any potential comparables.

"Strong comps give you the sharpest lens into a property's true potential value.”

Evaluating Comparable Properties: Strong vs. Weak Comps

Not all comps are created equal. It’s crucial to know the difference between a comp that will strengthen your analysis and one that will weaken it. Here’s a quick breakdown to help you spot the good from the bad.

| Attribute | Strong Comp Example | Weak Comp Example |

|---|---|---|

| Location | On the same block, near the same park | In a different neighborhood with different amenities |

| Age | Built within 2 years of the subject property | Built 20 years earlier with different construction |

| Style | The exact same floor plan and model | A completely different architectural style (e.g., ranch vs. colonial) |

| Condition | A similar level of recent renovation | Needs a major renovation or is in original condition |

Choosing strong comps is non-negotiable for an accurate ARV. Weak comps introduce uncertainty and risk, which is exactly what we’re trying to eliminate.

How to Adjust Comps for an Accurate ARV

Even a "golden" comp will rarely be a perfect one-to-one match. This is where adjustments come in. A finished basement adds value; a gravel driveway might detract from it. You have to account for these differences in your calculation.

For every comparable you use, make specific dollar-value adjustments for features like:

- Finished vs. unfinished basements

- Garage vs. carport configurations

- The presence or absence of a pool

- Recent energy-efficient upgrades (like new windows or a modern HVAC system)

Each adjustment should shift the comp’s sale price by a specific amount, based on what that feature is worth in your local market.

Pay close attention to mechanicals. A brand-new HVAC system, for example, can often command a 5–10% premium in neighborhoods with older housing stock.

Before you make an offer, do one last check of your adjusted comps. Make sure your final ARV stands on solid ground.

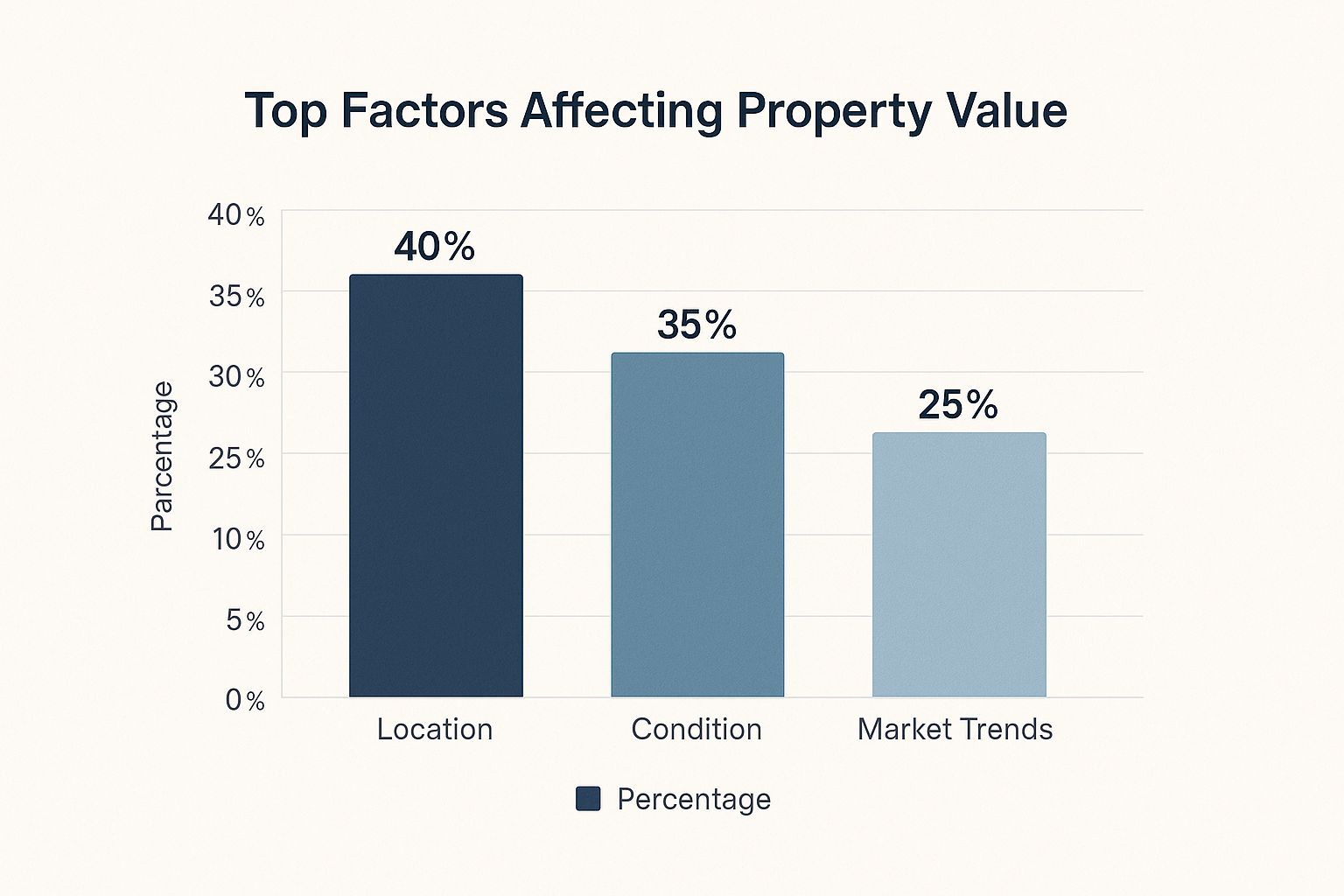

This infographic perfectly illustrates how experienced investors weigh the different factors. As you can see, Location (40%), Condition (35%), and Market Trends (25%) are the heavy hitters. Focusing too much on just one of these can easily lead to a miscalculation.

Manually pulling and adjusting comps can be incredibly time-consuming. Check out our guide on how automated tools can streamline your comp analysis for even greater precision. You can learn more about the benefits of this approach in our article on Why Smart Investors Use Automated Property Analysis.

With these strategies in your toolbelt, your ARV becomes virtually unassailable. This gives you the rock-solid confidence you need to make smart offers that protect your profits and minimize your risk.

Common ARV Mistakes That Can Sink Your Project

Knowing the ARV formula is just the entry ticket. Where seasoned investors separate themselves from the rookies is in sidestepping the common—and costly—mistakes that can turn a surefire deal into a financial sinkhole.

Even pros make errors, but understanding these pitfalls beforehand is your best defense. It's the key to protecting your capital and actually realizing the profits you project on paper.

Over-Optimism: The Silent Project Killer

The single biggest mistake? Underestimating renovation costs. It happens all the time. A simple cosmetic rehab suddenly uncovers a hornet's nest of bad wiring, hidden plumbing leaks, or even foundation issues.

Without a contingency fund of at least 10-15%, these "surprises" aren't just annoying—they can completely wipe out your profit margin.

Another classic trap is getting high on your own supply—basing your ARV on pure optimism. Too many investors fall for the fantasy that every dollar they pour into upgrades adds a dollar of value. This is almost never true. The market, not your receipts, decides what that shiny new kitchen is really worth.

Assuming a dollar-for-dollar return on investment for renovations is a dangerous gamble. Focus on what the market data from recent comps actually supports, not what you hope the value will be.

Just as dangerous is sticking your head in the sand about local market shifts. An ARV you calculated three months ago might be worthless today if buyer demand has cooled off or inventory has shot up. A great renovation in a declining market is just a beautifully rehabbed money pit.

Practical Errors in Judgment

Beyond fuzzy math and wishful thinking, plenty of tactical errors can throw your numbers way off. A classic is simply forgetting to account for all the expenses. Your profit isn't just the sale price minus the rehab cost. You have to factor in holding costs, closing fees, insurance, and realtor commissions.

Here are a few other common missteps I see investors make constantly:

- Using Bad Comps: Relying on comps that are too old, too far away, or not truly comparable in style and condition will lead to a dangerously flawed ARV. Garbage in, garbage out.

- Forgetting Holding Costs: Every single month you own that property, it’s costing you money in taxes, insurance, and utilities. A project that drags on for six months instead of three can bleed your returns dry.

- Ignoring Market-Specific Tastes: Don't get cute. Installing ultra-modern fixtures in a neighborhood full of traditional colonial homes isn't innovative; it's a mistake that can actively hurt your final sale price.

Successful investors know that real profit is made by managing risk, not just by picking the right property. Industry data shows that properties hitting an ARV 30-50% above the total acquisition and repair costs tend to deliver solid returns after everything is paid. Messing up your numbers can quickly shrink margins that historically average between 10% and 25%.

You can find more insights on real estate investment profit margins at Leaserunner.com. By sidestepping these common mistakes, you build a crucial buffer that protects your investment when things inevitably don't go exactly as planned.

Diving Deeper: Your ARV Questions Answered

Once you get the basics of what ARV stands for in real estate, the real-world questions start popping up. Let's tackle the most common ones investors run into, so you can apply this concept with confidence.

How Is ARV Different From Market Value or an Appraisal?

Think of it like this: Market Value is what a property is worth right now, "as-is." An official appraisal is just a licensed professional's opinion of that current, as-is value. It’s a snapshot in time.

ARV, on the other hand, is a forecast. It’s a prediction of what the property could be worth in the future—but only after you’ve completed a specific set of renovations. It’s the "after" picture.

The biggest difference is timing. Market Value is the present. After Repair Value is the future potential. One tells you what a house is worth; the other tells you what it could be worth.

This forward-looking approach is exactly why ARV is the most important number for any fix-and-flip or BRRRR (Buy, Rehab, Rent, Refinance, Repeat) investor. You're buying based on future value, not present condition.

Should I Trust an Online ARV Calculator?

Use them for a gut check, but never for the final word. An online ARV calculator is fantastic for a quick, back-of-the-napkin estimate. In seconds, it can tell you if a property is even worth digging into, helping you filter out the obvious duds.

But that's where their utility ends. These tools run on algorithms that can't see the reality on the ground. A computer has no idea about the home's true interior condition, the quality of finishes you plan to use, or that the "comparable" sale it pulled is on a beautiful tree-lined street while yours backs up to a noisy intersection.

Your most accurate, defensible ARV will always come from your own manual research. That means hand-picking recent comps and getting real-world quotes from your local contractors.

How Much Does the Local Market Affect My ARV?

Massively. Your ARV calculation doesn't exist in a bubble—it lives and dies by the local market. A picture-perfect renovation in a neighborhood where prices are tanking is still a losing bet.

You absolutely have to consider these factors:

- Market Trajectory: Is the market hot, cold, or flat? In a seller's market with rising prices, your ARV might actually be a conservative estimate. But in a cooling market, an ARV based on comps from two months ago could be dangerously optimistic.

- Days on Market (DOM): Watch how long renovated homes are sitting. If the average DOM is creeping up, it’s a red flag. That means higher holding costs for you, which will chew directly into your profits.

- Inventory Levels: A low supply of renovated homes can push your final sale price higher. But if three other flippers are about to list their projects on the same block, you’re suddenly facing a lot more competition and may need to lower your price.

An ARV without local market context isn't an analysis—it's just a wishful guess.

What Is the 70% Rule and How Does ARV Drive It?

The 70% Rule is a classic rule of thumb investors use to quickly decide the maximum price they should pay for a property. It's a simple formula to protect your potential profit from the very beginning.

The rule states you should pay no more than 70% of the property's After Repair Value, minus the total cost of the repairs.

The Formula: (ARV x 0.70) – Repair Costs = Your Maximum Offer

As you can see, ARV is the starting point for the entire equation. If your ARV is wrong, the 70% Rule is completely useless.

That leftover 30% isn't just your profit. It's a critical buffer designed to absorb all the other costs of doing business, like:

- Financing and loan costs

- Closing fees (when you buy and when you sell)

- Realtor commissions on the final sale

- Holding costs like taxes, insurance, and utilities

What's left over after all those expenses are paid is your actual net profit. Using the ARV to drive this rule helps ensure you build in a big enough cushion to make the whole project worthwhile.

Tired of spending hours manually analyzing properties? Flip Smart does the heavy lifting for you. Get accurate ARV projections, detailed rehab estimates, and complete profit analysis on any deal in seconds. Make faster, data-backed decisions and find your next winning investment with Flip Smart.