To figure out a property's cap rate, you divide its Net Operating Income (NOI) by its current market value. This straightforward formula gives you a percentage that represents the property's unleveraged rate of return, offering a powerful first look at an investment's potential.

Understanding Cap Rate and Why It's a Crucial Metric

Before you start crunching numbers, it’s critical to understand what they actually mean. Think of the capitalization rate—or cap rate—as the financial pulse of an investment property. It's the first metric seasoned investors look at to quickly gauge profitability and risk, long before financing ever enters the picture.

This simple percentage acts as a universal benchmark, letting you compare wildly different investment opportunities on a level playing field. Whether you're eyeing a 10-unit apartment building in Austin or a small commercial strip in Miami, the cap rate cuts right through the noise to the core of the deal.

The Power of a Simple Formula

Let's break down the core components of the cap rate formula to see how they work together. This table provides a quick reference for what each piece represents and why it's so important for your analysis.

Cap Rate At a Glance Key Components

| Component | What It Is | Why It Matters |

|---|---|---|

| Net Operating Income (NOI) | The property's total income minus all operating expenses (excluding mortgage payments). | It reflects the property's pure profitability from its operations, giving you a clean look at its performance. |

| Current Market Value | The price the property would likely sell for in the current market. | This is the denominator in your equation; it's what you're paying to acquire that stream of income. |

| Capitalization Rate | The percentage result of NOI divided by the market value. | It provides a standardized measure of return, making it easy to compare different properties and markets. |

Putting it all together, the formula gives you a powerful, at-a-glance metric for evaluating a deal.

For instance, if a commercial building generates an NOI of $500,000 a year and is valued at $5,000,000, the cap rate is 10% ($500,000 / $5,000,000). You can find more insights about cap rate formulas for commercial real estate to see how this simple calculation helps investors quickly estimate their expected return.

At its core, the cap rate tells a story about the relationship between a property's income and its value. It measures how hard your capital is working for you, based purely on the property's operational performance.

Getting this relationship right is the key to making smarter decisions. It helps you spot properties that are priced fairly for their income potential. A solid grasp of how to figure out the cap rate is the first step toward building a successful and profitable real estate portfolio.

Calculating Net Operating Income The Right Way

Your cap rate is only as accurate as your Net Operating Income (NOI). A small mistake here can throw off your entire analysis, making a bad deal look great on paper. Getting the NOI right is, without a doubt, the most critical step.

Start with the property's Gross Potential Income (GPI). This is the absolute maximum rent you could collect if every unit was occupied for all 12 months. But since no property stays 100% occupied, you must immediately adjust that figure for realistic vacancy and credit losses to find your Effective Gross Income (EGI).

Pinpointing Your Operating Expenses

Once you have a realistic EGI, subtract all legitimate operating expenses. These are the recurring costs of keeping the property running and generating income. Be thorough and conservative in your estimates.

Actionable tip: Request the seller's "T12" (Trailing 12 Months) financial statement to see actual, historical expenses. Common operating expenses you absolutely must include are:

- Property Taxes: A non-negotiable annual expense.

- Insurance: Essential for covering liability and the property itself.

- Utilities: Any utilities you, the landlord, are responsible for, like water or common area electricity.

- Routine Maintenance and Repairs: Think landscaping, fixing leaky faucets, and general upkeep.

- Property Management Fees: Even if you self-manage, include a standard fee (8-10% of EGI). This keeps your analysis conservative and comparable to other deals.

To get comfortable with how these numbers interact, it's worth reviewing the core real estate math formulas that drive investment analysis.

What You Must Exclude from NOI

Knowing what to leave out of your expense calculation is just as important as knowing what to put in. This is a common trap for new investors. Including the wrong costs will artificially lower your NOI and distort the cap rate.

Crucial Takeaway: Your mortgage payment (principal and interest) is never part of the NOI calculation. The whole point of using cap rate is to judge a property's performance on its own merits, completely independent of your financing.

Other big-ticket items to keep out of your operating expenses include:

- Capital Expenditures (CapEx): These are major, infrequent upgrades like a new roof or an HVAC system, not day-to-day costs.

- Depreciation: This is a "paper" expense used for tax purposes only; no actual cash leaves your pocket.

- Income Taxes: These are personal to you as the investor, not a cost of the property's operation.

By carefully tallying all relevant income and subtracting only the true operating expenses, you'll arrive at an accurate NOI—the foundation for a meaningful cap rate calculation.

Putting The Cap Rate Formula Into Practice

Let's move from theory to a real-world scenario. Imagine you're analyzing a 10-unit apartment building with an asking price of $1,500,000. To figure out if this is a good deal, we need to calculate its cap rate.

First, we must find the Net Operating Income (NOI). This involves adding up all income and subtracting all operating expenses—before any loan payments.

Example 10-Unit Apartment Financial Breakdown

Here’s a clear breakdown of the income and expenses for this property. This is exactly how you’d lay it out to get to your NOI.

| Line Item | Annual Amount | Notes |

|---|---|---|

| Gross Potential Rent | $144,000 | 10 units x $1,200/month x 12 months. |

| Less Vacancy Loss (5%) | ($7,200) | Assumes a realistic 95% occupancy rate. |

| Effective Gross Income (EGI) | $136,800 | This is our true potential income. |

| Less Property Taxes | ($18,000) | Based on local assessment records. |

| Less Insurance | ($6,500) | Annual premium for hazard and liability. |

| Less Maintenance & Repairs | ($8,000) | A conservative estimate for upkeep. |

| Total Operating Expenses | ($32,500) | The total annual cost to run the property. |

| Net Operating Income (NOI) | $104,300 | EGI minus all operating expenses. |

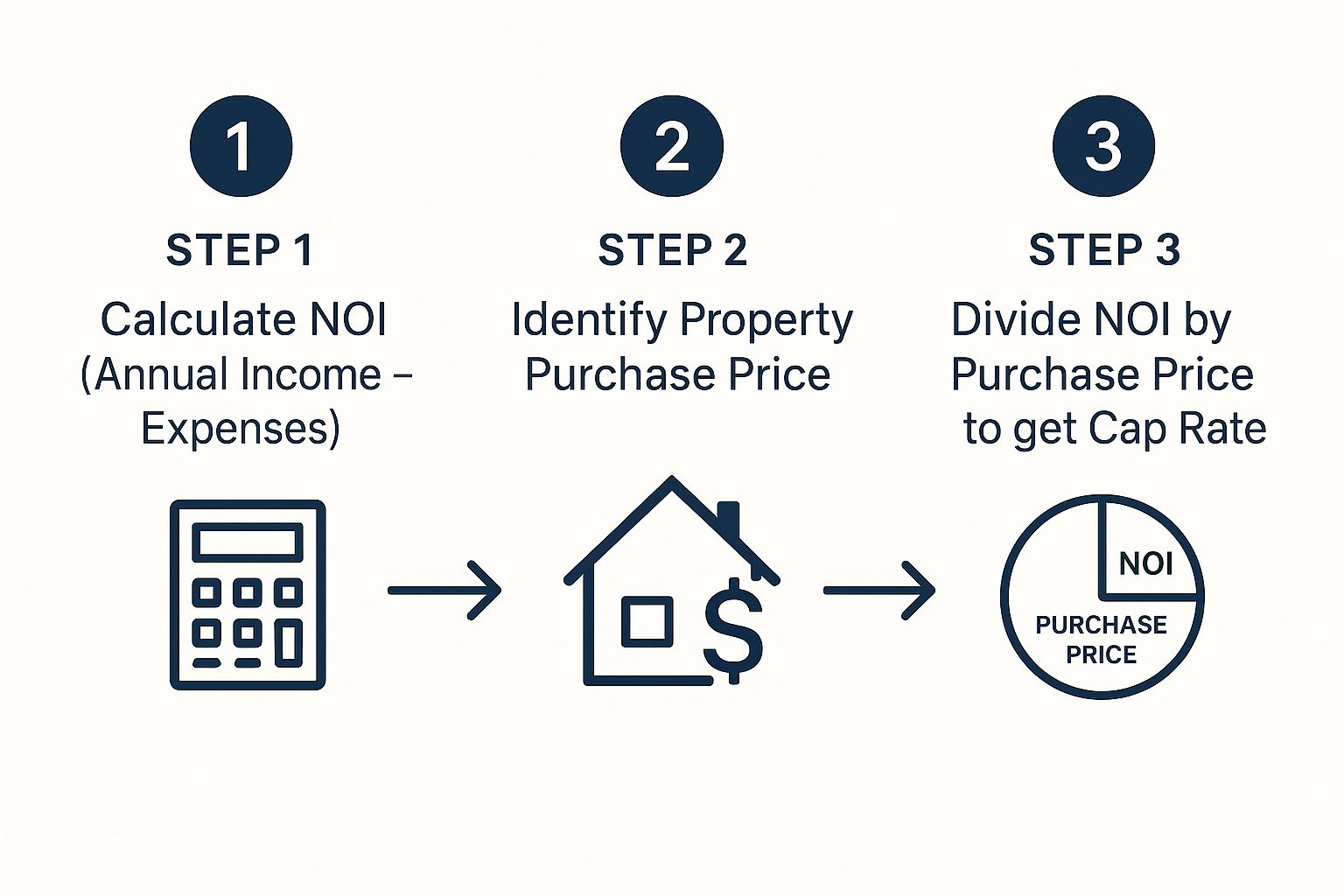

After accounting for realistic vacancy and operating costs, our true NOI for this building is $104,300. Now, we apply the cap rate formula.

With an NOI of $104,300 and a property value of $1,500,000, the math is straightforward.

Cap Rate = Net Operating Income / Property Value

Cap Rate = $104,300 / $1,500,000 = 0.0695 or 6.95%

So, for this 10-unit building, we're looking at a 6.95% cap rate.

This simple three-step process is the core of the calculation, as this chart shows.

It really is that simple: income divided by price. But here's why getting your numbers right is so critical. Let's say you discover that property taxes are projected to jump by $5,000 next year. Suddenly, your NOI drops to $99,300.

Run the numbers again: $99,300 / $1,500,000 = a new cap rate of 6.62%. That small change in one expense line item made a tangible difference in the return metric. This is why a hands-on approach is so vital among the various real estate property valuation methods investors use.

How to Interpret Cap Rates Like a Pro

Figuring out the cap rate is just step one. The real skill is interpreting what that number tells you about the property, its market, and the associated risk. A common mistake is to simply chase the highest cap rate, but a higher number often signals higher risk.

There's a simple inverse relationship to understand: when cap rates go down, property values tend to go up, and vice versa. A low cap rate usually indicates a more stable, lower-risk asset in a desirable market. Investors are willing to pay a premium (accepting a lower initial return) for that safety and potential appreciation.

Conversely, a high cap rate might seem attractive, but it's often a signal of higher risk—perhaps the property is in a declining area, has significant deferred maintenance, or faces high tenant turnover. The higher potential return is the market's way of compensating you for taking on those challenges. This ties directly into your take-home pay, so it's a good idea to also learn how to calculate the cash flow on a rental property to see the full picture.

Context Is Everything in Cap Rate Analysis

Investors always ask, "What's a good cap rate?" The only correct answer is, "It depends." A 5% cap rate might be excellent for a multifamily building in a prime urban core but terrible for a retail strip in a small town. You must compare apples to apples.

Different property types in different markets have vastly different cap rate expectations. Recent data shows industrial and multifamily properties trending toward lower cap rates, around 5.2% and 5.3% respectively, reflecting strong demand and perceived safety. Meanwhile, office and retail properties often have higher cap rates, closer to 6.4%, indicating more market uncertainty.

Think of the cap rate as a risk gauge. A lower cap rate doesn't mean it's a bad deal—it often means it's a safer deal. A higher cap rate isn't automatically a home run; it’s a bright red flag telling you to dig in and figure out exactly why the market is demanding a premium for that risk.

Common Mistakes to Avoid When Figuring Cap Rate

Knowing how to figure out the cap rate is one thing; avoiding the common pitfalls that distort the number is what separates pros from amateurs. A seemingly small error can make a bad deal look great.

One of the biggest blunders is using overly optimistic income projections. It’s tempting to assume 100% occupancy, but that's not realistic. You must factor in a vacancy rate based on the local market average to ground your numbers in reality.

Another classic mistake is miscalculating the Net Operating Income (NOI). Time and again, investors include expenses in the formula that simply don't belong there.

Remember this rule: The cap rate formula is built to judge the property's performance on its own, not your personal financing. That’s why your mortgage payments—both principal and interest—are always excluded from the NOI calculation.

Keeping Your Numbers Clean and Accurate

Beyond your loan, other costs can muddy the waters. It’s absolutely critical to know the difference between a routine operational cost and a major, one-time capital improvement.

Here are two key expense categories you need to watch out for:

- Capital Expenditures (CapEx): Putting on a new roof or replacing an entire HVAC system is a capital improvement, not a routine operating expense. If you dump these massive, infrequent costs into your annual NOI, you'll artificially crush it and get a skewed cap rate.

- "Below-the-Line" Costs: Things like income taxes and depreciation are specific to you, the investor, not the property's operational health. They should never touch your NOI calculation.

Don't forget that economic conditions play a massive role, too. Commercial real estate cap rates have always moved with interest rates and market demand. For instance, between 2014 and 2021, super-low interest rates drove cap rates to historic lows, which meant property prices were sky-high. But as lending got tighter around 2022-2023, cap rates started to climb. You can dive deeper into these commercial real estate trends on statista.com.

Common Questions About Cap Rate

Even after you master the formula, some key questions always come up. Getting clear on these nuances will elevate your analysis. Let's tackle the most common questions from investors.

What’s a “Good” Cap Rate?

There's no single magic number. A "good" cap rate is entirely dependent on the market, property type, and your investment strategy.

In a hot urban market like Austin or Miami, a 4-5% cap rate might be a fantastic deal because you're also banking on low risk and significant appreciation. But for a property in a smaller, slower-growing town, you might demand an 8% cap rate or higher to justify the perceived risk.

Actionable insight: Your benchmark for "good" should be the cap rates of similar properties that have recently sold in the exact same neighborhood.

Does My Loan Affect the Cap Rate Calculation?

No, and this is intentional. The cap rate formula is designed to ignore your mortgage payments (debt service).

This is a crucial feature, as it allows you to compare the raw earning power of different properties on a level playing field, regardless of how an investor finances their purchase. To see how your specific loan impacts your returns, you'd use a different metric like Cash-on-Cash Return.

Key Insight: Cap rate measures a property's unleveraged return. It answers the question, "How profitable is this asset based purely on its own operations?" not "How good is this deal for me with my loan?"

Can I Use Cap Rate for Single-Family Homes?

You can, but it's often not the best tool for the job. Cap rate is most powerful when evaluating income-producing commercial properties like apartment buildings or retail centers, where value is directly tied to the income generated.

For single-family homes, value is more often driven by comparable sales ("comps"). Investors focused on single-family rentals typically rely on metrics like Gross Rent Multiplier (GRM) or Cash-on-Cash Return for a clearer financial picture.

What's the Difference Between Cap Rate and ROI?

This is a common point of confusion. They sound similar but measure completely different things.

- Cap Rate: A one-year snapshot of a property's profitability based on its current income, without considering financing.

- ROI (Return on Investment): A broader metric that measures the total performance of your investment over the entire holding period, including financing, appreciation, and loan paydown.

In short, cap rate tells you how a property is performing right now. ROI tells you how your money performed from the day you bought it to the day you sold it.

Ready to stop guessing and start analyzing properties with precision? Flip Smart gives you the tools to figure out valuations, renovation costs, and profit potential in seconds. Analyze your next deal with Flip Smart and make data-driven decisions with confidence.