Determining a property's true worth is the cornerstone of any successful real estate investment. Whether you're flipping a house, purchasing a rental, or advising a client, an accurate valuation separates a profitable venture from a costly mistake. Moving beyond simple guesswork to data-driven analysis is critical for navigating the complexities of the market and securing a strong return on investment. This guide demystifies the appraisal process by providing a comprehensive yet actionable overview of the essential real estate property valuation methods.

We will explore eight distinct techniques, each offering a unique lens through which to assess a property's value. From the market-driven Comparable Sales Approach to the income-focused Gross Rent Multiplier, you will gain a practical understanding of how and when to apply each method. We will break down the mechanics, pros, and cons of each approach with clear examples and implementation details.

By mastering these core valuation strategies, you'll be equipped to:

- Identify undervalued assets with greater confidence.

- Analyze potential deals with enhanced precision.

- Negotiate from a position of strength, backed by solid data.

This article provides the actionable insights needed to refine your analytical skills and make more informed, profitable real estate decisions. Let's dive into the methods that will sharpen your investment edge.

1. Comparable Sales Approach (Market Approach)

The Comparable Sales Approach, often called the Market Approach, is one of the most fundamental and widely used real estate property valuation methods. It operates on the principle of substitution: a buyer will not pay more for a property than what it would cost to purchase a similar property with comparable utility. This method directly analyzes recent sales prices of similar properties, known as "comparables" or "comps," to determine a subject property's current market value.

This approach is the gold standard for residential appraisals, driven by guidelines from entities like Fannie Mae, Freddie Mac, and the FHA. It reflects the real-time actions of buyers and sellers in a specific market, making it a highly reliable indicator of current value.

How It Works and When to Use It

The process involves finding recently sold properties that are as similar as possible to the subject property. An appraiser or real estate professional then makes dollar value adjustments to the comps' sale prices to account for any differences. For instance, if a comparable property has an extra bedroom, a negative adjustment is made to its sale price to align it with the subject property.

Use this method for:

- Residential Homes: Appraising single-family homes, townhouses, and condos for mortgage lending or setting a list price.

- Vacant Land: Valuing lots within a subdivision by comparing recent lot sales.

- Established Commercial Properties: Determining the value of an office building in a district with many similar, recently sold properties.

Actionable Tips for Implementation

To effectively use this real estate property valuation method, precision is key. Follow these steps for a more accurate valuation:

- Select Quality Comps: Aim for at least 3-5 comparables that have sold within the last three to six months and are located as close to the subject property as possible.

- Make Defensible Adjustments: Every adjustment must be justified with market data. If you adjust $20,000 for a swimming pool, be prepared to prove that a pool adds that much value in your specific market.

- Verify Your Data: Don't rely solely on one data source like the MLS. Cross-reference information with public records or by contacting the agents involved in the transaction to confirm details like sale price, concessions, and property condition.

- Analyze the Broader Market: Beyond sold comps, look at pending sales and active listings. These provide valuable insight into the current market direction and competition.

2. Income Capitalization Approach

The Income Capitalization Approach is a core real estate property valuation method used to determine the value of income-generating properties. This approach operates on the principle that a property's value is directly related to the income it can produce. It essentially converts the anticipated future income stream of a property into a present-day capital value.

This method is the backbone of commercial real estate valuation and is heavily utilized by investors, commercial brokers, and appraisers. It provides a clear, numbers-driven perspective on a property's financial viability, moving beyond physical attributes to focus on its performance as a financial asset. A key part of this is understanding how to accurately calculate the income, a process detailed in our guide on how to analyze property cash flow.

How It Works and When to Use It

The process involves calculating the property's Net Operating Income (NOI) by subtracting all operating expenses (excluding mortgage payments) from the gross potential income. This NOI is then divided by a market-derived capitalization rate ("cap rate") to arrive at the property's value. The cap rate represents the expected rate of return on a real estate investment property.

Use this method for:

- Commercial Properties: Valuing office buildings, retail centers, and industrial warehouses based on tenant lease income.

- Multifamily Residential: Appraising apartment complexes or multi-unit rentals by analyzing rental revenue.

- Hospitality and Special-Use: Determining the value of hotels, self-storage facilities, or other properties with a clear income stream.

Actionable Tips for Implementation

To apply the Income Capitalization Approach accurately, you must be meticulous with your financial data and market assumptions.

- Verify Income and Expenses: Scrutinize the rent roll and operating statements. Confirm rental rates against market surveys and ensure all operating expenses, including vacancy rates and management fees, are realistic.

- Derive a Defensible Cap Rate: Don't rely on a single source. Analyze cap rates from recent sales of similar income properties in the same market, consult market reports from firms like CBRE or JLL, and speak with local commercial brokers.

- Account for Capital Expenditures: Future capital improvements (like a new roof or HVAC system) are not included in NOI but will impact cash flow. Set aside reserves for these items to get a true sense of the investment's long-term return.

- Analyze Tenant Quality: Consider the creditworthiness of tenants and the terms of their leases. A property with long-term leases to high-credit tenants is less risky and may warrant a lower cap rate, thus a higher valuation.

3. Cost Approach (Replacement Cost Method)

The Cost Approach is a real estate property valuation method that establishes value based on the cost of building a similar structure from scratch. It operates on the principle that a rational buyer would not pay more for an existing property than the cost to buy a comparable lot of land and construct a new building with equivalent utility. This method calculates value by adding the estimated land value to the current cost of replacing the improvements, then subtracting any depreciation.

This approach is highly valued for unique, newly constructed, or special-purpose properties where comparable sales data is scarce or nonexistent. It provides a clear, logical value based on tangible costs, making it essential for insurance valuations and tax assessments.

How It Works and When to Use It

The process starts by determining the value of the land as if it were vacant, typically using the comparable sales approach for land. Next, the appraiser calculates the current cost to construct the buildings and other improvements. Finally, this cost is reduced by an amount for depreciation, which includes physical deterioration, functional obsolescence, and external factors. The depreciated cost of the improvements is then added to the land value to arrive at the total property value.

Use this method for:

- Special-Purpose Properties: Valuing buildings like churches, schools, government facilities, or hospitals that have no direct market comparables.

- New Construction: Appraising newly built homes or commercial buildings where costs are known and depreciation is minimal.

- Insurance Valuations: Determining the replacement cost of a structure for insurance coverage purposes, which focuses solely on the cost to rebuild.

- Tax Assessments: Establishing a value for property tax calculations, particularly for new developments.

Actionable Tips for Implementation

A successful Cost Approach valuation requires meticulous data gathering and systematic analysis. Follow these steps for an accurate result:

- Use Current Local Cost Data: Rely on updated construction cost manuals, like the Marshall & Swift Valuation Service, or consult with local builders to get accurate, market-specific cost-per-square-foot data for materials and labor.

- Value the Land Separately: The land must be valued as if vacant and available for its highest and best use. Use recent comparable land sales in the immediate vicinity to establish a credible land value.

- Account for All Forms of Depreciation: Systematically analyze and deduct for physical wear and tear (curable and incurable), functional obsolescence (outdated design), and external obsolescence (negative neighborhood influences).

- Include Entrepreneurial Incentive: A complete cost estimate should include not just direct and indirect costs but also an "entrepreneurial incentive" or profit, which is what a developer would expect to earn for their risk and effort.

4. Automated Valuation Models (AVMs)

Automated Valuation Models (AVMs) are computer-based systems that use mathematical algorithms and extensive property databases to generate real estate value estimates instantly. This method relies on the power of big data, combining public records, MLS data, and proprietary analytics to produce a rapid valuation without direct human intervention. Popularized by platforms like Zillow and CoreLogic, AVMs provide a cost-effective and immediate starting point for property analysis.

While not a replacement for a formal appraisal, this real estate property valuation method has become a crucial tool for lenders, investors, and consumers needing quick, data-driven insights. It excels at processing vast amounts of market data simultaneously, offering a broad perspective on a property's potential value in seconds.

How It Works and When to Use It

AVMs analyze data points such as property characteristics (square footage, bedrooms, bathrooms), sales history, tax assessments, and recent comparable sales. The system applies a statistical model to weigh these factors and calculate an estimated market value. The output often includes a value range and a confidence score indicating the reliability of the estimate.

Use this method for:

- Initial Property Screening: Quickly assessing a large number of potential investment properties to identify promising leads.

- Portfolio Valuation: Tracking the estimated value of multiple properties in a real estate portfolio over time.

- Loan Pre-Qualification: Aiding lenders in making preliminary decisions on mortgage applications before ordering a full appraisal.

- Market Research: Understanding general value trends in a specific neighborhood or zip code.

Actionable Tips for Implementation

To leverage AVMs effectively, treat them as a powerful first step, not the final word. Smart investors know how to use automated property analysis to gain a competitive edge.

- Combine Multiple AVM Sources: Do not rely on a single AVM. Cross-reference estimates from several sources (e.g., Zillow, Redfin, bank estimators) to identify a more reliable value range.

- Understand the Confidence Score: Pay close attention to the accuracy rating or confidence interval provided. A low score signals that the AVM had limited or conflicting data, warranting more scrutiny.

- Manually Verify Key Data: AVMs can have outdated or incorrect information. Manually confirm critical details like square footage, bedroom count, and recent renovations against public records.

- Account for Property Condition: AVMs cannot see a property's condition. You must manually adjust the estimate to account for factors like a new roof, an outdated kitchen, or significant structural issues.

5. Discounted Cash Flow (DCF) Analysis

Discounted Cash Flow (DCF) Analysis is a sophisticated real estate property valuation method that estimates value based on the property's ability to generate future income. It projects the net cash flows a property will produce over a specific holding period and discounts them back to their present value using a rate that reflects the investment's risk. This method's power lies in its forward-looking perspective, making it invaluable for income-producing assets.

Popularized by institutional investors, private equity funds, and commercial real estate firms, DCF analysis provides a detailed financial model of an investment's potential. It treats the property not just as a physical asset but as a financial instrument whose value is intrinsically linked to its future earnings.

How It Works and When to Use It

The process involves forecasting a property's potential income and expenses over several years to determine its annual net operating income (NOI). These future cash flows, along with a projected sales price at the end of the holding period (terminal value), are then discounted to what they would be worth today. This sum represents the property's intrinsic value based on the analysis.

Use this method for:

- Commercial Development Projects: Assessing the financial feasibility of building a new office tower or retail center.

- REIT Acquisition Analysis: Evaluating large, complex assets like office buildings or shopping malls for an investment portfolio.

- Complex Income Properties: Valuing assets with fluctuating income streams, such as hotels with seasonal cash flows or mixed-use developments.

Actionable Tips for Implementation

The accuracy of a DCF analysis is highly dependent on the quality of its assumptions. To build a robust and reliable financial model, follow these essential steps:

- Use Conservative Assumptions: When forecasting variables like rent growth, vacancy rates, and expense inflation, err on the side of caution. Overly optimistic projections are a common pitfall that can lead to a significantly over-inflated valuation.

- Perform Sensitivity Analysis: Test your model by changing critical inputs like the discount rate and exit capitalization rate. This shows how the property's value changes under different market conditions, revealing the investment's risk profile.

- Validate Your Discount Rate: The discount rate should reflect the risk associated with the investment. Research comparable investments and market yields to select a rate that is defensible and aligned with current investor expectations.

- Consider Multiple Exit Scenarios: The terminal value often accounts for a large portion of the total value. Model different exit scenarios (e.g., selling at a higher or lower cap rate) to understand the potential range of outcomes.

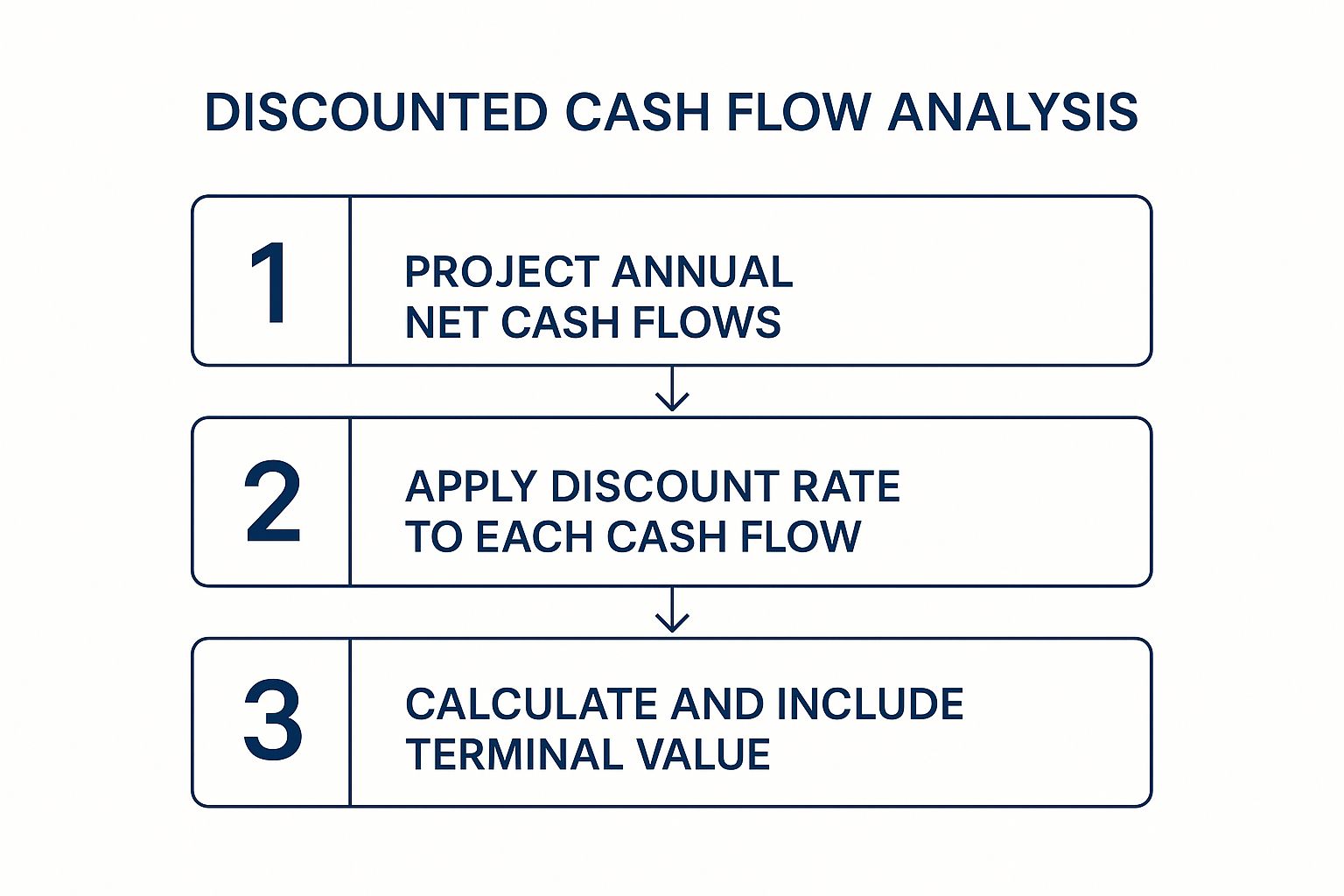

The following infographic illustrates the core steps of the DCF process.

This process flow visualizes how future earnings are systematically translated into today's value, forming the foundation of this analytical real estate property valuation method.

6. Gross Rent Multiplier (GRM) Method

The Gross Rent Multiplier (GRM) method is a straightforward valuation tool used to get a quick estimate of an income-producing property's value. It operates on a simple principle: the property's value is directly proportional to its gross rental income. This approach calculates value by multiplying the property's gross annual rent by a market-derived multiplier, offering a rapid way to screen investment opportunities without a deep dive into operating expenses.

Because it bypasses complex expense analysis, the GRM is a favorite among investors and agents for initial property comparisons. It provides a "back-of-the-napkin" valuation that helps quickly determine if a property warrants a more detailed financial investigation, making it an essential part of the real estate property valuation methods toolkit for residential investors.

How It Works and When to Use It

The process begins by finding the GRM for a specific market. This is done by analyzing recent sales of comparable rental properties and dividing each property's sale price by its gross annual rental income. The resulting average GRM is then multiplied by the subject property's gross annual rent to estimate its market value.

Use this method for:

- Small Residential Rentals: Quickly valuing single-family rentals, duplexes, triplexes, and fourplexes.

- Initial Investment Screening: Comparing multiple potential investment properties to quickly identify the most promising options.

- Market Analysis: Helping real estate agents provide investors with a fast market-based valuation for income properties.

Actionable Tips for Implementation

While simple, the GRM's accuracy depends on the quality of your inputs. Use these tips for a more reliable estimate:

- Use Truly Comparable GRMs: The multiplier must be derived from properties that are very similar in location, type, size, and condition. A GRM from luxury apartments is useless for valuing a C-class duplex.

- Verify Rental Income: Do not take the seller's stated rental income at face value. Verify it with lease agreements and market rent analysis. Inflated rent figures will skew your valuation significantly.

- Use It as a Preliminary Tool: The GRM ignores operating expenses, vacancy rates, and property condition. It should never be the sole basis for a final investment decision but rather a first-pass filter.

- Understand the Math: The GRM is one of several critical calculations for investors. Mastering these concepts is essential for success. Learn more about the key real estate math formulas on flipsmrt.com to strengthen your analytical skills.

7. Price Per Square Foot Analysis

The Price Per Square Foot Analysis is a comparative real estate property valuation method that simplifies the valuation process by breaking it down to a single, easily digestible metric. It operates by dividing a property's sale price by its total square footage, creating a normalized value that allows for direct comparison between properties of different sizes. This method is widely used in both residential and commercial real estate to quickly gauge market value and identify pricing trends.

While often considered a "back-of-the-napkin" calculation, this analysis provides a crucial snapshot of market health. It's particularly powerful when analyzing homogenous properties, such as condos in the same building or new homes in a single development, where size is a primary differentiator.

How It Works and When to Use It

The process involves calculating the average price per square foot from several recently sold, comparable properties. This average is then multiplied by the subject property's square footage to estimate its value. For example, if comparable homes are selling for an average of $250 per square foot, a 2,000-square-foot subject property would be valued at approximately $500,000. It's a quick way to establish a baseline before a more detailed analysis.

Use this method for:

- Condominium Pricing: Valuing units within the same high-rise building where amenities are shared.

- Commercial Real Estate: Comparing lease rates or sale prices for office or retail spaces in the same district.

- New Construction: Establishing consistent pricing for different models within a new housing subdivision.

- Market Trend Analysis: Tracking changes in price per square foot over time to understand market direction.

Actionable Tips for Implementation

To use this real estate property valuation method effectively, you must ensure your comparisons are as direct as possible. Avoid broad generalizations and focus on the details.

- Ensure Measurement Consistency: Always confirm if the square footage used is gross (total area) or net (usable area), especially in commercial properties. Using inconsistent measurements will skew your results.

- Adjust for Finishes and Condition: A newly renovated unit will command a higher price per square foot than a dated one. Make qualitative adjustments to account for significant differences in finishes, fixtures, and overall property condition.

- Consider Layout and Efficiency: Not all square footage is created equal. A property with a highly efficient and functional layout may be worth more per square foot than one with wasted space or an awkward design.

- Use as Supporting Data: This method is powerful but has limitations. Use it as a preliminary assessment or a supporting metric alongside a more comprehensive approach like the Comparable Sales Approach, rather than as the sole basis for valuation.

8. Residual Land Value Method

The Residual Land Value Method is a specialized technique used to determine the value of development land by working backward from its potential. It calculates the value of a piece of land by subtracting all costs associated with developing it, including developer profit, from the estimated gross development value (GDV) of the completed project. This method is fundamental for developers and investors conducting feasibility analyses.

This approach is one of the more complex real estate property valuation methods, as it relies heavily on forecasts and assumptions about future revenues and costs. It is the go-to method when the value of the land is directly tied to a specific development plan, rather than just comparable land sales.

How It Works and When to Use It

The process starts by estimating the final value of the proposed development once it is completed and sold or leased. From this total value, all development costs are subtracted. These costs include construction ("hard costs"), architectural fees, legal fees, marketing, and financing ("soft costs"), as well as a required profit margin for the developer. The remaining value, or "residual," is the maximum price a developer can afford to pay for the land.

Use this method for:

- Residential Subdivision: Determining the purchase price for a large tract of land intended for a new housing development.

- Commercial Development: Evaluating a site for a new shopping center or office building.

- Mixed-Use Projects: Assessing the land value for a complex project that combines retail, office, and residential components.

- Feasibility Analysis: Testing whether a proposed development project is financially viable before committing to land acquisition.

Actionable Tips for Implementation

Accuracy in this method hinges on the quality of your projections. To execute it effectively, focus on detailed and realistic financial modeling:

- Use Conservative Estimates: When projecting the Gross Development Value (GDV), use conservative sales prices or rental income figures. Overestimating future revenue is a common and costly mistake.

- Account for All Costs: Create a comprehensive budget that includes every potential expense. Don't forget soft costs like permits, financing interest, marketing, and a contingency fund for unexpected overruns.

- Validate with Market Data: While this isn't a direct comparison method, use comparable land sales to cross-reference and validate your final residual value. If your calculated value is significantly higher than recent sales, re-examine your assumptions.

- Factor in Timelines and Risks: Incorporate the development timeline into your financial model. Account for market risks, such as a potential downturn in property values or an increase in construction costs, by running multiple scenarios.

Comparison Matrix of 8 Property Valuation Methods

| Valuation Method | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Comparable Sales Approach (Market Approach) | Moderate - requires data collection & adjustments | Moderate - access to recent sales data required | Reflects current market value with real transaction data | Residential & commercial sales in active markets | Most reliable in active markets; widely accepted |

| Income Capitalization Approach | High - needs income data & finance knowledge | High - requires accurate income/expense data | Value based on income potential & investor yields | Income-producing properties & investment analysis | Direct link to income generation; scenario modeling |

| Cost Approach (Replacement Cost Method) | Moderate to High - detailed cost & depreciation estimation | Moderate - construction cost info & expertise needed | Value estimate based on replacement cost minus depreciation | Newer or unique/special-purpose properties | Useful when comps unavailable; insurance & tax purposes |

| Automated Valuation Models (AVMs) | Low - automated system usage | Low - uses big data and algorithms | Quick digital valuation estimates with large dataset | Preliminary valuations & large portfolio assessments | Fast, cost-effective, eliminates human bias |

| Discounted Cash Flow (DCF) Analysis | Very High - complex cash flow projection & discounting | High - extensive financial data & analysis required | Detailed investment value considering time value of money | Investment properties, developments, and risk analysis | Detailed scenario/risk analysis; models future cash flows |

| Gross Rent Multiplier (GRM) Method | Low - simple multiplier calculation | Low - minimal financial data needed | Quick value estimate from gross rental income | Preliminary screening of small rental & income properties | Fast and easy; good for quick investor comparisons |

| Price Per Square Foot Analysis | Low to Moderate - requires comparable sales data | Low - recent sales & size data | Normalized value per unit area to enable comparisons | Quick comparisons for residential and commercial properties | Easy to understand; effective quick screening tool |

| Residual Land Value Method | High - detailed cost, profit, and development analysis | High - needs projected values and detailed costs | Land value based on development feasibility & profit | Land acquisition & development feasibility analysis | Reflects development potential; essential for land deals |

Choosing the Right Valuation Method for Your Next Investment

Navigating the world of real estate investing without a firm grasp of valuation is like sailing without a compass. Throughout this guide, we've dissected eight distinct real estate property valuation methods, from the market-driven Comparable Sales Approach to the forward-looking Discounted Cash Flow Analysis. Each method offers a unique lens through which to view a property's worth, and mastering them transforms you from a speculative buyer into a strategic investor.

The key takeaway is that no single method provides a complete picture. A seasoned investor understands that the true art of valuation lies in reconciliation: the process of synthesizing insights from multiple approaches to arrive at a well-supported, defensible value. Relying solely on the Income Approach might cause you to overlook a property's physical deficiencies, while using only the Cost Approach could lead you to ignore what the current market is willing to pay.

Synthesizing Insights for a Holistic Valuation

Think of these methods as tools in a sophisticated toolkit. Your goal is to select the right combination of tools for the specific job at hand.

- For a primary residence or a fix-and-flip project, the Comparable Sales Approach is often the most reliable starting point, as it directly reflects current market sentiment and buyer behavior.

- When analyzing an income-producing asset like a multi-family apartment building or a commercial space, the Income Capitalization Approach and Gross Rent Multiplier (GRM) become indispensable for assessing profitability and investment returns.

- For unique properties such as custom-built homes, schools, or government buildings with few direct comparables, the Cost Approach provides a logical framework for determining value based on what it would cost to build a replacement.

By layering these perspectives, you create a robust valuation range. This multifaceted view not only strengthens your negotiating position but also significantly mitigates your investment risk by exposing potential discrepancies and confirming underlying value.

Taking Action: From Theory to Profitable Practice

Understanding these real estate property valuation methods is the first step; applying them effectively is what generates wealth. Your next move is to put this knowledge into action. Start by analyzing properties in your target market. Pull recent sales data, calculate potential income streams, and even estimate replacement costs. This hands-on practice will sharpen your analytical skills and build the confidence needed to spot genuine opportunities.

Remember, the goal is not just to find a property's value but to understand why it has that value. This deeper comprehension allows you to identify undervalued assets, forecast appreciation more accurately, and ultimately, make smarter, more profitable investment decisions that align with your long-term financial goals.

Ready to streamline your analysis and evaluate properties in seconds, not hours? Flip Smart integrates powerful AVM data with sophisticated analysis tools, allowing you to apply complex real estate property valuation methods with just a few clicks. Take the guesswork out of your next deal by visiting Flip Smart to see how our platform can give you a decisive market edge.