At its core, calculating cash flow on a rental property is simple: subtract total expenses from total income. A positive number means you're making money; a negative number means you're losing it. While the formula is easy, mastering the details is what separates successful investors from those with expensive hobbies. This guide provides the actionable steps to get it right.

Why Cash Flow is Your Most Important Metric

New investors often chase appreciation—the hope a property's value will skyrocket. Seasoned pros, however, focus relentlessly on cash flow. Why? Appreciation is theoretical wealth until you sell. Cash flow is the real money that hits your bank account every month.

Think of it as the lifeblood of your portfolio. It pays the mortgage, covers unexpected repairs, and, most importantly, funds your next investment. A property without positive cash flow isn't an asset; it's a liability draining your resources.

The Foundation of Smart Investing

Focusing on cash flow forces you to analyze a deal based on its real-world performance today, not on speculation about its future value. This practical mindset is the dividing line between being a strategic investor and a market gambler.

Before you can run the numbers, you need to gather the right data. This table breaks down the essential components for an accurate calculation.

Actionable Checklist: Key Components for Your Cash Flow Calculation

| Component | What It Is | Actionable Tip: Where to Find It |

|---|---|---|

| Gross Rental Income | Total rent collected before any deductions. | Analyze comparable listings on Zillow or Rentometer. Confirm with a local property manager. |

| Vacancy Loss | Estimated income lost due to empty units. | Assume 5-10% of gross rent. Check local vacancy rates via the US Census or real estate reports. |

| Mortgage (P&I) | The principal and interest portion of your loan payment. | Use a mortgage calculator with current interest rates for your scenario. Don't rely on generic online ads. |

| Property Taxes | Annual taxes levied by the local government. | Look up the property's tax history on the county assessor's website. Don't trust the seller's old figures. |

| Homeowners Insurance | Your policy premium to protect the asset. | Get a real quote from an insurance agent for a landlord policy, which is different from a homeowner's policy. |

| Repairs & Maintenance | Funds set aside for ongoing upkeep (e.g., plumbing, paint). | Budget at least 5% of gross rent. Increase to 10% for older properties (built before 1980). |

| Capital Expenditures | Savings for big-ticket items (roof, HVAC, etc.). | Budget a separate 5-10% of gross rent into a dedicated savings account for these future costs. |

| Property Management | Fees paid to a company to manage the property. | Get quotes from 2-3 local firms. Even if self-managing, include an 8-10% fee to pay yourself. |

| HOA Fees | Dues for condos or properties in planned communities. | Request the official HOA documents and budget. Ask about planned special assessments. |

| Utilities | Any utilities you, the landlord, are responsible for paying. | Ask the seller for the last 12 months of utility bills to get a year-round average. |

Having these components organized makes the actual calculation a breeze and ensures you don't miss anything that could turn a "good deal" into a money pit.

This calculation is your financial compass. It tells you the true profitability of a property after every single expense is accounted for. Savvy investors hunt for positive cash flow because it provides a reliable buffer against market swings; rental income is far more stable than speculative appreciation. You can find more rental property insights for maximizing your ROI from RentRedi.

For a rental property to be a true asset, it must generate income. If it costs you money each month, it's a liability, regardless of what its paper value might be.

Grasping this concept shifts your entire mindset. You stop hoping for a future payday and start building a sustainable, income-generating business today. Getting this calculation right isn't just a good idea; it's a non-negotiable skill for long-term success in real estate.

Step 1: Track Down Your Income and Expense Figures

To accurately calculate cash flow on a rental property, you must have a complete picture of every dollar coming in and going out. Any analysis based on incomplete data is just a guess. Frankly, this is where most new investors fail—they dramatically underestimate their true expenses. Let's make sure that doesn't happen to you.

Compiling Your Total Property Income

The income side seems simple, but it’s more than just the monthly rent check. Smart investors identify every possible revenue stream to get a true Gross Scheduled Income (GSI).

Start with the contracted monthly rent, then look for other income opportunities.

Actionable income streams to consider:

- Pet Fees: Don't just charge a deposit. Implement a monthly "pet rent" of $25 to $75 per pet. It's a recurring revenue source.

- Laundry Services: For multi-family properties, coin-op or card-operated laundry can generate a significant monthly profit.

- Late Fees: While you hope not to collect them, late fees are potential income and must be included in your projections and lease agreements.

- Parking or Storage Fees: In urban markets or large complexes, charging for assigned parking or small storage units is an easy way to boost revenue.

Adding these up gives you the property's maximum potential income. Now, let's hunt down every single expense.

Uncovering All Your Rental Expenses

This is where your deal analysis will either succeed or fail. Expenses are much more than the mortgage payment. Overlooking just one or two can quietly destroy your returns.

Your main fixed cost is PITI—investor-speak for Principal, Interest, Taxes, and Insurance. This is your core monthly payment. But the costs are just getting started.

The most common mistake new investors make is ignoring the "hidden" variable expenses that don't hit every month. These are the silent cash flow killers that will wreck your returns if you aren't planning for them from day one.

Here are the other costs you absolutely must account for.

- Vacancy Reserves: No property stays occupied 100% of the time. People move. It takes time to find a new tenant. Actionable Step: Set aside 5-10% of your gross monthly rent in a separate account to cover these empty months.

- Repairs and Maintenance: Things will break. It's a guarantee. Actionable Step: Budget another 5-10% of the gross rent for routine fixes—a leaky faucet, a running toilet, or a broken appliance.

- Capital Expenditures (CapEx): This is your savings fund for major items with a limited lifespan: the roof (20-30 years), HVAC system (15-20 years), or water heater (10-12 years). Ignoring CapEx is a recipe for disaster when a $10,000 bill arrives.

- Property Management Fees: If you hire a pro, expect to pay 8-12% of collected rent. Actionable Step: Even if you self-manage, bake this fee into your numbers. This realistically values your time and makes your analysis more accurate if you decide to hire help later.

- Other Costs: Don't forget landscaping, snow removal, pest control, or any utilities you've agreed to cover. Understanding the true cost of holding a property is critical for an accurate analysis.

Gathering these figures takes diligence, but this upfront work provides the clear, realistic data you need to make a confident investment decision.

Step 2: The Four Cash Flow Formulas Every Investor Uses

You've gathered your income and expense numbers. Now it's time to make them talk. Instead of one generic calculation, seasoned investors use a few core formulas to analyze a deal from multiple angles. This gives a clearer picture of a property's financial health. Each formula tells a different story, and knowing them all is what separates data-driven decisions from hopeful guesses.

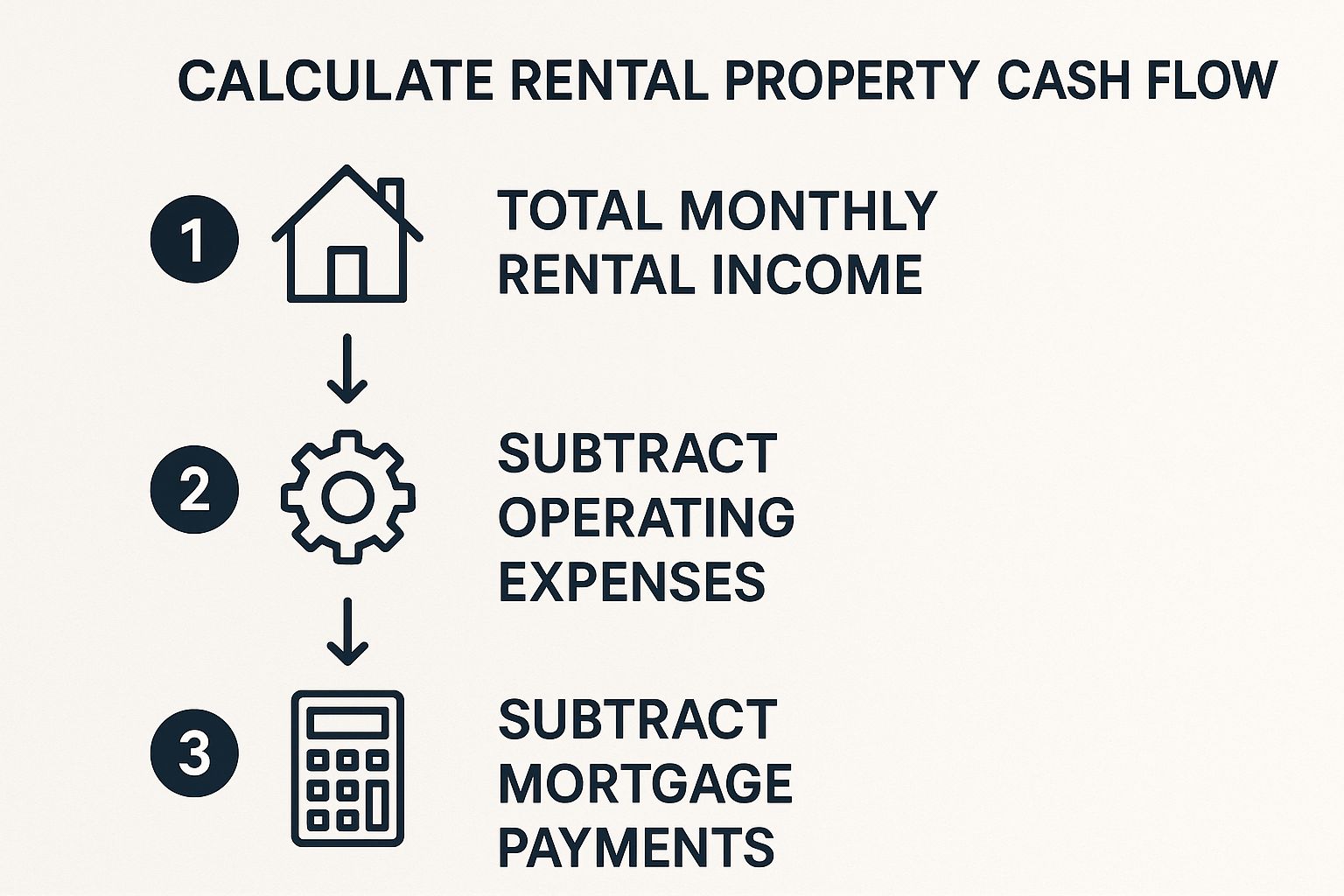

This visual shows the basic path, starting with income and systematically subtracting expenses to find your final take-home cash.

As you can see, it's a logical flow. We first strip out the property's direct operating costs and then account for financing to reveal the true cash flow.

Net Operating Income (NOI)

First up is Net Operating Income (NOI). This is the purest measure of a property's ability to generate profit, completely independent of financing. It tells you how the asset performs on its own.

The formula is simple:

NOI = Gross Operating Income - Total Operating Expenses

Here, Gross Operating Income is your total potential rent minus vacancy allowance. Your Total Operating Expenses include everything—taxes, insurance, maintenance, property management—except your mortgage payment. Leaving out the mortgage allows you to compare two properties on an apples-to-apples basis.

Cash Flow Before Tax (CFBT)

Next is Cash Flow Before Tax (CFBT). When investors say "cash flow," this is usually the number they mean. It represents the actual money that hits (or leaves) your bank account each month.

The formula for CFBT is:

CFBT = Net Operating Income (NOI) - Debt Service

"Debt Service" is your total mortgage payment—both principal and interest. Subtracting this from your NOI reveals the property's profitability after financing is factored in. A positive CFBT means you have money left over; a negative number means you’re feeding the property from your own pocket.

A property with a strong NOI can still have negative cash flow if the financing is structured poorly. This is why you must analyze both the property's performance (NOI) and the deal's structure (CFBT).

This distinction is critical. With mortgage rates climbing from near 3% in 2021 to over 7% in early 2025, that "Debt Service" number has ballooned for new buyers, squeezing cash flow. For a deeper analysis, see the global real estate market outlook from Aberdeen Investments.

Cash-on-Cash Return (CoC)

While CFBT tells you how much money you're making, Cash-on-Cash Return (CoC) tells you how hard your invested cash is working for you. It's a critical performance metric. It measures your annual pre-tax cash flow as a percentage of the total cash you put into the deal.

Here's the formula:

CoC Return = (Annual CFBT / Total Cash Invested) x 100

Your "Total Cash Invested" is everything you paid out-of-pocket: the down payment, closing costs, and any money spent on initial repairs to get it rent-ready. A "good" CoC return often starts in the 8-12% range, but this varies by market.

Putting It All Together: A Quick Example

Let's run the numbers on a single-family rental:

- Monthly Rent: $2,000

- Operating Expenses: $800/month (taxes, insurance, maintenance, etc.)

- Mortgage Payment: $900/month

- Total Cash Invested: $50,000 (down payment + closing costs)

Here’s the breakdown:

- NOI: $2,000 (Income) - $800 (Expenses) = $1,200 per month

- CFBT: $1,200 (NOI) - $900 (Mortgage) = $300 per month (or $3,600 annually)

- CoC Return: ($3,600 Annual Cash Flow / $50,000 Cash Invested) x 100 = 7.2%

By mastering these three calculations, you move past surface-level analysis and start making truly informed, data-driven decisions. To go even deeper, check out our complete guide on the most important real estate math formulas every investor should know.

Step 3: Determine What "Good" Cash Flow Means for You

You’ve crunched the numbers and have a final figure. So... is it any good? Answering that question is the most critical step of all.

The honest truth? There is no single magic number.

What's "good" cash flow depends on your investment strategy, risk tolerance, and market. A property pulling in $200 per month might be a home run for an investor targeting long-term appreciation in a hot market. For an investor focused purely on immediate income, anything less than $500 per month might be a hard pass.

Actionable Benchmarks Investors Use

While there's no universal standard, investors rely on rules of thumb to quickly size up a property's potential. Use them as a "gut check" before committing hours to a deep-dive analysis.

The two most common are the 1% Rule and the 50% Rule.

- The 1% Rule: A quick test suggesting a property's gross monthly rent should be at least 1% of its purchase price. For a $250,000 property, you'd want a monthly rent of at least $2,500.

- The 50% Rule: An estimation tool assuming your total operating expenses (everything except the mortgage) will average about 50% of your gross rental income over time.

Investor Insight: These rules are fantastic starting points, but they are getting much harder to find in today's world of high property prices and interest rates. If a property doesn't hit the 1% mark, don't just toss it aside. Instead, see it as a signal to be extra diligent with your expense projections.

Market Location Is Everything

You cannot discuss cash flow without talking about geography. Your expectations must be grounded in market reality.

Phenomenal cash flow in a stable Midwest city would be a pipe dream in a pricey coastal market like San Diego. In high-cost areas, investors often accept lower (or even negative) initial cash flow, banking on aggressive appreciation for their returns.

Data backs this up. Investors who prioritize cash flow hunt for markets with high net rental yields—the ratio of net rental income to property value. For instance, in 2025, cities like Memphis and Birmingham are posting gross rental yields of 9% or more. You can find more data on how top markets deliver superior rental yields at Rental Income Advisors.

Ultimately, a "good" number gets you closer to your financial goals. Actionable Step: Define your personal benchmark—whether it’s a minimum dollar amount per door or a target Cash-on-Cash Return—and use that to filter every deal. That's how you build a portfolio that works for you.

Step 4: Take Action to Boost Your Cash Flow

Knowing how to calculate cash flow on a rental property is the start. The real magic is actively improving it. Turning a good investment into a great one often comes down to small, strategic adjustments. Think of each adjustment as a lever you can pull to directly impact your bottom line.

Smartly Increasing Your Income

Boosting revenue doesn't always require buying another property. You can extract more value from the assets you already own.

An effective approach is to implement modest but regular rent increases of 3-5% annually, aligned with market rates and regulations. This slow-and-steady method avoids the sticker shock that can cause costly vacancies.

Beyond rent, look for value-add services to create new revenue streams.

- Offer Premium Services: Install an in-unit washer and dryer and charge a monthly convenience fee. Offer reserved or covered parking spots for a premium.

- Implement Utility Billing Systems: For multi-family properties, a Ratio Utility Billing System (RUBS) lets you fairly divide utility costs among tenants instead of absorbing that expense yourself.

- Pet-Friendly Policies: Charging a monthly pet rent of $25-$50 per animal creates a substantial new income stream and taps into a large market of responsible renters.

Diligently Trimming Your Expenses

While increasing income is great, controlling expenses provides more immediate and predictable results. A dollar saved goes straight to your bottom line.

An overlooked opportunity is appealing your property taxes. If you believe your property's assessed value is higher than comparable homes, a successful appeal can lower your tax bill for years to come.

Investor Insight: Too many investors "set and forget" insurance and property management. Treat these as variable costs. Actionable Step: Shop your insurance policy annually. Don't be afraid to renegotiate with your property manager, especially if you bring them multiple properties.

A proactive maintenance plan is another must. Stop reacting to expensive emergency calls. Actionable Step: Schedule regular inspections for your HVAC, plumbing, and roof. This preventative approach helps you catch small issues before they become budget-breaking disasters.

If you need help finding a team that thinks this way, be sure to ask the right questions when hiring a property management company to ensure they are proactive, not just reactive. By consistently applying these strategies, you can systematically improve your property's financial performance and build a resilient, high-performing rental portfolio.

Common Questions About Rental Cash Flow

Once you’ve run the numbers, a new set of questions always surfaces. It’s one thing to have a spreadsheet full of data; it’s another to understand what those numbers mean for your real-world investment strategy. Let's clear up some common points of confusion so you can move forward with confidence.

How Should I Handle Big, One-Time Expenses?

A surprise $10,000 roof replacement can wipe out your cash flow for months. How do you account for these massive, irregular costs?

The key is proactive saving, not reactive spending. These aren't "surprises"; they're inevitable Capital Expenditures (CapEx). You must budget for them from day one.

The best practice is to set aside 5-10% of your monthly rent into a separate savings account. This "sinking fund" ensures the money is ready when needed, protecting your regular cash flow from being derailed.

Don't treat a $10,000 roof replacement as a one-time expense in the month it happens. Instead, treat it as a $83 per month expense spread over 10 years. This mindset shift is the key to accurate long-term cash flow analysis.

What's the Difference Between Cash Flow and Profit?

This is a critical distinction.

Cash flow is the real, spendable money left in your bank account after every bill—including your full mortgage payment (principal and interest)—is paid. It’s the tangible result of your property's operation.

Profit is an accounting term. It often includes non-cash expenses like depreciation (a tax benefit) and only subtracts the interest portion of your mortgage, not the principal that builds your equity. A property can show a "profit" on paper but have negative cash flow.

For a real estate investor, cash flow is king. It’s what you can use to pay your bills, reinvest, or live on.

How Much Cash Reserve Should I Keep Per Property?

There's no single magic number, but a widely accepted best practice is to hold three to six months of total expenses in a liquid, easily accessible savings account for each property.

Your reserve calculation should include the full PITI (Principal, Interest, Taxes, and Insurance) plus your budgeted monthly amounts for vacancies, maintenance, and property management fees. This emergency fund is your ultimate safety net, giving you the peace of mind to handle an extended vacancy or a major repair without putting your entire investment—or your personal finances—at risk.

Stop spending hours on spreadsheets and start making smarter, faster decisions. Flip Smart gives you the power to analyze any rental property in seconds, providing accurate cash flow projections, renovation costs, and profit potential. Get your first property analysis at https://flipsmrt.com.