When you're buying a home, figuring out its true value comes down to one core concept: analyzing what similar, nearby properties have recently sold for. This is the bedrock of property valuation, whether you're a first-time buyer or a seasoned real estate agent. You're essentially comparing the house you're eyeing to its closest peers in size, condition, and location.

What Is Fair Market Value and Why Does It Matter?

Before you even think about writing an offer, understanding a property's Fair Market Value (FMV) is your single biggest advantage. Think of it as the realistic price a willing buyer and an informed seller can agree on when neither is under pressure to act.

It’s not the seller's wishful asking price or an instant online estimate. FMV is a valuation grounded in cold, hard market data.

Nailing down the FMV is crucial. It gives you the confidence to negotiate from a position of strength and keeps you from getting swept up in a bidding war and overpaying. It also paves the way for a smoother financing process, since your lender will hire an appraiser to determine the home's value and will only lend what they believe the property is truly worth.

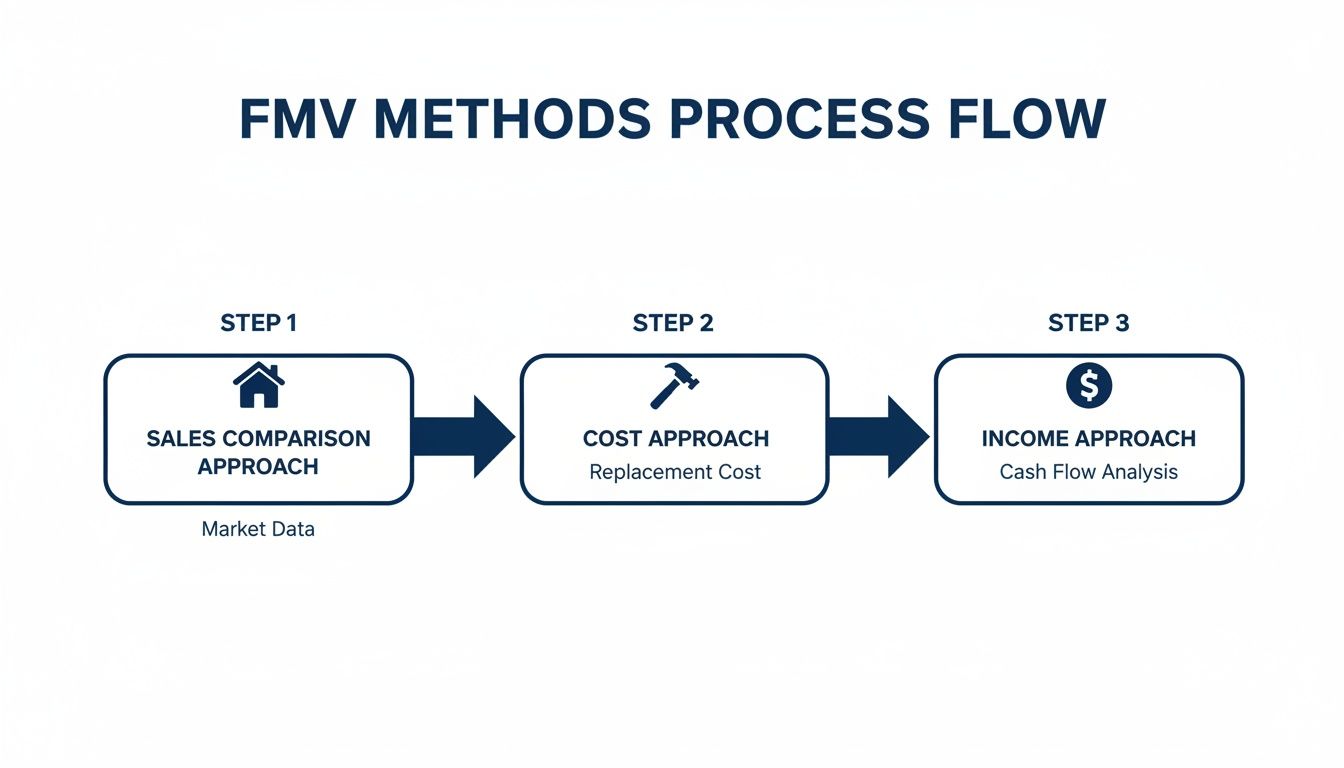

The Three Pillars of Property Valuation

Real estate professionals use three main methods to pin down a property's value. While the first one will be your go-to for buying a home, knowing all three gives you a much clearer picture of how value is determined.

Here's a quick rundown of the main valuation methods and when they're most effective.

Key Valuation Methods at a Glance

| Valuation Method | What It Measures | Best For... |

|---|---|---|

| Sales Comparison Approach | The recent sale prices of similar, nearby properties ("comps"). | Standard residential homes. This is the primary method for home buyers. |

| Cost Approach | The cost to rebuild the property from scratch, minus depreciation. | New construction, unique custom homes, or properties with few comparable sales. |

| Income Approach | The property's potential to generate income through rent. | Rental properties, multi-family units, and commercial real estate. |

For most home buyers, the Sales Comparison Approach is king. However, blending insights from the other two can give you a much more robust and defensible valuation.

Remember, even beyond the raw numbers, things like effective home staging techniques can seriously impact how buyers perceive a property's value and influence the final sale price.

A property's true value isn't just about square footage and a new roof. It's a blend of tangible data, market conditions, and buyer perception. Mastering FMV means you can confidently separate a good deal from a costly mistake.

Using the Sales Comparison Approach Like a Pro

When you need to figure out what a property is really worth, the single best method is the Sales Comparison Approach. This isn't some complex industry secret; it's the exact same technique professional appraisers lean on every single day. The core idea is simple: a home is worth what similar, nearby homes have recently sold for.

This process involves finding and analyzing "comparables," or "comps" for short. Think of these as your benchmark properties. They give you a real-world, data-backed snapshot of the current market, allowing you to build a strong case for a home's true value.

What Makes a Strong Comp

Not all sold homes are good comps. To get an accurate valuation, your comparables need to be as close to a mirror image of your target property—what appraisers call the "subject property"—as possible. Using a weak comp can throw your entire analysis off track.

Here’s what to look for in a quality comparable:

- Recent Sale Date: The market is always moving. A solid comp needs to have sold within the last 3-6 months. Anything older is likely stale data and won't reflect today's prices.

- Proximity: Closer is always better. Your comps should be in the same neighborhood and, if possible, the same school district to ensure you're comparing apples to apples on location value.

- Similar Features: Look for homes with a nearly identical number of bedrooms, bathrooms, square footage, and lot size. Even the overall style (like a ranch vs. a two-story) matters.

- Age and Condition: A 50-year-old fixer-upper is not a good comp for a turnkey new build. The age and physical state of the properties—whether they're fully updated or need a gut renovation—should line up.

Making Realistic Value Adjustments

You'll almost never find a perfect, identical comp. That's where the real skill comes in: making adjustments. This means you have to assign a dollar value to the differences between your subject property and the comps.

Let's say your target property is a standard 3-bed, 2-bath house. You find a comp that just sold for $480,000, but it has a brand-new, gourmet kitchen. Since your property doesn't have that pricey upgrade, you need to adjust that comp's price downward. If you know a high-end kitchen adds about $20,000 in value in that neighborhood, you'd treat that comp as if it sold for $460,000 for your comparison.

On the flip side, if another comp sold for $445,000 but only has 2 bedrooms, you would adjust its price upward. Why? Because your 3-bedroom property is inherently more valuable. This process of adjusting for features—like a finished basement, an extra garage stall, or a corner lot—is how you zero in on an accurate FMV. For a structured way to keep track of all this, a good comparative market analysis template can be a lifesaver.

This flowchart breaks down the three primary valuation methods used by the pros.

While all three have their place, the Sales Comparison Approach is almost always the most powerful and relevant for valuing residential homes.

Pro Tip: When you're adjusting values, never use the seller's asking price for a comp. Only the final, closed sale price matters. Asking prices are just a wish list; the sale price is market reality.

Adjusting comps is both an art and a science. It demands a sharp eye for detail and a solid understanding of local market data. For instance, a home in a prime urban location might command a 20-50% premium over a similar property just a few miles away in a rural setting. This systematic process is how an appraiser can take three comps sold at different prices, account for all their unique features, and land on a single, defensible fair market value.

When to Consider the Cost and Income Approaches

While analyzing comparable sales is your go-to method 95% of the time, some properties just don't play by the rules. What about that one-of-a-kind historic home with no recent comps? Or a duplex bought purely for its rental potential?

In these situations, relying solely on comps can leave you guessing. That's when two other professional valuation methods, the Cost Approach and the Income Approach, become useful. Think of them less as replacements and more as supplements that give you a complete, well-rounded picture of a property's true worth.

Using the Cost Approach for Unique Properties

Imagine you're looking at a brand-new custom build or a funky, architecturally unique home from the 70s. How do you value it when there’s simply nothing else like it in the neighborhood? This is the perfect scenario to break out the Cost Approach.

This method boils value down to a simple, tangible question: What would it cost to build this exact property from scratch today?

The formula is pretty straightforward:

- Cost to Rebuild: The total price of all labor and materials needed to construct an identical structure.

- Minus Depreciation: This accounts for the real-world wear and tear, age, and any outdated features of the existing home.

- Plus Land Value: The current market value of the dirt the house sits on.

The Cost Approach is a lifesaver for valuing new construction, properties undergoing massive renovations, or for insurance purposes. It establishes a baseline value rooted in tangible costs, which is critical when good comps are nowhere to be found.

The Income Approach for Investment Properties

Now, let's shift gears. Say you're analyzing a duplex, a small multi-family, or even a single-family home with a rentable apartment. Here, the property isn't just a home; it's a cash-flowing machine. To figure out what that machine is worth, you need the Income Approach.

This method speaks the language of serious investors. It treats the property like a small business and asks the ultimate question: "Is this a good financial move?" To get the answer, investors lean on a critical metric called the capitalization rate (or cap rate).

In simple terms, the cap rate is the expected rate of return on a real estate investment, based on the income it's projected to generate. A higher cap rate often signals higher potential returns, but it can also mean higher risk.

The Income Approach estimates value by looking at future cash flow. For example, across U.S. markets in 2024, real estate cap rates hovered around 6.2%. So, if a property has a Net Operating Income (NOI) of $50,000, its value using a 7% cap rate would be around $714,000 ($50,000 / 0.07). This method is non-negotiable for valuing any asset that produces an income stream.

By getting comfortable with all three real estate valuation methods, you build a much more accurate and defensible understanding of fair market value, no matter what kind of property crosses your desk.

Where to Find Reliable Property Data

An accurate valuation is built on a foundation of solid, reliable data. Knowing where to look is the first step in moving from guesswork to a confident understanding of fair market value. Fortunately, you don’t need a secret password to access high-quality information; you just need to know where to find it.

Your journey should always begin with public records. Nearly every county has an assessor or recorder’s office with a free online portal. These websites are absolute goldmines, offering details on property tax history, previous sale prices, and official records of square footage and lot size. This is the raw, unbiased data that all real estate pros start with.

Another powerhouse source is the Multiple Listing Service (MLS). While direct access is limited to licensed real estate agents, a good agent on your team is your gateway to this treasure trove. The MLS provides the most current and detailed information on sold properties, active listings, and market trends—far more than you'll ever find on public websites.

The Truth About Online Estimators

So, what about popular tools like Zillow’s Zestimate or other Automated Valuation Models (AVMs)? These platforms are a great starting point for a quick ballpark figure. They use algorithms to analyze public data and recent sales, which is certainly helpful for an initial gut check.

But here’s the thing: AVMs have a massive blind spot. They can’t see a property’s actual condition. An algorithm doesn't know if the kitchen was just gutted and renovated or if the roof is 20 years old and actively leaking. Their estimates are based on cold data, not a physical inspection, which is why they should be used as one tool among many—never as the final word.

Key Takeaway: Use online estimators to get a general sense of value, but always validate the numbers with real-world data from public records and the MLS. Your final valuation should never rely solely on an algorithm.

Well-known platforms are crucial for property data, and for more in-depth analysis, some users even explore methods for gathering data from platforms like Zillow. The more sources you can pull from, the more complete your picture becomes.

Your Property Data Collection Checklist

When you find a property you’re serious about, you need to collect specific data points to perform an accurate analysis. Having a structured approach ensures you don't miss anything critical.

Use this checklist as your guide:

- Property Address: The specific location you are evaluating.

- Sale Price & Date: The final closing price and the date of sale for at least 3-5 comparable properties.

- Key Features: Number of bedrooms, bathrooms, and total square footage.

- Lot Size: The total acreage or square footage of the land.

- Year Built: The age of the property helps compare it to others of a similar era.

- Property Taxes: The annual tax amount can provide clues about the assessed value.

Organizing these details systematically is crucial for making smart investment decisions. Properly leveraging data analytics in real estate is what separates amateur investors from seasoned pros. It transforms raw information into actionable intelligence, empowering you to determine fair market value with precision and confidence.

Common Mistakes to Avoid in Home Valuation

Figuring out a home's fair market value is an analytical game, but even the sharpest buyers can get tripped up by a few common pitfalls. Learning to sidestep these mistakes is what separates a smart, objective offer from a financial headache.

One of the biggest traps? Letting emotion get in the way. It’s incredibly easy to fall in love with a home’s charm and start justifying a price that the data just doesn't support. This is a classic mistake that can cost you tens of thousands right out of the gate.

Using Weak or Irrelevant Comps

Your entire valuation is built on the quality of your comparable sales. A sloppy comp selection will lead to a sloppy valuation—it’s that simple. Here’s where buyers often go wrong:

- Ignoring Location Nuances: A comp from a different school district or a neighborhood just a few blocks over can be totally misleading. Values can change dramatically from one street to the next.

- Comparing Dissimilar Properties: A foreclosure or short sale is not a valid comp for a standard transaction. Distressed properties almost always sell at a steep discount that has little to do with the true market value.

- Using Outdated Sales Data: Pulling comps from a year ago is like using an old map to navigate. Markets shift. Stick to sales data from the last 3-6 months to get a true picture of what’s happening right now.

Overlooking Significant Flaws and Repairs

That beautiful new kitchen is great, but it won’t fix the leaky roof. Too many buyers get distracted by cosmetic upgrades while completely underestimating the cost of major repairs. A cracked foundation, failing HVAC, or outdated electrical system can absolutely crush a home's value.

A property's true value must account for its liabilities, not just its assets. A thorough home inspection is non-negotiable; its findings should directly influence your final valuation and offer price.

If you fail to factor in a $15,000 roof replacement or a $10,000 HVAC upgrade, you aren't calculating the real fair market value. You're just guessing.

Misinterpreting Market Conditions

Finally, you have to understand the bigger picture. Fair market value isn’t a static number—it lives and breathes with the current economic climate.

In a hot seller's market with barely any inventory, you might have to offer at or even slightly above your calculated FMV just to get in the game. On the flip side, in a buyer's market loaded with listings, you have way more leverage. You can often negotiate a price below what the comps suggest.

Ignoring these market dynamics means you’re either leaving money on the table or making an offer that's dead on arrival. A smart valuation always considers the market forces at play.

Frequently Asked Questions About Fair Market Value

1. What's the difference between asking price and fair market value?

The asking price (or list price) is what the seller hopes to get for their home. The Fair Market Value (FMV) is the price that the home is actually worth based on data from recent, similar sales. A smart buyer makes an offer based on the FMV, not the seller's asking price.

2. What happens if the bank's appraisal is lower than my offer?

This is called an "appraisal gap." If you have an appraisal contingency in your contract, you can walk away from the deal and get your deposit back. You can also try to renegotiate the price with the seller, pay the difference in cash, or challenge the appraisal with stronger comparable sales data.

3. Are online home value estimators accurate?

Think of online estimators like Zillow's Zestimate as a helpful starting point, but not the final word. They use algorithms that can't see the home's current condition—like a brand-new kitchen or an old, leaky roof. Always back up these estimates with a detailed analysis of comparable sales, preferably with help from a real estate agent.

4. How much can I negotiate below the fair market value?

Your negotiating power depends entirely on the current housing market. In a "buyer's market" (many homes for sale), you may be able to successfully offer 5-10% below FMV. In a competitive "seller's market" (few homes for sale), you will likely need to offer at or even above the fair market value to have a chance.

Ready to stop guessing and start analyzing properties with the confidence of a pro? Flip Smart equips you with the tools to nail your valuations, estimate rehab costs, and see the real profit potential in seconds.