Getting a property's valuation right is the single most important step in any real estate deal. It's the bedrock for every decision you'll make, from your initial offer to your final profit projection. This isn't about pulling a number out of thin air; it’s a methodical process that relies on established techniques to arrive at a realistic, defensible value.

Think of these valuation methods as different tools in your toolbox, each designed for a specific job. One might be perfect for a single-family home in a dense subdivision, while another is essential for a commercial apartment building. Just like a carpenter wouldn't use only a hammer to build a house, a savvy investor never relies on just one way to value a property.

Understanding the Core Real Estate Valuation Methods

The three main approaches to property valuation have been battle-tested for decades. While early methods were quite basic, the rise of cities and complex markets pushed the industry to develop the more precise tools we still use today: the Sales Comparison, Income, and Cost methods.

These aren't just abstract theories. They are the practical frameworks that separate successful investors from the rest. Each one provides a unique angle on a property's worth, and understanding how they work together gives you a complete financial picture.

This idea of looking at value from different perspectives isn't unique to real estate. In fact, very similar principles are used in business valuation methodologies, where appraisers also look at assets, income, and market comparisons. It just goes to show that the logic is universal: an asset's worth is tied to what it costs, what it earns, or what someone else will pay for something similar.

At-a-Glance Overview of Valuation Methods

To quickly see how these methods fit together, here’s a simple breakdown of the three main approaches.

| Valuation Method | Best For | Core Principle |

|---|---|---|

| Sales Comparison Approach | Single-family homes, condos | Value is determined by what similar, nearby properties have recently sold for. |

| Income Approach | Rental properties, commercial buildings | Value is based on the property's ability to generate income. |

| Cost Approach | New construction, unique properties | Value is the cost to rebuild the property from scratch, minus depreciation. |

Each method gives you a different piece of the puzzle. We’ll break down each of these in detail, but the key takeaway is that the most confident investors don't just pick one—they use them to cross-check each other.

Relying on a single valuation method can leave you with serious blind spots. A multi-faceted approach, on the other hand, lets you build a much more reliable and data-backed estimate of a property's true market value.

Mastering the Sales Comparison Approach

Of all the ways to value real estate, the Sales Comparison Approach is king, especially when you're looking at residential properties. The logic is refreshingly simple: a house is worth what other similar houses nearby have sold for recently.

Think about it like pricing a used car. You wouldn't just pull a number out of thin air. You'd check what the same make, model, year, and condition are selling for right now. This method, which we call "pulling comps" in the industry, is the absolute bedrock of almost every home appraisal.

Finding and Selecting the Right Comps

The entire accuracy of this approach lives and dies by the quality of your comps. A great comparable property is like your subject property's near-identical twin; a bad one will send your valuation completely off the rails.

The mission is to find at least three to five recently sold homes that mirror yours as closely as possible. You need to focus on the features that truly matter to a buyer.

Here's what makes a comp a winner:

- Recent Sale Date: The deal needs to have closed in the last 3-6 months. A sale from a year ago is ancient history in a shifting market.

- Proximity: The closer, the better. Ideally, comps should be in the same subdivision or within a tight, one-mile radius to ensure the neighborhood vibe is the same.

- Physical Features: Look for similar square footage (within 10-15%), the same number of bedrooms and bathrooms, a similar age, and the same architectural style.

- Condition and Quality: A gut-renovated home is not a fair comparison for a fixer-upper, and vice versa. You have to compare apples to apples.

Getting this information is easier now than ever. Historical sales data is crucial for seeing the bigger picture of market trends and nailing down an accurate value. Investors and appraisers dive into massive datasets from public records, the Multiple Listing Service (MLS), and other online sources to spot these patterns. This is the same data that fuels Automated Valuation Models (AVMs), which spit out quick value estimates. To dig deeper, you can learn more about why historical data matters in property valuation.

The Art of Adjusting Comparables

Here's the thing: no two properties are ever truly identical. This is where the real skill of the Sales Comparison Approach comes into play—making financial adjustments to a comp's sale price to account for every little difference. The goal is to figure out what the comp would have sold for if it were an exact clone of your property.

The core rule of adjustments is simple yet critical: If the comp is superior to your property, you subtract value from its sale price. If the comp is inferior, you add value.

Let's walk through a quick example. Imagine your subject property is a 3-bed, 2-bath, 1,800 sq. ft. home. You find a comp that just sold for $420,000.

- Comp Details: It's a 3-bed, 2-bath, 2,000 sq. ft. home, but it doesn't have a garage (your place does).

- Adjustment for Size: The comp is 200 sq. ft. bigger. If space in this neighborhood is worth about $100/sq. ft., the comp is superior by $20,000. So, you subtract $20,000 from its sale price.

- Adjustment for Garage: Your property is better because it has a two-car garage, which adds about $15,000 in value in this market. You need to add $15,000 to the comp's price.

Adjusted Comp Value Calculation: $420,000 (Sale Price) - $20,000 (Size) + $15,000 (Garage) = $415,000

You repeat this process for all your comps, leaving you with a tight range of adjusted values. The last step is to reconcile these numbers, often by taking a weighted average, to land on a confident estimate for your property. While it sounds like a lot of manual work, platforms like Flip Smart do all of this heavy lifting for you, instantly analyzing comps and making data-backed adjustments to give you a reliable after-repair value (ARV).

Valuing Property with the Income Approach

When you’re looking at an investment property, its value isn't just about curb appeal or square footage. It's a business. Its primary job is to make money, and its value is directly tied to how much cash it can generate.

This is the entire philosophy behind the Income Approach. It's the preferred valuation method for commercial real estate—think apartment buildings, office complexes, or retail centers. Instead of asking what a similar property sold for, an investor asks, "How much profit can this asset produce?"

Unpacking NOI and Cap Rate

To answer that question, you need to get comfortable with two of the most important terms in an investor's vocabulary: Net Operating Income (NOI) and the Capitalization Rate (Cap Rate). These aren't just fancy jargon; they're the engine that drives this valuation method.

- Net Operating Income (NOI): This is the property's pure, unadulterated profit from its daily operations. You take all the income it generates and subtract all the operating expenses—before you factor in any mortgage payments or income taxes.

- Capitalization Rate (Cap Rate): The Cap Rate is a simple percentage that shows the expected rate of return on an investment. It’s set by the market and tells you what other investors are willing to pay for similar properties in that specific area, based on their risk and return expectations.

The magic happens when you put these two together. The core formula is surprisingly simple:

Market Value = Net Operating Income (NOI) / Capitalization Rate (Cap Rate)

This powerful little equation translates a property's annual profit directly into a solid estimate of its market value. It's a must-know for any serious investor. If you want a deeper dive into the math, check out our guide on the essential real estate math formulas.

A Practical Example of the Income Approach

Let's see how this works in the real world with a small, four-unit apartment building. Each unit rents for $1,500 per month.

1. Calculate Gross Potential Income (GPI): First, figure out the maximum possible income if everything is perfect.

- $1,500/month x 4 units = $6,000/month

- $6,000/month x 12 months = $72,000 (Annual GPI)

2. Account for Vacancy and Credit Loss: Realistically, no property stays 100% occupied. We'll use a conservative 5% vacancy rate.

- $72,000 x 5% = $3,600

- Effective Gross Income (EGI) = $72,000 - $3,600 = $68,400

3. Tally the Operating Expenses: Next, add up all the costs to keep the lights on (but not the mortgage).

- Property Taxes: $7,000

- Insurance: $2,500

- Maintenance & Repairs: $5,000

- Property Management: $6,840 (a typical 10% of EGI)

- Total Operating Expenses = $21,340

4. Determine the Net Operating Income (NOI): Now, find the property's true operating profit.

- NOI = $68,400 (EGI) - $21,340 (Expenses) = $47,060

5. Apply the Market Cap Rate: You've done your homework and found that similar buildings in the area are selling at a 6% Cap Rate.

- Estimated Value = $47,060 / 0.06 = $784,333

Just like that, you have a data-driven valuation based purely on the property's financial performance.

Income Approach Metrics Compared

The Income Approach uses a few different metrics to analyze a property's financial health. While NOI and Cap Rate are the stars of the show for valuation, understanding tools like the GRM can provide quick, high-level insights. Here's how they stack up.

| Metric | What It Measures | Best Used For |

|---|---|---|

| Cap Rate | The unlevered annual rate of return based on NOI. | Comparing the relative value and profitability of similar income properties. |

| NOI | The property's annual profit before debt service and taxes. | Assessing the operational efficiency and raw profitability of an asset. |

| GRM | A simple ratio of property price to its gross scheduled income. | Quick, back-of-the-napkin screening of smaller residential rental properties. |

Each metric offers a different lens through which to view an investment. The Cap Rate provides a deep, profitability-focused valuation, while the GRM gives you a fast way to see if a property is even in the right ballpark before you dig deeper.

Limitations and Best Practices

The Income Approach is incredibly powerful, but its output is only as good as the data you put in. "Garbage in, garbage out" is the mantra here.

A classic rookie mistake is using pie-in-the-sky income projections or conveniently forgetting a few major expenses. Always ground your numbers in reality. Look at the property's historical performance, but also be realistic about future market trends.

Because it relies on predictable cash flow, this method shines for stable, income-producing properties. It’s far less reliable for vacant land or buildings in highly volatile markets where forecasting future income is more of a guessing game than a calculation.

Applying the Cost Approach for Unique Properties

Sometimes, a property just doesn't play by the usual rules. It might be brand new construction with zero sales history, or it could be so unique—think a school, a historic church, or a one-of-a-kind custom home—that finding "comps" is a fool's errand.

So, when a property has no rental income and no direct peers, how on earth do you figure out what it's worth? This is exactly where the Cost Approach steps into the spotlight.

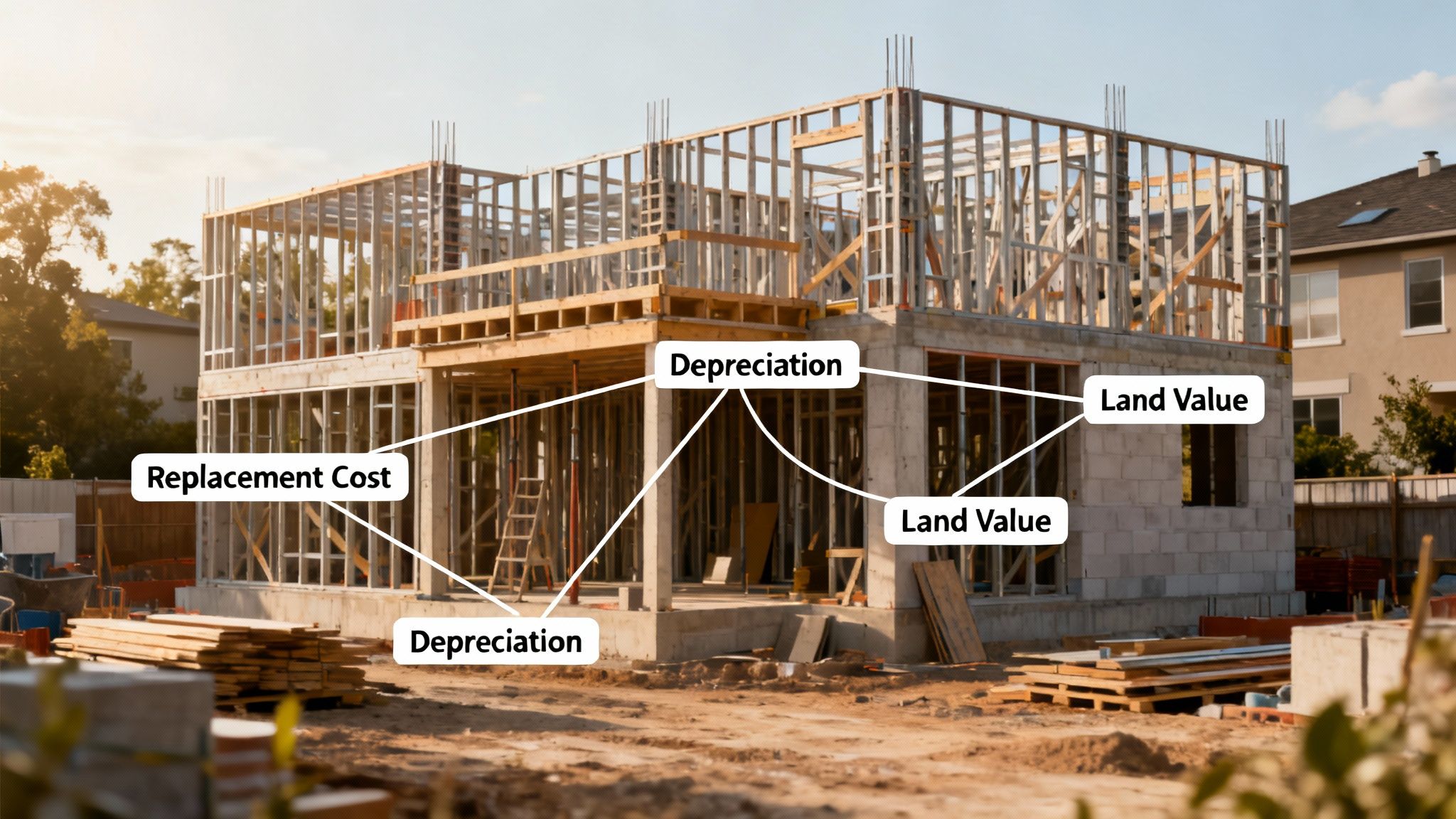

Think of it as the "build it from scratch" method. The logic is simple and surprisingly intuitive: a property is worth what it would cost to build a similar one today, minus any wear and tear, plus the value of the land it sits on.

The formula itself is pretty straightforward.

Value = Replacement Cost - Accumulated Depreciation + Land Value

This is a go-to tool for appraisers and insurance companies who need a baseline value that isn't tied to the whims of the market or rental income. Let's pull back the curtain on each piece of this puzzle.

Replacement Cost Versus Reproduction Cost

First things first, you have to figure out the cost to build. And right away, we hit a critical fork in the road: the difference between replacement cost and reproduction cost. They sound alike, but they’re worlds apart.

Replacement Cost: This is the cost to build a structure with the same function and utility using modern materials and construction methods. For example, if you were valuing an old home with plaster walls, you’d estimate the cost of building it with modern drywall instead.

Reproduction Cost: This is the cost to build an exact duplicate of the property, using the original materials and craftsmanship. Trying to replicate ornate, historic details or source obsolete materials would be incredibly expensive, which is why this is rarely used for typical investment analysis.

For most real-world scenarios, replacement cost is the practical number you’ll use. For new construction, where this method is most common, a detailed guide to construction cost breakdown is your best friend for getting this number right.

The Challenge of Calculating Depreciation

Here's where things get tricky. The toughest part of the Cost Approach is nailing down depreciation—the total loss in value since the property was first built. This isn't just about age; it's a catch-all for anything that makes an older building less valuable than a new one.

Depreciation comes in three flavors.

Physical Deterioration: This is the obvious stuff you can see and touch. It’s the leaky roof, the cracked foundation, the worn-out flooring, or an HVAC system on its last legs. It’s the tangible decay from years of use.

Functional Obsolescence: This is when a property's design is outdated by today's standards, even if everything is in perfect working order. Think of a house with a bizarre floor plan, closets barely big enough for a few shirts, or frustratingly low ceilings. The design itself is the problem.

External Obsolescence: This type of depreciation comes from factors completely outside the property lines and totally out of the owner's control. A new highway pops up behind the backyard, the city rezones the adjacent lot for a factory, or the local economy takes a nosedive.

Once an appraiser estimates the replacement cost and subtracts all three forms of depreciation, the last step is to add the current market value of the land itself. The final number is the property's value according to the Cost Approach. While it's a specialized tool, it provides a crucial perspective for those properties that simply defy the other valuation methods.

Using the Discounted Cash Flow Model for Future Value

While the sales, income, and cost approaches give you a solid snapshot of a property’s value today, serious commercial investors often need to look further down the road. They're not just buying a single chapter; they're investing in the property's entire long-term financial story.

This is where the Discounted Cash Flow (DCF) model comes in. It's one of the more advanced real estate valuation methods for a reason. Think of it like a financial time machine for your property.

Instead of just looking at one year, DCF analysis projects a property's financial performance over a holding period, usually 5-10 years. It takes all the rent you expect to collect, accounts for the day you'll eventually sell it, and then translates all that future money back into today's dollars. This tells you what the property is worth right now, based on its total future profit potential.

Projecting Future Cash Flows

The heart of any DCF model is a detailed forecast of income and expenses. This isn't just about one year's NOI. You have to project how rents will grow, how operating costs will inflate, and when you'll need to shell out for big-ticket items like a new roof or HVAC system over your entire hold period.

Accuracy here is everything. Your numbers can't be pulled out of thin air. They need to be grounded in solid market research on rental growth rates and expense inflation for that specific neighborhood. A well-built DCF model tells a multi-year story of the property's financial health.

The real power of the DCF model is its flexibility. You can model different futures. What if rent growth slows? What if the market softens when you plan to sell? By tweaking your assumptions, you can stress-test an investment and see how it holds up, giving you a much clearer picture of the risks and rewards.

Choosing a Discount Rate

Once you've mapped out your cash flows for each year, you need a way to bring them back to the present. That's the job of the discount rate.

In simple terms, the discount rate is the rate of return you demand for taking on the investment's risk. A riskier property (maybe it's in a transitional neighborhood or has a major tenant with an expiring lease) requires a higher discount rate. A higher rate makes future dollars less valuable today.

Picking the right discount rate is both an art and a science. It's a blend of factors like:

- The risk-free rate (think the return on a super-safe government bond)

- General market risk for real estate

- Property-specific risk (location, tenant quality, building condition, etc.)

This number is critical. It directly controls what all that future cash is actually worth to you today.

Putting It All Together

The final steps involve calculating the terminal value—the property's projected sale price at the end of your holding period. Then, you discount all those annual cash flows and that final sale price back to their present-day value. Add them all up, and you get the property's value according to the DCF model.

This method really took off for professional appraisers with the rise of personal computing in the 1980s and 1990s. Suddenly, running these complex, multi-year analyses became practical. Today, it's considered the standard for income property appraisal in the U.S. This shift from simple capitalization to sophisticated, computer-assisted valuation reflects a global move toward more precise, scenario-based analysis. You can find more on this evolution in these insights on property valuation models.

The math might sound intimidating, but modern tools have made it much more manageable. If you want to get your hands dirty and model your own deals, check out our guide on using a real estate investment calculator. It's a powerful approach that gives you a dynamic, forward-looking valuation that static methods just can't match.

How to Choose the Right Valuation Method for Any Property

Picking the right valuation method isn't just some academic exercise—it's a strategic move that can make or break your investment. Every property tells a different story, and your job is to pick the method that translates that story into a reliable number.

Think of it like picking a tool from your toolbox. You wouldn't use a sledgehammer to hang a picture frame, right? The same logic applies here. The key is to match the method to the property type and what you're trying to accomplish with the deal.

A Practical Decision-Making Framework

To cut through the noise, just start by asking one simple question: What is this property's main job? Is it a home for a family? A cash-flowing business? Or something completely unique? The answer almost always points you in the right direction.

Here’s a straightforward guide to get you started:

For Single-Family Homes, Condos, and Townhouses: Your go-to is the Sales Comparison Approach. The value of these properties is almost entirely driven by what similar homes in the same neighborhood have recently sold for. It's the most trusted and universally accepted method for residential real estate, period.

For Multi-Unit Apartment Buildings and Commercial Rentals: Lead with the Income Approach. These properties are businesses, plain and simple. Their value is directly tied to how much money they make. You'll want to calculate the Net Operating Income (NOI) and apply a market cap rate to get your valuation. For a deep dive on that, check out our guide on how to figure out cap rate.

For Unique or New-Construction Properties: What if there are no comps and no income stream? Think of a brand-new custom home, a church, or a school. In these cases, the Cost Approach is your most logical starting point. It establishes a baseline value based on what it would cost to build from scratch.

For Complex Commercial Investments: For the bigger, more sophisticated deals like large office buildings or retail centers, you'll still use the Income Approach, but you should back it up with a Discounted Cash Flow (DCF) model. This analysis looks into the future, giving you a much more dynamic picture of the property's long-term value.

The sharpest investors I know rarely rely on just one number. They'll use a primary method as their guide and a secondary one as a reality check. For instance, they might value a duplex primarily with the Income Approach but cross-reference it with Sales Comparison data to make sure their final number is firmly grounded in reality.

At the end of the day, these methods are powerful instruments, not magic wands. Their accuracy gets a massive boost from solid due diligence, good old-fashioned market research, and a clear vision for your investment. Confidently choosing and defending your valuation approach is a true hallmark of a disciplined investor.

Your Top Property Valuation Questions, Answered

Once you get a handle on the main real estate valuation methods, the real-world questions start popping up. Let's tackle the most common ones investors ask so you can navigate the details with more confidence.

What Is the Most Accurate Real Estate Valuation Method?

This is the million-dollar question, but the honest answer is: it depends entirely on the property. There's no single "best" method.

For a standard single-family home, the Sales Comparison Approach is king. Why? Because there's usually a ton of recent sales data (comps) to pull from, making it the most reliable benchmark. But for a commercial strip mall or an apartment building, the Income Approach is far more relevant because an investor's primary concern is the cash flow it generates.

Seasoned appraisers never just pick one and call it a day. They typically run the numbers using two or even three methods. Then they perform what's called a "reconciliation," where they weigh the different results to arrive at a single, defensible value.

Can I Perform My Own Real Estate Valuation?

Absolutely. In fact, you must. Running your own numbers is a non-negotiable part of your due diligence as an investor. It’s how you quickly sift through dozens of potential deals and know when to make an aggressive offer or walk away.

However, when it's for official business—like getting a bank loan, settling an estate, or for a court case—you need a formal appraisal. That has to be done by a state-licensed appraiser who provides an unbiased, legally sound valuation that lenders and courts will actually accept.

How Do Online Valuation Tools Like Zillow Work?

Those online estimators, officially known as Automated Valuation Models (AVMs), are basically a supercharged version of the Sales Comparison Approach. They crunch massive amounts of public data, like tax records and recent sales, to spit out a quick estimate.

They're great for getting a quick gut check on a property, but they have their limits.

An AVM can give you a ballpark figure in seconds, but it can't see the brand-new quartz countertops you just installed or notice that the "comp" down the street backs up to a noisy highway. A human appraiser catches the nuances that algorithms miss.

How Does Market Volatility Affect Property Valuation?

Market swings have a massive impact on a property's value. In a red-hot seller's market, comps are constantly setting new records, which pushes valuations up when using the Sales Comparison Approach. Conversely, in a cooling market, an appraiser has to make downward adjustments to reflect that properties are sitting longer and selling for less.

The same goes for the Income Approach. A shaky economy can hit rental demand hard, increasing vacancy rates and squashing your Net Operating Income (NOI). A good appraiser doesn't just look at old data; they analyze current market trends to make sure the final value reflects today's reality, not yesterday's news.

Ready to stop guessing and start analyzing? Flip Smart eliminates the manual work by instantly calculating property values, rehab costs, and profit potential for any property in the U.S. Make smarter, faster investment decisions today at https://flipsmrt.com.