Think of a comparative market analysis (CMA) as a property's data-driven resume. It gives you a clear, objective snapshot of its true market value by stacking it up against similar, recently sold homes in the same neighborhood.

It’s just like checking the going rate for other cars with the same make, model, and mileage before you buy. You wouldn't just guess, right? A CMA makes sure you don't overpay for a house, giving you the confidence to make a smart offer.

The Foundation of a Smart Home Offer

For a first-time buyer, figuring out what a home is really worth can feel like throwing darts in the dark. A comparative market analysis, or CMA, takes the guesswork out of the equation by giving you a solid pricing benchmark.

It's not just a price tag. It's the story of a home's value, told through hard data, that helps you understand why it's priced the way it is. By using a structured template, a real estate agent can lay all this information out clearly, empowering you to make a confident, well-informed offer.

At its core, a CMA is about understanding a property's real value in the current market. This process really shows why an expert is crucial for accurate house pricing.

Core Components of a CMA

Every solid CMA template is built on a few key pillars that, together, paint a complete picture of a property's value. Get familiar with these, and you're already ahead of the game.

- The Subject Property: This is the detailed breakdown of the home you're eyeing—square footage, bed and bath count, lot size, age, and any unique features. It’s the starting point for all comparisons.

- Comparable Properties ("Comps"): This is the heart of the whole analysis. It's a list of 3-5 very similar homes nearby that have sold recently. The best comps are nearly identical to your target property in size, condition, and location.

- Adjustments: Let's be real—no two houses are exactly the same. This is where agents make value adjustments to level the playing field. They might add value for a slick, brand-new kitchen or subtract it for a roof that's seen better days, making sure the comparison is truly apples-to-apples.

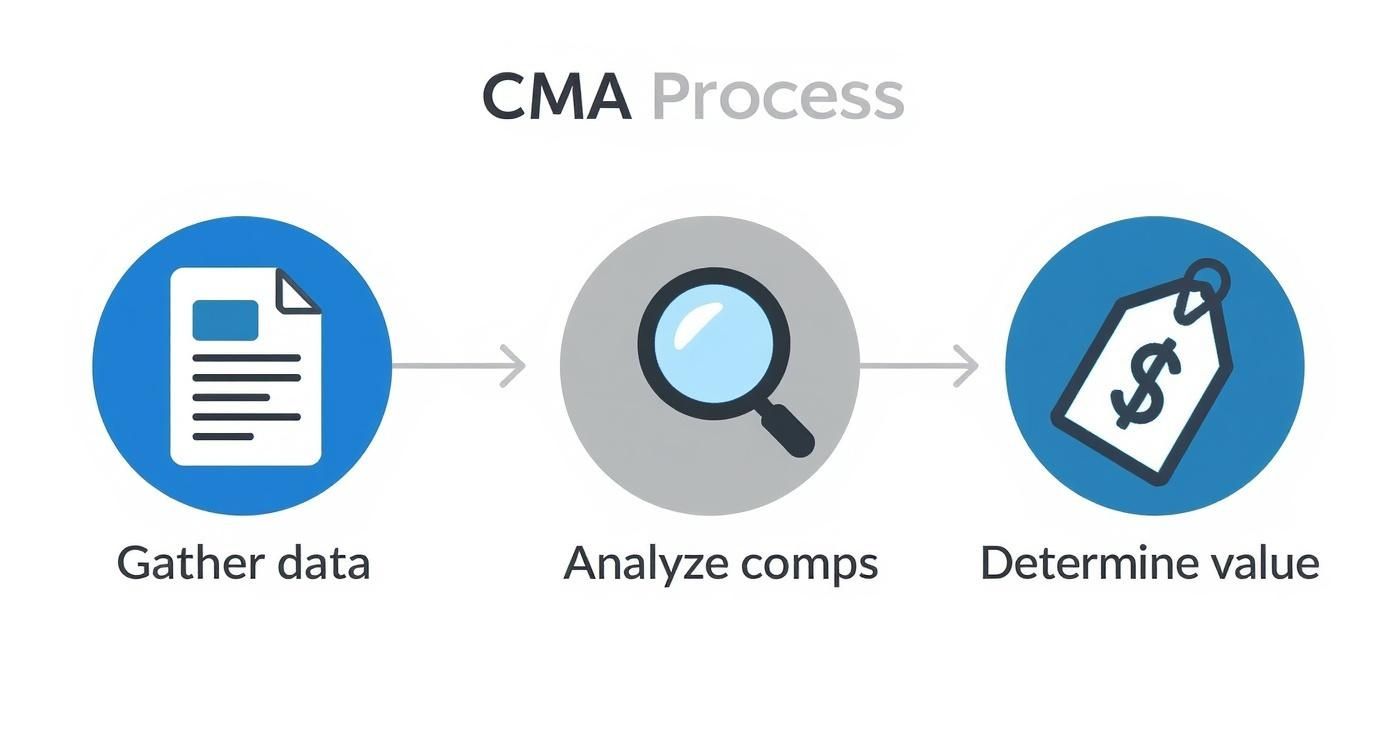

The infographic below breaks down the simple, three-step process agents follow to build a CMA from scratch.

This flow shows exactly how raw property data gets gathered, analyzed against comparable homes, and finally synthesized to pinpoint an estimated market value. A good agent uses this process to ensure the final price recommendation is backed by solid evidence.

Key Components of a Standard CMA Template

To help you quickly identify what's important, this table breaks down the essential parts of any good CMA report and explains why each piece of information is critical for you as a buyer.

| Component | What It Tells You | Why It Matters for Buyers |

|---|---|---|

| Subject Property Details | The core facts: Sq. Ft., Beds/Baths, Lot Size, Age | Establishes the baseline for a fair comparison. |

| Comparable Properties | Details of 3-5 similar, recently sold homes nearby | Provides real-world evidence of market value. |

| Sales Data | Sale Price, Sale Date, Days on Market for each comp | Shows what buyers are actually paying right now. |

| Adjustments | Value added/subtracted for differences (e.g., garage, pool) | Ensures the comparison is accurate and fair. |

| Photos & Maps | Visuals of the subject property and all comps | Helps you see the similarities and differences firsthand. |

| Suggested List Price | The final, data-backed price range suggested by the agent | Gives you a strong, defensible number for your offer. |

Having these elements laid out clearly allows you to see the logic behind the final price, turning a complex analysis into a straightforward decision-making tool.

Making Sense of Your CMA Report

Getting a Comparative Market Analysis (CMA) report can feel like trying to read a foreign language. It's packed with numbers, property details, and real estate jargon. Let's translate it together.

Think of the CMA as the story of a home's value, told through data. The main character in this story is the subject property—the one you’re looking to buy. The report lays out its core features: square footage, bed and bath count, lot size, and age. This section sets the baseline for everything that follows.

Decoding the Comparable Properties

The most critical part of any CMA is the section on "comparables," or comps as we call them in the business. These are recently sold homes that are as similar to your subject property as possible. They are the hard evidence backing up the final price recommendation.

But what makes a comp a good comp? A skilled agent is looking for a specific combination of factors:

- Proximity: The closer, the better—ideally within the same neighborhood or subdivision. A property one mile away can be in a completely different micro-market than one just a few streets over.

- Recency of Sale: The market changes fast. Comps that sold within the last three to six months paint the most accurate picture of current buyer behavior and pricing trends.

- Similar Features: The best comps mirror the subject property in size, number of bedrooms and bathrooms, age, and overall condition.

Buyer's Tip: Pay close attention to the sale dates on the comps. If all the comparable homes sold three months ago for less than the current asking price, it could mean the market is heating up—or that the seller is being a bit too optimistic.

Understanding the Adjustments

No two homes are identical, which is where adjustments come into play. This is the part of the report where your agent plays detective, adding or subtracting value from the comps to make the comparison truly apples-to-apples.

For example, imagine your target property has a brand-new, top-of-the-line kitchen, but a comparable home has an outdated one from the 90s. Your agent will add value to the comp's sale price to account for that difference. It’s a way of saying, "If this comp had the better kitchen, it would have sold for X amount more."

Common adjustments you’ll see include:

- Upgrades: A renovated bathroom or a finished basement in the subject property will result in a positive adjustment to a comp without those features.

- Condition: If a comp has a roof that needs replacing, its value will be adjusted downward to align with your subject property’s newer roof.

- Amenities: A swimming pool, a three-car garage, or a prime corner lot are all factors that require value adjustments.

One crucial red flag to watch for is a distressed sale, like a foreclosure or short sale. These homes often sell below market value and can dramatically skew the data if they’re included without proper context or significant adjustments. Reading these details helps you ask smarter questions and understand the true story behind the numbers.

Understanding the Market Data in Your CMA

https://www.youtube.com/embed/vhOCI2eXP8E

A Comparative Market Analysis (CMA) does more than just line up a few neighboring houses. It’s a snapshot of the local real estate market at a very specific moment, and understanding this bigger picture is what explains the "why" behind your potential property's value.

Local and even national trends have a direct impact on the numbers you see. For example, when there are fewer homes for sale, this supply shortage can push prices up across the board. This is the kind of dynamic a good comparative market analysis template has to account for.

Key Metrics That Tell the Market's Story

To really get a feel for what’s happening on the ground, you need to look at the same key performance indicators (KPIs) that agents use to take the market's temperature. These metrics give crucial context to the prices you see in the CMA.

Here are the big ones you need to watch:

- Days on Market (DOM): This is the average time a house sits on the market before it sells. A low DOM—think under 30 days—screams a hot market where you have to move fast. A high DOM suggests a cooler market where you have more breathing room to negotiate.

- List-to-Sale Price Ratio: This percentage tells you how close homes are selling to their initial asking price. A ratio over 100% means properties are consistently selling above asking, usually thanks to bidding wars. A ratio below 100% signals that sellers are frequently accepting offers for less.

- Housing Inventory Levels: This tells you how many months it would take to sell every home currently listed. Anything under four months of inventory points to a seller's market, where intense demand outstrips supply and drives prices upward. More than six months of inventory signals a buyer's market, giving you the upper hand with more choices and negotiating power.

Pro Tip: If your CMA shows comparable homes sold for 5% over asking in just 10 days, that’s a flashing sign of a strong seller's market. This data justifies why a new, similar listing might be priced a bit higher and tells you that you’ll need to come in with a competitive offer.

Translating Market Conditions into Strategy

Knowing whether you’re walking into a buyer's or a seller's market gives you a huge strategic advantage. In a seller's market with low inventory, the comps in your CMA might all show sales well above the list price. That’s not an error; it's a reflection of fierce competition. This knowledge helps you set realistic expectations and craft an offer that won't get ignored.

If you want to go deeper, exploring various real estate pricing strategies can sharpen your approach even more.

On the flip side, in a buyer's market, you'll likely see comps that sold below their asking price after sitting for 60+ days. This is powerful information. It empowers you to negotiate more aggressively and use the CMA data as hard evidence to justify a lower offer. Learning about different real estate valuation methods will give you even more context on how these market forces shape a property's final price.

How Technology Is Shaping Modern CMA Templates

The old-school comparative market analysis—that stack of papers your agent used to hand you—is going extinct. Thank goodness. Today’s CMA is a dynamic, digital tool, supercharged by tech and AI to make the whole process faster, sharper, and way more insightful.

This isn't just a minor upgrade. It means a modern comparative market analysis template does more than just list comps. It actually brings the data to life.

The Rise of AVMs and Data Visualization

At the core of this evolution are Automated Valuation Models (AVMs). You’ve definitely seen these in action on sites like Zillow or Redfin. An AVM is basically a powerful algorithm that churns through mountains of public data—tax records, recent sales, you name it—to spit out a quick estimate of a home’s value.

AVMs are a fantastic starting point, but they’re just one piece of the puzzle. An algorithm can't see the brand-new quartz countertops your subject property has, nor can it appreciate the killer curb appeal. This is exactly why an experienced agent’s eye is still critical to interpret the raw numbers and make the right adjustments.

The real game-changer, though, is how modern CMAs present information. We're talking about data visualization. Instead of a boring list of addresses and prices, you get visuals that make complex market trends click instantly.

- Heat Maps: These can show you, block by block, where prices are heating up in a neighborhood. It’s an incredible way to spot the next hot pocket before everyone else does.

- Trend Charts: Want to know if prices in the area are climbing, dipping, or just sitting flat? Trend charts lay it all out, giving you a clear picture of market momentum over time.

These tools transform a flat report into an interactive story about the market. You don’t just see the final number; you understand the forces driving it.

The Human Element in a Tech-Driven World

The best real estate agents today combine technology with their on-the-ground expertise. Tech-powered templates and visual analytics, which you can read about in the global real estate outlook for 2025, help buyers quickly see what the data means.

Key Takeaway: Technology delivers the powerful "what" (the raw data), but an experienced human provides the crucial "why" (the story behind the numbers). An algorithm can’t tell you a comp sold low because of a messy divorce or that the “updated kitchen” was actually a cheap DIY disaster.

And that’s where the real value is. A sharp agent uses their street-level knowledge to filter the data, flag weird outliers, and account for all the little things technology misses. They know if the comps are genuinely comparable or if there’s a hidden reason for a price difference.

If you want to learn more about the specific platforms that make this possible, check out our breakdown of top-tier real estate analysis software.

Ultimately, the best CMA isn't just about powerful tech. It's the perfect blend of smart software and irreplaceable human insight.

Using the CMA to Craft a Winning Offer

This is the moment all that homework pays off. With your completed comparative market analysis in hand, you’re not just another hopeful buyer. You're an informed buyer who can turn hard data into a compelling offer. Think of the CMA as your playbook for negotiating a competitive, fair, and data-backed deal.

Let's break down how this works in the real world. Imagine your CMA confirms the property is priced just right. You see several solid, recent comps that sold for almost exactly the asking price. That’s a clear signal the seller has done their homework, too.

In this case, making an offer at or very close to the list price is a strong move. It immediately signals that you're serious and you respect their valuation, which can get negotiations started on the right foot.

Navigating Different Market Signals

But what if your CMA tells a totally different story? Let's say the comps clearly show the home is overpriced by $15,000. This is your opportunity to put that CMA data to work.

Instead of just tossing out a lowball offer, you can anchor your number in reality. You might approach the seller and say, "We love the house, but based on the recent sales of 123 Maple Street and 456 Oak Avenue, we feel a price of X is more in line with the current market." An argument backed by data is infinitely more powerful than just saying, "We think it's worth less."

Another critical detail is the sale date on your comps. Are prices in the neighborhood trending up? If the newest comps sold for a bit more than the older ones, you're likely in a hot market. A slightly more aggressive offer might be what it takes to edge out the competition.

Expert Insight: The goal isn't to "win" by getting the absolute lowest price. It's about landing on a fair number that both you and the seller feel good about. Your CMA acts as the objective, unbiased voice in the room that helps everyone get there.

Building Your Offer Strategy

A winning offer is more than just the price—it's the entire package, including contingencies, timelines, and terms. A solid CMA helps you fine-tune these details, too. If your comps show homes are going under contract in a matter of days, you might make your offer stand out by offering a shorter inspection period.

Here’s a practical guide to translating the data from your CMA into a concrete offer strategy for different market conditions.

| CMA Insights and Your Offer Strategy | ||

|---|---|---|

| If the CMA Shows... | This Likely Means... | Your Offer Strategy Could Be... |

| The home is priced accurately, with strong supporting comps. | The seller has done their research and knows the property's value. | Make a strong offer at or very near the asking price. A lowball will probably be dismissed. |

| The home is clearly overpriced by $10,000 or more. | The seller might be testing the market or has an emotional attachment to their price. | Come in lower, but justify it with the specific comps from your CMA. Frame it as aligning with the market. |

| The home is slightly underpriced and comps are selling fast. | The seller is likely trying to spark a bidding war to drive the price up. | Use your CMA to determine the true market value. This becomes your ceiling so you don't overpay in the heat of the moment. |

By letting the data guide you, you can craft a strategic offer that's tailored to the specific property and market, dramatically increasing your chances of getting the deal done on favorable terms.

Of course, price is only one part of the equation. Before you submit any offer, it's absolutely crucial to perform your own deep dive. Our comprehensive real estate due diligence checklist is a great resource that walks you through every essential step, from inspections to title searches, to make sure you've covered all your bases.

Frequently Asked Questions

A clear comparative market analysis template is a powerful tool, but it's natural to have a few questions. Here are answers to some common concerns for home buyers.

How is a CMA different from a professional appraisal?

This is a big one, and the difference is critical. A CMA is an analytical tool a real estate agent creates to determine a home's market value for pricing and negotiation. An appraisal is a formal, legally recognized valuation conducted by a state-licensed appraiser. Your mortgage lender will require an appraisal to ensure the home is worth the loan amount. While both use "comps," the appraisal is a more rigorous and official process.

Can I trust an online home value estimator?

Online estimators (like Zillow's Zestimate) are a good starting point for a general idea of a home's value, but you shouldn't rely on them for your offer. These tools use algorithms that can't see the property's actual condition—like a beautifully renovated kitchen or a leaky roof. A custom CMA from a local agent who has seen the home in person will always be more accurate.

What if there are no good "comps" for a property?

This can happen with unique homes or in rural areas with few recent sales. In this situation, a skilled agent will need to get creative. They may look at sales from a wider geographic area or a longer time frame and make larger value adjustments. They might also analyze currently active listings to gauge the competition. A lack of perfect comps makes your agent's local market knowledge even more valuable.

Ready to stop guessing and start analyzing? Flip Smart gives you the power to evaluate any property in seconds. Our platform delivers accurate valuations, rehab cost estimates, and profit projections, turning hours of work into minutes of smart decision-making. Find your next winning investment with Flip Smart today