When you're starting to look at investment properties, one of the first terms you'll encounter is "rental yield." This is a key metric that helps you understand how much return you can expect from a property. Think of it as a quick financial health check.

At its core, the formula is simple: it compares the income a property generates to its total cost, giving you the annual return as a simple percentage. This single number is your secret weapon for quickly comparing the income potential of different properties, making it an essential tool for any new buyer.

What Rental Yield Reveals About Your Investment

Think of rental yield as a way to make apples-to-apples comparisons. It cuts through the noise of different property prices and rental rates, giving you a standardized way to evaluate your options. Whether you're eyeing a slick downtown condo or a quiet suburban duplex, this metric levels the playing field.

Understanding how to calculate yield is one of the first steps toward making smarter, data-driven investment decisions. It forces you to ground your analysis in hard numbers rather than getting caught up in the emotion of buying a home.

Gross Yield vs. Net Yield

You're going to hear about two main types of rental yield, and knowing the difference is absolutely critical. Each one tells a different, but equally important, part of your property's financial story.

To make this crystal clear, let's break down the key differences between the two.

Gross Yield vs Net Yield at a Glance

| Metric | Gross Rental Yield | Net Rental Yield |

|---|---|---|

| Calculation Speed | Very quick, back-of-the-napkin math | More detailed and time-consuming |

| What It Includes | Only annual rental income and property value | Annual rental income, property value, and all operating expenses |

| Purpose | Best for high-level, initial property comparisons | Essential for understanding actual cash flow and profitability |

| Accuracy | Provides a ballpark estimate; often optimistic | Gives a realistic picture of your true return on investment |

While Gross Yield is a great starting point for quickly filtering through dozens of listings, it’s the Net Yield that truly matters for your bottom line.

Gross Rental Yield is your high-level, ballpark figure. It’s a fast and easy calculation: just divide the total annual rental income by the property’s purchase price and multiply by 100. This is a great first-pass filter. For a deeper dive into valuation, check out our guide on various real estate valuation methods.

Net Rental Yield is the number that really shows you what's going into your bank account. This calculation gets into the nitty-gritty by factoring in all the operating expenses you'll have to cover—things like property taxes, insurance, maintenance, property management fees, and potential vacancy periods.

Quick Takeaway: One of the most common mistakes new investors make is stopping at the gross yield. It's useful for a quick scan, but the net yield tells you the real story of what you'll actually keep in your pocket after all the bills are paid.

For example, let's say you buy a property for $200,000 and it generates $15,000 in annual rent. Your gross rental yield is a healthy-looking 7.5%. But remember, this initial figure doesn't account for a single ongoing cost.

If you're looking for more perspectives on this, you can also explore another guide on how to calculate rental yield for your property for some additional insights.

Finding Your Gross Rental Yield

First things first, let's talk about gross rental yield. This is your starting point, the quick-and-dirty calculation that gives you a baseline idea of a property's income potential.

Think of it as a first-pass filter. It helps you quickly compare a handful of properties and weed out the obvious duds without getting lost in the weeds of detailed expenses just yet.

The Formula and What Really Matters

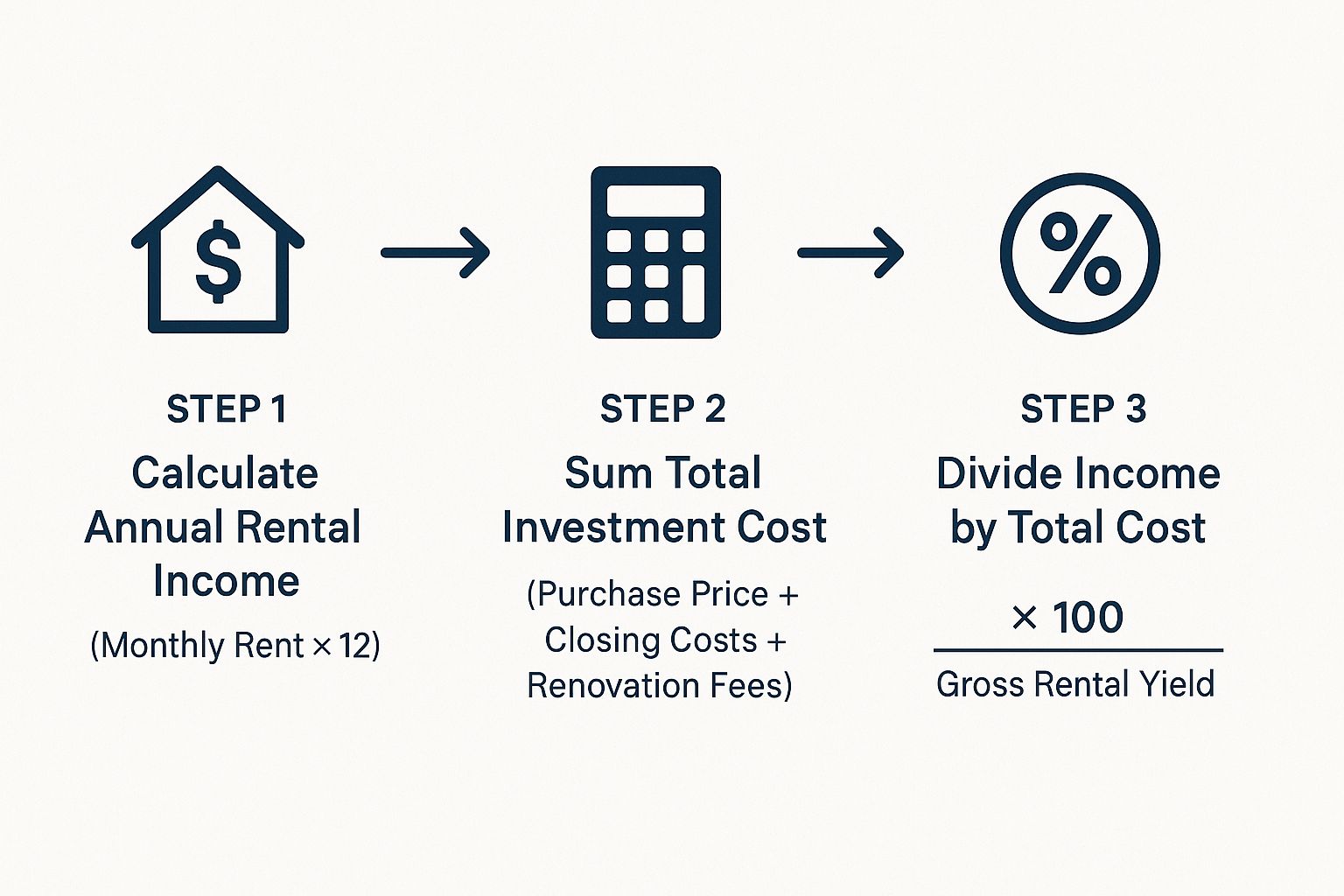

The math for gross rental yield is simple enough:

(Annual Rental Income / Total Property Cost) x 100

But here's where new investors often trip up: getting the two main components of that formula right. A small mistake here can make a bad deal look good.

- Annual Rental Income: This is your monthly rent estimate multiplied by 12. Be brutally realistic here. Base your number on what similar properties in the exact area are renting for right now, not what you hope to get.

- Total Property Cost: This is the big one. It's not just the purchase price. You have to bake in all the other upfront cash you're spending, like closing costs, legal fees, and any immediate repairs or updates needed to get it rent-ready.

This infographic lays out the three basic moves to get to your gross yield.

As you can see, it’s all about nailing down your total income and your true total investment before you can land on a percentage that actually means something.

A Real-World Example

Let's run the numbers on a real scenario. Say you’re eyeing a condo with a $300,000 price tag. Based on local comps, you're confident it will rent for $2,200 a month.

Right away, you know your annual rental income is $2,200 x 12 = $26,400. Easy.

Now for the total cost. The purchase price is $300,000, but you also have $10,000 in closing costs. Plus, you know it needs about $5,000 in new paint and flooring before anyone will want to move in.

- Total Property Cost: $300,000 + $10,000 + $5,000 = $315,000

Now we can plug these numbers into the formula:

($26,400 / $315,000) x 100 = 8.38%

If you'd only used the purchase price, you'd have calculated a yield of 8.8%. That might not seem like a huge difference, but these small inaccuracies add up and can lead to bad decisions. This is exactly why accounting for every single initial dollar is a non-negotiable.

To keep all these numbers straight, a good rental property analysis spreadsheet is invaluable for making sure no expense gets overlooked.

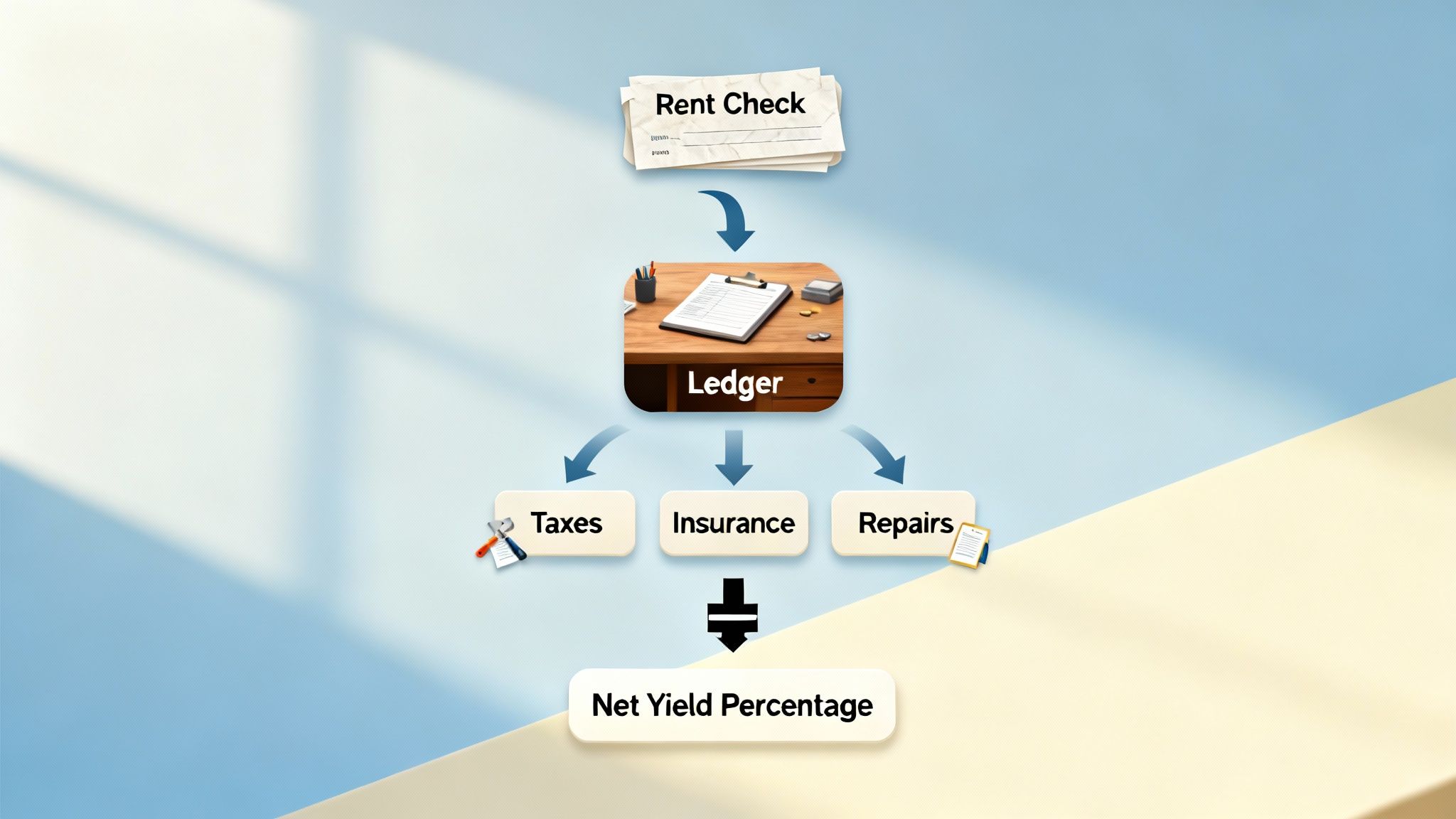

Calculating Net Yield for the Real Profit Picture

While gross yield gives you a quick snapshot, net yield is the high-definition picture of your investment's health. It’s where the truth lies because it accounts for all the ongoing operational costs that eat into your rental income.

Think of it this way: net yield is the money you actually get to keep.

This calculation is absolutely crucial. It moves beyond rosy projections and grounds your analysis in the reality of property ownership, revealing your true profit margin. It's the metric seasoned investors live by.

Identifying Your Key Operating Expenses

So, what costs are we talking about? These are the predictable, recurring expenses that come with being a landlord. Forgetting even one of them can throw off your calculations and lead to nasty financial surprises down the road.

Here is a practical checklist of annual expenses to include:

- Property Taxes: Your yearly bill from the local government.

- Homeowner's Insurance: This protects your asset from damage.

- HOA Fees: If your property is in a homeowners association, these are non-negotiable.

- Property Management: Typically 8-10% of monthly rent if you hire a professional.

- Maintenance & Repairs: A good rule of thumb is to budget 1% of the property's value per year.

- Vacancy Allowance: No property stays rented 100% of the time. Set aside 5-10% of the annual rent to cover months without a tenant.

Quick Takeaway: Net yield is what separates a sustainable investment from a short-term gamble. It forces you to look past the attractive gross income and focus on the real profitability after all the bills are paid.

Putting It All Together with an Example

Let's revisit our $300,000 condo example. We already know the annual rental income is $26,400 and the total property cost is $315,000.

Now, let's tally up the estimated annual expenses:

- Property Taxes: $3,600

- Insurance: $900

- HOA Fees: $2,400 ($200/month)

- Repairs Fund (1% of $300k): $3,000

- Vacancy Allowance (5% of rent): $1,320

Total Annual Expenses: $11,220

With these costs, our net annual income is $26,400 - $11,220 = $15,180.

Now we can finally calculate the net yield:

(Net Annual Income / Total Property Cost) x 100

($15,180 / $315,000) x 100 = 4.82%

Suddenly, our initial 8.38% gross yield has been cut nearly in half to a much more realistic 4.82%. This number is far more useful for making a smart investment decision.

For those interested in a similar metric used in commercial real estate, you can learn more about how to figure cap rate in our related guide.

What Is a Good Rental Yield for Your Market?

You've crunched the numbers and have your rental yield. Now for the million-dollar question: is it any good?

The honest answer is: it depends on your goals and your market. There’s no magic number that works everywhere. A 4% net yield might be excellent in a high-growth city where property values are expected to soar.

But if you’re investing in a slower-growth area where monthly cash flow is your top priority, you might be looking for something closer to 8% or higher. It all boils down to your personal investment strategy.

Benchmarking Your Property's Performance

Instead of searching for a universal "good" number, the smart move is to compare your potential property against local trends. You need to understand what’s driving rental demand in the area.

Here are a few key things to check:

- Job Growth: Are new companies moving in? A thriving job market is the number one driver of rental demand. More jobs mean more tenants.

- Population Trends: Is the city growing or shrinking? Simple supply and demand. More people moving in means more competition for rentals.

- Local Market Health: Look at vacancy rates and average rents for similar properties nearby. Are they stable? Rising? This tells you how much pricing power you'll have.

Quick Takeaway: A "good" rental yield isn’t a fixed number. It’s a yield that makes sense for the local market and aligns with your personal goals—whether that’s immediate cash flow or long-term wealth building.

Historically, yields move with the economy. In the U.S., we've seen rental yields average around 8% in recent years, largely because we simply haven’t built enough housing. One stunning statistic is that between 2012 and 2022, 6.5 million more households were formed than homes were built. That massive supply gap is what’s been pushing rents up.

Contrast that with many G7 countries, where gross yields often sit below 5%. Those are typically more mature, expensive markets. To get a better feel for the big picture, AmericaMortgages.com has some great insights into the U.S. rental landscape.

Common Mistakes to Avoid When Calculating Yield

Getting your yield calculation wrong can be an expensive lesson. It might lead you to buy a property that loses money or, just as bad, pass on a deal that could have been a winner.

A few common missteps can easily throw your numbers way off, turning what looks like a great deal on paper into a financial trap.

One of the most frequent errors is focusing only on the purchase price. New buyers often forget to add thousands of dollars in closing costs and initial renovation budgets to their total investment. This simple oversight dangerously inflates the projected yield right from the start.

Overly Optimistic Projections

Another major pitfall is putting on rose-colored glasses when forecasting expenses and income. Hope is not a strategy. This mistake usually shows up in a few key areas of an investor's spreadsheet.

Here are the most common wishful-thinking assumptions you need to avoid:

- Ignoring Vacancy: Assuming your property will be rented 100% of the time is a rookie move. A conservative vacancy allowance, typically 5-8% of the annual rent, provides a critical buffer for the inevitable gaps between tenants.

- Underestimating Maintenance: Believing maintenance and repairs will cost zero is a recipe for disaster. Budgeting at least 1% of the property’s value each year for repairs isn't just a suggestion; it's a necessary practice for survival. Things will break.

- Guessing on Rent: Pulling a rental rate out of thin air is a huge gamble. You must ground your income projections in reality by researching current market rates for comparable, nearby properties.

Quick Takeaway: A conservative calculation is your best defense against costly surprises. It’s always better to be pleasantly surprised by higher-than-expected profits than to face a cash flow crisis because your initial numbers were based on hope instead of data.

Building a more realistic forecast means confronting these potential costs head-on. By assuming there will be vacant months and that things will need fixing, you create a financial model that can withstand the realities of being a landlord. This disciplined approach protects you from making a decision you'll later regret.

Frequently Asked Questions About Rental Yield

Even after you've run the numbers, a few questions always seem to pop up, especially for new buyers. Let's tackle some of the most common ones.

1. Does my mortgage payment affect rental yield?

No, your mortgage is not included in the rental yield calculation. This might seem odd, but rental yield is designed to measure the performance of the property itself, regardless of how you finance it. This allows you to compare two properties equally, even if one is bought with cash and the other with a loan. If you want to measure the return on your actual cash invested (like your down payment), you would calculate the cash-on-cash return.

2. What's the difference between rental yield and cap rate?

They are very similar, but the key difference is how they're used. Rental yield is the standard for residential properties and is calculated using your total purchase cost. Cap rate is the standard for commercial real estate and uses the property's current market value instead of what you originally paid. Cap rate gives you a snapshot of performance today, while yield is tied to your initial investment.

3. How often should I recalculate my rental yield?

It's a smart practice to recalculate your net rental yield at least once a year. Your costs and income are not static—property taxes, insurance premiums, and market rents can all change over time. An annual check-up gives you an accurate, real-world picture of your investment's actual return, not just what you projected on day one.

Tired of crunching the numbers with a calculator and spreadsheet? Flip Smart automates your entire property analysis in seconds. Get accurate valuations, rehab costs, and profit potential without the guesswork. Make smarter, faster decisions by visiting https://flipsmrt.com today.