Figuring out the cap rate for a rental property is simpler than it sounds. You just need to divide its Net Operating Income (NOI) by its current market price. This simple formula gives you a percentage that shows the property's potential return without factoring in a loan, making it a very effective tool for quickly comparing different investment opportunities.

What Cap Rate Reveals About a Rental Property

When you're starting to look at investment properties, the capitalization rate, or "cap rate," is one of the first and most important numbers you’ll encounter. Think of it as a quick health check on a property's profitability relative to its price, before you get into the nitty-gritty of mortgage details.

It answers the core question every potential buyer has: "How much money does this property actually generate compared to what it costs?"

A higher cap rate can signal a higher potential return, but it often comes with more risk. On the flip side, a lower cap rate usually points to a safer, more stable property, but with a lower potential payoff. To really get a handle on the concept, you can dive deeper into what is cap rate and see how seasoned investors use it for their initial analysis.

Finding the Balance Between Risk and Return

The real magic of the cap rate is that it puts all properties on a level playing field. It lets you compare a $200,000 duplex and a $500,000 apartment building on an apples-to-apples basis to see which one is working harder for the money.

Quick Takeaway: A property's cap rate is a snapshot of its performance right now. It’s not just about the number itself, but what that number tells you about the property's location, risk profile, and income-generating power.

Wider economic trends have a huge impact on what investors consider a "good" cap rate. You can't analyze a property in a vacuum. For example, recent market shifts show just how much these numbers can move.

Between 2020 and 2022, multifamily cap rates hit rock bottom, averaging around 4.5% nationwide. But as interest rates shot up, cap rates followed, climbing to an average of 5.75% by 2024—the highest they’ve been since 2014. You can find more on multifamily cap rate trends on butterflymx.com. This context is absolutely critical for knowing if a property's cap rate is actually a good deal in today's market.

Cap Rate at a Glance

To give you a general idea, here’s a quick breakdown of what different cap rate levels might suggest about a property. Keep in mind, this can vary a lot by market and property class.

| Cap Rate Level | Potential Return | Associated Risk | Typical Property Location |

|---|---|---|---|

| 3% - 5% | Lower | Lower | Prime urban areas (e.g., NYC, San Francisco), high demand |

| 5% - 8% | Moderate | Moderate | Stable suburban markets, Class B properties |

| 8% - 10% | Higher | Higher | Emerging neighborhoods, areas with economic uncertainty |

| 10%+ | Very High | Very High | High-risk markets, properties needing significant work |

Ultimately, the "right" cap rate depends entirely on your investment strategy and how much risk you're comfortable taking on. An investor looking for stable, long-term growth might be thrilled with a 4% cap rate in a top-tier market, while a value-add investor might not even look at a deal unless it’s over 8%.

Calculating Net Operating Income: Your Most Important Number

Before you can even think about cap rate, you have to nail down a property's Net Operating Income (NOI). This is the single most important figure for understanding a property’s raw profitability, completely separate from any mortgage you might get.

Think of NOI as the property's annual paycheck after all its essential bills are paid—but before you, or the bank, get a cut. It gives you a clean, honest look at how well the asset itself is performing.

Tallying Up the Income

First things first, let's figure out all the money the property could make. This starts with the gross rental income—the total you’d collect if every single unit was rented out, 365 days a year.

But don't stop there. Many buyers miss the extra cash flow hiding in plain sight. Make sure you account for every revenue stream, like:

- Coin-operated laundry machines

- Paid parking spaces or storage units

- Vending machines

- Pet fees or other miscellaneous charges

Adding all that up gives you the Gross Potential Income. To get a more realistic number, you then have to subtract an allowance for vacancies and tenants who don't pay. A common rule of thumb is 5-10% of gross income, but this can change a lot depending on your local market.

Once you subtract that vacancy factor, you’re left with the Effective Gross Income (EGI). This is a much truer picture of the money actually hitting the bank account.

Subtracting Operating Expenses

With your real income calculated, it’s time to subtract all the necessary costs of keeping the lights on. These are the day-to-day operating expenses required to maintain the property. Your list should include property taxes, insurance, routine maintenance, repairs, utilities, and any property management fees you pay.

Simple Explanation: It's crucial to distinguish between operating expenses and capital expenditures. A new roof is a capital expense and isn't included in NOI, while fixing a leaky faucet is a routine repair and is included.

This simple infographic brings it all together, showing how the NOI you just calculated plugs directly into the cap rate formula.

As you can see, a property's income potential (NOI) divided by its market value is what determines its return, or cap rate.

One cost you absolutely must exclude from this calculation is your mortgage payment (principal and interest). The whole point of cap rate is to measure the property’s performance independent of your personal financing, so your loan terms don't belong in the NOI equation. For a deeper dive into this and other crucial calculations, check out our guide on essential https://flipsmrt.com/blog/real-estate-math-formulas.

While you're at it, many savvy investors also look at how to calculate rental yield to get another angle on a property's income. Both metrics are powerful, but they tell slightly different stories about your investment. Mastering both will give you a serious edge when you're analyzing deals.

Putting the Cap Rate Formula into Practice

Alright, you've done the hard work and figured out an accurate Net Operating Income (NOI). The rest is pretty straightforward. Now we can plug that NOI into the cap rate formula and see what the numbers really tell us about a property's performance.

The formula itself is simple: Cap Rate = (Net Operating Income / Property Value) x 100

This gives you a clean percentage, making it incredibly easy to stack different investment opportunities against each other.

What's the "Property Value"?

So, what figure do you use for "Property Value"? You've got two main choices: the seller's asking price or what you believe is its true current market value.

For your initial run-through, the asking price is the perfect starting point. It shows you the cap rate you'd get if you accepted the seller's terms, which is exactly what you need to know first.

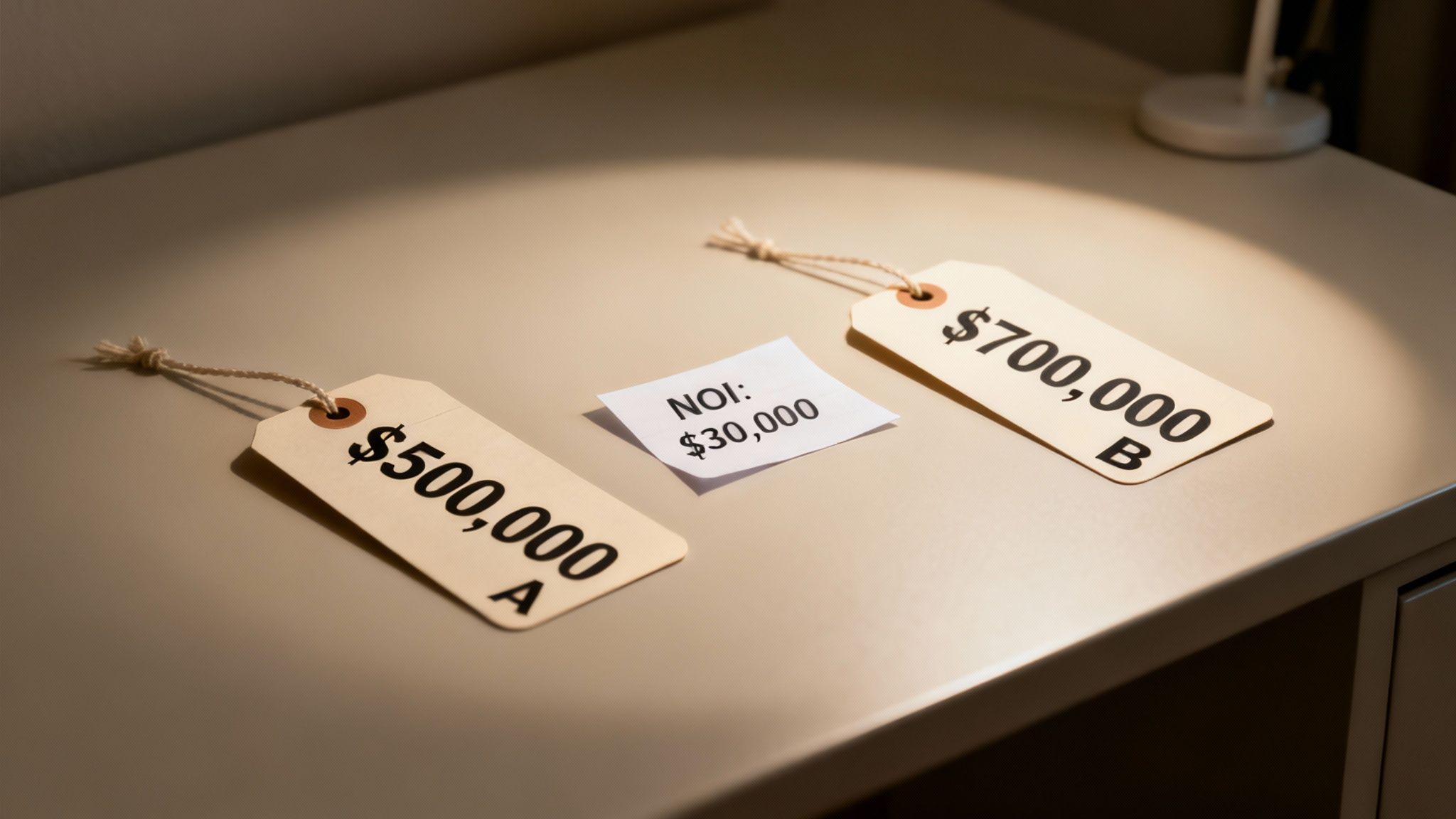

Let's stick with the example from the last section. We've got a duplex with a solid $30,000 NOI, and the seller is asking $500,000.

- ($30,000 NOI / $500,000 Price) x 100 = 6% Cap Rate

That 6% figure is the property's unleveraged annual return. In plain English, for every dollar you put in (without factoring in a mortgage), the property kicks back six cents in profit each year. Using a good rental property analysis spreadsheet is a huge help for tracking these numbers when you're comparing multiple deals at once.

Practical Example: The real magic of cap rate happens when you start comparing properties. Imagine you find another duplex, also with a $30,000 NOI, but this one is listed for $600,000. A quick calculation reveals a 5% cap rate. Right away, you can see the first property offers a better return for your money, at least on paper.

It's also super important to zoom out and look at the bigger picture. Economic shifts, especially changes in interest rates, can have a huge impact on what's considered a "good" cap rate. U.S. apartment cap rates, for instance, have been on a rollercoaster for the past 15 years. They hit historic lows around 4.1% in 2021 when money was cheap, but then climbed back up to 5.2% by 2024 as the Federal Reserve raised rates.

Knowing this kind of market context helps you judge whether a 6% cap rate is a genuinely great deal or just the going rate for that area.

How to Judge What Makes a Good Cap Rate

So you've run the numbers and have a cap rate staring back at you. Now what? The million-dollar question every investor asks is, "Is this number any good?"

The most honest—and accurate—answer is: it completely depends on the context.

A "good" cap rate isn't a universal number you can just plug into a formula. A 5% cap rate might be an absolute home run for a pristine apartment complex in a bustling city center. On the other hand, an 8% cap rate on a rural property needing work might barely be worth the risk. Understanding the story behind the number is what separates amateur investors from the pros.

Risk and Return: The Fundamental Tradeoff

At its core, the cap rate is a reflection of the classic investment tradeoff between risk and potential return. Properties that come with more uncertainty, more management headaches, or more work generally have to offer higher cap rates to attract investors.

Think of it this way:

- Higher Cap Rates (e.g., 8%-12%): You'll often find these in up-and-coming neighborhoods, properties that need significant renovations, or markets with less stable economies. That higher potential return is your compensation for taking on more risk.

- Lower Cap Rates (e.g., 4%-6%): These are typical for high-demand, stable areas with strong tenant pools and well-maintained properties. They're considered safer bets, so investors are willing to accept a lower annual return for that peace of mind.

Quick Takeaway: A higher cap rate doesn't automatically mean a better investment, and a lower one doesn't mean it's a bad deal. It's a signal of the risk profile you’re stepping into. For a different perspective on property returns, check out our guide on how to calculate rental yield.

The cap rate you should target really depends on the type of property and its location. A brand-new building in a prime downtown area is a low-risk asset, so you'd expect a lower cap rate. A 30-year-old building in a less desirable neighborhood carries more risk, so you'd need a higher cap rate to make the investment worthwhile.

Here's a general idea of what you might see in the market.

Typical Cap Rate Ranges by Property Risk Profile

| Risk Profile | Typical Cap Rate Range | Example Location/Property Type |

|---|---|---|

| Low Risk | 4% - 6% | Class A property in a prime urban location (e.g., Austin, Miami) |

| Medium Risk | 6% - 8% | Class B property in a stable, secondary market |

| High Risk | 8% - 12%+ | Class C property needing significant rehab or in a transitional area |

This table just provides a rough guideline. Local market dynamics can shift these ranges significantly, so always do your own research.

How Economic Conditions Shift the Goalposts

Broader economic factors, especially interest rates, play a massive role in defining what a "good" cap rate is at any given time. When interest rates are low, investors might accept lower cap rates because even a modest return on real estate looks attractive compared to other safe investments like bonds.

But when rates rise, investors start demanding higher returns to justify putting their money into real estate instead of less risky assets.

This relationship isn't always a perfect one-to-one correlation, though. For instance, when the Fed increased rates by 400 basis points between 2004 and 2006, multifamily cap rates surprisingly decreased by 90 basis points. More recently, the 2022–2024 period showed a much stronger connection, with cap rates rising as the Fed tightened its monetary policy. You can dive deeper into this complex relationship over at cohnreznick.com.

This just goes to show that while interest rates are a major influence, market sentiment and other economic factors also drive property returns.

Common Cap Rate Mistakes That Cost Investors Money

A simple miscalculation can turn what looks like a golden opportunity into a financial headache. Knowing how to calculate the cap rate for a rental property is only half the battle; avoiding the common pitfalls that trip up even experienced investors is just as crucial. These mistakes often seem small, but they can drastically alter your projected returns and sink a deal before it ever gets off the ground.

One of the biggest blunders is using gross rental income instead of the true Net Operating Income (NOI). This paints an unrealistically rosy picture by completely ignoring all the expenses that eat into your profit. A property generating $50,000 in rent looks very different once you subtract $20,000 in real-world costs like taxes, insurance, and maintenance.

Overlooking Future Costs and Unverified Numbers

Another major mistake is blindly trusting the seller's expense sheet without doing your own deep dive. Always verify the numbers with actual utility bills, tax statements, and maintenance records. It's amazing how a seller might conveniently forget to mention the aging HVAC unit that’s on its last legs.

Similarly, many buyers forget to budget for future unknowns—the stuff that doesn't show up on a monthly statement but will absolutely hit your bank account. Your calculations should always include a buffer for:

- Vacancies: No property stays 100% occupied forever. A conservative vacancy allowance, often 5-10% of gross rent, makes your numbers much more realistic.

- Capital Expenditures (CapEx): Big-ticket items like a new roof or boiler aren't daily operating costs, but you absolutely have to set money aside for them. Ignoring CapEx is a recipe for disaster.

- Unexpected Repairs: Things break. A busted water heater or a leaky pipe can pop up at any time. A dedicated reserve fund for surprise repairs will save you from a major cash-flow crisis.

A cautionary tale: An investor I know bought a small apartment building based on a fantastic seller-provided cap rate. They soon discovered the seller had deferred all major maintenance for years, leaving the new owner with a $30,000 plumbing overhaul bill that completely wiped out their first year's profit.

Comparing Apples to Oranges

Finally, never compare cap rates from wildly different markets or property types without context. A 5% cap rate for a Class A downtown condo in a prime city is not the same as a 5% cap rate for a Class C rural duplex. The risk, appreciation potential, and tenant quality are completely different animals.

Your analysis must always be grounded in the local market context to be meaningful. You have to compare your subject property to similar properties in the same area to get a true sense of its value and performance.

Frequently Asked Questions (FAQ)

1. Does a high cap rate always mean a better investment?

Not necessarily. A high cap rate often signals higher risk. It could mean the property is in a less desirable area, needs significant repairs, or has unstable rental income. While it indicates a higher potential return, you must investigate why the cap rate is high. A lower cap rate usually suggests a safer, more stable investment with lower risk. The best choice depends on your personal risk tolerance and investment goals.

2. Can I use cap rate to evaluate a single-family home I plan to live in?

Cap rate is an investment metric designed for income-producing properties, so it's not relevant for a primary residence. Its purpose is to measure the profitability of a rental property based on the income it generates. When buying a home to live in, your focus should be on factors like location, school districts, home condition, and your personal financing, not its potential rental income.

3. Should I trust the cap rate listed in a real estate advertisement?

Be cautious. The cap rate in a listing is a marketing tool and may be based on optimistic or incomplete numbers (like using potential rent instead of actual rent, or omitting certain expenses). Always do your own due diligence. Ask for the seller’s detailed expense records for the past 1-2 years and use them to calculate your own, more realistic Net Operating Income (NOI) and cap rate.

4. How does my mortgage affect the cap rate?

It doesn't. This is a key point to understand. The cap rate calculation purposely excludes financing costs like your mortgage payment. It measures the property's performance as if it were bought with cash. This allows you to compare different properties on an equal footing, regardless of how they are financed. To understand your personal return after your loan, you should calculate the "cash-on-cash return."

Stop guessing and start analyzing. Flip Smart gives you the tools to calculate renovation costs, after-repair values, and profit potential in seconds, not hours. Make your next investment decision with total confidence. Try our powerful property analysis platform today at https://flipsmrt.com.