Thinking about buying a rental property? It’s a fantastic way to build wealth, but success comes down to knowing your numbers. To figure out if a property is a smart investment, you need to look beyond the listing price and understand how it will actually make you money.

We’ll walk you through the three most important numbers every investor needs to know: Cash-on-Cash Return, Cap Rate, and Total ROI. Each one tells a different part of the story, and together they give you a complete picture of a property's financial health.

Understanding Your Key Rental Investment Metrics

Before you start crunching numbers, it helps to know what you're actually measuring. Think of these metrics as different tools in your toolbox—each one is designed for a specific job. Getting these concepts down is the first step to making smart, confident decisions instead of just guessing.

A property might look great because of its monthly cash flow, but have poor long-term growth potential. Another might seem average at first, but become a winner once you factor in appreciation and the equity you're building. Let's break them down in simple terms.

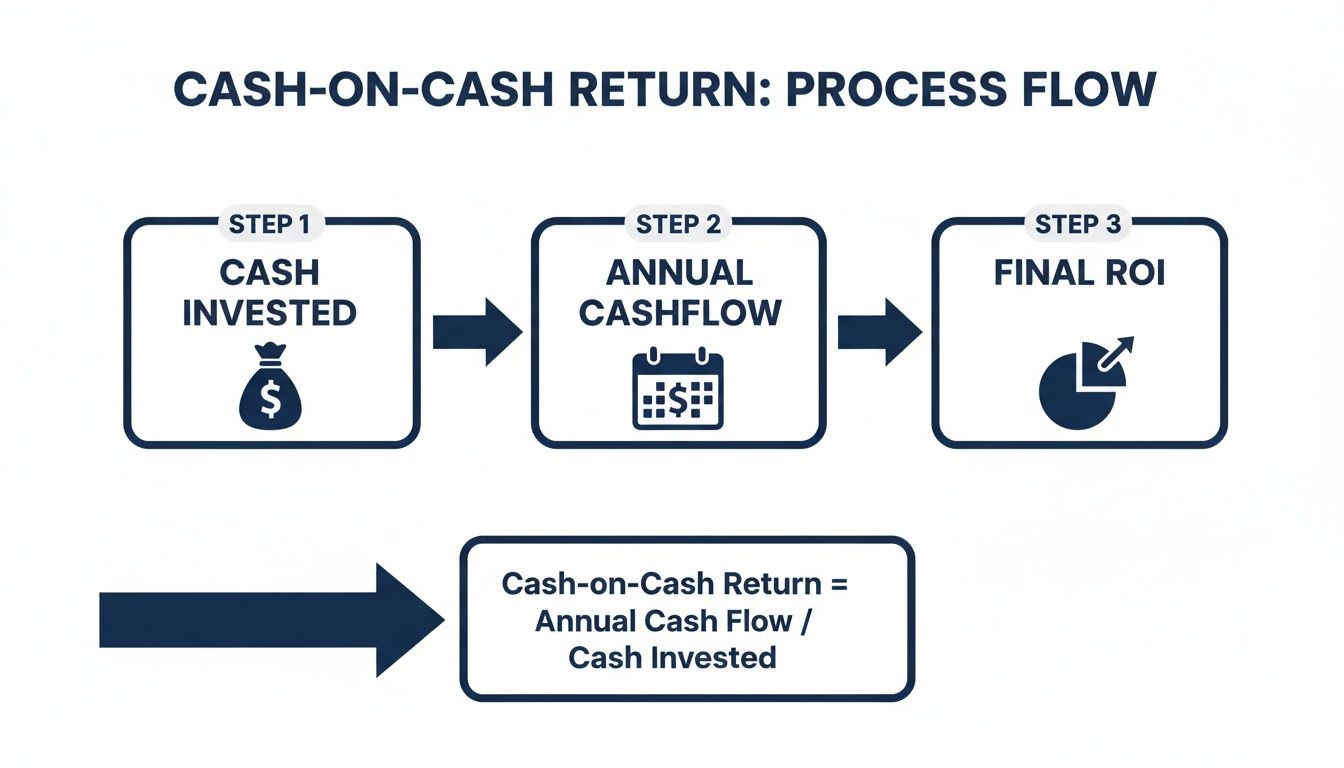

Cash-on-Cash Return: Your Immediate Profit

This is usually the first number new investors learn, and for good reason. It answers a simple but vital question: "For every dollar of my own money I put into this deal, how many cents am I getting back each year?"

Cash-on-Cash Return is powerful because it focuses only on the actual cash you invested—your down payment, closing costs, and any initial repair money. It ignores the loan and potential appreciation, giving you a crystal-clear look at how hard your cash is working for you right now.

Cap Rate: The Great Equalizer

Next up is the Capitalization Rate, or Cap Rate. While Cash-on-Cash Return is specific to your deal and your financing, Cap Rate looks at the property itself, as if you bought it with all cash. This allows you to make fair, apples-to-apples comparisons between different properties.

The formula is simple: Net Operating Income (NOI) / Property Purchase Price. By taking the mortgage out of the picture, you can see the property's raw earning power. This is how professional investors quickly compare opportunities in different markets.

For a deeper dive into these metrics specifically for the UK market, this comprehensive guide to analysing UK buy-to-let deals is an excellent resource.

Total ROI: The Complete Wealth Picture

Cash flow is great, but real wealth in property is often built over the long term. That's where Total ROI comes in. It combines all the ways a property makes you money to give you the most complete view of your investment's performance.

It's a combination of three key wealth-building parts:

- Annual Cash Flow: The profit you have left after all bills are paid.

- Property Appreciation: The increase in the property's market value over time.

- Equity Buildup: Every mortgage payment you make reduces your loan balance, increasing your ownership stake.

This complete metric shows you how your net worth is growing from all angles. A good historical benchmark for a rental's Total ROI is often between 8% and 12% annually. For example, a property with a 7.44% cash return combined with just 3% appreciation gives you a 10.44% Total ROI. It shows how even modest market growth can seriously boost your overall returns.

To give you a quick reference, here’s how these three key metrics stack up.

Quick Takeaway: Key Rental ROI Metrics

| Metric | What It Measures | Best Used For |

|---|---|---|

| Cash-on-Cash Return | The annual return on your actual cash invested. | Evaluating immediate cash flow and how efficiently your money is working. |

| Cap Rate | The property's unleveraged annual return (as if paid in cash). | Comparing the raw profitability of different properties, regardless of financing. |

| Total ROI | The combined return from cash flow, appreciation, and equity. | Understanding the long-term wealth-building potential of an investment. |

Knowing which metric to use and when is what separates seasoned pros from beginners. Using them together empowers you to analyze any deal with confidence.

Checklist: Gathering Your Numbers

Any ROI calculation is only as good as the numbers you use. Think of it like a recipe—if you get the measurements wrong, the result will be disappointing. One forgotten expense can turn a great-looking deal into a financial headache.

Before you can confidently calculate ROI on a rental property, you have to be honest about all potential income and expenses. This means digging deeper than the obvious numbers. Let's build a financial checklist so your projections are built on a solid foundation.

Uncovering All Potential Income Streams

A property's income often goes beyond just the monthly rent check. To get the full picture, you need to account for every dollar the property could bring in. We have a detailed guide on how to calculate rental income that takes a much deeper dive into maximizing these numbers.

Here’s what to include on the income side of your ledger:

- Gross Monthly Rent: This is the big one. Research similar properties ("comps") in the area to make sure your estimate is realistic.

- Pet Fees: Many landlords charge a one-time fee or monthly "pet rent." This can add up significantly over a year.

- Parking or Garage Fees: If your property has dedicated parking in a crowded area, you can often charge an extra monthly fee.

- Laundry Income: Coin-operated or card-based laundry in a multi-unit building can be a consistent, low-effort source of cash flow.

- Late Fees: While you hope not to collect these, they are a potential income source and should be part of your analysis.

The Full Spectrum of Property Expenses

This is where most new investors get into trouble. It's easy to remember the mortgage, but the smaller, recurring, and unexpected costs are what truly determine your profit. A thorough expense list is essential.

Here are the expenses you absolutely must account for:

- Mortgage Payment (Principal & Interest): Your monthly loan payment.

- Property Taxes: You can find this on the seller's current tax bill or the local government's website. Be aware this amount can increase after you purchase the property.

- Homeowners Insurance: Get quotes from multiple providers for a "landlord policy," which is different from a standard homeowner's policy.

- Property Management Fees: If you plan to hire someone to manage the property, budget 8% to 12% of the monthly rent. It's better to include this in your budget even if you plan to self-manage at first.

- Utilities: Even if your lease makes tenants pay for most utilities, you might still be responsible for water, sewer, or trash, especially during vacancies.

Practical Tip: Don't just budget for today's expenses—plan for tomorrow's. Setting aside money for vacancies, maintenance, and big-ticket replacements is what separates successful investors from those who are always one broken water heater away from a crisis.

The Expenses Investors Always Forget

Beyond the basics, three key expense categories will protect you from surprises. Ignoring these will make your ROI calculations dangerously optimistic.

- Vacancy Reserve: No property stays rented 100% of the time. A conservative rule of thumb is to set aside 5% to 8% of the gross monthly rent to cover the time between tenants.

- Maintenance and Repairs: Things break. Pipes leak and appliances die. A good way to budget for this is the “1% Rule,” which suggests budgeting 1% of the property's purchase price for annual maintenance. On a $250,000 property, that’s $2,500 a year, or about $208 per month.

- Capital Expenditures (CapEx): This is for the big stuff—a new roof, an HVAC system, or a water heater. These aren't monthly costs, but they are inevitable. Setting aside another 3% to 5% of the rent ensures you have the cash when these expensive items need replacing.

For landlords with properties overseas, understanding local rules like the rental income tax in the Netherlands is essential, as local tax laws can dramatically impact your true net profit.

A Real-World Example: Calculating Cash-on-Cash Return

Theory is one thing, but let's see how the numbers work in a real-world deal. When you're using a loan to buy a property, Cash-on-Cash Return is the most important metric for understanding your immediate profit.

Let's walk through a common scenario: buying a $300,000 duplex with a standard 20% down payment. I'll break down every number so you can follow the same process for your own analysis.

Step 1: Tally Up Your Total Cash Investment

First, we need to figure out your total cash out-of-pocket. Many new investors make the mistake of only counting the down payment. Your actual investment includes every dollar you spend to close the deal and get the property ready for tenants.

Here's the cash needed for our $300,000 duplex:

- Down Payment:20% of $300,000 is $60,000.

- Closing Costs: These usually run between 2% and 5% of the purchase price. We'll use a conservative 3%, which adds $9,000.

- Initial Renovation Budget: Assume the property needs some updates before it's rent-ready. A realistic $6,000 for paint, new fixtures, and minor repairs is a good estimate.

Add it all up to get the true starting point for our calculation.

Total Cash Invested = $60,000 (Down Payment) + $9,000 (Closing Costs) + $6,000 (Renovations) = $75,000

That $75,000 is your real investment. Forgetting to include closing costs or initial repairs will give you a dangerously inflated and misleading return.

Step 2: Calculate Your Annual Net Cash Flow

Next, let's calculate the property's annual profit, also known as Annual Net Cash Flow. This is your total rent collected minus every single operating expense. Be honest and thorough with your expense projections.

Here are the income and expenses for the duplex.

Monthly Income:

Each side of the duplex rents for $1,500 a month, giving us a gross monthly income of $3,000.

Monthly Operating Expenses:

- Mortgage (Principal & Interest): A $240,000 loan at 6.5% over 30 years comes out to about $1,517.

- Property Taxes: We'll estimate $300 per month.

- Insurance: A landlord policy might be around $125 per month.

- Vacancy Reserve (5%): Set aside $150 (5% of $3,000). You will have a vacancy eventually, so plan for it.

- Maintenance & Repairs (5%): Budget another $150 for small fixes.

- CapEx Reserve (3%): Put away $90 for big-ticket items like a new roof or HVAC system down the road.

- Property Management (8%): If you hire a professional to manage it, that’s $240.

Now, let's see where that leaves us.

| Description | Monthly Amount |

|---|---|

| Gross Rental Income | +$3,000 |

| Total Monthly Expenses | -$2,572 |

| Monthly Net Cash Flow | +$428 |

| Annual Net Cash Flow | $5,136 |

That $5,136 is the annual profit—the actual cash you can expect to have at the end of the year.

Step 3: Put It All Together

We have both pieces of the puzzle: the total cash invested and the annual profit. Now we can calculate the Cash-on-Cash Return using a simple formula.

Cash-on-Cash Return = (Annual Net Cash Flow / Total Cash Invested) x 100

Cash-on-Cash Return = ($5,136 / $75,000) x 100 = 6.85%

For this duplex, your Cash-on-Cash Return is 6.85%. This means for every dollar you invested, you’re getting back nearly 7 cents in profit each year. It’s a powerful gut check on how hard your money is working for you.

Whether 6.85% is a "good" return depends on your personal goals and the market, a question we explore in our guide on what is a good cash on cash return.

Finding Your Cap Rate and Total ROI for a Fuller Picture

While Cash-on-Cash Return gives you a great snapshot of your immediate profit, it doesn't tell the whole story. To truly understand an investment and compare different opportunities like a pro, you need to look at two other important metrics: Cap Rate and Total ROI.

These numbers help you see beyond your specific financing and appreciate the long-term wealth-building power of a property. Let's stick with our $300,000 duplex example to see how these calculations provide a richer understanding of the deal.

This process shows that Cash-on-Cash Return is a direct measure of how efficiently your invested money is working for you right now. But there's more to the story.

Decoding the Cap Rate

The Capitalization Rate, or Cap Rate, is the great equalizer in real estate analysis. It answers the question: "What is this property's return if I bought it with all cash?"

By removing the mortgage from the equation, it reveals the property's raw profitability. This makes it the perfect tool for comparing different properties fairly.

To find it, you first need the Net Operating Income (NOI). This is your gross income minus all operating expenses—excluding your mortgage payment.

From our duplex example:

- Annual Gross Income:$3,000/month x 12 = $36,000

- Annual Operating Expenses (excluding mortgage): ($300 taxes + $125 insurance + $150 vacancy + $150 maintenance + $90 CapEx + $240 management) x 12 = $12,660

NOI = $36,000 - $12,660 = $23,340

Now, the Cap Rate formula is straightforward:

Cap Rate = Net Operating Income / Purchase Price

Cap Rate = $23,340 / $300,000 = 7.78%

A 7.78% Cap Rate is a solid indicator of the property's built-in earning power. You can use this number to compare the duplex against any other property, regardless of how it's financed. To dig deeper, check out how a rental property cap rate calculator can help you master your own analyses.

Unveiling Your Total ROI for the Full Story

Total ROI is where you see the complete picture of how real estate builds wealth. It combines your immediate cash flow with the "silent" returns that build up over time.

Total ROI adds three key components together:

- Annual Cash Flow: The actual profit you put in your pocket.

- Equity from Loan Paydown: The portion of your mortgage payments that reduces your loan balance.

- Property Appreciation: The increase in the property's market value.

Let's calculate this for our duplex's first year:

- Annual Cash Flow: We already know this is $5,136.

- Equity Paydown: In the first year of our $240,000 loan, roughly $3,980 of our payments goes toward paying down the principal.

- Appreciation: Let's assume a conservative 3% annual appreciation on the $300,000 property, which adds $9,000 in value.

Total Annual Return = $5,136 (Cash Flow) + $3,980 (Equity) + $9,000 (Appreciation) = $18,116

Now, we calculate Total ROI using your initial cash investment:

Total ROI = (Total Annual Return / Total Cash Invested) x 100

Total ROI = ($18,116 / $75,000) x 100 = 24.15%

That 24.15% is a world away from the 6.85% Cash-on-Cash Return. It shows that while your immediate cash flow is good, the real financial power of this investment comes from the combined forces of appreciation and having your tenants pay down your mortgage. Understanding all three metrics gives you a complete toolkit to make truly informed investment decisions.

Common Mistakes When Calculating ROI (And How to Avoid Them)

Even the best formula is useless if you feed it bad numbers. The old saying "garbage in, garbage out" is especially true when you calculate ROI on a rental property. Overly optimistic projections are the number one reason new investors get into trouble.

Let's cover the most common mistakes and how you can avoid them. Steering clear of these pitfalls is what separates a sustainable portfolio from a house of cards.

Assuming Your Property Will Never Be Empty

One of the most dangerous—and common—assumptions is planning for 100% occupancy, 12 months a year. In reality, it never happens.

Tenants move out, and it always takes time to clean, make repairs, and find the next qualified renter. Even in a hot market, you have to expect gaps.

Here’s how to be more realistic:

- The 5% Rule: At a minimum, reduce your gross annual income projection by 5% to account for vacancy. In slower markets, you might want to increase this to 8% or even 10%.

- Example: If your property rents for $2,000 a month ($24,000 a year), don't use $24,000 in your calculations. Use $22,800 ($24,000 x 0.95) as your realistic income figure.

This one simple adjustment makes your entire analysis more reliable.

Underestimating Big-Ticket Repairs (CapEx)

It's easy to budget for small repairs, but what about the roof that will need replacing in seven years? Or the HVAC system that's on its last legs? These are Capital Expenditures (CapEx), and ignoring them is a recipe for disaster.

Forgetting CapEx is like pretending your car will never need new tires. Eventually, a massive bill will come due, and if you haven't been saving for it, it can wipe out years of cash flow.

Investor Takeaway: Treat your CapEx savings like a non-negotiable monthly bill. It’s not "if" you'll need the money, it's "when." Setting this cash aside ensures a major repair is a planned expense, not a financial emergency.

Forgetting All the "Little" Costs

The devil is in the details. New investors often focus on the main costs (Principal, Interest, Taxes, and Insurance) and forget about the other expenses that slowly eat away at their profit.

Did you account for these?

- Property Management Fees: Even if you plan to self-manage, budget 8-10% of the rent for a professional manager. Your time isn't free, and you might need to hire someone unexpectedly.

- Closing Costs: These can be 2-5% of the purchase price and must be included in your "Total Cash Invested" for an accurate Cash-on-Cash Return. Forgetting $9,000 in closing costs on a $300,000 home will make your ROI look much better than it really is.

- HOA Fees: If the property is in a community with a Homeowners Association, these fees are mandatory and tend to increase over time.

- Utilities During Vacancy: When the property is empty, you're responsible for electricity, water, and gas to keep the place ready to show to prospective tenants.

By being realistic about these costs, you move from wishful thinking to strategic investing. This disciplined approach protects your money and sets you up for long-term success.

Frequently Asked Questions (FAQ)

What is a good ROI for a rental property?

There's no single magic number, as a "good" ROI depends on your financial goals and the market. However, many investors aim for a Cash-on-Cash Return of 8% to 12%. In a market with high appreciation, some investors might accept a lower cash flow (e.g., 5-6%) because they expect long-term value growth to provide most of their return.

What’s the difference between Cash-on-Cash Return and Total ROI?

Think of it this way:

- Cash-on-Cash Return measures your immediate, annual profit based on the actual cash you invested. It's all about your cash flow right now.

- Total ROI gives you the bigger picture by including cash flow, property appreciation, and the equity you build as you pay down your loan. It measures the total growth in your net worth from the investment over a year.

How do I calculate my initial cash investment?

Your initial cash investment is more than just the down payment. To calculate it correctly, you need to add up all of your out-of-pocket costs to acquire the property. The formula is: Down Payment + Closing Costs + Initial Repair/Renovation Costs = Total Cash Invested.

What are the most common expenses that new investors forget?

New investors often underestimate or forget three key expenses:

- Vacancy: Budgeting for the property to be empty for at least 5% of the year.

- Capital Expenditures (CapEx): Saving for large, infrequent repairs like a new roof or HVAC system.

- Property Management: Even if you self-manage, it's wise to budget 8-10% of the rent for management fees in case you need to hire someone later.

Ready to stop guessing and start analyzing deals with precision? Flip Smart automates the entire process, giving you accurate valuations, renovation estimates, and comprehensive ROI projections in seconds. Make your next investment your best investment by visiting https://flipsmrt.com.