Calculating the return on investment (ROI) for a rental property seems simple on the surface: divide your annual profit by your total initial investment. But this single number reveals how hard your money is working for you, making an accurate roi calculation rental property a non-negotiable step before you even think about buying. This guide will walk you through the process in simple, conversational terms.

Why ROI Is Your Most Important Number

It's easy to fall in love with a property's great location or a newly renovated kitchen. But before you get emotionally invested, it's crucial to ground yourself in the numbers. In real estate investing, your financial compass is the Return on Investment, or ROI. It's a straightforward metric that measures how profitable an investment is compared to its total cost.

Think of it this way: ROI cuts through gut feelings and excitement. It gives you a clear, standardized way to compare different properties—and even different kinds of investments entirely. A house might look like a fantastic deal, but a proper ROI calculation will reveal its true potential… or expose it as a poor choice.

Guiding Your Investment Strategy

Understanding ROI is the foundation of making smart decisions. It helps you objectively determine if a potential rental will actually help you achieve your financial goals. Without it, you're essentially flying blind and hoping for the best instead of planning for success.

A solid ROI analysis forces you to dig into all the factors that will impact your bottom line:

- Income: How much rent can you realistically collect each month? This should be based on what similar properties in the area are currently renting for.

- Expenses: What are the true costs of owning the property? This includes taxes, insurance, maintenance, property management, and budgeting for vacancies.

- Total Investment: What is your actual, all-in, out-of-pocket cost? This includes the purchase price, all your closing costs, and the money you'll spend on initial renovations.

By focusing on these components, you shift from being a hopeful home buyer to a strategic investor. A detailed guide on real estate investment analysis can give you a much deeper dive into all the metrics that truly matter.

Quick Takeaway: The whole point of investing is to build wealth. ROI is the scorecard that tells you if you're winning. It turns your investment from just a piece of property into a high-performing financial asset.

At the end of the day, mastering the ROI calculation is what separates successful real estate portfolios from money pits. It ensures every decision you make is backed by solid data, steering you toward the deals that will consistently build your wealth for the long haul.

The Core Formulas for Calculating ROI

To get a clear picture of a property's potential, you need to move beyond guesswork and lean on proven formulas. A solid roi calculation rental property process really boils down to two essential metrics that seasoned investors live by: Simple ROI and Cash on Cash Return. Each one tells a slightly different, but equally important, story about your investment's performance.

Before you can use either of those, however, you have to nail down your Net Operating Income (NOI). Think of this as the foundation of your entire analysis. NOI shows you the property's total income after you've subtracted all the necessary operating expenses—but, crucially, before you factor in your mortgage payment.

Getting your NOI right is non-negotiable. It’s calculated by taking your gross rental income and subtracting all the real-world costs of keeping the property running. Forgetting even one or two expenses can dramatically inflate your projected returns on paper and lead you into a bad deal.

Mastering Net Operating Income

Calculating NOI accurately demands brutal honesty about your expenses. It's not just the obvious stuff like property taxes and insurance. The small, recurring costs and the big, infrequent ones are what consistently trip up new investors.

To get a true picture, you absolutely must include everything:

- Property Taxes: The annual bill from your local government.

- Insurance: Your landlord or hazard insurance policy.

- Utilities: Any services you, the landlord, are responsible for (water, sewer, trash, etc.).

- Maintenance & Repairs: A budget for routine upkeep. A good starting point is 5-10% of your gross rent.

- Vacancy: A critical buffer for when the property sits empty between tenants. A 5-10% vacancy rate is a standard, conservative estimate to protect yourself.

- Property Management Fees: If you hire a professional, this is typically 8-12% of the monthly rent.

- Capital Expenditures (CapEx): Funds you set aside for the big-ticket replacements that will happen eventually—think a new roof, HVAC system, or water heater.

Pro Tip: A classic rookie mistake is only factoring in the mortgage, taxes, and insurance. To get a real sense of profitability, you must budget for the inevitable—vacancies, leaky faucets, and that 15-year-old furnace giving out. These "hidden" costs can easily make or break your investment.

To make this crystal clear, here's a detailed checklist of expenses you should be tracking for your NOI calculation. Don't skip these.

Comprehensive Checklist of Rental Property Expenses

This table breaks down all the potential operating expenses you need to account for when calculating your Net Operating Income (NOI). Overlooking these can lead to a dangerously optimistic ROI projection.

| Expense Category | Description | Example Annual Cost (for a $300k property) |

|---|---|---|

| Property Taxes | Annual taxes levied by local authorities (county, city, school district). | $4,500 |

| Property Insurance | Landlord or hazard insurance policy to cover property damage and liability. | $1,200 |

| Vacancy Allowance | A conservative estimate (typically 5-8% of gross rent) for periods without tenants. | $1,440 (at 5% of $2,400/mo rent) |

| Repairs & Maintenance | Budget for routine upkeep like plumbing repairs, painting, and appliance fixes. | $1,500 |

| Property Management | Fees paid to a professional manager (usually 8-12% of collected rent). | $2,880 (at 10% of gross rent) |

| Capital Expenditures (CapEx) | Savings for major replacements like a roof, HVAC, or water heater. | $1,200 |

| Utilities | Any utilities paid by the landlord (e.g., water, sewer, trash). | $900 |

| HOA Fees | If applicable, the monthly or annual fees for a homeowners' association. | $600 |

| Landscaping/Snow Removal | Costs for maintaining the property's exterior. | $750 |

| Pest Control | Regular pest control services. | $400 |

| Professional Fees | Costs for legal or accounting services related to the property. | $500 |

By meticulously tracking these expenses, your NOI will reflect the true operating reality of the property, not just an idealized version.

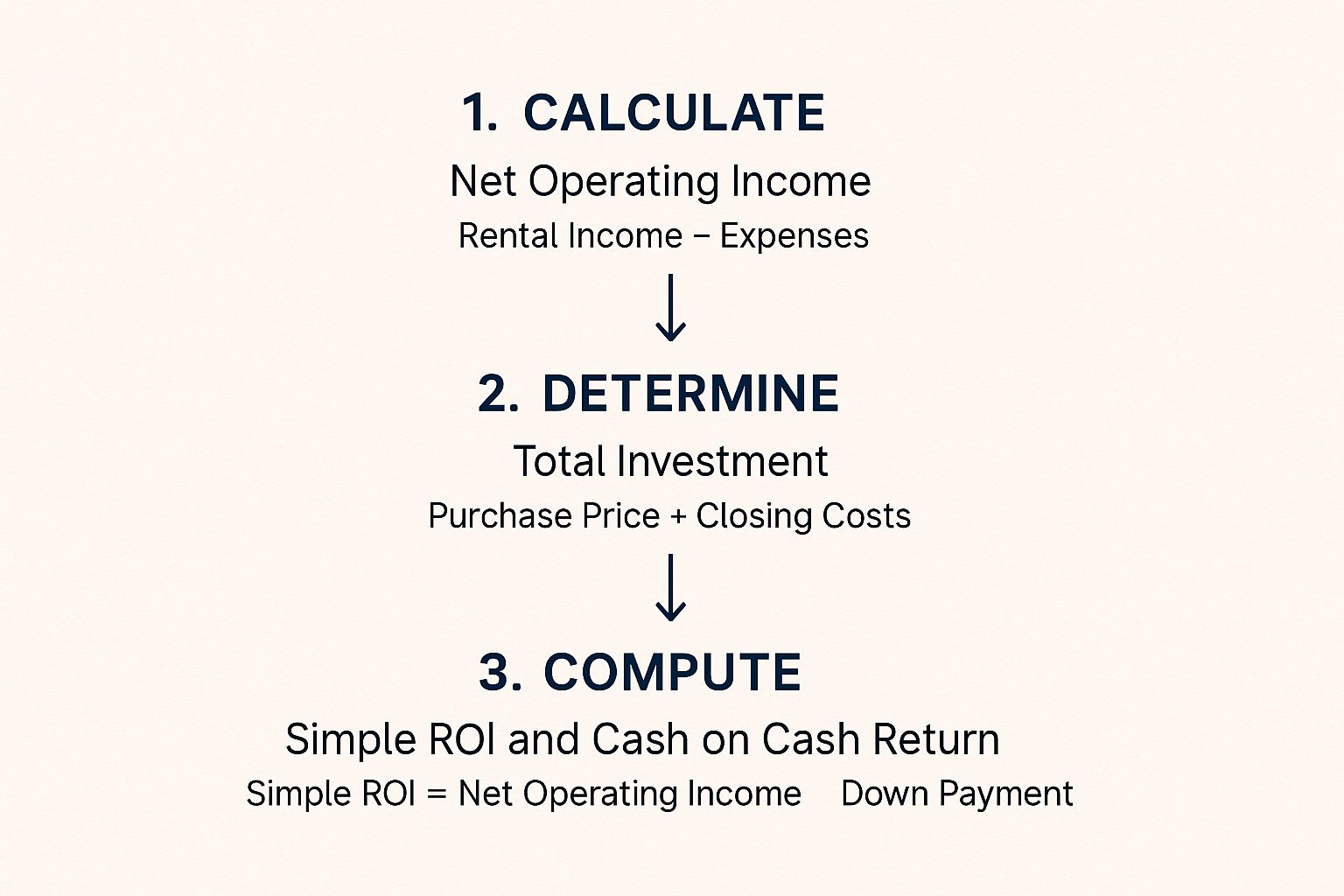

This infographic neatly visualizes how all these pieces fit together, from finding your NOI to applying the final ROI formulas.

As the flow shows, a precise NOI is the launchpad for every other calculation. Get it right, and you'll have an accurate understanding of your property's financial health.

The Two Key ROI Formulas

With a realistic NOI in hand, you’re ready to actually figure out your return. The two most common methods give you different, but equally valuable, perspectives.

1. Simple ROI (or Cap Rate)

This formula is all about the property itself, stripped of any financing. It measures the unleveraged return, which makes it a fantastic tool for comparing different properties on an apples-to-apples basis. It shows you the raw, income-generating power of the asset.

- Formula: Simple ROI = Net Operating Income / Total Property Cost

Here, "Total Property Cost" isn't just the purchase price; it includes all your closing costs and initial renovation expenses. For a solid primer on the core concept, you can learn more about how to calculate general return on investment (ROI).

2. Cash on Cash Return

For investors using a mortgage, this is often the most important metric. It gets straight to the point: what return are you getting on the actual cash you pulled out of your own pocket?

- Formula: Cash on Cash Return = Annual Pre-Tax Cash Flow / Total Cash Invested

Your Annual Pre-Tax Cash Flow is simply your NOI minus your total annual mortgage payments (principal and interest). The Total Cash Invested is your down payment, closing costs, and all rehab expenses. This formula is so powerful because it truly demonstrates the impact of using a loan (also known as leverage).

While these two formulas are vital, they're just the beginning. You can find a more extensive list of other crucial calculations in our guide to essential real estate math formulas.

A Real World ROI Calculation in Action

Formulas on a page are one thing, but running the numbers on an actual deal is where the real learning happens. Seeing a roi calculation rental property example from start to finish clears up the confusion and gives you a practical framework for your own analysis.

Let's break down a realistic scenario to see how the numbers play out in the real world. Imagine you've found a single-family home that looks promising. We'll look at it two ways: first as an all-cash deal, and then with a mortgage to see how financing changes the picture.

Setting the Scene: The Property Details

Before we can calculate anything, we need to gather the core numbers for our example property. These are the building blocks for our entire analysis.

- Purchase Price:$250,000

- Closing Costs:$7,500 (a good estimate is 3% of the purchase price)

- Initial Renovation Costs:$12,500 (for basics like paint, flooring, and new appliances)

- Projected Monthly Rent:$2,100 (which comes out to $25,200 annually)

The first step is figuring out your total initial investment. This isn't just the sticker price of the house—it's every single dollar you need to spend to get it ready for a tenant.

Total Investment = Purchase Price + Closing Costs + Renovations

$250,000 + $7,500 + $12,500 = $270,000

With our total investment locked in at $270,000, we can now start digging into the expenses that will determine our Net Operating Income (NOI). Getting these expense estimates right is absolutely critical for an accurate projection.

Calculating Net Profit and Simple ROI (All-Cash Purchase)

Let's start simple and assume you're buying this property with cash. This strips out the complexity of a loan and gives us a raw look at the asset's performance, much like a cap rate calculation.

Here’s a breakdown of the annual operating expenses:

- Property Taxes:$3,750

- Insurance:$1,000

- Vacancy (5% of gross rent):$1,260

- Repairs & Maintenance (5%):$1,260

- Capital Expenditures (5%):$1,260

- Total Annual Expenses: $8,530

Now, let's find our Net Operating Income (NOI).

NOI = Gross Annual Rent - Total Annual Expenses

$25,200 - $8,530 = $16,670

With an NOI of $16,670, we can plug it into our formula to find the Simple ROI for this all-cash deal.

Simple ROI = NOI / Total Investment

$16,670 / $270,000 = 6.17%

A 6.17% return is a pretty solid baseline. But what happens when we bring a mortgage into the mix?

The Power of Leverage: Calculating Cash on Cash Return

Now for the far more common scenario: buying with financing. We'll assume a standard 20% down payment on the $250,000 purchase price, which is $50,000. The other $200,000 will be financed with a 30-year mortgage at a 6% interest rate.

Notice how your actual cash out-of-pocket drops significantly:

- Down Payment:$50,000

- Closing Costs:$7,500

- Renovation Costs:$12,500

- Total Cash Invested: $70,000

Next, we have to account for the mortgage. A $200,000 loan at 6% for 30 years works out to about $1,199 per month, or $14,388 per year. We subtract this new debt service cost from our NOI to find our pre-tax cash flow.

Annual Cash Flow = NOI - Annual Mortgage Payment

$16,670 - $14,388 = $2,282

Finally, we can calculate the Cash on Cash Return by dividing that annual cash flow by the actual cash we put into the deal.

Cash on Cash Return = Annual Cash Flow / Total Cash Invested

$2,282 / $70,000 = 3.26%

Quick Takeaway: At first glance, 3.26% seems much worse than the 6.17% Simple ROI. But this metric doesn't tell the whole story. It completely ignores other powerful wealth-building factors, like your tenant paying down your loan principal every month and long-term property appreciation. A good rental property analysis spreadsheet is essential for tracking all these variables in one place.

Historically, real estate has been a strong performer over the long haul. For example, recent data showed the average American home delivered a 10-year ROI of 41.7% in 2023. These long-term returns, which blend appreciation and income, show why investors are often willing to accept lower day-one cash flow for a piece of a great asset. You can dig deeper into these trends and explore returns across different property types. This example really drives home how different financing strategies can completely change your return metrics and overall investment approach.

Looking Beyond the Basic ROI Formula

A strong Cash on Cash Return is a fantastic starting point, but it only tells part of the story. If you stop there, you’re missing some of the best parts of investing in real estate.

The true power comes from the wealth-building engines that a basic roi calculation rental property formula simply doesn't capture. Understanding these "hidden returns" is the key to seeing why a property with modest cash flow can still be a financial powerhouse over the long haul. These other benefits are always working in the background, quietly building your net worth year after year.

The Power of Property Appreciation

Appreciation is simply your property’s value going up over time. While it’s never guaranteed, it’s often the single biggest contributor to your total return. A property that appreciates by just 3-4% a year can easily add tens of thousands of dollars to your net worth, often dwarfing your yearly cash flow.

This is where serious, life-changing wealth is often made. One landmark 145-year study covering 16 countries found that residential real estate actually delivered a higher average annual return (7.05%) than the stock market (6.89%). That tells you that over many economic cycles, property has proven to be an incredibly robust asset.

Quick Takeaway: Appreciation is like a silent partner working for you 24/7. Your rental income pays the bills today, but appreciation is what can fund your retirement tomorrow.

Loan Amortization: Your Secret Savings Account

When you have a mortgage on your rental, part of every rent check you collect goes toward paying down the loan principal. This process, known as amortization, means your tenants are literally buying the asset for you, one month at a time.

Each mortgage payment directly increases your ownership stake—your equity—in the property. It doesn’t show up in your bank account as cash flow, but this forced savings mechanism is an incredibly powerful and consistent way to build wealth.

Unlocking Significant Tax Advantages

Real estate investing comes with a unique set of tax benefits that can dramatically boost your real-world returns. These advantages are a huge benefit and let you keep more of the money you earn.

- Mortgage Interest Deduction: The interest you pay on your mortgage is almost always a write-off against your rental income.

- Property Tax Deduction: The property taxes you pay are also generally tax-deductible.

- Depreciation: This is a game-changer. Tax authorities let you deduct a portion of your property's value each year for "wear and tear," even if the property is actually going up in value.

- Expense Deductions: Pretty much every cost you incur to manage your rental—from repairs and insurance to property management fees—can be written off.

To get the full picture, you have to factor in the specifics of the rental income tax in the Netherlands or wherever your property is located, as these rules have a huge impact on your net return.

When you combine appreciation, loan paydown, and tax benefits, you create a multi-faceted investment that is much more powerful than simple monthly profit.

Common Mistakes in ROI Calculation to Avoid

A small math error up front can snowball into a massive investment mistake down the road. A deal that looks like a home run on paper can turn into a financial headache because the initial projections were built on shaky ground. Getting your roi calculation rental property analysis right isn’t just paperwork—it’s your best defense against a bad deal.

Many new investors stumble over the exact same hurdles. Let's walk through the most common ones so you can sidestep them and build a successful rental portfolio.

Underestimating Your True Expenses

The number one mistake is being too optimistic about costs. It's easy to remember the mortgage payment and property taxes, but it’s the dozens of smaller expenses that quietly eat away at your cash flow. Forgetting them makes a property look far more profitable than it actually is.

You have to be brutally honest with your expense sheet. Did you actually budget for these profit-killers?

- Vacancies: Even in a hot market, you need to plan for empty months. A conservative floor is a 5% vacancy rate. Think of it as losing about one month of rent every two years.

- Property Management: Are you managing it yourself? Your time isn't free. If you hire a professional, that’s an 8-12% fee right off the top. You need to account for one or the other.

- Capital Expenditures (CapEx): The roof, HVAC, and water heater have a finite lifespan. You must set money aside for their eventual replacement. A good starting point is stashing 5% of your gross rent for these big-ticket items.

Pro Tip: A fantastic rule of thumb for a quick reality check is the 50% Rule. It suggests that, on average, half of your gross rental income will be eaten up by operating expenses—and that’s before your mortgage payment. So if a place rents for $2,000 a month, you should assume around $1,000 is going right back out the door for costs.

Miscalculating Potential Rental Income

Right behind underestimating costs is overestimating income. It’s tempting to assume you can charge top-dollar rent from day one, but your projections must be grounded in reality, not wishful thinking.

Dive deep into rental comps. Look at what properties just like yours in the immediate neighborhood are actually renting for right now. Don’t look at what they’re listed for; find out what they leased for.

This is where another handy guideline, the 1% Rule, comes into play for a quick "sniff test." It suggests a property’s monthly rent should be at least 1% of its total purchase price. So, a $250,000 house should ideally rent for around $2,500 per month. If the real-world market rent is only $1,800, the numbers are probably too tight.

Understanding these benchmarks is crucial. For instance, while the average gross rental yield in the U.S. climbed to 6.51% by Q3 2025, that's just a starting point. Once you factor in all those expenses we just talked about, the net yield is often 2–4% lower. You can see how rental yields vary by market to get a better feel for national trends.

Frequently Asked Questions (FAQ)

What is a good ROI for a rental property?

There's no single magic number, as a "good" ROI depends on your financial goals and the local market. However, many experienced investors aim for a Cash on Cash Return of 8% to 12% or higher. In a high-appreciation market, you might accept a lower initial return (e.g., 5-6%) in exchange for long-term value growth. In contrast, if your main goal is immediate monthly income, you'll want to target deals with higher, double-digit returns from day one.

How do I account for unexpected repairs in my ROI calculation?

You can't predict when a repair will be needed, but you can—and must—plan for it. The best practice is to build a financial cushion into your budget from the start. A conservative approach is to set aside a percentage of your gross rental income each month into two separate funds:

- Repairs & Maintenance (5-10%): For smaller, routine fixes like a leaky faucet or broken doorknob.

- Capital Expenditures (CapEx) (5-10%): For large, expensive replacements like a new roof, HVAC system, or appliances.

This ensures you're not caught off guard by a major expense that could wipe out your profits.

Can I calculate ROI before buying a property?

Yes, and you absolutely should. Calculating a property's potential ROI before you make an offer is the most critical step of your due diligence. This pre-purchase analysis tells you if the property is a worthwhile investment. To do this, you'll use well-researched estimates: the listing price, typical closing costs in the area (2-5% of the purchase price is a safe estimate), and comparable rental rates to project your income. After plugging in conservative estimates for all expenses, you can run the numbers to see if the deal makes financial sense.

Ready to stop guessing and start analyzing deals with precision? Flip Smart was built to take the complexity out of ROI calculations. Our platform helps you evaluate any property in seconds, giving you accurate valuations, renovation cost estimates, and profit potential so you can make smarter, faster investment decisions. Analyze your next deal with Flip Smart and see the difference for yourself.