When you’re thinking about buying a rental property, the rental property cap rate is one of the most useful numbers for quickly judging if it's a good investment.

Think of it as a snapshot of the property's earning potential. It shows you the expected annual return on your investment before you factor in any mortgage or financing details. A higher cap rate often points to a higher potential return, but—and this is a big but—it can also signal more risk. This guide will walk you through everything you need to know in simple, conversational language.

What Cap Rate Tells You About an Investment Property

The capitalization rate, or cap rate, is a key metric that measures the potential rate of return on a rental property.

In plain English, it tells you how much income a property generates relative to its price. Imagine you’re comparing two stocks. You might look at their dividend yields to see which one pays out more compared to its share price. The cap rate does the exact same job for rental properties.

It gives you a clean, apples-to-apples way to compare different investment opportunities. Whether you're eyeing a small single-family home in the suburbs or an apartment building downtown, the cap rate cuts through the noise. It strips away your personal financing details, like your loan terms and interest rate, to focus purely on the performance of the property itself.

Decoding the Cap Rate Signal

So, what does that number actually mean for you? A cap rate gives you an immediate gut check on two critical parts of any deal: its potential return and its perceived risk.

Higher Cap Rates (e.g., 8-12%): These often suggest stronger cash flow potential. But a high number can also be a red flag. It might mean the property is in a less desirable neighborhood, needs significant repairs, or is in a shaky rental market.

Lower Cap Rates (e.g., 4-7%): These usually point to a safer, more stable investment. You’ll typically find low cap rates on properties in prime locations with high tenant demand. While the annual returns might look smaller, the investment is generally seen as less risky and often has better potential for long-term appreciation.

Quick Takeaway: The main purpose of the cap rate is to help you quickly assess if a property's potential return aligns with the level of risk you are willing to take. It’s the first filter smart investors use to decide if a deal is worth a closer look.

Ultimately, understanding the cap rate is about making smarter, more confident decisions. It's a powerful tool for your initial analysis, helping you spot undervalued gems and steer clear of overpriced duds. To get a deeper dive into the concept, you can read more about What Is Cap Rate In Real Estate Investing. This initial check is the first step toward building a profitable real estate portfolio.

Calculating Cap Rate with Confidence

To really get a feel for a rental property's potential, you have to look under the hood and run the numbers yourself. While the cap rate formula looks simple, its accuracy is only as good as the numbers you plug into it. Let's walk through the process, step by step, to make sure your calculations are rock-solid.

The core formula is pretty straightforward:

Cap Rate = Net Operating Income (NOI) / Property Value

The two pieces you need to nail down are the property’s Net Operating Income (NOI) and its current Market Value. Getting these right is often the difference between a smart investment and a painful mistake.

Finding Your Net Operating Income

Net Operating Income, or NOI, is the most important number for judging a property’s raw profitability before you factor in any loans. Think of it as the total income the property brings in, minus all the necessary expenses to keep it running smoothly.

The calculation for NOI is:

NOI = Gross Operating Income - Operating Expenses

To get an accurate NOI, you need to be realistic when adding up both sides of this equation.

First, you'll calculate the Gross Operating Income (GOI). This is all the potential money the property can generate.

- Annual Rental Income: The total rent you'd collect if the property was 100% occupied all year long.

- Other Income: Don't forget the little things that add up. This could be extra cash from parking spots, coin-operated laundry, storage units, or even pet fees.

Next, you have to subtract the Operating Expenses. These are all the day-to-day costs required to maintain the property. Be thorough here—underestimating expenses is a classic rookie mistake.

Checklist of Common Operating Expenses:

- Property Taxes: Your annual bill from the city or county.

- Insurance: Your landlord or property insurance policy.

- Utilities: Any bills you pay as the owner, like water, sewer, or trash collection.

- Maintenance and Repairs: Set aside a budget for routine upkeep—think leaky faucets, landscaping, and appliance fixes. A common rule of thumb is to estimate 1% of the property's value each year.

- Property Management Fees: If you hire a pro to manage the property, expect to pay 8-12% of the monthly rent.

- Vacancy Costs: No property stays full 100% of the time. You have to account for the potential lost rent when a unit is empty. A vacancy allowance of 5-10% of the gross rental income is a safe bet.

It's just as critical to know what not to include in your operating expenses. Things like your mortgage payment (principal and interest), personal income taxes, and depreciation are all tied to your financing and tax situation, not the property's standalone performance. Leaving them out keeps the cap rate a pure, apples-to-apples comparison metric.

For new investors, getting a precise handle on all the income streams can be a challenge. To help with that, check out this detailed guide on how to calculate rental income the right way.

Determining the Property Value

The second half of the cap rate formula is the property’s value. If you're looking to buy, the purchase price is what you’ll typically use for the market value.

If you already own the place, you'd use its current fair market value. You can get a good estimate from a recent appraisal or by looking at what similar, nearby properties have sold for recently (known in the industry as "comps").

This flowchart gives you a quick visual of how cap rate helps investors make smarter decisions.

It's all about comparing different assets to gauge their relative value, which is the core reason we calculate a rental property cap rate in the first place.

A Practical Cap Rate Calculation Example

Alright, let's pull this all together with a real-world scenario. Imagine you're analyzing a duplex with a list price of $400,000.

Here’s a breakdown of how the numbers shake out.

Sample NOI and Cap Rate Calculation for a Rental Property

| Financial Component | Calculation/Notes | Amount |

|---|---|---|

| Gross Operating Income (GOI) | ||

| Annual Rental Income | $1,500/mo per unit x 2 units x 12 months | $36,000 |

| Other Income (Laundry) | $50/mo x 12 months | $600 |

| Total GOI | Sum of all income sources | $36,600 |

| Operating Expenses (OpEx) | ||

| Property Taxes | Annual estimate from county records | $4,500 |

| Insurance | Annual premium for landlord policy | $1,200 |

| Vacancy Allowance | 5% of Gross Operating Income ($36,600 * 0.05) | $1,830 |

| Maintenance & Repairs | 5% of Gross Operating Income ($36,600 * 0.05) | $1,830 |

| Property Management | 8% of Annual Rental Income ($36,000 * 0.08) | $2,880 |

| Total OpEx | Sum of all operating costs | $12,240 |

| Net Operating Income (NOI) | GOI - Total OpEx | $24,360 |

| Cap Rate Calculation | NOI / Property Value ($24,360 / $400,000) | 6.09% |

After running the numbers, you can see the Net Operating Income (NOI) for this property is $24,360.

Now for the final step:

- Cap Rate = NOI / Property Value

- Cap Rate = $24,360 / $400,000 = 0.0609

The rental property cap rate is 6.09%. With this single number, you can now confidently stack this duplex up against other investment opportunities you're considering.

Finding the Right Cap Rate for Your Goals

Sooner or later, every new investor asks the same question: "What's a good cap rate for a rental property?"

The honest answer is: it depends. A "good" cap rate isn't a magic number. It’s a figure that reflects the balance between the risk you're taking and the potential reward.

Think of it like investing in the stock market. A high-yield savings account might offer a safe and predictable 5% return. A new tech stock, on the other hand, could promise a 20% return, but it comes with a much higher chance of losing money. Real estate works the same way. The right cap rate is simply the one that aligns with your strategy and how much risk you're comfortable with.

The Great Cap Rate Trade-Off

You have to get comfortable with the relationship between risk and return. A low cap rate isn't automatically a bad deal, and a high one isn't always a home run. The story is in the context—the property's location, its condition, and what's happening in the broader economy.

Let's look at two very different scenarios:

Low Cap Rate (e.g., 4%): Imagine a brand-new apartment building in a booming city full of high-paying tech jobs. Its cap rate will likely be low. Why? Because it’s a low-risk investment. Tenant demand is high, vacancies are rare, and the property's value is likely to climb steadily. Investors are willing to accept a smaller annual return for that kind of stability.

High Cap Rate (e.g., 9%): Now picture an older single-family home in a small town with a flat job market. It might boast a high cap rate. That higher number is your compensation for taking on more risk. You could struggle to find good tenants, face higher maintenance bills, and see little to no appreciation for years.

Quick Takeaway: A low cap rate often signals a safer bet—a property with high demand and strong fundamentals. A high cap rate suggests more cash flow potential but brings more uncertainty and potential headaches.

The trick is learning to read what the number is telling you about the property and its market.

How Economic Cycles Influence Cap Rates

Cap rates don't exist in a vacuum. They move with the wider economy and financial markets. Just look at the historical data for U.S. commercial real estate. In the early 2000s, it wasn't strange to see cap rates in the 8% to 10% range as investors demanded a higher premium for what they saw as higher risk.

Then, as interest rates fell and financing became easier to get, cap rates started to compress, dropping into the 5% to 7% range for many properties by the mid-2000s. These cycles show how economic shifts directly shape investor expectations and, in turn, property values. To dig deeper, you can explore how real estate cycles affect cap rates and see these trends for yourself.

Setting Your Personal Cap Rate Benchmark

So, how do you figure out what cap rate is right for you? It all comes back to your goals. Are you playing the long game, focused on steady wealth appreciation? Or are you hunting for immediate cash flow to live on?

Here’s a simple framework to get you started:

The Growth Investor: If appreciation is your main goal and you prefer lower risk, you'll probably target properties in prime locations with cap rates in the 4% to 6% range. Your focus is on asset quality and long-term value, not immediate income.

The Cash Flow Investor: If you need rental income hitting your bank account now and don't mind a few management headaches, you might hunt for properties with cap rates of 8% or higher. These are often found in less competitive markets or are "value-add" deals that need some work.

The Balanced Investor: Most of us fall somewhere in the middle. A property with a cap rate in the 6% to 8% range often delivers a healthy mix of decent cash flow and solid appreciation potential, making it a sweet spot for both new and seasoned investors.

At the end of the day, there is no universal "good" cap rate. The right one is a personal benchmark that reflects your financial goals, your comfort with risk, and the specific market you’re buying in.

Understanding Cap Rate Benchmarks by Market and Property Type

A cap rate is never just a number floating in space. Its real meaning comes from context—specifically, the property's location and what kind of property it is.

Think of it this way: a 6% cap rate might be a home run in one city but a total dud in another. To spot a genuine opportunity, you have to know the typical benchmarks for different markets and asset classes. It's the only way to tell if you're looking at a deal or a dud.

Why Location Is Everything

Just like the weather is different on the coast than it is in the Midwest, cap rates vary wildly from one market to the next. Big-ticket coastal cities like San Francisco or New York are seen as low-risk, high-demand areas. Because of this stability, investors are willing to pay a premium for properties, which naturally pushes cap rates down, often into the 4-5% range.

On the flip side, you'll find much higher cap rates in many Midwest markets, frequently in the 7-10% range. This is because property prices are lower compared to the rent they can pull in. While that signals stronger potential cash flow, it often comes with slower appreciation and a less dynamic local economy. To learn more, it pays to understand what makes the best rental property markets tick.

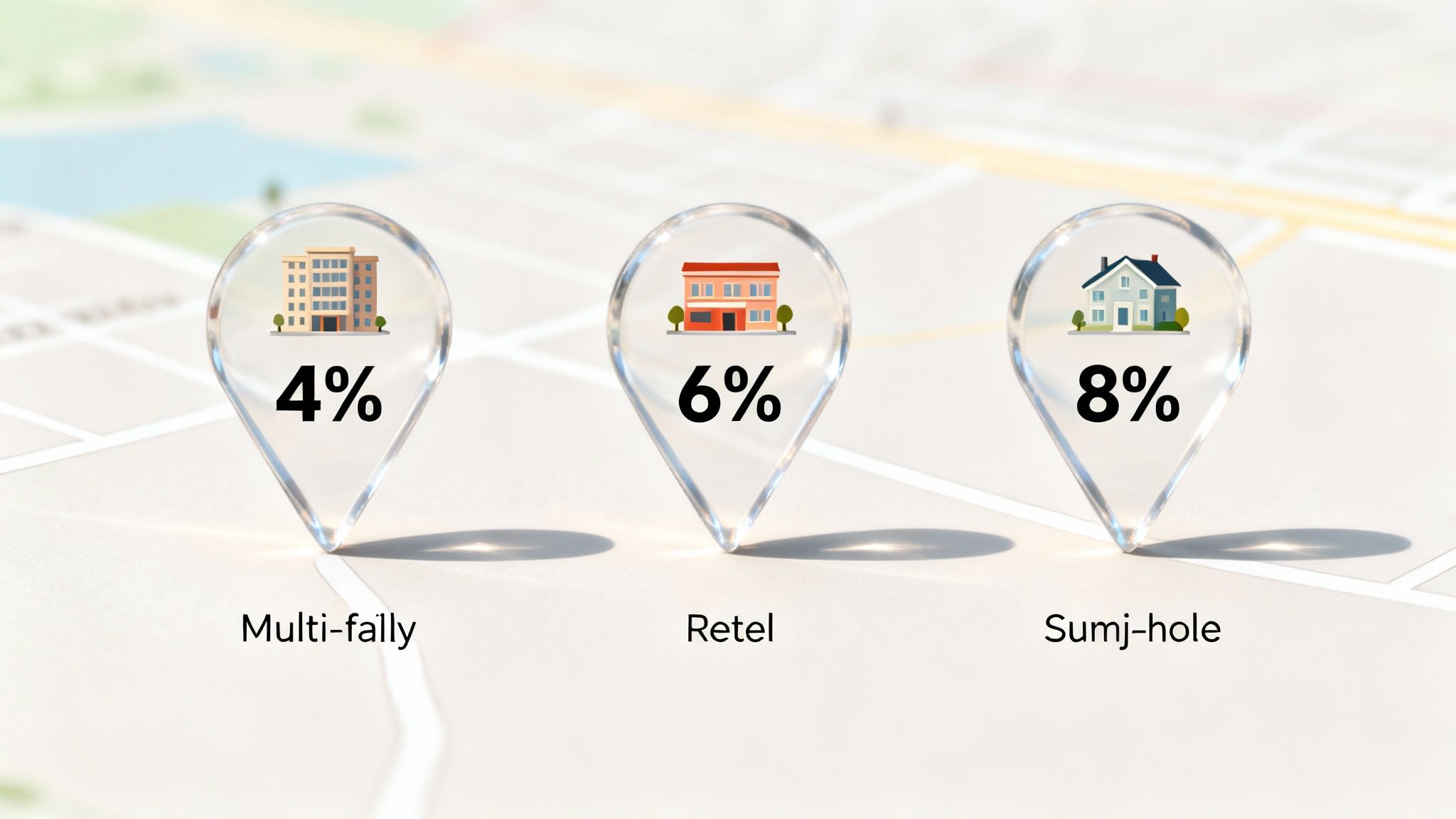

How Property Type Shapes Cap Rates

The type of property you’re buying plays just as big a role in what you should expect for a cap rate. Different asset classes come with different levels of risk and management headaches, and that gets priced right into the numbers.

For example, a brand-new, fully-leased multifamily apartment building is a pretty stable investment. You have multiple tenants and predictable income streams. Now, compare that to a commercial retail space with a single tenant whose lease is about to expire—that’s a much riskier bet.

This difference in risk is what drives the cap rate up or down.

Key Takeaway: Lower-risk properties with steady, predictable income (like multifamily apartments) will almost always have lower cap rates. Higher-risk properties with more uncertain income (like some office or retail spaces) demand higher cap rates to compensate investors for taking on that extra risk.

A Look at Typical Cap Rate Ranges

To give you a clearer picture, it helps to see how these risk profiles translate into real-world numbers. The table below provides a general guide for what you might expect when analyzing different types of properties.

Typical Cap Rate Ranges by Property Type

| Property Type | Typical Cap Rate Range | Associated Risk Level |

|---|---|---|

| Multifamily Apartments (Class A) | 4.0% – 5.5% | Low |

| Single-Family Rentals | 5.0% – 8.0% | Low to Moderate |

| Industrial / Warehouse | 5.5% – 7.0% | Moderate |

| Retail (Neighborhood Center) | 6.5% – 8.5% | Moderate to High |

| Office (Class B/C) | 7.0% – 9.0%+ | High |

This is just a snapshot, of course. Always, always, always research the specific rates in your target neighborhood before you even think about making an offer. Market conditions can shift quickly.

How Cap Rate Works with Other Key Investment Metrics

While the rental property cap rate is a fantastic tool for a quick health check on a property, it's just one piece of the puzzle. Relying on it alone is like trying to build a house with only a hammer. To get the full picture of a deal, you need to see how it fits alongside other crucial metrics.

Cap rate gives you the raw, unleveraged return of a property—its earning potential as if you bought it with cash. This makes it perfect for comparing different properties on an apples-to-apples basis. But since most of us use financing, we also need metrics that account for our specific loan terms.

Cash-on-Cash Return: The Personal Profitability Metric

This is where Cash-on-Cash Return shines. If cap rate tells you how hard the property is working, cash-on-cash return tells you how hard your actual cash investment is working for you.

It's a straightforward calculation that measures your annual pre-tax cash flow against the total cash you actually pulled out of your pocket to close the deal.

Cash-on-Cash Return = Annual Pre-Tax Cash Flow / Total Cash Invested

This metric is intensely personal because it includes your mortgage payments (both principal and interest), which the cap rate formula intentionally ignores. It shows you the real return on your down payment and closing costs, which is often what investors care about most.

Why Both Metrics Matter: A Practical Example

Let's see how this plays out. Imagine two investors, Alex and Ben, are looking at the exact same duplex. The property has a market value of $500,000 and a Net Operating Income (NOI) of $30,000.

For both investors, the cap rate is a solid 6% ($30,000 / $500,000). The property itself has the same raw potential for each of them. But their financing strategies change everything.

- Alex (The Conservative Investor): Puts down 40% ($200,000) and secures a loan with a $1,500 monthly mortgage payment.

- Ben (The Leveraged Investor): Puts down only 20% ($100,000) and takes a loan with a $2,000 monthly mortgage payment.

Now, let's run the numbers for their cash-on-cash returns:

| Investor | Alex (Conservative) | Ben (Leveraged) |

|---|---|---|

| Annual NOI | $30,000 | $30,000 |

| Annual Mortgage Payments | $18,000 ($1,500 x 12) | $24,000 ($2,000 x 12) |

| Annual Pre-Tax Cash Flow | $12,000 | $6,000 |

| Total Cash Invested | $200,000 | $100,000 |

| Cash-on-Cash Return | 6.0% ($12k / $200k) | 6.0% ($6k / $100k) |

Interestingly, their cash-on-cash returns are identical in this scenario, but their financial positions couldn't be more different. Alex has more skin in the game (equity) and lower monthly risk. Ben has less cash tied up, freeing him to hunt for his next deal.

This example proves that the same cap rate can support very different investment structures.

ROI: The Long-Term View

Return on Investment (ROI) is another key player, but it takes a much broader, long-term perspective. While cap rate and cash-on-cash focus on income, ROI measures the total return—that means it includes both the cash flow and the property's appreciation over the entire time you own it.

Think of ROI as the ultimate scorecard for an investment, measuring its total performance from the day you buy to the day you sell. To learn more about professional valuation techniques, you can explore this guide to Mastering Real Estate Property Valuation Methods.

By using all three metrics together—cap rate for comparison, cash-on-cash for personal cash flow, and ROI for total long-term profit—you can build a complete, 360-degree view of any investment opportunity.

Common Cap Rate Mistakes and How to Avoid Them

Even the most promising cap rate on paper can be misleading. New investors, and even some seasoned ones, often stumble into a few common traps that can turn a seemingly great deal into a financial nightmare.

Knowing what these pitfalls are is the first step to analyzing properties like a true professional.

Mistake #1: Trusting the Seller's Pro-Forma

The single biggest mistake you can make is blindly trusting the numbers in the seller's marketing package. Sellers often provide a "pro-forma" income statement, which is a fancy way of saying "best-case scenario." It's a highlight reel, not the full game tape.

This pro-forma often assumes 100% occupancy, below-market repair costs, and zero management fees. It’s designed to look as attractive as possible, not to reflect the day-to-day reality of owning the property.

Investor Tip: Always perform your own due diligence. Your mantra should be "trust, but verify." Get your hands on actual utility bills, the last 12-24 months of rent rolls, tax statements, and maintenance records. Never take a seller's pro-forma at face value.

Mistake #2: Forgetting About Capital Expenditures

This is a silent killer of cash flow. The standard operating expenses used to calculate NOI cover routine stuff like fixing a leaky faucet. They absolutely do not account for the big-ticket items that wear out over time.

We're talking about the roof that will need replacing in five years, the HVAC system on its last legs, or the aging water heaters. These are Capital Expenditures (CapEx), and if you don't budget for them, they will ambush your profits. Failing to set aside a monthly reserve for these inevitable costs gives you a falsely inflated NOI and a dangerously optimistic cap rate.

Mistake #3: Applying the Wrong Market's Cap Rate

Finally, you can't just grab a cap rate from one city and apply it to another. This is a classic apples-to-oranges comparison that leads investors to drastically overpay.

A 6% cap rate might be a fantastic deal in a high-demand, low-risk market like San Francisco. But that same 6% cap rate in a small Midwest town, where typical rates are closer to 9%, could be a massive red flag signaling an overpriced property. Each market, and even each neighborhood, has its own benchmark for what makes a "good" cap rate.

You have to compare your potential deal to similar properties in the exact same area. Using an out-of-context number is a recipe for a bad investment. By sidestepping these common errors, you can use the cap rate as it was intended: as a powerful tool for making clear-eyed, confident investment decisions.

Frequently Asked Questions

Here are answers to some of the most common questions new home buyers and investors have about cap rates.

What is a good cap rate for a first-time rental property buyer?

For a first-time buyer, a cap rate in the 5% to 8% range is often a good target. This range usually offers a healthy balance between risk and return, providing decent potential for cash flow without taking on the high risk that can come with properties in the 10%+ range. It's more important to find a quality property in a good location than to chase the highest possible cap rate.

Does the cap rate include my mortgage payment?

No, and this is a critical point. The cap rate formula intentionally does not include mortgage payments (principal or interest). Its purpose is to measure the property's profitability independent of financing. This allows you to compare different properties on an equal footing, regardless of your personal loan terms. To figure out your return after the mortgage, you should calculate the Cash-on-Cash Return.

How does a home inspection affect the cap rate calculation?

A home inspection is crucial because it can uncover hidden costs that will impact your operating expenses. For example, if an inspector finds that the roof needs replacing soon or the furnace is on its last legs, these are major capital expenditures you must budget for. These future costs will lower your true Net Operating Income (NOI), resulting in a lower (and more realistic) cap rate than the one advertised by the seller.

Should I choose a property based on cap rate alone?

Absolutely not. While cap rate is an excellent starting point for comparing investments, it doesn't tell the whole story. You should also consider the property's condition, the quality of the neighborhood, local job growth, potential for appreciation, and your personal financial goals. A good investment decision always relies on a combination of factors, not just a single number.

Stop the guesswork and start making data-driven decisions. Flip Smart automates your rental property analysis, calculating cap rates, cash flow, and profit potential in seconds. Analyze any property for free on flipsmrt.com and find your next winning investment today.