Identifying the best rental property markets is the cornerstone of building a profitable real estate portfolio. In a constantly shifting economy, key drivers like robust job growth, consistent population migration, and a high quality of life can elevate a good investment into a great one, generating reliable cash flow and long-term appreciation. However, manually sifting through mountains of data to pinpoint these lucrative opportunities is both complex and incredibly time-consuming.

This guide provides a strategic analysis of the top 9 markets poised for significant rental property returns in 2025. We move beyond generic advice to deliver actionable insights and tactical approaches for each city, helping you make smarter, faster investment decisions.

You will learn:

- The critical data points for each city, including cash-on-cash return, cap rates, and population growth.

- The distinct pros and cons that define each market’s investment landscape.

- Actionable strategies you can implement to gain a competitive edge in each location.

- How to use analytics tools like Flip Smart to evaluate properties quickly and confidently.

Whether you are a seasoned investor diversifying your holdings or a newcomer making your first purchase, this roundup delivers the clarity needed to make informed, profitable decisions in today's most promising locations. Let's explore where your next investment should be.

1. Austin, Texas

Austin, Texas, continues its reign as one of the best rental property markets, driven by a powerful synergy of economic expansion and relentless population growth. The city's "Silicon Hills" moniker is backed by major tech giants like Apple, Tesla, and Oracle, which act as magnets for high-earning young professionals. This migration fuels an intense, sustained demand for rental housing across all property types.

The combination of a booming job market and the absence of a state income tax creates a fertile ground for real estate investors. The rental market is diverse, catering to tech workers seeking luxury downtown condos, students from the University of Texas needing housing near campus, and families looking for single-family homes in burgeoning suburbs.

Why Austin Stands Out

The key driver behind Austin's rental strength is its robust and diversified job market, which directly correlates to population growth and housing demand. Unlike markets that rely on a single industry, Austin's economy spans tech, education, and government sectors, creating stability and a consistent tenant pool. For instance, East Austin neighborhoods have seen annual rent growth between 15-20%, while single-family homes in desirable areas like South Austin command rents of $3,000-$5,000 or more.

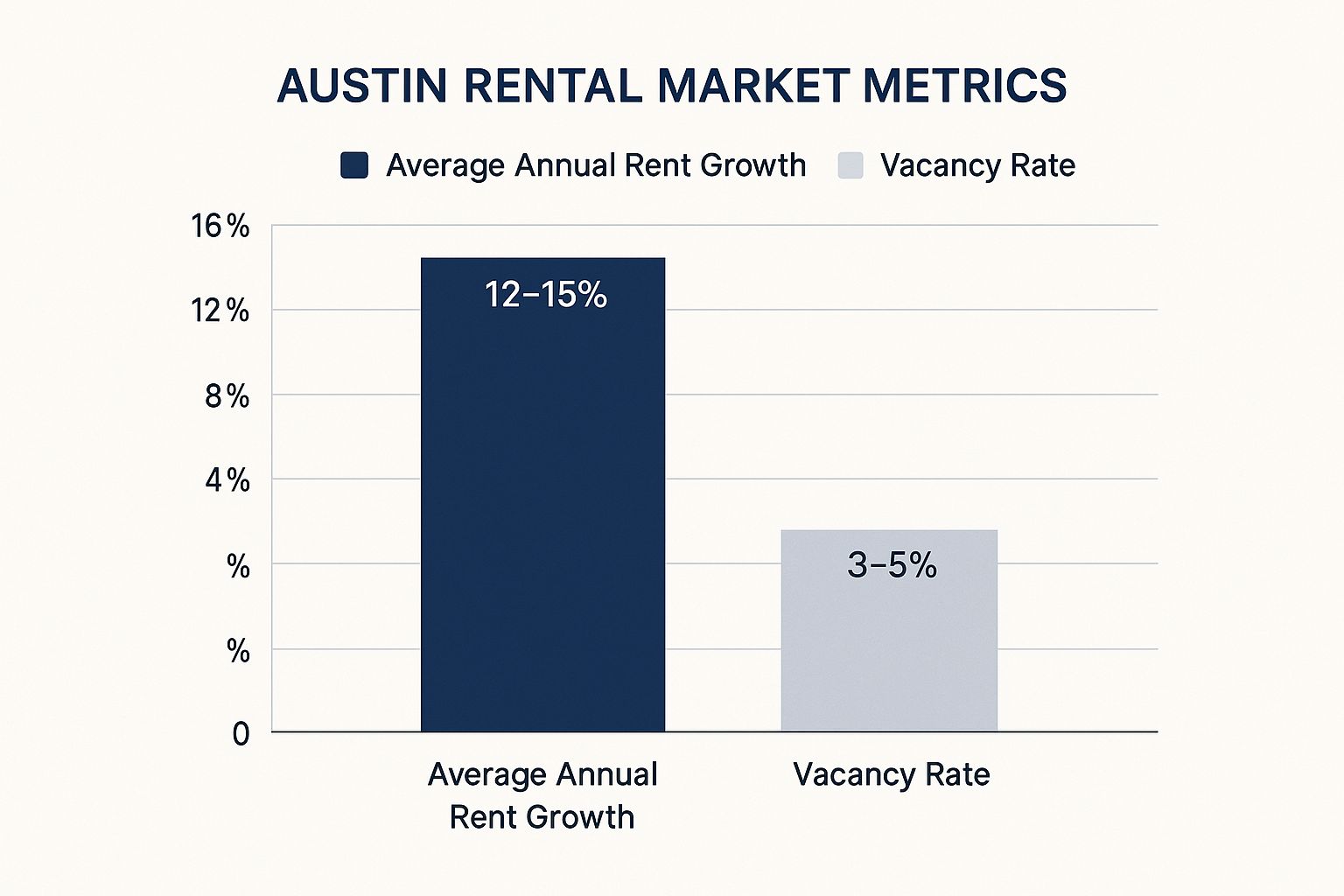

The bar chart below visualizes two critical metrics for the Austin rental market: the strong average annual rent growth and the remarkably low vacancy rate.

This data highlights a market where demand significantly outpaces supply, allowing landlords to increase rents while maintaining high occupancy.

Actionable Investment Strategies

To succeed in Austin, investors must adopt a targeted approach. Focusing on specific submarkets and tenant profiles is crucial.

- Target Tech Corridors: Concentrate property searches in areas like The Domain (North Austin) or along the East Austin tech corridor to attract high-income tech employees.

- Student Housing Focus: Invest in multi-bedroom properties or condos near the University of Texas campus to tap into the perennial student rental market.

- Monitor Infrastructure: Keep an eye on projects like Project Connect, the city's public transit expansion, as properties near new transit lines are poised for significant appreciation and rental demand.

2. Raleigh-Durham, North Carolina

The Raleigh-Durham area, known as the Research Triangle, presents one of the most stable and promising rental property markets in the country. This region's strength is built on a powerful trifecta of world-class universities, a booming life sciences and technology sector, and a steady influx of highly educated professionals. The presence of Duke University, UNC-Chapel Hill, and NC State University anchors a consistent demand for housing.

This blend of academic and corporate influence creates a resilient economy and a high-quality tenant pool. Investors find a market with relatively affordable entry points compared to other tech hubs, offering a balanced opportunity for cash flow and appreciation. The area caters to a wide range of renters, from students and academics to corporate employees at major firms in Research Triangle Park.

Why Raleigh-Durham Stands Out

Raleigh-Durham’s core advantage is its economic and demographic stability, fueled by the non-cyclical education and healthcare sectors. This creates a perpetually renewing tenant base, insulating the market from wider economic downturns. For instance, single-family homes in suburbs like Cary and Apex are in high demand from families relocating for jobs, often commanding rents of $2,400-$3,500.

Simultaneously, the constant student population guarantees near-zero vacancy rates for properties near campuses, with landlords often pre-leasing units a year in advance. The area's sustained job growth also fuels demand for corporate housing, providing another lucrative niche for investors. Exploring different real estate investment strategies for markets like Raleigh-Durham is key to maximizing returns.

Actionable Investment Strategies

Success in the Research Triangle market requires an understanding of its distinct submarkets and the economic drivers behind them.

- University-Centric Investing: Focus on multi-bedroom properties or condos in Chapel Hill, Durham, and West Raleigh to cater to the student demographic. Understanding the academic calendar is crucial for timing leases.

- Target Corporate Tenants: Acquire properties in areas with easy commutes to Research Triangle Park (RTP), such as Morrisville or Brier Creek. Consider offering furnished units to attract relocating professionals on short-term contracts.

- Follow Development Corridors: Invest in neighborhoods along planned transit expansions or in areas with significant new commercial development, like Downtown Raleigh or Durham's Innovation District, to capitalize on future appreciation.

3. Phoenix, Arizona

Phoenix, Arizona, has surged to the forefront as one of the best rental property markets, propelled by an astonishing rate of population growth. The metro area acts as a magnet for residents relocating from more expensive states like California, drawn by a lower cost of living, a robust job market, and a desirable climate. This relentless influx creates sustained, high demand for rental properties.

The city’s economic landscape is diversifying rapidly beyond its traditional retirement roots, with strong growth in technology, healthcare, and advanced manufacturing sectors. This expansion fuels demand across the entire rental spectrum, from luxury apartments in Scottsdale catering to high-income professionals to single-family homes in suburban communities like Mesa and Chandler sought by families.

Why Phoenix Stands Out

The primary factor underpinning Phoenix's rental market strength is its explosive and consistent population growth, which directly translates to a pressing need for housing. Unlike more established markets, Phoenix offers investors a blend of affordability and high rental yield potential. For instance, single-family homes in burgeoning suburbs can yield cash-on-cash returns of 6-8%, while downtown Phoenix is undergoing a significant urban renewal, creating new opportunities for multi-family investments.

This combination of job creation and in-migration keeps vacancy rates low and gives landlords considerable pricing power. The market’s momentum is supported by significant infrastructure development, ensuring its long-term viability for real estate investors.

Actionable Investment Strategies

Success in the competitive Phoenix market requires a strategic focus on property type and tenant amenities. Investors must cater to the specific demands of the desert environment and diverse tenant base.

- Target Employment Hubs: Concentrate on properties in areas like the Price Road Corridor in Chandler or North Scottsdale to attract tenants working in the growing tech and finance sectors.

- Prioritize Essential Amenities: A swimming pool and reliable, high-efficiency air conditioning are not luxuries but necessities. Properties featuring these amenities command higher rents and experience lower vacancy.

- Serve Diverse Demographics: Tailor your investments to specific renter profiles. Consider smaller, low-maintenance properties for retirees in areas like Sun City, or larger family homes near top-rated school districts in Gilbert.

4. Tampa Bay, Florida

Tampa Bay, Florida, has emerged as one of the best rental property markets, propelled by a potent mix of economic diversification, population influx, and an enviable lifestyle. The region's appeal is amplified by Florida's no-state-income-tax policy, which attracts both businesses and new residents. This has fueled a booming tech scene and expanded the financial services sector, creating a steady stream of high-quality tenants.

This economic vitality, combined with the magnetic pull of its beaches and cultural amenities, creates a dynamic environment for real estate investors. The rental market is multifaceted, serving professionals seeking luxury apartments in Downtown Tampa, corporations needing housing in the Westshore business district, and students attending the University of South Florida (USF). This diverse demand ensures market stability and consistent rental income potential.

Why Tampa Bay Stands Out

The primary force behind Tampa's rental strength is its powerful job growth paired with significant in-migration from higher-cost states. The market's economy is not reliant on tourism alone; it's a growing hub for finance, healthcare, and technology. This diversification creates a resilient tenant base. For instance, neighborhoods like Seminole Heights and Riverside Heights are seeing high demand, with single-family rental homes commanding strong monthly rents due to their proximity to downtown employment centers.

The demand for rental properties is consistently high across different segments. From waterfront high-rises in the urban core to suburban single-family homes, investors can find opportunities that align with various strategies, all supported by a landlord-friendly legal environment.

Actionable Investment Strategies

Success in the Tampa Bay market requires a nuanced strategy that accounts for its unique geography and tenant demographics.

- Target Employment Hubs: Focus on properties near major employment centers like the Westshore district, Downtown St. Petersburg, or the I-4 corridor to attract long-term corporate tenants.

- Understand Environmental Risks: Be diligent about flood zones and associated insurance costs, especially for properties near the coast. This is a critical part of your due diligence.

- Leverage Lifestyle Amenities: Invest in properties that feature amenities appealing to the Florida lifestyle, such as pool access, outdoor living spaces, or proximity to parks and waterfronts. These features can justify higher rents.

- Partner with Local Experts: Navigating the market's nuances is easier with the right team. Before you invest, make sure you are prepared by knowing the right questions to ask a property management company to ensure your asset is well-managed.

5. Nashville, Tennessee

Nashville, Tennessee, has emerged as one of the best rental property markets, powered by a vibrant cultural scene and a rapidly diversifying economy. While "Music City" remains an entertainment hub, its economic base has expanded to include major healthcare, technology, and automotive corporations. This dynamic mix attracts a steady stream of young professionals, artists, and corporate transplants, ensuring robust and consistent demand for rental housing.

The city's appeal is amplified by its lack of a state income tax, making it a magnet for both talent and investment. The rental market caters to a wide audience, from musicians needing flexible living near Music Row and professionals seeking luxury apartments in The Gulch, to families desiring single-family homes in sought-after suburbs like Franklin and Brentwood.

Why Nashville Stands Out

Nashville's primary strength lies in its explosive job and population growth, which fuels continuous housing demand. The city's economic diversification creates resilience, preventing over-reliance on a single sector. This translates into a stable and varied tenant pool. For instance, high-end condos in The Gulch command premium rents, often exceeding $2.50 per square foot, while well-located single-family homes easily rent for $2,800-$4,500 per month. This dynamic ensures investors can find opportunities across different price points and property types.

The market fundamentals are exceptionally strong, with rent growth frequently outpacing national averages and vacancy rates remaining impressively low. This high-demand, low-supply environment allows landlords to optimize rental income and maintain high occupancy levels, cementing Nashville's status as a top-tier investment location.

Actionable Investment Strategies

To capitalize on Nashville's market, investors should focus on specific neighborhood dynamics and tenant needs. A tailored strategy is essential for maximizing returns.

- Serve the Music Industry: Target properties in or near Music Row and East Nashville. Consider offering furnished units or flexible lease terms to attract touring musicians and industry professionals who need temporary housing.

- Focus on Corporate Corridors: Invest in single-family rentals or townhomes in suburbs like Franklin and Brentwood, which are close to major corporate headquarters like Nissan North America, to attract high-income families.

- Understand Local Regulations: Be mindful of Nashville's specific regulations, such as noise ordinances and restrictions on non-owner-occupied short-term rentals, which can impact your investment strategy and profitability.

6. Denver, Colorado

Denver, Colorado, has emerged as one of the best rental property markets, fueled by a unique blend of a booming tech scene, a world-class outdoor lifestyle, and a thriving young professional population. The "Mile High City" attracts a consistent stream of new residents who value work-life balance, drawn by both high-paying jobs and proximity to the Rocky Mountains. This migration creates sustained demand for quality rental housing.

The city’s economic landscape is increasingly diverse, with strong sectors in technology, aerospace, and renewable energy complementing its traditional government and tourism industries. This economic resilience, combined with a highly educated workforce, makes Denver a stable and lucrative environment for real estate investors looking for long-term growth and a reliable tenant base.

Why Denver Stands Out

Denver's primary advantage is its powerful appeal to the millennial and Gen Z demographics, who prioritize lifestyle amenities alongside career opportunities. This creates a deep and consistent tenant pool for various property types. For instance, the revitalized RiNo (River North) Arts District now commands premium rents for its trendy lofts, while established neighborhoods like Capitol Hill remain popular with young professionals seeking classic apartments with urban walkability.

The city's strategic investments in public transit, like the RTD Light Rail system, have also unlocked significant value. Properties in suburbs such as Lakewood and Aurora located near transit stations are increasingly sought after by commuters, offering investors opportunities for strong cash flow outside the urban core.

Actionable Investment Strategies

Success in the Denver market requires catering to the specific lifestyle demands of its residents. Investors should focus on properties and amenities that align with the local culture.

- Prioritize Outdoor-Adjacent Amenities: Properties with features like secure bike storage, gear closets, or proximity to parks and trailheads are highly desirable. Marketing these features can attract premium tenants.

- Focus on Transit-Oriented Development: Invest in properties within a short walk of light rail stations in areas like Englewood or Littleton to attract commuters seeking a balance of affordability and convenience.

- Understand Local Regulations: Be aware of Denver's specific landlord-tenant laws and regulations, including those related to short-term rentals and occupancy limits, to ensure compliance and maximize profitability.

7. Atlanta, Georgia

Atlanta, Georgia, has solidified its position as the economic engine of the Southeast, making it one of the best rental property markets for savvy investors. Its strength lies in a diverse economy, a world-class international airport, and a rapidly growing population. The city continues to attract major corporate headquarters, a booming film and entertainment industry, and students attending prestigious universities like Georgia Tech and Emory University.

This dynamic blend of economic drivers ensures a consistent and varied tenant pool. Atlanta's relatively affordable cost of living, when compared to other major U.S. cities, makes it a magnet for both renters seeking opportunity and investors looking for sustainable returns. The market offers a wide spectrum of investment options, from luxury high-rises in Buckhead to single-family homes in rapidly appreciating neighborhoods.

Why Atlanta Stands Out

The key to Atlanta's rental market strength is its economic diversification and role as a major logistics and corporate hub. Unlike markets dependent on a single industry, Atlanta's job growth spans technology, finance, media, and healthcare, creating a resilient rental ecosystem. For example, properties in Midtown near corporate HQs attract high-earning professionals, while emerging neighborhoods like the West End and Grant Park are seeing significant rent growth due to gentrification and new development.

This economic momentum keeps vacancy rates low and creates upward pressure on rents. A thorough financial review is critical to capitalize on these trends. For a deeper understanding of the numbers, investors should learn more about how to analyze property cash flow before entering this competitive market.

Actionable Investment Strategies

Success in Atlanta requires a nuanced, neighborhood-specific strategy that accounts for its rapid changes.

- Focus on Transit-Oriented Development: Target properties within walking distance of MARTA train stations. As the city grows, access to public transit will become an increasingly valuable amenity for renters.

- Target Major Employment Hubs: Invest in areas with high concentrations of jobs, such as the Perimeter Center, Midtown, or Buckhead, to attract a stable pool of professional tenants.

- Monitor Gentrification Patterns: Research up-and-coming neighborhoods like Adair Park or Pittsburgh. Investing ahead of major development can yield significant appreciation and rental income growth, but requires careful risk assessment.

8. Charlotte, North Carolina

Charlotte, North Carolina, has solidified its position as one of the best rental property markets, propelled by its status as a leading financial hub and rapid population growth. As the nation's second-largest banking center, home to headquarters for Bank of America and a major hub for Wells Fargo, the city attracts a consistent stream of high-earning financial professionals. This economic engine fuels strong and stable demand for rental properties.

This financial prowess, paired with a cost of living that remains lower than other major metropolitan areas, creates an ideal environment for real estate investment. The market is diverse, ranging from high-rise apartments in Uptown catering to banking executives to single-family homes in suburban neighborhoods that appeal to families drawn by the city's robust job market and quality of life.

Why Charlotte Stands Out

The primary driver of Charlotte's rental market strength is its powerful financial sector, which provides a high-income, stable tenant base. The city’s economy is also diversifying into tech and healthcare, adding layers of resilience. This economic stability ensures consistent rental demand across various property types. For instance, trendy apartments in the South End can command premium rents due to their proximity to both corporate offices and vibrant social scenes, while properties near the University of North Carolina at Charlotte (UNCC) benefit from perennial student demand.

This combination of economic growth and relative housing affordability creates a market where investors can acquire assets with strong cash flow potential and significant appreciation prospects.

Actionable Investment Strategies

A targeted strategy is essential for maximizing returns in Charlotte's dynamic market. Investors should focus on specific neighborhoods and tenant demographics.

- Target Financial and Corporate Hubs: Concentrate property searches in and around Uptown and Ballantyne to attract professionals working in the city's major banking and corporate centers.

- Focus on High-Demand Amenities: Young professionals in Charlotte prioritize walkability, modern finishes, and proximity to dining and entertainment. Investing in properties in areas like South End or NoDa can yield higher rents.

- Monitor Transit Expansion: The LYNX Blue Line light rail has already spurred development. Research planned expansions and target properties along future transit corridors to capitalize on appreciation.

- Consider Corporate Housing: Explore furnished rentals aimed at corporate relocations or contract workers, as these can command significantly higher rental rates than traditional long-term leases.

9. Las Vegas, Nevada

Las Vegas, Nevada, has evolved far beyond its reputation as an entertainment capital to become one of the best rental property markets in the country. This transformation is fueled by its lack of a state income tax, a diversifying economy, and a significant influx of new residents, particularly from neighboring California. The result is a dynamic and expanding rental market with high demand.

The city's economic landscape is broadening to include tech, healthcare, and logistics, creating a varied tenant base. This ranges from service and hospitality workers to high-earning professionals, driving demand for everything from affordable single-family homes to luxury condos. This diversification provides investors with a stable foundation for long-term growth.

Why Las Vegas Stands Out

The primary factor driving the Las Vegas rental market is its powerful population growth, which consistently outpaces national averages. This influx creates a sustained demand for housing that the current supply struggles to meet, leading to low vacancy rates and steady rent appreciation. For instance, master-planned communities like Summerlin and the rapidly growing suburb of Henderson are experiencing strong demand for single-family rentals.

Unlike markets dependent on a single industry, Vegas is actively diversifying. The emergence of a tech corridor in Henderson and the revitalization of Downtown Las Vegas are attracting new businesses and a different demographic of renters. This economic resilience makes it an attractive and more secure option for real estate investors looking for consistent returns.

Actionable Investment Strategies

To capitalize on the Las Vegas market, investors need to be strategic and focus on specific submarkets and tenant needs.

- Target Economic Diversification: Focus on properties in Henderson or near the downtown innovation districts to attract tenants from the growing tech and professional services sectors.

- Explore Furnished Rentals: Consider offering furnished rental options, especially in areas close to the Strip or major convention centers, to cater to the large population of temporary workers and corporate clients.

- Focus on Master-Planned Communities: Invest in single-family homes in communities like Summerlin or Inspirada, which attract long-term family tenants with their amenities, schools, and safety.

Top 9 Rental Markets Comparison

| City | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Austin, Texas | Moderate - competitive market, high property costs | High - costly acquisition, infrastructure needed | High appreciation (12-15% annual rent growth), low vacancy (3-5%) | Target tech corridors, student housing near UT | No state income tax, strong job growth, diverse tenant pool |

| Raleigh-Durham, NC | Moderate - steady growth, university-driven demand | Moderate - affordable property prices | Stable growth (8-12%), moderate vacancy (4-6%) | Corporate relocations, university students | Affordable entry, strong universities, diverse industries |

| Phoenix, Arizona | Moderate - extensive metro management challenges | Moderate - diverse properties, utilities research | Strong growth (10-15%), low vacancy (3-5%) | Young professionals & retirees, single-family rentals | Rapid population growth, low taxes, expanding job market |

| Tampa Bay, Florida | Moderate-High - hurricane risk requires planning | High - insurance costs, seasonal market shifts | Very strong growth (12-18%), very low vacancy (3-4%) | Coastal rentals, mixed demographics | No state income tax, growing tech & finance sectors |

| Nashville, Tennessee | Moderate - gentrification and competitive zones | Moderate - varied property types | Strong growth (10-14%), moderate vacancy (4-6%) | Entertainment industry focus, young professionals | No state income tax, cultural amenities, diversified economy |

| Denver, Colorado | Moderate - regulatory challenges, seasonal effects | Moderate - higher acquisition costs | Stable growth (8-12%), vacancy (4-7%) | Outdoor lifestyle renters, tech workers | Strong lifestyle appeal, diverse job market |

| Atlanta, Georgia | Moderate-High - traffic and safety concerns | Moderate - affordability balanced with demand | Growth (9-13%), moderate vacancy (5-7%) | Corporate relocations, transit-oriented rentals | Major transport hub, diverse economy, affordable properties |

| Charlotte, North Carolina | Moderate - banking sector dependence | Moderate - affordable acquisition costs | Growth (8-11%), moderate vacancy (4-6%) | Financial sector tenants, young professionals | Financial hub, pro-business environment |

| Las Vegas, Nevada | Moderate-High - tourism dependence and climate risks | Moderate - affordable but diverse tenant needs | Growth (10-16%), higher vacancy (5-8%) | Service industry workers, tech sector, temporary housing | No state income tax, diverse tenant pool, strong tourism sector |

From Data to Deal: Your Next Steps in Smart Investing

Navigating the dynamic landscape of real estate investment can feel overwhelming, but this guide has illuminated the most promising opportunities across the nation. We've explored the high-growth tech hubs of Austin and Raleigh-Durham, the sun-drenched, population-booming metros of Phoenix and Tampa Bay, and the culturally rich, economically diverse centers of Nashville and Atlanta. Each of these locations represents one of today's best rental property markets, but a name on a list is just the starting point.

The true path to a profitable portfolio is paved with meticulous, data-driven analysis. It’s the ability to look beyond the headlines and assess individual properties on their own merit, calculating precise cash-on-cash returns, cap rates, and long-term appreciation potential. This is where successful investors separate themselves from the crowd.

Bridging the Gap Between Opportunity and Action

The critical takeaway is this: knowledge of a good market is useless without the ability to analyze a good deal within it. A thriving city like Denver or Charlotte can still contain underperforming assets. Your success hinges on your capacity to quickly and accurately vet properties, distinguishing the hidden gems from the financial pitfalls.

Instead of getting bogged down in manual calculations and complex spreadsheets, your focus should be on making informed decisions. The goal is to develop a repeatable, efficient system for evaluating opportunities.

Key Insight: The speed at which you can confidently analyze a deal is a significant competitive advantage. In hot markets, the best properties are often under contract within days, leaving no time for slow, manual due diligence.

Your Action Plan for Market Mastery

To transform this information into tangible results, follow these concrete next steps:

- Refine Your Investment Thesis: Revisit your personal financial goals. Are you prioritizing immediate cash flow, long-term appreciation, or a balanced "hybrid" approach? Your answer will determine whether a market like Las Vegas (higher cash flow potential) or Austin (strong appreciation) is the right fit.

- Select Two Target Markets: Don't spread yourself too thin. Choose two cities from this list that best align with your investment criteria and begin your deep-dive research. Start tracking local market trends, familiarizing yourself with key neighborhoods, and networking with local agents or property managers.

- Embrace a Tool-Driven Approach: Your most valuable asset is time. The critical step is to adopt a system that automates the heavy lifting of financial analysis. This is where you move from theory to practice, turning a potential property address into a clear, actionable investment profile.

Mastering this process is not just about buying a property; it’s about building a scalable, profitable real estate business. By combining market knowledge with powerful analytical tools, you empower yourself to invest with the precision and confidence of a seasoned professional, ensuring that every decision you make is backed by solid data.

Ready to stop guessing and start analyzing? Flip Smart is the essential tool that helps you evaluate properties in any of the best rental property markets in minutes, not hours. Gain a decisive edge by calculating cash flow, ROI, and renovation costs with unparalleled speed and accuracy by visiting Flip Smart today.