Real estate investment property analysis is the essential process of vetting a potential deal to determine its profitability. It's not about gut feelings; it's about a systematic evaluation of income, expenses, and potential returns to make data-driven decisions. A disciplined analysis is the only thing standing between a lucrative asset and a financial drain.

This guide provides an actionable framework for dissecting any investment property. You'll learn how to move beyond surface-level appeal and build a financial case for your investment, ensuring every decision is backed by solid numbers and a clear understanding of the risks involved.

Building Your Analytical Framework

Before you analyze a single property, you must first define your investment strategy. A clear framework ensures you're not just buying property, but acquiring assets that align with your financial goals. This strategic approach is what separates seasoned investors from amateurs.

First, clarify your objective. Are you seeking long-term cash flow from a rental (buy-and-hold), or are you aiming for a quick profit from a renovation (fix-and-flip)? Your strategy dictates which financial metrics are most important. A buy-and-hold investor will prioritize metrics like Net Operating Income (NOI) and Cash Flow, while a flipper is singularly focused on the After Repair Value (ARV) and renovation costs.

Establishing Your Core Metrics

To screen deals efficiently, you need a set of initial filters. These metrics allow you to quickly discard properties that don't meet your basic criteria, saving you valuable time. Two of the most effective initial tests are the 1% Rule and the Capitalization (Cap) Rate.

The 1% Rule: This simple guideline suggests a property's gross monthly rent should be at least 1% of its purchase price. For example, a $200,000 property should command a monthly rent of at least $2,000 to warrant further investigation.

Cap Rate: Calculated by dividing the Net Operating Income by the property’s market value, the Cap Rate allows you to compare the relative return of different properties on an even playing field, independent of financing.

While these rules are excellent for initial screening, a comprehensive analysis requires a deeper dive. For a practical tool to get started, our guide on building a rental property analysis spreadsheet provides a structured template for organizing your calculations.

To give you a clearer picture, here’s a quick rundown of the metrics that form the backbone of any solid property analysis.

Essential Property Analysis Metrics

This table breaks down the core numbers you'll be running. Each one tells a different part of the story, and together they give you the full picture of a deal's potential.

| Metric | What It Measures | Why It's Critical |

|---|---|---|

| ARV | The property's estimated value after all repairs are done. | The foundation for flips and BRRRR; determines your potential profit margin. |

| Rehab Costs | The total cost of renovations and repairs. | Directly impacts your Maximum Allowable Offer (MAO) and overall profitability. |

| Cash Flow | Monthly rental income minus all operating expenses. | The lifeblood of rental investments; determines your passive income. |

| Cap Rate | The rate of return based on the property's income. | Allows you to compare the relative value of different investment opportunities. |

| Cash-on-Cash Return | Annual pre-tax cash flow divided by total cash invested. | Shows the return on your actual out-of-pocket investment. |

| NOI | All revenue from the property minus operating expenses. | A pure measure of a property's ability to generate profit, excluding debt. |

Understanding these metrics is non-negotiable. They are the language of real estate investing, and fluency is your best defense against bad deals.

Understanding the Broader Market Context

A great deal on paper can turn sour in a bad market. Your framework has to account for what’s happening on a larger scale. The global real estate investment landscape for 2025 is showing cautious optimism, but with plenty of economic curveballs still in play.

A recent report from PwC and the Urban Land Institute noted that smart money is moving toward assets that sit at the intersection of real estate and infrastructure—things like data centers or logistics hubs. Understanding these macro trends helps you see where the puck is going, ensuring your analysis isn't happening in a vacuum.

A disciplined framework forces you to ask the right questions upfront. It prevents you from wasting time on deals that never had a chance of meeting your financial goals from the start.

By establishing this foundation, you can approach every potential deal with clarity and confidence. You’ll know exactly what to look for, which numbers to run, and—most importantly—when to walk away. This is how you make your real estate investment property analysis both thorough and brutally efficient.

From Estimates to Actual Profitability

This is where the theoretical meets reality. It’s time to move beyond initial filters and calculate the hard numbers that will determine your actual profit. The goal is to build a precise financial model for the property, starting with its potential future value and working backward to determine a viable purchase price.

The cornerstone of this process is the After Repair Value (ARV). This is not a guess; it's a data-driven estimate of what the property will be worth after all renovations are complete. To calculate a reliable ARV, you must analyze recent "comps"—comparable sales of similar, fully updated properties in the immediate vicinity. Focus on homes with the same bed/bath count and square footage that have sold within the last three to six months for the most accurate data.

Building a Realistic Rehab Budget

With a solid ARV established, the next critical step is creating a detailed renovation budget. This is where many new investors falter, as underestimating repair costs can erase your entire profit margin. A practical budget goes far beyond cosmetic updates like paint and flooring.

Your analysis must account for big-ticket items and potential hidden problems. Focus your inspection on these key areas:

- Major Systems: Assess the age and condition of the HVAC, roof, and water heater. Replacing any of these can add thousands to your budget.

- Structural and Mechanical: Look for signs of foundation issues, outdated electrical wiring, or old cast iron plumbing. These are costly, non-negotiable repairs.

- Permits and Fees: Determine if your renovation scope will require municipal permits, which add both cost and delays to your timeline.

- Contingency Fund: Always add a contingency of 10-20% to your total budget. This fund is your buffer for unexpected issues like mold or termite damage.

For a step-by-step guide to this process, explore our detailed article on how to estimate renovation costs, which includes practical checklists and cost examples.

Your real estate investment property analysis is only as strong as your most conservative estimate. Optimism is great for motivation, but pessimism is what protects your capital.

The market is showing some positive signs for investors, too. After a two-year correction, private real estate values have ticked up for five straight quarters. This signals a recovery and fresh opportunities. This trend, combined with the steady income that real estate provides, suggests new capital might start flowing in, even with the stock market near all-time highs.

Projecting Your True Net Income

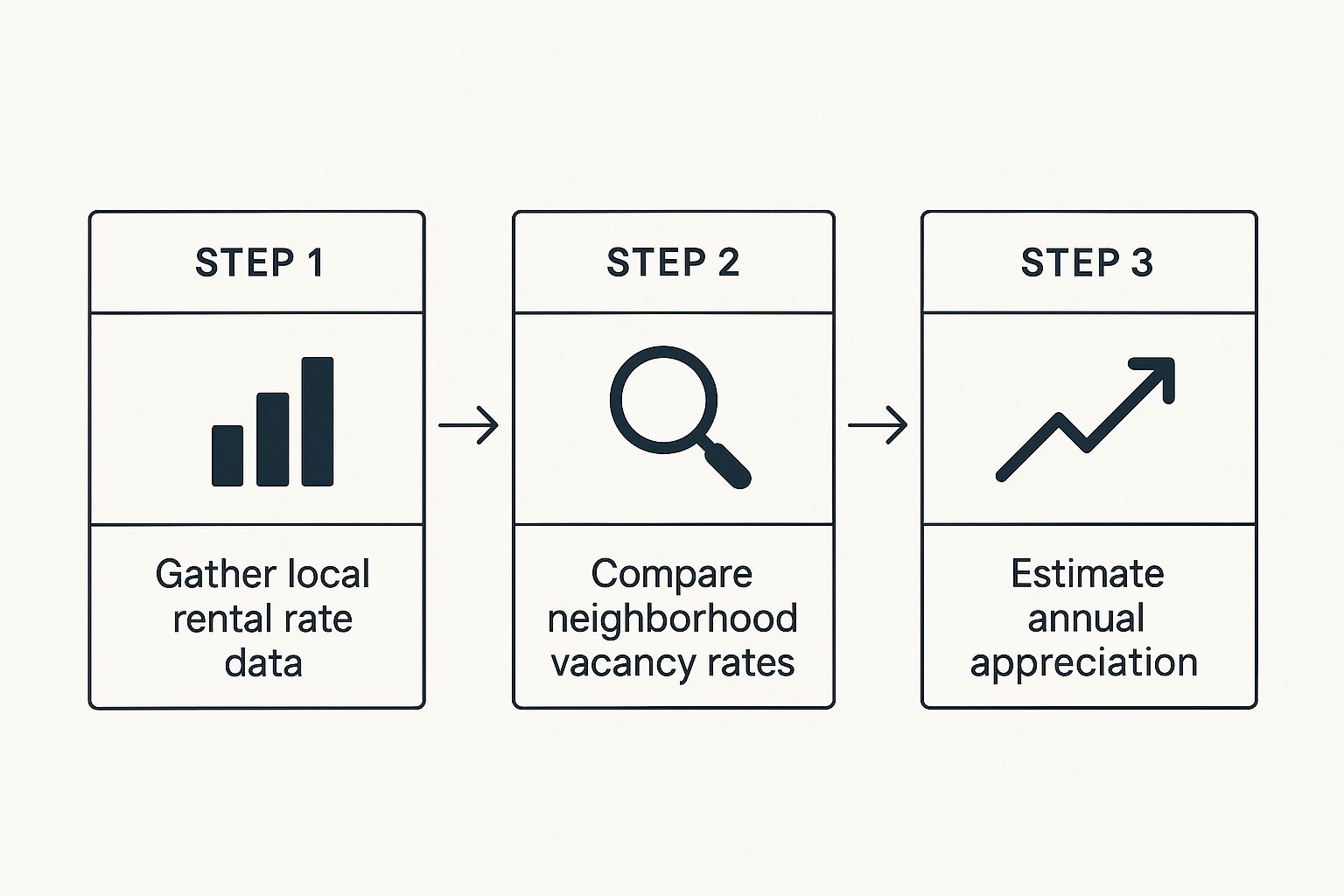

Finally, you must project the property's actual net income. This involves more than just looking up average rents online. The infographic below illustrates the multi-layered approach required for an accurate financial forecast.

To calculate your net cash flow—the profit that lands in your bank account—you must subtract all operating expenses from the gross rental income.

Ensure your budget includes every one of these costs:

- Property Taxes

- Homeowner's Insurance

- Property Management Fees (typically 8-10% of gross rent)

- Vacancy (budget for at least 5-8% of the year)

- Maintenance and Repairs

- Utilities (if not paid by the tenant)

- HOA Fees (if applicable)

Only after subtracting these expenses can you determine your true net cash flow. This final number is the ultimate measure of the property's performance and its ability to generate passive income.

Uncovering Risks Beyond the Spreadsheet

A deal that looks perfect on paper can become a financial nightmare if you ignore the on-the-ground realities. A truly thorough real estate investment property analysis has to go far beyond the calculations and into the physical world of inspections and neighborhood dynamics.

This is where you find the hidden landmines that spreadsheets simply can't see.

Begin with a detailed property walkthrough. Train your eye to spot subtle red flags: faint water stains on ceilings, uneven floors suggesting foundation issues, or a musty odor that indicates hidden moisture. Identifying these early warning signs can save you from a costly mistake.

Knowing When to Call the Professionals

While you can spot many issues yourself, some problems require an expert. Never skip professional inspections for a property's major systems, as their failure can single-handedly destroy your budget.

- Foundation and Structural: A structural engineer can identify critical issues invisible to an untrained eye, from foundation cracks to soil instability.

- Electrical Systems: An electrician should verify the panel, wiring, and outlets are up to code. Faulty electrical is a significant safety hazard and an expensive repair.

- Plumbing and Sewer: A plumber can scope the main sewer line to check for cracks or root intrusion, a repair that can cost over $10,000.

- Roofing: A professional roofer can provide a realistic estimate of the roof's remaining lifespan and identify potential leaks.

These inspections are vital data points for your analysis and powerful tools for negotiation. For a complete guide, our real estate due diligence checklist breaks down every single step you need to take to protect your investment.

Analyzing the Neighborhood's DNA

A great house in a declining neighborhood is a bad investment. The property's surroundings have a direct and powerful impact on its future appreciation and rental demand. Your analysis must include a deep dive into the neighborhood's vital signs.

Look beyond curb appeal and investigate the data. What are the local school ratings? High-performing schools are a magnet for families and can seriously boost property values. Check online crime maps for recent trends—a rising crime rate can quickly tank your investment's appeal.

A property's value is fundamentally tied to its location. You aren't just buying a structure; you're investing in a block, a school district, and a community's future.

Finally, dig into local zoning laws and upcoming developments. Is a new shopping center or major employer moving in? That's a huge plus. On the flip side, is the city planning to rezone the area for industrial use? That could be a deal-breaker. Understanding the local rental market—from tenant demand to average vacancy periods—is your ultimate defense against a costly misstep.

Finding Deals Worth Analyzing

Knowing how to run the numbers on a potential investment is a critical skill, but it’s completely useless if you don't have a steady stream of deals to analyze. The best investors I know don't wait for opportunities to fall into their laps; they build systems that keep their pipeline full.

This means blending old-school hustle with new-school efficiency. The traditional methods still work for a reason. Building a relationship with a real estate agent who actually gets the investor mindset—not just the retail homebuyer—is gold. They can bring you off-market deals before anyone else sees them. The same goes for networking with local wholesalers or even just "driving for dollars" and spotting distressed properties yourself. These tactics can uncover some absolute gems.

Modernizing Your Deal Sourcing

Let's be real, though. While those classic methods are great, they take a ton of time. This is where technology gives you a massive leg up, letting you scan entire markets and filter for exactly what you want in minutes, not weeks. For serious investors, using a dedicated platform isn't a luxury anymore—it's essential to stay in the game.

Today's market is tricky. We're in what some experts call a K-shaped recovery, where different properties and locations are heading in opposite directions. The Global Real Estate Outlook for 2025 highlights that investors need to be incredibly selective to get strong returns. It's all about finding "the right asset in the right place." This is exactly why a tool that can instantly sift through the noise is so valuable. You can check out the full 2025 real estate outlook from M&G Investments for a deeper dive into these trends.

In a market where timing and precision are everything, your ability to source and vet deals quickly is your biggest competitive edge. Don't just look for deals; build a system that brings them to you.

This is exactly what we built Flip Smart to do. The dashboard lets you find and filter properties based on your specific investment criteria, so you're only looking at deals that actually make sense.

Instead of manually digging through thousands of listings, you can apply filters for price, property type, and even potential ROI. It takes a sea of possibilities and narrows it down to a handful of high-potential candidates worth your time.

Combining Traditional and Tech-Driven Approaches

The most successful investors don’t pick one method—they integrate them. They use technology to cast a wide net and then deploy their boots-on-the-ground knowledge to zero in on the best opportunities.

Here’s what that blended approach looks like in the real world:

- Identify: First, use a tool like Flip Smart to scan a zip code for properties that are listed below market value and fit your basic criteria.

- Verify: Next, take the top candidates from your online search and go for a drive. Get a feel for the neighborhood and see the property's exterior condition with your own eyes.

- Connect: Finally, share the most promising addresses with your investor-friendly agent. They can dig up insider info or get you in the door for a showing.

This combination of scale and precision means you're only spending your valuable time analyzing deals that have already passed several checks. It's a simple way to make your investment workflow dramatically more efficient.

Making the Final Investment Decision

You’ve run the numbers, walked the property, and dug into the neighborhood data. Now, all that groundwork leads to the single most important moment: the decision. This is where you pull every piece of your analysis together into a clear, concise investment summary that will either kill the deal or give you the green light.

This summary isn’t just for you; it’s a professional document. If you’re lining up a loan or bringing in partners, a well-organized proposal is your best sales tool. It proves your decision is backed by solid research, not just a gut feeling.

Building Your Investment Proposal

Your proposal needs to tell the complete financial story of the deal. It should be logical, easy to follow, and allow anyone—a lender, a partner, or even your future self—to understand the property’s potential at a glance. Think of it as the ultimate executive summary for your real estate investment property analysis.

At a minimum, your proposal needs to neatly lay out these key data points:

- Final After Repair Value (ARV): The concrete value you’ve landed on based on hard comparable sales.

- Detailed Rehab Budget: The full scope of work, plus a contingency fund of 10-20% for surprises.

- Projected Cash Flow: The estimated monthly and annual net income after all expenses are paid.

- Key Risk Factors: An honest outline of potential downsides, like looming zoning changes or an aging HVAC system.

Don't shy away from listing the risks. It shows you’ve done your homework and are prepared for what could go wrong, which builds tremendous credibility with anyone putting money on the line.

The most successful investors are disciplined enough to walk away from a deal that looks good but doesn't meet their pre-established criteria. Emotion is the enemy of profit.

Setting Your Go/No-Go Criteria

Before you ever look at a property, you need to have firm "go/no-go" criteria. These are your non-negotiable financial thresholds that a deal absolutely must meet for you to even consider it.

These benchmarks are your objective filter. They protect you from emotional decisions and the temptation to fudge the numbers on a property you’ve fallen in love with.

Your personal criteria might look something like this:

- Cash-on-Cash Return: Must hit 8% or higher.

- Monthly Cash Flow: Needs to be at least $300 per door.

- Total All-In Cost: Cannot go over 75% of the ARV.

These rules are your guardrails. If a property doesn't hit every single one of your targets, the decision is simple: you walk away. There will always be another deal.

The discipline to stick to your criteria is what separates consistently profitable investors from those who gamble and lose. This final step transforms your analysis from a simple exercise into a decisive action plan, giving you the confidence to move forward.

Common Questions on Property Analysis

Even when you feel like you've got the basics down, a few nagging questions always seem to pop up during property analysis. Getting these sorted out is key to building real confidence in your numbers. Let's tackle a few of the ones I hear all the time.

Which Metric Is the Most Important?

Investors love to debate which single number reigns supreme. While every metric tells a piece of the story, if I had to pick just one, it would be the Cash on Cash Return (CoCR).

Why that one? Because it's personal. The Cap Rate is great for comparing properties in a vacuum, but CoCR gets down to brass tacks: how much cash did you put into this deal, and how much cash is it putting back in your pocket each year?

It accounts for your actual down payment, your closing costs, and those initial rehab expenses. CoCR tells you exactly how hard your personal capital is working, which is a powerful way to measure the true efficiency of an investment.

How Perfect Do My Rehab Estimates Need to Be?

This is a huge source of anxiety, especially for newer investors. You want your numbers to be spot-on, but let's be real—perfection is a myth. You're going to find things you didn't expect behind a wall or under a floor. It just happens.

That's why a smart analysis always bakes in a contingency fund of 10-20% right on top of your detailed budget. When you're just screening a deal, a quick per-square-foot estimate is fine to see if it's even in the ballpark.

But before you ever sign on the dotted line, you need a qualified contractor to walk the property with you and give you a real, line-item quote. Underestimating the rehab is probably the fastest way to turn a "great deal" into a money pit.

The goal of your analysis isn't to predict the future with 100% accuracy. It's to build a financial model so resilient that it can absorb the inevitable surprises that come with every single project.

Can I Do This Without Expensive Software?

Finally, people often wonder if they need a bunch of fancy tools to do a proper analysis. The honest answer is no—a well-built spreadsheet can absolutely get the job done. You can track your ARV, budget your rehab, and project your cash flow manually. I did it for years.

But that's where the "but" comes in. Dedicated software was built to dramatically speed up that process and cut down on human error.

These platforms automate the grunt work of pulling comps, they have financial models already built out, and they keep your entire deal pipeline organized. While not strictly necessary, the right tool can save you dozens of hours, which means you get to analyze more properties and, ultimately, find better deals before your competition does.

Ready to stop guessing and start analyzing with precision? Flip Smart turns hours of manual work into seconds of automated insight. Find your next profitable investment today.