When you're buying a home or an investment property, it's crucial to know your numbers. The most important number of all? Your Return on Investment (ROI).

At its core, the ROI formula is pretty straightforward: you take your net profit, divide it by your total investment cost, and multiply that by 100 to get a percentage. This simple calculation cuts through the noise and tells you exactly how well your investment is performing.

Understanding Real Estate ROI and Why It Matters

Think of ROI as your investment's report card. It's the ultimate metric that answers the one question every buyer or investor cares about: "Was this a good financial decision?" Whether you're buying your first home or building a rental portfolio, understanding ROI is essential for making smart choices.

A great ROI tells you you've made a solid investment. A low one? It’s a clear signal that your money could be working harder for you elsewhere.

Knowing this number helps you:

- Spot the winners: Easily compare the potential of different properties before you make an offer.

- Track your performance: See how your investment is really doing long after you've closed the deal.

- Make strategic moves: Decide with confidence whether it’s time to sell, hold, or invest in renovations.

Of course, a big part of maximizing your return is knowing where to put your renovation dollars. Focusing on specific upgrades that boost your home renovation return on investment can make a massive difference to your final numbers.

Key Components of Your Real Estate ROI Calculation

Before we jump into the math, you need to gather the right data. Every solid ROI calculation is built on a foundation of accurate income and expense figures. Without them, you're just guessing.

This table breaks down the essential variables you'll need to pull together.

Key Components of Your Real Estate ROI Calculation

| Component | What It Includes | Why It Matters |

|---|---|---|

| Initial Investment | Your down payment, all closing costs, inspection fees, and any cash spent on initial renovations. | This is your total "skin in the game" — the cash you paid upfront. It’s the baseline for your entire calculation. |

| Ongoing Costs | Mortgage payments (principal and interest), property taxes, insurance, routine maintenance, surprise repairs, and any HOA fees. | These are the recurring expenses that can affect your profit. Tracking them carefully is crucial for getting a true picture of your ROI. |

| Income Generated | All the rental income collected over the time you held the property, plus the final sale price when you sell. | This represents the total cash your property brought in. It’s the "return" part of your Return on Investment. |

Getting these three components right is the first and most critical step. Once you have these numbers nailed down, you're ready to accurately measure the success of your investment.

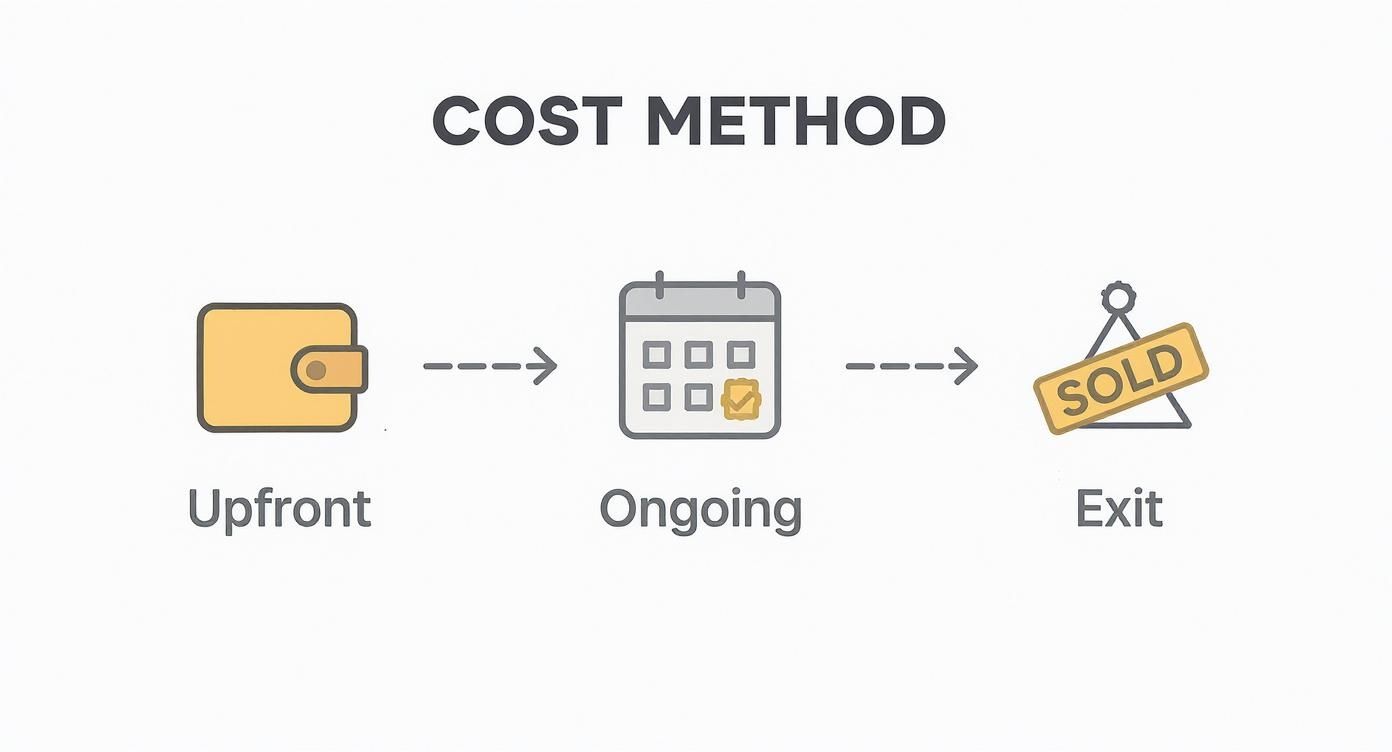

Gathering Your Numbers for the Cost Method

To get a real, honest ROI, you need to track every dollar that leaves your pocket. The cost method is the most straightforward way to do this, breaking down all your financials into two simple buckets: the money you spend to acquire the property and the money it costs to own and eventually sell it.

Your upfront investment is everything it takes to get the keys and make the property ready. This goes way beyond just the purchase price—it’s all the little fees and initial expenses that can add up if you're not paying attention.

Then you have your ongoing and exit costs. These cover the entire time you own the home, from day one right up to the closing table when you sell. Forgetting these is one of the biggest mistakes investors make, and it can silently eat into your profits over the years.

Your Complete Expense Checklist

To make sure nothing gets missed, let's walk through the exact numbers you'll need to pull together.

Upfront Investment Costs

- Purchase Price: The number on the final sales contract.

- Closing Costs: Plan for 2-5% of the purchase price. This covers lender fees, title insurance, attorney charges, and other administrative paperwork.

- Inspection and Appraisal Fees: These are essential checks to verify the home's condition and confirm its market value. For a deeper dive, check out our guide on different real estate valuation methods.

- Initial Renovations: Any immediate repairs, upgrades, or cosmetic work you do before moving in, renting out, or selling.

Ongoing and Exit Costs

- Property Taxes: The annual bill from your local government.

- Homeowners Insurance: Essential protection for your asset against damage.

- Maintenance and Repairs: A solid rule of thumb is to budget 1% of the property's value each year for upkeep. Things break. It's best to be prepared.

- HOA Fees: Don't forget these if the property is in a homeowners association.

- Selling Costs: When it's time to sell, you'll have agent commissions (typically 5-6% of the sale price) and another round of closing fees.

The cost method is popular because it's simple and clear. You just subtract your total costs from your final sale price, then divide that by your initial investment to get a clean ROI percentage.

To really nail down your numbers, using a dedicated data platform can be a massive help. If you're looking for comprehensive property data, you can try TitleTrackr's real estate data tools to speed things up.

While this approach doesn't factor in the time value of money, it's a fantastic first-pass calculation to quickly see the raw profitability of any potential deal.

Putting It All Together With a Real-World Example

Theory is great, but let's run the numbers on a practical scenario to see how this all connects.

Imagine you've found a promising single-family home to buy as a rental. Your plan is to hold it for five years, collect rent, and then sell it. Let's walk through the Cost Method step-by-step to see how the numbers actually play out.

First, we need to figure out the total cash you’re putting into the deal. This is more than just the down payment—it includes every dollar you need to bring to the table to get the property up and running.

- Purchase Price: $450,000

- Down Payment (20%): $90,000

- Closing Costs: $12,000

- Initial Renovations: $18,000

- Cash Reserves: $7,500

- Total Initial Investment:$127,500

This infographic gives you a clean visual of the three financial stages of a typical real estate investment.

As you can see, the journey starts with those upfront costs, moves through the ongoing dance of income and expenses, and finishes with the final sale.

Calculating Your Total and Annualized ROI

Over the next five years, your property generates rental income. Of course, it also comes with expenses—like taxes, insurance, and inevitable repairs. At the end of that five-year holding period, you decide to sell for a higher price.

Here’s a quick summary of the financials from that time:

- Total Rental Income (5 years): $125,000

- Total Expenses (5 years): $35,000

- Final Sale Price: $510,000

With these figures, your net profit is $150,000. That comes from adding your capital gain ($60,000 from the sale) and your net rental profit ($90,000). This gives you a total ROI of 117.6%, meaning you more than doubled your initial cash. Investors across North America use this exact approach, and you can discover more insights about how Canadian investors model ROI for a different market perspective.

Quick Takeaway: A total ROI of 117.6% over five years sounds incredible, but it doesn't tell you your yearly performance. For that, you need the Annualized ROI.

This extra step allows you to compare your real estate investment against other opportunities, like stocks or bonds. Using our formula, your annualized ROI comes out to 16.8%.

That number gives you a much clearer, year-over-year benchmark of your investment's success, making it easier to evaluate your strategy.

Essential Metrics for Rental Properties

When you're buying a property to rent out, the simple ROI formula only gets you part of the way there. To really understand a rental's financial health, you have to dig into its cash flow.

This is where two other powerful metrics come into play: Capitalization Rate (Cap Rate) and Cash-on-Cash Return.

Think of Cap Rate as a way to quickly compare the income potential of different properties. It measures a property's Net Operating Income (NOI) against its market value, completely ignoring any mortgage payments. This makes it a great tool for evaluating which property is the better income-generator before financing enters the picture.

Cash-on-Cash Return, on the other hand, focuses on your specific deal. It zeroes in on the return you're getting on the actual cash you've invested out-of-pocket, like your down payment and closing costs. It's a vital metric when you’re using a loan because it shows you exactly how well your personal investment is performing.

Cap Rate vs Cash-on-Cash Return

These two metrics give you different, but equally valuable, perspectives. For example, a property generating $18,000 in net income on a $200,000 purchase price has a 9% cap rate—a strong figure in many areas.

But let's say you only invested $45,000 of your own money. If your annual cash flow after the mortgage is $8,400, your cash-on-cash return is a stellar 18.67%.

To get a better grasp on these concepts, explore our deep dive into essential real estate math formulas.

Expert Tip: Use Cap Rate to shop for properties and Cash-on-Cash Return to analyze your specific deal once financing is involved. A high cap rate suggests a good income engine, while a high cash-on-cash return shows your leverage is working effectively for you.

When you're knee-deep in deals, it's easy to get these two mixed up. Here’s a quick guide to help you keep them straight.

Cap Rate vs Cash on Cash Return: Which Metric to Use?

A comparison to help you understand the key differences between these two essential rental property metrics.

| Metric | What It Measures | Best For | Considers Financing? |

|---|---|---|---|

| Cap Rate | The property's unleveraged income potential. | Comparing multiple properties quickly to find the best income-producer. | No |

| Cash-on-Cash Return | The return on your actual cash invested. | Evaluating the performance of a specific, financed deal for yourself. | Yes |

Understanding the distinction is key. One metric tells you if the asset is good, and the other tells you if the deal is good for you. By adding these two tools to your arsenal, you can analyze rental deals with more confidence.

Common Mistakes That Skew Your ROI

Getting an accurate ROI is all in the details, but it’s easy to make mistakes that throw your numbers off. The line between a profitable investment and a financial headache often comes down to catching these common errors.

One of the biggest pitfalls is underestimating ongoing costs. It's not enough to just budget for the mortgage and taxes; you have to plan for the unexpected. A good rule of thumb is to set aside 1-3% of the property’s value every year for maintenance and repairs. A new water heater or a surprise roof leak can quickly impact your profits if you're not prepared.

Another frequent oversight is forgetting about closing costs—on both ends of the deal. When you buy, you can expect to pay 2-5% of the purchase price. When you sell, agent commissions and other fees can easily take another 5-6%. Ignoring these will lead to a surprise when you look at your final net profit.

Overly Optimistic Projections

Hope is not a strategy in real estate. Overestimating your potential rental income is a surefire way to get a skewed ROI. Don't just guess. Talk to local property managers or research comparable rental listings in the area to get a realistic rate.

Similarly, many new investors forget to account for vacancy. Even in a hot market, it's smart to factor in at least a 5% vacancy rate to cover the time between tenants. These holding costs can add up fast, and failing to budget for them will inflate your ROI on paper but hurt your wallet in reality. You can learn more about how to prepare for the financial impact of holding a property in our detailed guide.

Quick Tip: Don't forget your "sweat equity." If you're doing renovations yourself, assign a fair market value to your labor. Your time is valuable, and including it gives you a truer sense of the investment's total cost and ultimate return.

Still Have Questions About Real Estate ROI?

Even after you’ve got the formulas down, you might still have a few real-world questions. It's one thing to run the numbers, but it's another to know what they actually mean for your bottom line.

This section clears up common "what-if" scenarios that pop into every home buyer's or investor's head.

What Is a Good ROI for a Real Estate Investment?

This is a common question, and the honest answer is: it depends. While you'll often hear investors aim for an annual ROI between 8% and 12%, what's considered "good" is completely tied to your market and your strategy.

For instance, a 5% ROI might be incredible in a stable, high-demand neighborhood where property values are steadily climbing. But if you're taking on a fixer-upper project in a developing area, you might look for a deal that projects at least 15%.

Your personal goals are a huge piece of the puzzle, too. Are you focused on long-term appreciation, or do you need immediate cash flow from a rental? Your answer directly shapes what a successful ROI looks like for you.

Key Insight: A "good" ROI isn't a single number. It's a target that aligns with your specific investment strategy, your tolerance for risk, and the realities of your local market.

How Does a Mortgage Affect My ROI Calculation?

A mortgage can dramatically improve your ROI, and it all comes down to a powerful concept called leverage. In simple terms, this means using borrowed money (the mortgage) to control a much larger asset.

Your "Total Investment" in the ROI formula isn't the property's purchase price; it's your actual cash out of pocket—your down payment, closing costs, and any renovation funds.

Think about it: if you buy a $300,000 house with a $60,000 down payment, your ROI is calculated against that $60,000, not the full $300,000. This means even a small increase in the property's value can create a large percentage return on your personal cash.

Just remember to be diligent. To get a true picture, you must factor in all mortgage-related expenses—principal, interest, taxes, and insurance—into your ongoing costs.

How Often Should I Recalculate My Property's ROI?

For a long-term rental, you should get in the habit of recalculating your ROI at least once a year. This annual check-in is your chance to replace projections with actual, hard numbers. It lets you see how your property is performing and whether you need to make any strategic adjustments.

You should also run the numbers again after any major event. Did you complete a significant renovation, refinance your mortgage, or see a big jump in local market rents? Each of these is a perfect reason to update your calculations. Staying on top of your numbers is the only way to know if your investment is truly working for you.

Frequently Asked Questions (FAQ)

Q: What's the simplest way to calculate ROI for a first-time home buyer?

A: For a primary residence, the simplest ROI calculation is the "Cost Method." Subtract your total costs (purchase price, closing costs, renovation expenses, and selling costs) from the final sale price. Then, divide that net profit by your total costs to get your ROI percentage. This shows your total return over the life of your ownership.

Q: Are property taxes and insurance included in the ROI calculation?

A: Yes, absolutely. Property taxes, homeowners insurance, HOA fees, and maintenance costs are all "ongoing costs" of owning property. Forgetting to include these expenses will give you an inflated and inaccurate ROI. Always track every dollar spent to get a true measure of your investment's performance.

Q: Can I calculate ROI before I even buy a property?

A: Yes, and you should! This is called a "projected ROI." You can estimate your initial investment (down payment, closing costs), ongoing expenses (mortgage, taxes, insurance), potential rental income (if applicable), and an estimated future sale price based on market trends. This helps you compare different properties and decide which one is the best financial fit before you make an offer.

Ready to stop guessing and start analyzing properties with precision? Flip Smart gives you the tools to evaluate any property in seconds, providing accurate valuations, renovation cost estimates, and profit potential. Make smarter, data-driven decisions on your next investment. Analyze your first deal with Flip Smart today!