Flipping houses can be an incredibly profitable venture, but it's also a high-stakes game where one missed step can erase your entire margin. Many investors jump in, armed with enthusiasm but lacking a systematic approach, leading to budget overruns, timeline delays, and costly mistakes. This isn't just another list of generic tips; it's a comprehensive, actionable flipping houses checklist designed for today's dynamic market. We will guide you through the eight critical phases, from initial property analysis to cashing the final check, transforming the often chaotic process into a predictable, repeatable system.

This detailed blueprint breaks down every crucial stage, ensuring you have a clear plan for everything from securing financing to managing contractors and executing a powerful sales strategy. While national strategies provide a solid foundation, understanding local market nuances is equally critical. For instance, investors in specific high-growth areas might need to adapt their approach to regional regulations and buyer preferences. For a more detailed regional perspective on executing a successful flip, refer to this comprehensive fix-and-flip checklist.

Whether you are a seasoned pro looking to refine your process or a newcomer tackling your very first project, this blueprint will provide the essential structure you need to navigate every challenge. By following this itemized guide, you can minimize unforeseen risks, stay on schedule, and ultimately maximize your return on investment. Let's dive into the essential steps that turn a distressed property into a highly profitable sale.

1. Phase 1: Property Acquisition and Due Diligence

The single most critical phase in any successful house flip is the initial acquisition and due diligence. This foundational step dictates your potential profit margin before the first hammer swings. It involves identifying a promising property, conducting a rigorous analysis, and purchasing it at a price that leaves ample room for profit. Get this wrong, and even the most beautiful renovation can result in a financial loss. This is where you make your money; the renovation simply realizes the profit you locked in at purchase.

This stage moves beyond just finding a house with "good bones." It's a forensic financial and physical examination of the asset. The goal is to uncover every potential issue, from hidden structural defects to title clouds and zoning restrictions, ensuring the numbers work on paper before they have to work in reality. A comprehensive approach here is the first and most important part of your flipping houses checklist.

The 70% Rule in Practice

A guiding principle for new investors is the 70% Rule. This rule states that you should pay no more than 70% of the property's After-Repair Value (ARV) minus the estimated repair costs.

- Formula:

Maximum Purchase Price = (ARV * 0.70) - Estimated Repairs

For example, if a property has an ARV of $300,000 and needs $50,000 in repairs, your maximum offer should be $160,000. ($300,000 * 0.70) - $50,000 = $160,000. This 30% buffer is designed to cover your holding costs (insurance, taxes, utilities), closing costs, selling expenses (agent commissions), and your desired profit. While a good starting point, experienced flippers often adjust this percentage based on market conditions, holding time, and desired profit margins.

Actionable Due Diligence Tips

To execute this phase effectively, you must go beyond a standard homebuyer's inspection.

- Walk with a Pro: Before making an offer, walk the property with your general contractor. Their expert eye can provide a much more accurate repair estimate than a simple visual inspection, identifying potential big-ticket items you might miss.

- Verify Permit History: Contact the local building department to check the property's permit history. Unpermitted work, like a DIY garage conversion, can create significant legal and financial headaches that you will have to correct.

- Conduct a Title Search: Don't skip this. A title search uncovers outstanding liens, unpaid taxes, or ownership disputes. Finding a $10,000 mechanic's lien before closing allows you to negotiate or walk away, saving you from a costly surprise. For an in-depth guide on this crucial step, you can review this comprehensive real estate due diligence checklist.

- Analyze Hyper-Local Comps: Don't just look at city-wide trends. Analyze sold renovated properties within a half-mile radius from the last 6-12 months. This hyper-local data gives you a far more accurate ARV than broader market reports.

2. Phase 2: Financing and Budget Planning

With a potential property identified, the next critical phase is securing capital and creating a bulletproof budget. This stage transforms your deal analysis from a theoretical exercise into a funded, operational plan. Miscalculating your budget or choosing the wrong financing can erode your profit margin just as quickly as overpaying for the property itself. This is where you assign a dollar amount to every task and create the financial roadmap for the entire project.

This process is more than just getting a loan; it's about structuring the deal for maximum profitability and minimum risk. A meticulously detailed budget, complete with a robust contingency, is the most vital tool in your flipping houses checklist for navigating the unpredictable nature of renovations. As real estate expert Brandon Turner often emphasizes, you must account for every single expense, from interest payments to final staging costs, to truly understand your potential return.

The 15% Contingency Rule

A non-negotiable principle for both novice and veteran flippers is the 15% Contingency Rule. This rule dictates that you must add a contingency fund of 10% to 20% (with 15% being a safe average) of your total estimated repair costs to your budget. This fund is not for upgrades; it is exclusively for unforeseen problems.

- Formula:

Total Budget = (Purchase + Repairs + Holding/Closing Costs) + (Repairs * 0.15)

For example, if your renovation budget is $60,000, you must set aside an additional $9,000 for a total repair-related budget of $69,000. This buffer covers project-derailing surprises like discovering foundation cracks hidden behind drywall, needing to replace a rotted subfloor, or unexpected plumbing issues that arise during demolition.

Actionable Financing and Budgeting Tips

To master this financial phase, you need a proactive and detailed approach.

- Secure Pre-Approval First: Before you even make offers, get pre-approved from your chosen lender (whether a hard money lender, private lender, or bank). This demonstrates to sellers that you are a serious buyer and gives you the ability to close quickly, which is a powerful negotiating tool.

- Build Your Lending Network: Don't rely on a single funding source. Build relationships with multiple hard money lenders and private investors. This allows you to compare terms, secure the best rates, and have backup options ready if your primary lender's criteria change.

- Itemize Every Single Cost: Create a line-item spreadsheet that details every anticipated expense. Go beyond the big items like kitchens and baths. Include smaller costs like dumpster fees, portable toilet rentals, utility bills during the hold, insurance premiums, and final cleaning services.

- Calculate Your Daily Burn Rate: Once the loan closes, your project has a daily cost in interest. If your holding costs are $3,000 per month, your "burn rate" is $100 per day. Knowing this number creates a powerful sense of urgency and helps you make smart decisions to keep the project timeline on track.

3. Renovation Scope and Design Planning

Once the property is yours, the focus shifts to creating a strategic renovation plan. This phase is about maximizing return on investment by carefully selecting upgrades that appeal directly to your target buyer demographic. It involves a delicate balance between adding tangible value and avoiding over-improvement that simply adds cost without increasing the final sale price. This is where you transform the property's potential, identified during acquisition, into a marketable and highly desirable product.

This stage moves beyond a simple repair list; it is the blueprint for profitability. A well-defined scope and cohesive design plan, popularized by design-focused flippers like Chip and Joanna Gaines, ensures every dollar spent contributes to the ARV. The goal is to create a home that feels both aspirational and attainable, hitting the sweet spot of market trends without alienating the broadest pool of potential buyers. A detailed plan is a non-negotiable part of any comprehensive flipping houses checklist.

ROI-Focused Renovation in Practice

The core principle here is to prioritize updates that yield the highest return. Not all renovations are created equal; some add significant value, while others are financial black holes. The key is to know the difference for your specific market.

- Example: A targeted kitchen renovation with new shaker cabinets, quartz countertops, and stainless-steel appliances might cost $20,000. In many markets, this update can add $35,000 or more to the home's value, generating a positive ROI. Conversely, adding a $25,000 master bathroom might only increase the value by $20,000 in a neighborhood where it's not a standard feature, resulting in a net loss.

This financial discipline ensures your budget is allocated to changes that directly boost your profit margin.

Actionable Design & Scoping Tips

To develop a winning renovation plan, you must blend market data with timeless design principles.

- Focus on the "Money Rooms": Pour the majority of your budget into kitchens and bathrooms. These are the spaces that sell houses and where buyers see the most value in modern finishes and functional layouts.

- Don't Over-Improve: Research the finishes in recently sold comparable properties. If every home in the neighborhood has laminate countertops, installing high-end marble will likely not provide a return. Match the standard of the area to control costs.

- Create Powerful Curb Appeal: The first impression is critical. A new front door, fresh paint on the exterior, updated house numbers, and clean, simple landscaping can cost just a few thousand dollars but dramatically increase buyer interest and perceived value.

- Use Neutral Palettes: Stick to timeless and neutral color schemes like greys, beiges, and off-whites for walls and permanent fixtures. This creates a blank canvas that allows the widest range of buyers to envision themselves living in the space. You can introduce trendy colors through easily changed items like throw pillows during staging. For a detailed guide on budgeting these changes, review this resource on how to estimate renovation costs.

4. Contractor Selection and Management

After securing the property and finalizing your renovation plan, the success of your flip shifts to the people who will execute the vision: your contractors. This phase involves vetting, hiring, and managing the skilled labor needed to transform the property. Poor contractor management is a primary reason projects go over budget, miss deadlines, and fail to meet quality standards, directly eroding your profit margin.

This stage is about building a professional team, not just hiring a crew. It requires diligence in selection, precision in contract negotiation, and consistent oversight throughout the project. As TV personality and contractor advocate Mike Holmes often emphasizes, quality and accountability are paramount. Getting this part of your flipping houses checklist right protects your investment, timeline, and sanity.

The Three-Bid and Milestone Payment System

A proven strategy for ensuring fair pricing and maintaining project control is the Three-Bid System combined with Milestone-Based Payments. Never simply accept the first quote you receive. Securing at least three detailed, written bids for any significant job (like roofing, plumbing, or a full kitchen remodel) establishes a market-rate baseline and exposes any outliers.

- Process: Provide each contractor with the exact same scope of work to ensure bids are comparable. A bid that is dramatically lower than the others is often a red flag for cutting corners, using subpar materials, or a lack of understanding of the full scope.

Once you select a contractor, structure the contract with milestone-based payments. Never pay large sums upfront. A small deposit (e.g., 10% or the cost of initial materials) is standard, but subsequent payments should be tied directly to the completion of specific, verifiable phases of work, like "framing complete" or "drywall installed and finished." This incentivizes progress and protects you if the contractor fails to perform. For example, on a $40,000 renovation, you might release payments in four $10,000 increments only after pre-defined stages are inspected and approved by you.

Actionable Contractor Management Tips

Effective management is an active, not passive, process. Use these tips to build a strong team and ensure a smooth renovation.

- Verify Credentials: Before signing anything, verify the contractor's license, liability insurance, and worker's compensation coverage. Ask for their license number and check it with the state licensing board. A lapse in their insurance could leave you liable for accidents on your property.

- Check References and Past Work: Talk to at least three recent references. Ask about their communication, timeliness, budget adherence, and the quality of the finished product. If possible, visit a completed project to see their work firsthand.

- Demand a Detailed Contract: Your contract is your most important tool. It must detail the full scope of work, a specific list of materials, a firm timeline with start and end dates, the milestone payment schedule, and procedures for handling change orders.

- Conduct Regular Site Visits: Visit the job site daily or every other day. This allows you to monitor progress, catch errors early, and maintain a presence. Catching a framing error before drywall goes up can save thousands of dollars and weeks of delays.

5. Project Timeline and Scheduling

Once you've closed on the property, the clock starts ticking. A meticulously planned project timeline is the engine that drives a profitable flip, transforming a chaotic renovation into a streamlined, cost-controlled process. Every day of delay adds to your holding costs like mortgage payments, insurance, taxes, and utilities, directly eroding your profit margin. This phase is where operational efficiency meets financial discipline, ensuring the potential profit you secured at purchase is fully realized.

The goal is to move from closing to listing in the shortest time possible without sacrificing quality. Most successful flippers aim for a 60 to 90-day renovation window. This tight schedule demands precise coordination of contractors, materials, and inspections. Failing to create and adhere to a detailed schedule is one of the most common and costly mistakes in a flipping houses checklist, turning a promising project into a financial drain.

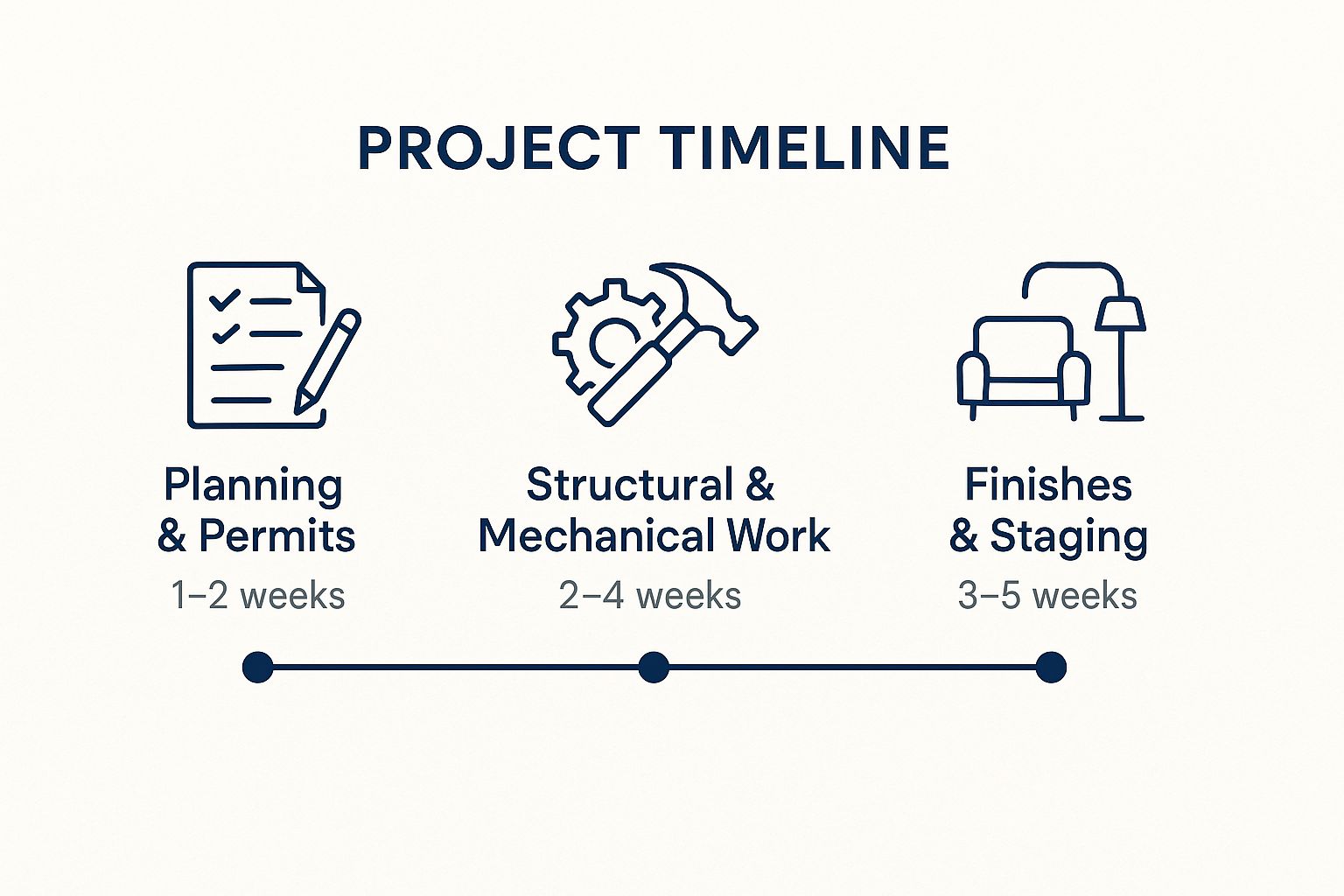

This simple timeline visualizes the three core stages of a typical house flip renovation.

This illustrates how critical foundational work must be completed before the more visible finishing work can even begin, highlighting the sequential nature of a renovation.

The Critical Path Method

A core concept from professional project management, the Critical Path Method, is invaluable for house flipping. This involves identifying the sequence of dependent tasks that dictate the project's minimum duration. Delaying any task on the critical path will delay the entire project.

- Example: Drywall installation is on the critical path. It cannot start until electrical, plumbing, and HVAC rough-ins are complete and inspected. A one-week delay in the plumber's schedule directly translates to a one-week delay in the final completion date.

By identifying this path, you know where to focus your management efforts. For instance, if flooring is delayed but painters are still working, it may not impact the timeline. However, if the electrician is delayed, everything stops.

Actionable Scheduling Tips

To build and manage an effective timeline, you must be proactive and detail-oriented.

- Work Backward: Start with your desired listing date and work backward, assigning deadlines for each major phase (e.g., painting complete, flooring installed, kitchen complete). This helps create realistic milestones.

- Order Long-Lead Items Immediately: The moment you close, order items with long lead times like custom cabinets, windows, or specialty tile. A three-week delay waiting for cabinets can cost you thousands in holding costs.

- Build in a Buffer: No renovation goes perfectly. Build a 15-20% time buffer into your schedule to absorb unexpected delays, such as failed inspections, weather issues, or material shortages. If your ideal timeline is 75 days, schedule for 90.

- Schedule Inspections in Advance: As soon as you have a rough idea of when a phase will be done, call to schedule the corresponding city inspection. This avoids waiting days or weeks for an available inspector, a common source of significant delays.

6. Permits, Inspections, and Code Compliance

Navigating the bureaucratic maze of permits and inspections is a non-negotiable part of a successful flip. This phase isn't about design or demolition; it's about legal and structural integrity. Obtaining the correct permits, passing mandatory inspections, and ensuring all work adheres to local building codes are what separate a professional, saleable renovation from a DIY disaster with immense legal and financial liability.

Ignoring this step is one of the most catastrophic mistakes an investor can make. Unpermitted work can lead to stop-work orders, hefty fines, demands to tear out finished work, and major complications during the sale. Properly permitted work, conversely, acts as a third-party verification of quality, providing a powerful selling point and protecting you from future claims. This step is a critical component of any comprehensive flipping houses checklist.

Why You Can't Afford to Skip Permits

Skipping permits to save a few hundred dollars and a few weeks is a high-risk gamble that rarely pays off. The potential consequences far outweigh the perceived benefits. Lenders may refuse to finance a property with unpermitted additions, and title insurance companies can deny coverage for issues arising from it.

- Example Scenario: A flipper completes a beautiful basement finish without permits. The appraiser cannot legally include the square footage in the home's value, reducing the ARV by $40,000. The buyer's lender then requires the work to be retroactively permitted, a process involving tearing open walls for inspection and costing thousands in unexpected repairs and delays.

Actionable Compliance Tips

To navigate the permitting process efficiently, you must be proactive and organized. Treat the building department not as an adversary but as a partner in ensuring a safe and compliant final product.

- Pre-Purchase Research: Before you even buy the property, call the local building department to understand the permit requirements and associated costs for your planned scope of work. Factoring a $1,500 electrical permit and a four-week approval timeline into your budget from day one prevents major surprises.

- Apply Early and Accurately: Submit your permit applications as soon as your renovation plans are finalized. Delays in processing are common, and starting early prevents your crew from being idle while waiting for paperwork. Ensure all plans are detailed and accurate to avoid rejections.

- Schedule Inspections Strategically: Plan your project timeline around mandatory inspection points. You cannot cover up framing, plumbing, or electrical work until it has been signed off. A failed inspection can halt all progress, so schedule them carefully and ensure work is 100% ready.

- Maintain Meticulous Records: Keep a binder on-site with all approved permits, inspection reports, and architectural plans. When the project is complete, you will provide this documentation to the buyer and their agent as proof of a high-quality, professionally executed renovation.

7. Marketing and Selling Strategy

The final, crucial step in realizing your profit is the marketing and selling strategy. After months of renovation, your goal is to sell the property quickly and for the highest possible price. An effective sales plan minimizes holding costs like taxes and insurance, which accumulate daily and erode your profit margin. This phase is not just about listing the home; it's a calculated effort to create an emotional connection with buyers and generate maximum market demand.

This stage combines visual presentation, strategic pricing, and targeted outreach. Real estate mogul Barbara Corcoran often emphasizes that you're selling a lifestyle, not just a house. A well-executed strategy, a key component of any comprehensive flipping houses checklist, can lead to a faster sale, multiple offers, and a final price that exceeds your initial ARV projections.

The Power of Presentation and Pricing

The core of a successful sales strategy lies in how the property is presented and priced. These two elements work together to attract the largest pool of qualified buyers. A beautifully staged home priced strategically can trigger a bidding war, as seen when a property priced just $5,000 below market value to generate buzz results in a final sale price $12,000 over asking.

- Staging: Professional staging helps buyers visualize themselves living in the space. It defines rooms, highlights architectural features, and makes the property feel larger and more inviting.

- Photography: High-quality, professional real estate photos are non-negotiable. Data consistently shows that listings with professional photos generate significantly more online views and showing requests. For example, a professional shoot can result in 300% more online engagement than using amateur smartphone pictures.

Actionable Sales Strategy Tips

To execute this phase for maximum return, focus on creating a polished, market-ready product that stands out from the competition.

- Stage the Impact Zones: If a full staging isn't in the budget, focus on the highest-impact areas: the living room, kitchen, and master bedroom. These are the rooms that most influence a buyer's decision.

- Hire a Real Estate Photographer: Do not use a general photographer. A specialist understands lighting, angles, and composition specific to real estate, which is crucial for creating compelling online listings.

- Time Your Listing: List your property on a Thursday or Friday. This timing maximizes exposure for buyers planning their weekend showings, creating a surge of initial activity.

- Price for the Market: In a hot seller's market, pricing slightly below comparable sales can generate a bidding war. In a slower market, price at fair market value and consider offering incentives, like a closing cost credit or a home warranty, to attract buyers.

- Conduct a Pre-Listing Inspection: Uncovering and fixing potential issues before buyers find them prevents last-minute negotiations or deals falling apart. It demonstrates transparency and confidence in your renovation.

8. Risk Management and Exit Strategy Planning

Professional investors understand that flipping houses isn't just about the potential for high returns; it's also about managing the inherent risks. This phase involves creating a safety net for your investment by planning for potential problems before they happen. It’s about answering the question, "What will I do if things don't go according to plan?" This proactive approach prevents a difficult situation from turning into a catastrophic financial loss and is a non-negotiable part of any comprehensive flipping houses checklist.

This stage requires you to think like a pessimist so you can execute like an optimist. It involves securing the right insurance, structuring your business to protect your personal assets, and defining multiple exit strategies from the outset. By planning for worst-case scenarios, such as market downturns or unexpected renovation issues, you gain control over your investment's outcome, ensuring you can pivot intelligently rather than react emotionally when challenges arise.

Contingency and Exit Strategy Scenarios

A core tenet for sophisticated investors is always having multiple exits. Planning for these scenarios is not a sign of doubt but a mark of professionalism. It provides the flexibility needed to protect your capital and still profit even when market conditions shift unexpectedly.

- Formula for Reserves:

Contingency Fund = Total Estimated Costs (Purchase + Rehab + Holding) * 10-20%

For instance, if your total project cost is $250,000, you should have at least $25,000 to $50,000 in a separate contingency reserve. A fire might damage the property mid-renovation; your builder's risk insurance should cover the $45,000 in damages, but your reserves cover the holding cost overruns during the delay. This buffer is your project's financial lifeline.

Actionable Risk Management Tips

To effectively insulate your projects from risk, you need to implement specific, strategic measures from day one.

- Secure Builder's Risk Insurance: Standard homeowner's insurance is inadequate. A builder's risk policy is designed for properties under construction, covering theft of materials, vandalism, fire, and liability. Secure this policy before you close on the property.

- Establish a Business Entity: Operate your flipping business as an LLC or S-Corp. This creates a legal shield between your business and personal assets. If a contractor files a lien for a payment dispute, this structure protects your personal home and savings from being targeted.

- Define Your Pivot Points: Predetermine when you will switch strategies. For example: "If the house isn't sold after 90 days on the market, I will offer a lease-option." This removes emotion from the decision-making process. For a deeper dive into these options, you can explore this guide to real estate investment exit strategies.

- Analyze the Rental Exit: Before you buy, analyze the property's potential as a long-term rental. If a market downturn occurs during your renovation, you can pivot to renting it out, cover your mortgage through rental income, and wait for the market to recover before selling.

8-Step Flipping Houses Checklist Comparison

| Aspect | Property Acquisition and Due Diligence | Financing and Budget Planning | Renovation Scope and Design Planning | Contractor Selection and Management | Project Timeline and Scheduling | Permits, Inspections, and Code Compliance | Marketing and Selling Strategy | Risk Management and Exit Strategy Planning |

|---|---|---|---|---|---|---|---|---|

| Implementation Complexity 🔄 | Moderate - requires expert inspections and market research | Moderate - involves multiple financing options and budgeting | Moderate to High - design decisions and ROI analysis needed | High - vetting, contracts, and communication essential | High - detailed scheduling and coordination required | Moderate - legal knowledge and scheduling inspections | Moderate - marketing and staging coordination needed | Moderate - insurance and multiple exit plans to manage risks |

| Resource Requirements ⚡ | Skilled inspectors, market data, real estate professionals | Access to lenders, accounting tools, cash reserves | Designer/consultant, contractor input, material sourcing | Contractors, legal contracts, frequent site visits | Project management tools, contractor coordination | Permitting authorities, licensed contractors | Staging professionals, photographers, marketing platforms | Insurance providers, legal counsel, financial reserves |

| Expected Outcomes 📊 | Reduced investment risk, accurate pricing, deal leverage | Controlled costs, scalable funding, protected profit margins | Maximized ROI, appealing design, efficient renovations | Quality work, project timeline adherence, dispute prevention | Efficient project flow, minimized delays, cost control | Legal compliance, avoidance of fines, smooth sale process | Faster sale, higher offers, minimized holding costs | Loss prevention, flexible exits, reduced stress |

| Ideal Use Cases 💡 | Initial property evaluation and purchase decision | When securing funds and planning project finances | Planning renovation impact and design before execution | Managing renovation contractors for quality and timeline | Controlling costs via efficient renovation scheduling | Projects requiring major code compliance and permits | Final market positioning and sale of renovated properties | Projects with uncertain markets or high risk exposure |

| Key Advantages ⭐ | Identifies hidden issues early, supports negotiation | Enables flexible funding, prevents cost overruns | Focuses budget on high-value improvements, avoids scope creep | Professional work quality, reduced rework and disputes | Reduces holding costs, improves contractor coordination | Ensures safety, legal compliance, builds buyer confidence | Maximizes sale price and reduces market time | Protects assets, provides multiple fallback options |

Turning Your Checklist into Consistent Profits

Navigating the world of house flipping can feel like assembling a complex puzzle with dozens of moving pieces. From initial property evaluation and securing financing to managing contractors and executing a flawless sales strategy, each step is critical. The comprehensive "flipping houses checklist" we've detailed provides the blueprint, the itemized guide to ensure no crucial task is overlooked. It’s the structured framework that transforms a chaotic, high-risk venture into a manageable, process-driven business.

However, the real art of flipping isn't just following the list; it's mastering it. True success lies in the execution, the subtle adaptations you make with each new project, and the lessons learned from both your wins and your setbacks. Think of this checklist not as a one-time guide but as a dynamic tool that evolves with your experience. Each flip sharpens your instincts, refines your budget projections, and improves your ability to spot a genuine opportunity versus a potential money pit.

From Checklist to Scalable System

The ultimate goal for any serious investor is to move beyond completing a single successful flip and build a repeatable, scalable operation. This transition happens when the checklist becomes second nature, an ingrained system that governs your every move.

- Internalize the Process: The initial flips will have you glued to your checklist. Over time, you'll begin to anticipate the next steps, instinctively knowing when to order materials, schedule inspections, or start your pre-marketing push. This is the point where you begin to operate with speed and confidence.

- Refine Your Numbers: Your first budget might be based on research and educated guesses. Your tenth will be based on hard data from your own projects. You'll know your actual cost per square foot for flooring installation, the true price of a kitchen cabinet package in your market, and exactly how much to set aside for contingencies.

- Build Your A-Team: A checklist can tell you to hire a contractor, but experience teaches you who to trust. A reliable team of agents, lenders, contractors, and legal experts is perhaps the most valuable asset you can build. They are the engine that allows your flipping business to scale efficiently.

The Most Important Takeaway: Master Your Due Diligence

If there is one area that separates consistently profitable flippers from those who gamble, it’s the rigor of their upfront analysis. Every other step in the process, from your renovation budget to your final sales price, is dependent on the accuracy of your initial due diligence. A mistake here can cascade through the entire project, erasing your potential profit margin before you’ve even hammered a single nail. This is where meticulous adherence to your "flipping houses checklist" is non-negotiable.

Key Insight: Profit is not made at the sale; it is locked in at the purchase. Rushing your analysis or falling in love with a property's potential without verifying the numbers is the fastest route to a failed flip.

Furthermore, a critical component of your financial analysis involves looking beyond the sale itself. After all the hard work, maximizing your take-home profit is paramount. Crucially, maximizing your returns means understanding house flipping taxes and how profits are treated for tax purposes. Factoring this into your initial calculations ensures your net profit projections are realistic and helps you plan for your financial obligations from day one.

Ultimately, this checklist is your roadmap to building a thriving real estate investment business. By treating each project as a learning opportunity and relentlessly refining your systems, you transform a checklist into a powerful engine for generating consistent, life-changing profits.

Ready to stop guessing and start analyzing like a pro? Flip Smart takes the most critical part of your flipping houses checklist, the property analysis, and automates it with powerful, data-driven software. Get instant rehab estimates, accurate profit projections, and find better deals faster by visiting Flip Smart today.