In real estate investing, finding the deal gets all the attention, but your profit is realized at the exit. An investment without a clear exit plan is a gamble. The most successful investors know their way out before they even get in, turning calculated risks into substantial returns. This is where mastering a diverse set of real estate investment exit strategies becomes your most valuable asset, distinguishing strategic wealth-building from hopeful speculation.

This guide provides a comprehensive roundup of eight distinct exit strategies, moving far beyond generic advice. We will dive deep into the mechanics of each approach, from the classic Fix and Flip to more nuanced options like the 1031 Exchange and Seller Carryback financing. You will gain actionable insights into not just what these strategies are, but how and when to implement them effectively in today's market.

For each strategy, we'll break down:

- The ideal property and market conditions.

- Step-by-step implementation details.

- Critical pros and cons to weigh for your portfolio.

We will also demonstrate how to use modern tools like Flip Smart to model these scenarios, helping you analyze potential outcomes with greater speed and accuracy. Understanding these powerful options is fundamental; choosing the right one for your specific deal, financial goals, and risk tolerance is what will ultimately amplify your profits and set the stage for your next successful venture. Let's explore the pathways that can lead you from acquisition to profitable exit.

1. Buy and Hold Cash Flow

The Buy and Hold Cash Flow strategy is a foundational approach in real estate investing, often considered less of an "exit" and more of a long-term wealth-building engine. The core principle involves acquiring a property and retaining ownership indefinitely, generating consistent monthly income from rent that exceeds all operating expenses, including mortgage, taxes, insurance, and maintenance.

This strategy shifts the focus from a single, large payday to creating a reliable, passive income stream. While the property appreciates in value and the mortgage balance decreases over time, the primary goal is the steady cash flow. It's a method championed by long-term wealth builders who prioritize financial stability and portfolio growth over quick profits.

When to Use This Strategy

This approach is ideal for investors seeking to build generational wealth and a stable income source to supplement or replace their primary earnings. It works best in markets with strong rental demand, steady population growth, and economic stability. If your goal is to create a portfolio that pays you every month with less focus on timing the market for a sale, the buy-and-hold method is an excellent fit.

How to Implement It Successfully

Executing a successful buy-and-hold strategy requires meticulous planning and a focus on numbers from day one.

- Prioritize Positive Cash Flow: The property must be profitable after all expenses are paid. Never bank on appreciation alone. Rigorous financial analysis is non-negotiable. To master this crucial step, explore our in-depth guide on how to analyze property cash flow.

- Thorough Tenant Screening: Your tenants are the engine of your cash flow. Implement a strict screening process that includes credit checks, background checks, and verification of income and employment to minimize risks like late payments and evictions.

- Establish a Maintenance Fund: Set aside a percentage of the monthly rent (typically 5-10%) specifically for repairs, capital expenditures (like a new roof or HVAC), and unexpected vacancies. This prevents financial strain when issues inevitably arise.

- Consider Professional Management: As your portfolio grows, managing properties can become a full-time job. A reputable property management company can handle tenant relations, rent collection, and maintenance, freeing you to focus on acquiring more assets.

2. Fix and Flip

The Fix and Flip strategy is one of the most popular short-term real estate investment exit strategies, focusing on speed and value creation. The model is straightforward: purchase an undervalued property, renovate it to increase its market value (forced appreciation), and then sell it quickly for a profit. The entire process is typically completed within a 6 to 12-month timeframe to minimize holding costs and maximize the return on investment.

This approach is the opposite of the long-term buy-and-hold method. Instead of generating passive income over years, flippers aim for a significant capital gain in a single transaction. Success hinges on accurately estimating repair costs, managing renovations efficiently, and understanding local market values to ensure a profitable sale.

When to Use This Strategy

The fix-and-flip strategy is best suited for investors who have the capital, time, and expertise to manage a construction project. It thrives in markets where there is a strong demand for move-in ready homes and a sufficient inventory of distressed properties available below market value. If your goal is to generate lump sums of cash to reinvest into other projects rather than building a long-term rental portfolio, this is an excellent strategy.

How to Implement It Successfully

A successful flip requires more than just good design sense; it demands disciplined project management and precise financial calculations.

- Follow the 70% Rule: This is a crucial guideline for acquisitions. Aim to pay no more than 70% of the property's after-repair value (ARV), minus the estimated cost of repairs. This formula helps build a sufficient profit margin and protects you from unforeseen expenses.

- Secure Multiple Contractor Bids: Never accept the first quote. Get detailed bids from at least three reputable contractors to ensure a fair price. It's also wise to build a 15-20% contingency fund into your renovation budget to cover unexpected overruns or delays.

- Focus on High-ROI Improvements: Concentrate your budget on renovations that add the most value to a potential buyer. These almost always include modernizing kitchens and bathrooms, enhancing curb appeal, and applying fresh paint.

- Have Multiple Exit Plans: While selling is the primary goal, be prepared for other scenarios. Could the property be rented out if the market suddenly cools? Having a backup plan mitigates risk. For a deeper dive, read our comprehensive guide on how to get into flipping houses.

3. Wholesale Assignment

Wholesale Assignment is a fast-paced strategy that positions the investor as a middleman, connecting motivated sellers with end buyers. The core of this approach involves finding a deeply discounted property, putting it under contract, and then assigning that purchase contract to another investor or buyer for a fee. The wholesaler never actually takes title to the property, minimizing risk and capital requirements.

This strategy is one of the quickest real estate investment exit strategies, focusing on deal-finding and networking rather than property management or renovation. The wholesaler profits from the "assignment fee," which is the difference between the contracted price with the seller and the price the end buyer agrees to pay. It’s a powerful method for generating active income and building capital for other investments.

When to Use This Strategy

This approach is ideal for new investors looking to enter the market with minimal capital or for experienced investors who excel at marketing and negotiation. It thrives in markets with a high volume of transactions and a large pool of cash buyers, such as fix-and-flip investors and landlords. If your strength lies in finding off-market deals and building relationships, wholesaling provides a clear path to generating income without the burdens of property ownership.

How to Implement It Successfully

A successful wholesale assignment hinges on speed, accuracy, and building a reliable network. Precision in your numbers and contracts is paramount.

- Build a Robust Cash Buyers List: Your ability to sell a contract quickly depends on having a pre-vetted list of serious buyers. Network at local real estate investment meetings, connect with agents, and use online platforms to find investors ready to close deals with cash.

- Master Sourcing Motivated Sellers: Finding undervalued properties is the key. Use direct mail campaigns, digital marketing, and local networking to connect with distressed or motivated sellers who need to sell quickly. The goal is to find properties with significant equity.

- Ensure Correct Contract Language: Your purchase agreement with the seller must include an assignment clause (e.g., "and/or assigns") that gives you the legal right to transfer the contract. Consult with a real estate attorney to ensure your contracts are compliant with local laws.

- Accurately Calculate Your Numbers: You must be able to quickly and accurately estimate the After Repair Value (ARV) and repair costs to determine a profitable offer price for both you and your end buyer. Get a handle on your potential profits with our guide to using a wholesale real estate calculator.

4. BRRRR Strategy

The BRRRR method (Buy, Rehab, Rent, Refinance, Repeat) is a powerful real estate investment exit strategy that combines the principles of house flipping with the long-term benefits of buy-and-hold investing. The core concept is to acquire a distressed property, increase its value through strategic renovations, place a tenant to generate cash flow, and then execute a cash-out refinance to pull your initial investment back out.

Popularized by investors like Brandon Turner of BiggerPockets, this strategy is designed for rapid portfolio scaling. Instead of tying up capital indefinitely in one property, you recycle the same funds to acquire the next deal. The "exit" here isn't a sale but a refinance that frees your capital, positioning you to repeat the process and build a cash-flowing rental portfolio with minimal money left in each deal.

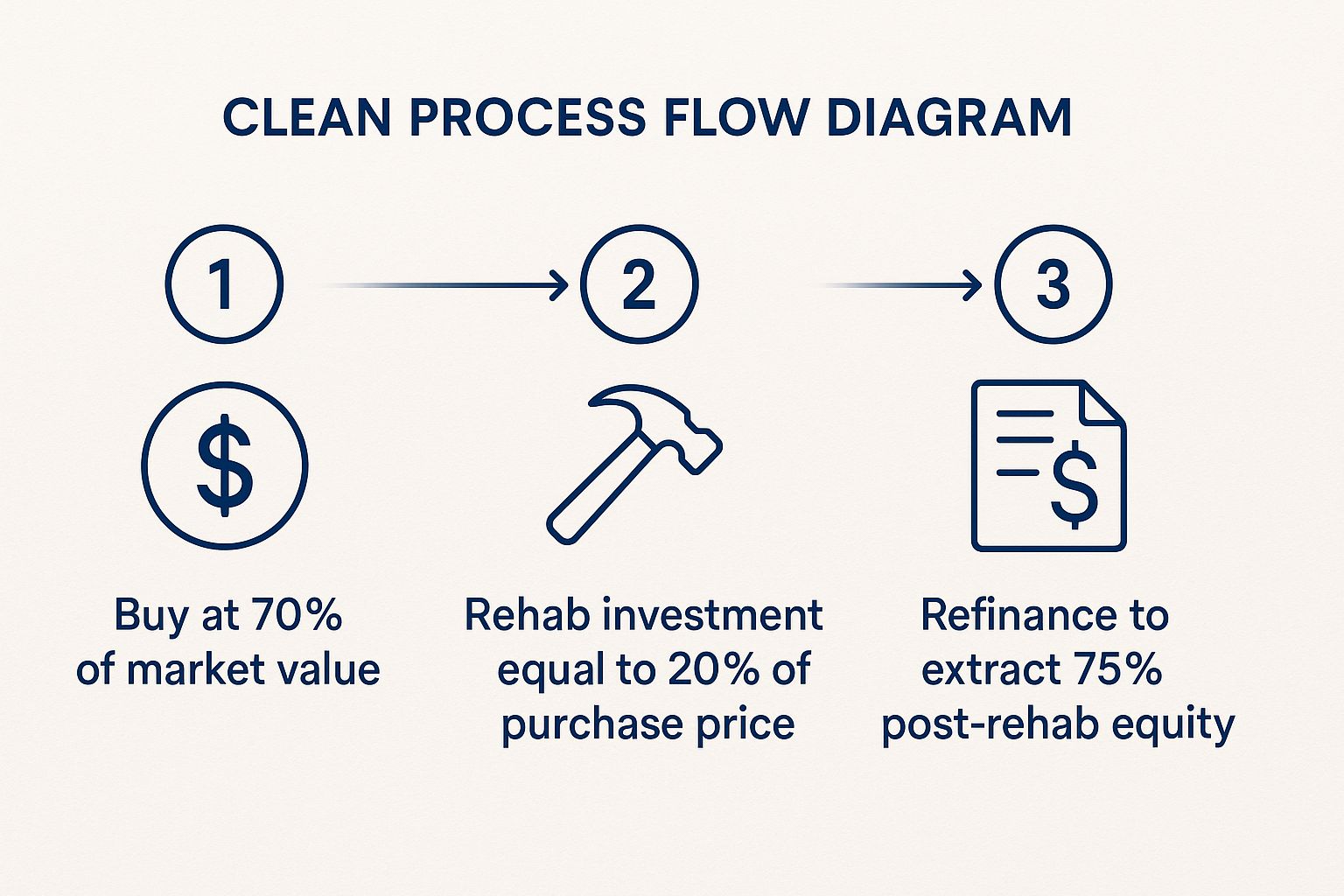

The following infographic illustrates the financial flow of a typical BRRRR deal, showing how investors can purchase a property below market value, add value through renovations, and then refinance to extract their initial capital based on the new, higher appraisal.

This process visualizes how an investor can use the After Repair Value (ARV) to their advantage, leveraging the bank's loan to recoup their entire initial investment and sometimes more, all while retaining a cash-flowing asset.

When to Use This Strategy

The BRRRR strategy is ideal for ambitious investors who want to scale their rental portfolio quickly without needing vast amounts of new capital for each purchase. It works best in markets where you can find undervalued properties that have significant potential for forced appreciation through renovation. If your goal is to build substantial long-term wealth and passive income streams aggressively, and you have a high tolerance for the complexities of construction and financing, BRRRR is an unparalleled approach.

How to Implement It Successfully

Executing the BRRRR strategy requires precision at every stage, as a mistake in one step can derail the entire process.

- Buy Right: Your profit is made on the purchase. You must acquire a property significantly below its After Repair Value (ARV). A common guideline is to pay no more than 70% of the ARV minus the estimated repair costs.

- Establish Financing Relationships: Before you buy, build relationships with lenders who are experienced with cash-out refinancing for investors. Understand their "seasoning" period requirements (the time you must own the property before refinancing) and their loan-to-value (LTV) limits.

- Accurate Rehab Budgeting: Underestimating renovation costs is the quickest way to fail at BRRRR. Get detailed quotes from contractors and add a 10-15% contingency fund for unexpected issues. Keep meticulous records of all improvements, as this documentation is crucial for the appraiser.

- Ensure Positive Cash Flow: Before ever making an offer, run the numbers to confirm the property will generate positive cash flow after the refinance. Your new mortgage payment, based on the higher loan amount, must be comfortably covered by the market rent, along with taxes, insurance, and maintenance reserves.

5. 1031 Tax-Deferred Exchange

The 1031 Tax-Deferred Exchange is not just an exit strategy; it's a powerful tool for wealth preservation and portfolio growth. Governed by Section 1031 of the Internal Revenue Code, this strategy allows an investor to sell an investment property and defer paying capital gains taxes by reinvesting the proceeds into a new "like-kind" property.

This approach transforms a potential tax event into a strategic opportunity. Instead of surrendering a significant portion of your profits to taxes, you can roll the entire equity into a larger, better-performing, or more strategically located asset. It's a cornerstone of sophisticated real estate investment exit strategies, enabling investors to scale their holdings and adapt to changing market conditions without the immediate tax burden.

When to Use This Strategy

This strategy is perfect for long-term investors looking to upgrade or reposition their portfolios without liquidating their holdings and incurring a large tax bill. It's ideal when you want to trade up from a single-family rental to a multi-family building, exchange a property in a stagnant market for one in a high-growth area, or transition from a hands-on property to a more passive investment. If your goal is to grow your real estate empire and compound your returns, the 1031 exchange is an essential mechanism.

How to Implement It Successfully

Executing a 1031 exchange requires strict adherence to IRS rules and precise timing. Mistakes can be costly, so meticulous planning is critical.

- Engage a Qualified Intermediary (QI): You cannot personally touch the proceeds from the sale. A QI must hold the funds in escrow between the sale of your old property (the "relinquished" property) and the purchase of your new one (the "replacement" property).

- Adhere to Strict Timelines: You have 45 days from the date you sell your property to formally identify potential replacement properties. You then have a total of 180 days from the sale date to close on the purchase of one or more of those identified properties.

- Understand "Like-Kind" Rules: The term "like-kind" is broad for real estate. You can exchange an apartment building for raw land, or a retail center for a portfolio of single-family rentals, as long as both are held for investment or business purposes.

- Plan Your Replacement Purchase: Start your search for a replacement property before you even list your current one. The 45-day identification window is notoriously short, so having a list of potential targets, including backups, is crucial for a successful exchange. Always consult with a tax professional before initiating the process.

6. Owner Financing/Seller Carryback

Owner Financing, often called Seller Carryback, is one of the more creative real estate investment exit strategies where the seller effectively becomes the lender. Instead of the buyer securing a loan from a traditional bank, they make regular payments directly to the seller, who holds the note on the property. This arrangement can create a win-win scenario, opening up the pool of potential buyers and generating a steady income stream for the seller.

This strategy transforms a one-time capital gain into a long-term passive investment. The seller earns interest on the loan, often at a higher rate than they could get from other fixed-income investments, while still receiving a down payment upfront. It’s a powerful tool for sellers who prioritize consistent cash flow over a single lump-sum payment and want to facilitate a sale in a challenging market.

When to Use This Strategy

This strategy is particularly effective in several situations. It's ideal for retired investors who have paid off a property and want to convert their equity into a reliable monthly income stream. It's also a powerful tool in high-interest-rate environments or slower markets where traditional financing is difficult for buyers to obtain. If a property has unique characteristics that make it hard to appraise or qualify for conventional loans, seller financing can be the key to closing the deal.

How to Implement It Successfully

Executing an owner financing deal requires diligence and legal precision to protect your interests as the seller-lender.

- Rigorous Buyer Vetting: Treat the process as if you were a bank. Conduct a thorough financial review of the buyer, including credit checks, income verification, and debt-to-income analysis. Their ability to pay is your primary security.

- Secure a Substantial Down Payment: A larger down payment (ideally 10-20% or more) gives the buyer "skin in the game" and reduces your risk. It provides a financial cushion and makes it less likely the buyer will default on the loan.

- Professional Legal Documentation: Do not use generic online forms. Hire a real estate attorney to draft a promissory note, a deed of trust or mortgage, and other necessary documents that comply with state and federal lending laws. This is non-negotiable.

- Include Protective Clauses: Your attorney should include essential clauses like a "due on sale" provision to prevent the buyer from selling without paying you off, and an acceleration clause that makes the entire loan balance due if the buyer defaults.

7. Real Estate Syndication

Real estate syndication is a powerful strategy where multiple investors pool their capital to acquire a property far larger than they could afford individually. It's a team approach to real estate investing, allowing access to institutional-grade assets like large apartment complexes, commercial office buildings, or retail centers. The deal is typically managed by a "sponsor" or "general partner" who finds, operates, and eventually sells the property, while the investors act as "limited partners" providing the bulk of the equity.

This strategy serves as an exit for your capital from smaller, self-managed deals and an entry into passive, large-scale investing. Instead of managing tenants and toilets, you're investing in a professional operation, leveraging the expertise of an experienced team. The sponsor handles all active management, while investors receive a share of the cash flow and profits from the eventual sale, making it one of the more hands-off real estate investment exit strategies.

When to Use This Strategy

Syndication is an excellent exit strategy for investors who have built up capital from other real estate ventures and want to transition from active to passive involvement. It is ideal if you want to diversify into larger, more stable asset classes without taking on the immense operational burden they require. If you seek passive cash flow and equity growth but lack the time, expertise, or capital to acquire a 100-unit apartment building on your own, syndication is the perfect vehicle.

How to Implement It Successfully

Success in syndication hinges almost entirely on the quality of the sponsor and the deal itself. Your due diligence is paramount.

- Vet the General Partner (Sponsor): This is your most critical step. Scrutinize the sponsor's track record, experience in the specific asset class, and communication style. Ask for case studies on past deals, including those that didn't go as planned.

- Understand the Fee Structure: Syndicators are compensated through various fees, such as acquisition fees, asset management fees, and a share of the profits (promote). Ensure you fully understand this structure and that it aligns the sponsor's interests with yours.

- Analyze the Deal Diligently: Do not rely solely on the sponsor's projections. Review the property's financials, the business plan, and the market analysis. Stress-test the assumptions to understand the potential risks and downside scenarios.

- Review All Legal Documents: An attorney should review the Private Placement Memorandum (PPM) and operating agreement. These documents outline the terms of the deal, risks, and the rights and responsibilities of all parties.

- Assess Your Liquidity Needs: Capital in a syndication is typically tied up for 5-10 years. Unlike a publicly-traded stock, you cannot easily sell your stake. Ensure the investment timeline aligns with your personal financial goals.

8. REITs and Real Estate Crowdfunding

REITs (Real Estate Investment Trusts) and Real Estate Crowdfunding represent a significant departure from traditional real estate investment exit strategies, offering liquidity and diversification without the complexities of direct property ownership. These vehicles allow investors to buy shares in a large portfolio of income-producing real estate, much like buying stock in a company. The exit is simple: you sell your shares.

This strategy democratizes real estate investing, making it accessible to individuals who lack the capital or desire to manage physical properties. Whether through publicly traded REITs like Realty Income or platforms such as Fundrise and RealtyMogul, investors can gain exposure to various property sectors, from commercial and residential to industrial, with a much lower barrier to entry.

When to Use This Strategy

This approach is perfect for investors seeking portfolio diversification, passive income through dividends, and high liquidity. If you want exposure to the real estate market without the hands-on responsibilities of being a landlord, or if you want to spread your investment across numerous properties and geographic regions to mitigate risk, this is an ideal strategy. It also serves as an excellent entry point for new investors or a balancing component in a larger portfolio of direct real estate holdings.

How to Implement It Successfully

Successfully leveraging REITs and crowdfunding requires due diligence similar to stock market investing, focusing on the underlying assets and management.

- Research Management and Portfolios: The success of a REIT or crowdfunding deal hinges on the expertise of its management team. Investigate their track record, investment philosophy, and the quality and diversity of the properties within their portfolio.

- Diversify Across Sectors and Regions: Avoid concentrating your investment in a single property type (e.g., only retail REITs). Spread your capital across different sectors like industrial, healthcare, residential, and data centers to protect against sector-specific downturns.

- Analyze Dividend Sustainability: For income-focused investors, a high dividend yield is attractive, but its sustainability is crucial. Review the REIT's funds from operations (FFO) and payout ratio to ensure it can comfortably cover its dividend payments long-term.

- Understand Fee Structures: Crowdfunding platforms and some REITs have management or administrative fees. Carefully read the prospectus or platform terms to understand how these fees will impact your net returns. Transparency is key.

Exit Strategy Comparison Matrix

| Strategy | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Buy and Hold Cash Flow | Moderate | High capital, ongoing management | Steady passive income & equity growth | Long-term wealth building & passive income | Predictable cash flow, tax benefits |

| Fix and Flip | High | High capital, renovation skills | Quick profit through value-add | Active investors seeking fast returns | High short-term returns |

| Wholesale Assignment | Low | Minimal capital, strong networking | Quick fees from contract assignments | New investors with limited capital | Low capital, no ownership risk |

| BRRRR Strategy | High | Moderate capital, multiple skills | Scalable cash flow & appreciation | Investors scaling rental portfolios rapidly | Rapid scaling, uses refinancing |

| 1031 Tax-Deferred Exchange | High | Significant capital, legal support | Tax deferral, portfolio upgrades | Experienced investors with large capital gains | Significant tax savings |

| Owner Financing/Seller Carryback | Moderate | Moderate capital, buyer vetting | Ongoing income from financed sale | Sellers seeking steady income, buyers lacking financing | Steady income, flexible terms |

| Real Estate Syndication | High | Pooled capital, legal compliance | Passive income from large assets | Investors seeking passive, diversified investments | Access to large properties, professional management |

| REITs and Real Estate Crowdfunding | Low | Low capital, no management | Liquid passive income & diversification | Passive investors seeking liquidity | High liquidity, easy access |

Choosing Your Path to Profit with Confidence

Navigating the world of real estate investing is not just about finding the right property; it’s about mastering the art of the exit. As we've explored, the most successful investors enter a deal with a clear understanding of how they will eventually leave it. The true power lies not in choosing one favorite strategy, but in building a versatile toolkit of real estate investment exit strategies that can be deployed based on market conditions, property specifics, and personal financial goals.

From the rapid velocity of a wholesale assignment to the long-term wealth creation of the BRRRR method, each path offers a distinct set of advantages and challenges. A fix-and-flip might maximize short-term profit, while a 1031 Exchange is designed to preserve and grow capital over decades. The key takeaway is that no single strategy is universally superior. Your mission is to match the right exit to the right opportunity at the right time.

From Knowledge to Action: Your Next Steps

Understanding these options is the first critical step. Now, it's time to translate that knowledge into decisive action. A successful exit is the culmination of meticulous planning, accurate analysis, and a deep understanding of your numbers. This is where many investors falter, getting caught in "analysis paralysis" or, worse, making a gut decision based on incomplete data.

To move forward with confidence, focus on these actionable steps:

- Define Your Core Objectives: Before analyzing your next deal, clearly define what you want to achieve. Are you seeking immediate cash flow, a quick lump-sum profit, or long-term appreciation? Your answer will immediately narrow down the most viable exit strategies.

- Master Your Market: Deeply understand your local market's dynamics. Is it a landlord's market, favoring buy-and-hold strategies? Or is inventory low and demand high, creating a perfect environment for flipping? This context is crucial.

- Analyze Every Deal Through Multiple Lenses: For your next potential investment, don't just run the numbers for one exit. Model the outcomes for at least two or three different strategies. What does the profit look like as a flip versus a rental? This comparative analysis will illuminate the optimal path.

The Strategic Advantage of Data-Driven Decisions

Ultimately, the difference between a good investment and a great one often comes down to the quality of your initial analysis. Relying on spreadsheets and manual calculations is not only time-consuming but also prone to error. The modern investor leverages technology to gain a competitive edge, comparing multiple real estate investment exit strategies in minutes, not hours.

By embracing a data-first approach, you transform yourself from a hopeful speculator into a strategic operator. You can pivot when the market shifts, confidently select the most profitable path for each unique property, and build a resilient, diversified portfolio that stands the test of time. Your exit is your payday, and planning for it from day one is the most important decision you'll make.

Key Insight: Your investment journey doesn't conclude with a property purchase; it begins there. The most profitable investors are not just experts at finding deals, but masters of the exit.

This strategic foresight ensures that every property you acquire serves its intended purpose in your broader financial plan. Whether you're cashing out, reinvesting, or creating a stream of passive income, your exit strategy is the final, critical piece of the puzzle that turns potential into profit.

Ready to stop guessing and start analyzing? Flip Smart empowers you to instantly model various exit scenarios, from flipping to renting, with comprehensive reports on ARV, rehab costs, and profit projections. Make your next investment decision with data-driven confidence by visiting Flip Smart today.