The BRRRR strategy is one of the most powerful methods for building a real estate portfolio, and for good reason. It’s a systematic approach for acquiring multiple rental properties by recycling the same capital. The entire playbook hinges on buying a property below market value, forcing its value up with strategic renovations, and then pulling your original cash out through a refinance to do it all over again.

What Is The BRRRR Strategy, Really?

Think of the BRRRR method as a high-velocity, active approach to real estate investing. With a typical buy-and-hold rental, your down payment is locked into one property for years, slowly building equity. The BRRRR strategy is designed for speed and momentum.

You hunt for a property that needs work, fix it up to significantly boost its market value, and then use that newly created equity to get your investment back from a lender. This is what allows you to "repeat" the process, turning one initial investment into the seed money for an entire rental portfolio.

What truly sets this strategy apart from other real estate investment strategies is its reliance on forced appreciation. You're not just waiting for the market to rise; you're creating value through calculated improvements. The ultimate goal is to own a portfolio of cash-flowing rental properties with little to none of your own cash left in the deals.

The Five Steps That Power The System

The strategy's name is an acronym for its five core phases. Each step must be executed correctly for the next one to succeed, creating a powerful wealth-building cycle.

To make it actionable, here’s a breakdown of what each part of the process entails.

The BRRRR Method At A Glance

| Phase | What It Means | Actionable Goal |

|---|---|---|

| Buy | Purchase an undervalued property. | Find a deal with enough margin to cover rehab, holding costs, and profit. Your purchase price should be at or below 70% of the ARV minus rehab costs. |

| Rehab | Renovate the property to increase its value. | Focus on updates that maximize appraisal value, like kitchens and baths, to force appreciation and attract high-quality tenants. |

| Rent | Find a qualified tenant and lease the property. | Secure a signed lease to generate stable, positive cash flow and prove income potential to your refinance lender. |

| Refinance | Secure a new loan based on the after-repair value (ARV). | Execute a cash-out refinance to pull your initial investment capital back out, ideally tax-free. |

| Repeat | Use the refinanced cash to fund the next property. | Apply the lessons learned and use your recovered capital to acquire the next undervalued property, scaling your portfolio. |

This cycle is engineered to maximize velocity and return on investment. By targeting properties you can improve, you unlock the ability to get a new loan based on the higher, post-renovation value. Lenders will typically offer a loan-to-value (LTV) of up to 75%, which, in a well-executed deal, is enough to recoup your initial purchase price and rehab costs.

The magic of BRRRR isn't just in owning rentals; it’s in structuring deals where you get your down payment back. That’s what turns a single investment into a reusable tool for acquiring more assets.

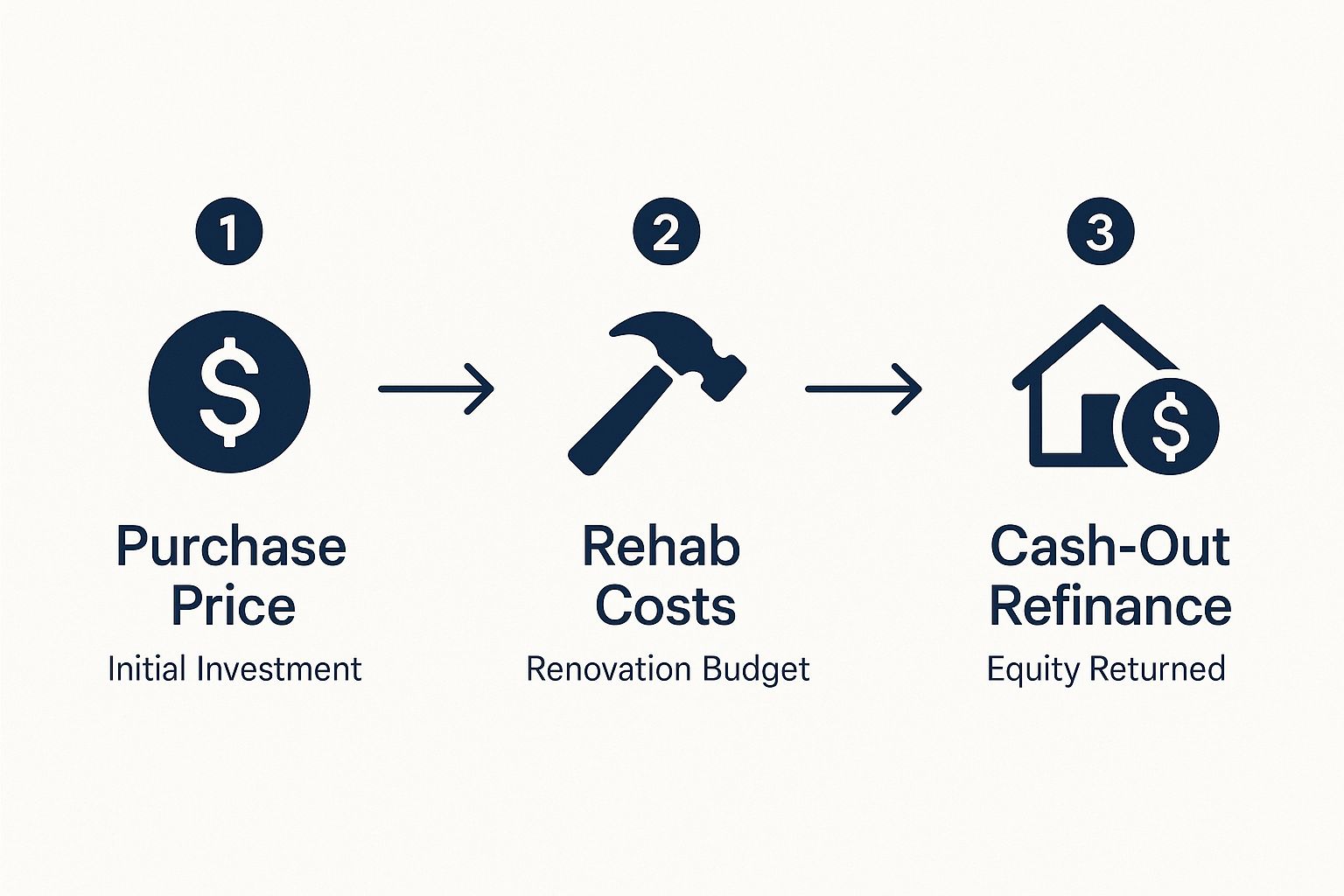

This image helps visualize how your capital flows through each key stage.

As you can see, the cash-out refinance is the pivotal moment where you recover your initial capital, freeing you up to hunt for the next deal.

Why This Method Is So Effective

At its core, the BRRRR strategy works because it puts you in control. You’re not just a passive investor buying a turnkey rental and hoping the market cooperates. You are actively manufacturing equity from the moment you close on the property.

You become the force behind the asset's improved value and performance. This hands-on approach gives you far more control over your returns and timeline, which is precisely why it has become one of the most powerful wealth-building engines in real estate.

Finding and Funding Your First BRRRR Deal

The BRRRR method lives and dies by one thing: finding the right deal. This isn't a typical house hunt for a move-in-ready home. You're on a mission to find a property with built-in potential—a diamond in the rough that others have overlooked.

The entire strategy hinges on buying below market value. That initial discount isn't just profit; it's your safety net. You need to create a wide enough gap between what you pay and what the property could be worth (the after-repair value, or ARV) to cover all your renovation costs, holding expenses, and still have a significant chunk of equity left for the refinance. This is where your deal-finding skills are truly tested.

Sourcing Properties Like A Pro

Finding these undervalued homes means you have to get proactive. You can’t just scroll through the MLS and expect a golden opportunity to fall into your lap. Experienced investors build a consistent pipeline of potential deals from multiple sources.

Here are a few of the most reliable channels to start using today:

- Networking with Wholesalers: These individuals are specialists at digging up off-market deals. They get properties under contract and then assign that contract to an investor (like you) for a fee. Action Step: Attend local real estate investor meetups to connect with reputable wholesalers and get on their buyers' lists.

- Driving for Dollars: It sounds old-school, but it's incredibly effective. Action Step: Dedicate two hours a week to driving through your target neighborhoods. Look for signs of neglect—tall grass, overflowing mail, boarded-up windows. Use an app to log addresses and pull owner information for direct outreach.

- Local Auctions: You can find incredible deals on distressed properties, foreclosures, and tax liens at county courthouse steps or online auction sites. Action Step: Research upcoming local auctions online. Do your due diligence before you bid, as sales are almost always "as-is" and without inspection contingencies.

If you want to go deeper on these tactics, our guide on how to find distressed properties breaks down even more techniques.

Mastering The Art Of Renovation Estimates

Finding a property is only half the battle. Nailing the rehab budget is what truly makes or breaks a BRRRR deal. Underestimate repair costs, and you can easily wipe out your entire profit margin. I've seen it happen. New investors get excited about a deal and end up with no cash to pull back out at the refinance stage.

Your analysis must be methodical. Walk the property and create a detailed scope of work, listing every single item that needs to be fixed or updated.

Actionable Renovation Checklist

- Major Systems (The "Big 5"): Don't gloss over these. Get professional opinions on the Roof, HVAC, Plumbing, Electrical, and Foundation. These are budget-killers if missed.

- Exterior: Assess siding, windows, paint, and landscaping. Curb appeal is critical for a high appraisal and attracting quality tenants.

- Interior Finishes: Kitchens and bathrooms provide the biggest ROI. Budget for flooring, paint, light fixtures, and doors throughout the home. Get quotes from at least two contractors.

Putting together a detailed scope of work prevents budget creep and helps you get accurate quotes. And trust me: always add a contingency fund of 10-15% to your total estimate. Unexpected problems always pop up once you start opening up walls.

The core of BRRRR is "forced appreciation." You’re not just fixing things; you're making strategic upgrades that an appraiser will recognize as added value. A dated kitchen that you transform with a modern refresh can add far more to the home's value than the actual cost of the renovation.

Securing The Initial Funding

Before you can refinance, you have to buy the property. Since distressed homes often don't qualify for traditional mortgages, BRRRR investors must get creative with financing.

Common Funding Options for BRRRR Deals

- Hard Money Loans: These are short-term, asset-based loans perfect for buying and renovating a property. Lenders focus more on the deal's potential than your personal credit.

- Private Money Lenders: This involves borrowing from individuals—friends, family, or other investors in your network. The terms are often more flexible than a traditional bank's.

- Seller Financing: In some cases, a motivated seller might be willing to act as the bank and finance the purchase for you, often with little money down.

Each option has different costs and benefits. The right choice depends on the specific deal, your financial situation, and the relationships you’ve built in your market.

From Rehab to Rental Income

https://www.youtube.com/embed/xoLprbdZpjE

The construction dust has settled, and your renovation is complete. What was once a project is now a beautiful, blank canvas. The next step is pivotal: turning that empty house into a cash-flowing asset. This is the "Rent" phase of BRRRR, and it’s where the property begins to pay you back, generating the income necessary to secure your refinance.

Don't relax yet. Time is money. Every day the property sits vacant, you're bleeding cash on holding costs—taxes, insurance, and loan payments. You need to move with purpose to find a great tenant and start the cash flow.

Getting the Word Out: Marketing Your New Rental

First, you need to attract qualified applicants. In today's market, that starts with exceptional photos. You just invested heavily in this renovation; grainy smartphone pictures will kill your momentum. They are the single most important part of your online listing.

Action Step: Hire a professional photographer for one hour. The return on that small investment is immense. If you do it yourself, use a good camera on a bright day to maximize natural light. A little light staging—even just a few clean, tasteful pieces of furniture—can help prospective tenants visualize themselves living there.

Once your photos are ready, syndicate your listing everywhere. Post it on Zillow, Trulia, Apartments.com, and Facebook Marketplace.

Nailing the Rent Price

Pricing your rental is a balancing act. Price it too high, and you'll face a lengthy vacancy. Price it too low, and you're leaving money on the table every month, hurting both your cash flow and your upcoming refinance appraisal.

Your goal is to hit the market-rate sweet spot. To do that, you need to run rental comps.

- Analyze Active Listings: Start by researching what similar, currently available rentals in the neighborhood are asking for. Compare size, bed/bath count, and amenities.

- Find Rented Comps: This is your best data. Action Step: Ask a friendly real estate agent or property manager to pull a report of what comparable properties actually rented for in the last 60-90 days.

- Factor in Your Upgrades: Did you install stainless steel appliances or add a new washer and dryer? Is there a fenced-in yard? These premium features justify a higher rent than the dated unit down the block.

This process is directly tied to understanding your property’s new, higher value. To master this, check out our deep dive into what ARV means in our guide on After Repair Value.

Your Tenant Screening Playbook

Getting applications is easy; placing the right tenant is the real win. One bad tenant can wipe out years of profit. A rock-solid, consistent screening process is your best defense against this nightmare.

Create a system and stick to it for every single applicant. This not only protects your investment but also ensures you comply with fair housing laws.

My Go-To Screening Checklist

- Quick Pre-Screen: Before a showing, a brief phone call can save time. Confirm they meet basic criteria like income and move-in date.

- The Application: Every adult who will live in the property must fill out a complete application. No exceptions.

- Credit & Background Check: Use a professional service to run a full report. You need to see their credit score, eviction history, and criminal record.

- Proof of Income: Verify that their gross monthly income is at least 3x the monthly rent. Ask for recent pay stubs or bank statements.

- Talk to Past Landlords: Call their last two landlords. Ask targeted questions: "Did they pay rent on time every month?" "Did they leave the property in good condition?" "Would you rent to them again?"

A fantastic tenant is the most valuable asset you have. They pay on time, treat your property with respect, and make landlording easy. Never cut corners on screening just to fill a vacancy a week faster.

To Manage or Not to Manage?

The final decision in this phase is who will manage the property. You have two choices: do it yourself or hire a professional property manager.

Self-management saves you the management fee (typically 8-10% of monthly rent) but costs you time. You’re the one who gets the 2 a.m. call about a leaky toilet.

Hiring a property manager frees you up to find your next BRRRR deal, but that fee directly impacts your monthly cash flow.

There’s no universally correct answer. If this is your first rental and it’s local, managing it yourself is an invaluable learning experience. But if you're investing out-of-state or aiming to scale quickly, a great property manager is an essential team member.

With a signed lease and a management plan, you're finally ready for the main event: the refinance.

How to Nail the Cash-Out Refinance

This is the moment of truth in the BRRRR strategy real estate cycle. The cash-out refinance is where your hard work pays off. Your smart purchase, strategic rehab, and quick tenant placement all culminate in this critical financial step.

The goal is simple: replace your short-term financing (like a hard money loan) with a long-term, conventional mortgage. This new mortgage is based on the property's new, much higher appraised value.

When executed correctly, you can pull most—if not all—of your initial investment back out. You're left with a cash-flowing rental property that you essentially own with little to none of your own money left in the deal. This is the fuel that enables the "Repeat" phase and allows you to scale your portfolio.

Preparing for a Winning Appraisal

The entire refinance hinges on one number: the appraised value. A high appraisal means you get your capital back to reinvest. A low one can stop your BRRRR journey dead in its tracks.

You cannot afford to be passive. You need to proactively manage the appraisal process.

This is where a "brag sheet" becomes your most powerful tool. It's a professional package that you hand to the appraiser upon their arrival. Its purpose is to make their job easier and ensure they don't miss any value-adding improvements you've made.

Your brag sheet should include:

- A Detailed List of All Renovations: Itemize everything, from the new roof to the cabinet hardware. Include the cost of each item and the completion date.

- Before and After Photos: Nothing tells a story like a picture. A side-by-side visual comparison is incredibly powerful and demonstrates the property's transformation.

- A Copy of the Signed Lease: This is hard proof that the property is generating income at the new market rate, which justifies a higher valuation.

- Comparable Sales (Comps): Don't rely solely on the appraiser to find the best comps. Pull 3-4 examples of recently sold, renovated properties in the area that support your target value.

Never assume an appraiser will see all the hidden value you created. A brag sheet isn't about being arrogant; it’s about providing clear, undeniable proof of the property's increased worth. It shows you're a professional investor.

Finding the Right Lender for Your BRRRR Strategy

Not all lenders are created equal, especially for the BRRRR method. Large national banks often have strict "seasoning" rules and may be hesitant to do a cash-out refinance so soon after a purchase. You need an investor-friendly lender who understands the strategy.

Action Step: Start by calling local credit unions, community banks, and mortgage brokers who specialize in working with real estate investors. Ask them directly about their policies on cash-out refinances for investment properties and their seasoning requirements.

Key Lender Considerations

- Seasoning Period: This is how long a lender requires you to own the property before they'll do a cash-out refinance based on the new appraised value. It can range from six to twelve months. Finding a lender with a shorter seasoning period is key to recovering your capital faster.

- Loan-to-Value (LTV): For an investment property refinance, most lenders will cap their loan at 75% LTV. So, if your property appraises for $200,000, they’ll lend you up to $150,000.

- Debt-to-Income (DTI) Ratio: The lender will analyze your total monthly debt payments versus your gross monthly income. They need to see that you can comfortably handle the new mortgage payment.

The Power of Tax-Free Capital

One of the biggest advantages of the refinance phase is the tax treatment of the funds. In the United States, the BRRRR real estate investing strategy comes with significant tax benefits. Since the money you pull out from a cash-out refinance is considered loan proceeds, it isn’t taxable income.

This allows you to access the equity you've created without triggering the capital gains taxes associated with selling a property.

Let's look at a quick example.

Sample BRRRR Refinance Calculation

| Metric | Amount |

|---|---|

| Purchase Price | $200,000 |

| Rehab & Holding Costs | $50,000 |

| Total Initial Investment | $250,000 |

| After-Repair Value (ARV) | $350,000 |

| New Loan Amount (75% of ARV) | $262,500 |

| Capital Recovered | $12,500 |

In this scenario, you not only recovered your entire $250,000 investment but also walked away with an extra $12,500 in tax-free cash. And you still own the asset.

This tax-free liquidity is the engine that drives portfolio growth. You can learn more about these financial details from experts like The Real Estate CPA.

You get your capital back without selling the property, which means you keep the asset, the cash flow, and all future appreciation. With your original funds back in your bank account, you're ready for the best part: doing it all over again.

Scaling Your Portfolio with the Repeat Phase

You’ve done it. You found the deal, managed the rehab, placed a tenant, and completed the refinance. With your original capital back in your bank account, you've officially completed one full cycle of the BRRRR strategy real estate method.

This is a huge milestone, but the final 'R'—Repeat—is what separates a one-off success from a true wealth-building machine. It's time to take what you learned, refine your process, and do it again.

This is where momentum takes over. The repeat phase isn’t just about buying another property; it's about building a scalable system. Each successful cycle adds another cash-flowing asset to your portfolio, boosting your net worth and monthly income. This compounding effect is the engine that drives you toward financial freedom.

Assembling Your Power Team

You cannot scale effectively by yourself. The secret to repeating the BRRRR process without burnout is having a reliable "power team." These are the professionals you trust to execute their roles flawlessly, freeing you up to focus on finding the next great deal.

Your first deal was a trial run. Now it's time to solidify those key relationships.

Your Core Team Should Include:

- A Savvy Real Estate Agent: You need an agent who understands the investor mindset. They should be bringing you off-market deals and have a deep knowledge of rental demand in your target areas.

- A Reliable Contractor: A great general contractor is worth their weight in gold. When you find one who delivers quality work on time and on budget, give them consistent work to ensure they prioritize your projects.

- An Investor-Friendly Lender: The same lender who handled your first refinance could become your go-to partner. They already understand your strategy and have seen you perform, which can streamline future loans.

This team becomes your operational backbone. When you spot a potential property, you should be able to get a quick rehab estimate from your contractor and a valuation from your agent within 24-48 hours. That’s how you make offers with speed and confidence.

Accelerating the Deal-Finding Process

With your team and capital ready, your primary job is to feed the machine with good deals. Hunting for that first property was likely slow and uncertain. Now, you have experience and a proven model.

It's time to systematize your deal-finding efforts. Don't just wait for deals to appear on the MLS. Create multiple channels that consistently bring opportunities to you.

Actionable Deal-Finding Systems:

- Automate Your Search: Set up customized alerts on platforms like Zillow and Redfin for properties meeting specific criteria (e.g., age, size, keywords like "fixer-upper" or "TLC").

- Build Your Network: Make a habit of attending local real estate investor meetups. The relationships you build with wholesalers, other investors, and property managers are an incredible source of off-market deals.

- Launch a Direct Mail Campaign: It's an old-school tactic that still works. Target absentee owners or homeowners in pre-foreclosure in your desired zip codes to find motivated sellers no one else is talking to.

The goal is to shift from passively looking for deals to actively creating a consistent flow of them.

The repeat phase is where the BRRRR strategy truly compounds. Each new property adds to your cash flow, which strengthens your financial position and makes it easier to qualify for more loans. You are no longer just an investor; you are building a business.

Managing the Risks of a Growing Portfolio

Of course, scaling brings new challenges. Juggling one property is one thing; managing five or ten is a different ballgame. As your portfolio grows, so do your responsibilities and potential risks.

One of the biggest pitfalls is over-leveraging. It’s tempting to immediately reinvest all your refinanced cash into the next deal. Resist this urge. Start building a healthy cash reserve. A good rule of thumb is to have at least six months of total expenses (mortgage, taxes, insurance, maintenance) for each property saved in a dedicated account.

Another key to managing risk is meticulous bookkeeping. Track the income and expenses for every property. This isn't just for tax time; it gives you a clear, real-time picture of your portfolio's financial health and helps you identify underperforming assets early.

With a solid system, a trusted team, and a close eye on your numbers, you can repeat the BRRRR cycle again and again, turning that first investment into a true legacy.

Got Questions About BRRRR? You're Not Alone.

Even with a solid plan, diving into the BRRRR strategy real estate world can feel like a big leap. Honestly, every single investor I know—myself included—started out with a whole list of "what-ifs."

Let's tackle some of the most common questions. Think of this as our final huddle before you start making deals. We’ll get into the real risks, how to get started with less cash than you’d think, and why this strategy works no matter what the market is doing.

What Are the Biggest Risks and How Do I Sidestep Them?

The BRRRR method is a powerhouse for building wealth, but let's be real—it's not without its pitfalls. The biggest risks are front-loaded in the Buy and Rehab phases. If you overpay or underestimate repairs, your project can be underwater before it starts. And then there's the dreaded low appraisal during the refinance, which can leave all your capital trapped in the deal.

The good news is you can mitigate most of these with rigorous due diligence.

- Live by the 70% Rule: As a guideline, your offer price should be no more than 70% of the After-Repair Value (ARV), minus your estimated rehab costs. This formula provides a built-in buffer for profit and unexpected expenses.

- Never, Ever Skip the Inspection: I can't stress this enough. A professional inspector is your best defense against catastrophic surprises like a cracked foundation or faulty electrical system that could destroy your budget.

- Have a Contingency Fund: Always pad your renovation budget with an extra 10-15%. The moment you open up a wall, you'll find something you weren't expecting. That fund keeps a small problem from becoming a project-killing disaster.

The biggest risk in any real estate deal is always what you don't know. The more you analyze, inspect, and plan for the unexpected, the more you turn that risk into a manageable part of the business.

Can I Really Do This With Little or No Money?

This is the million-dollar question. The short answer is yes, but it requires hustle and creativity. A true "zero money down" deal is rare, but you can absolutely get started with far less cash than people imagine by using other people's money (OPM).

The key is to find financing that covers both the purchase and the rehab costs. This means thinking beyond traditional banks.

Getting Creative with Financing

- Hard Money Lenders: These lenders are a BRRRR investor's best friend. They focus on the property's value, not your W-2 income. Many will fund 100% of your renovation budget and a large portion of the purchase price, minimizing your out-of-pocket cash.

- Private Money Lenders: This is borrowing from individuals in your network—friends, family, or other investors. The terms are negotiable. If you bring them a fantastic deal, you can often structure it to finance the entire project.

- Partnerships: Have the skills but not the cash? Find someone with capital but not the time or expertise. You bring the deal and manage the project; they bring the money, and you both win.

How Does BRRRR Hold Up When the Market Gets Weird?

One of the most powerful aspects of the BRRRR strategy real estate approach is its adaptability. It works in a hot seller's market, a slow buyer's market, and everything in between. You just have to adjust your tactics.

When the market is hot and prices are rising, appreciation provides a tailwind, often leading to a higher-than-expected appraisal. The challenge is finding a good deal. You must be more aggressive with off-market searches, like direct mail campaigns or networking.

In a flat or declining market, it's easier to find properties, but you must be extremely conservative with your ARV projections. Your profit is made almost entirely by the value you force through the renovation, so your numbers must be precise. In these markets, strong cash flow is paramount—it ensures the property pays for itself, even if values dip temporarily.

Ready to stop guessing and start analyzing deals with precision? Flip Smart gives you the tools to calculate renovation costs, determine after-repair value, and forecast profits in seconds. Take the uncertainty out of your next BRRRR deal by visiting https://flipsmrt.com to see how it works.