Finding distressed properties is about executing a repeatable strategy to connect with motivated sellers before your competition does. It involves identifying properties under financial strain—like pre-foreclosures, short sales, or homes with tax liens—as well as those that are physically neglected.

The key to consistent deal flow is blending proven, boots-on-the-ground tactics with modern digital tools to uncover and vet these hidden investment opportunities.

Your Guide to Finding Undervalued Properties

Unearthing a great distressed property deal is like striking gold in a competitive market. For savvy investors, it's one of the most reliable methods for building a real estate portfolio with significant equity built-in from day one.

This guide provides actionable strategies for locating these high-potential, undervalued assets, moving beyond theory to focus on practical execution.

First, you must understand what "distressed" truly means. It's a broad category that extends far beyond bank-owned foreclosures. A property can be distressed for various reasons, each creating a unique opportunity for investors who know how to approach it.

The Spectrum of Distressed Properties

Different types of distress require different strategies. Knowing the nuances helps you refine your search and tailor your outreach.

Here are the most common types you'll encounter:

- Pre-Foreclosures: This is the ideal stage. The owner has defaulted on their mortgage, but the lender has not yet repossessed the property. This creates a critical window to negotiate directly with a highly motivated homeowner seeking a solution to avoid foreclosure.

- Short Sales: Here, the homeowner owes more on the mortgage than the property's current market value. To avoid foreclosure, they negotiate with their lender to sell the home for less than the outstanding loan balance, a process requiring lender approval.

- REO (Real Estate Owned): After a property fails to sell at a foreclosure auction, the bank takes ownership, and it becomes an REO property. The buying process is often more conventional, but you will likely face more competition from other investors and owner-occupants.

- Neglect and Deferred Maintenance: Sometimes, the distress is purely physical. The owner may have clear title but lacks the funds or ability to handle maintenance. These are the classic "ugly houses" that can be transformed into profitable investments.

The strategic advantage lies in finding properties before they are listed on the open market. By focusing your efforts on pre-foreclosures and physically distressed homes, you bypass the competition and can negotiate better terms directly with the seller.

Think of this as your strategic roadmap. It's not just about finding cheap houses; it's about understanding the specific problem behind each property and offering a viable solution. Securing these deals requires a combination of traditional legwork and the smart application of modern technology.

In today's market, mastering the right tools is essential. The effective use of data analytics in real estate can help you identify trends and pinpoint potential leads with far greater efficiency than your competition. The following sections will show you exactly how to combine these methods to build a consistent pipeline of high-quality deals.

Mastering On-The-Ground Sourcing Methods

Long before data analytics and online platforms existed, the most successful real estate investors found their best deals with a simple, powerful tool: direct observation. These classic, on-the-ground sourcing methods remain incredibly effective, often uncovering opportunities that digital-only investors completely miss.

This is about getting out into your target market and connecting directly with the story behind each potential property.

A hands-on approach is about keen observation and building a genuine local presence. While technology provides speed and scale, nothing replaces the insights gained from seeing a property and its environment firsthand. When you combine this old-school detective work with modern efficiency, it becomes a potent strategy.

Driving for Dollars The Right Way

The "driving for dollars" strategy is legendary because it works. However, it's more than just a casual drive; it's a systematic process of identifying the visual clues of neglect or vacancy. An effective search requires training your eye to spot specific signs that a homeowner might be motivated to sell.

Here's your actionable checklist for what to look for:

- Overgrown Landscaping: Uncut grass, sprawling weeds, and overgrown bushes are often the first signs that a property is not being maintained.

- Visible Exterior Damage: Look for peeling paint, sagging gutters, a tarp on the roof, or boarded-up windows. These issues suggest deferred maintenance that may signal financial hardship.

- Signs of Vacancy: An overflowing mailbox, yellowed newspapers on the porch, or official notices taped to the door are clear indicators that no one is currently living there.

Once you spot a potential property, execute this simple process: jot down the address, snap a photo for reference, and make a few notes on its condition. This initial data becomes the starting point for researching ownership records and property history.

A well-executed driving for dollars campaign isn't about covering the most ground; it's about systematically canvassing specific B- and C-class neighborhoods where your investment model thrives. Consistency is the key to building a robust pipeline of off-market leads.

Building Your Local Intelligence Network

Beyond your own observations, the best deals often come from tips and referrals. Building a local network of professionals who encounter distressed properties in their daily work can create a steady stream of exclusive leads.

Think of these individuals as your strategic partners on the ground.

These connections can give you a critical head start on finding distressed properties before they are exposed to the wider market. Your goal is to become the go-to investor they call first when an opportunity arises.

Here are the key professionals to connect with:

- Real Estate Agents: Focus on agents specializing in REOs or short sales. They have direct access to bank-owned inventories and homeowners in difficult situations.

- Probate Attorneys: When a property owner passes away, their estate often needs to be settled quickly. Attorneys handling these cases are an invaluable source of leads for inherited properties that heirs are motivated to sell.

- Mail Carriers and Contractors: People who are in the neighborhoods every day—like postal workers, roofers, or plumbers—often know which houses are vacant or neglected long before anyone else. A friendly conversation and a business card can go a long way.

Using Public Records and Legal Notices

While driving for dollars is excellent for spotting physical neglect, the paper trail of financial distress leads to some of the most motivated sellers. Public records and legal notices are a goldmine for investors who know how to interpret them. This is how you find true off-market deals before they ever appear on the MLS.

These documents mark the official beginning of a property's journey into distress. When a homeowner falls behind on payments, the initial actions taken by lenders and the county are almost always recorded in public files—and that's your cue to act.

Uncovering Pre-Foreclosure and Tax Lien Data

Your local county courthouse or recorder's office is ground zero for these opportunities. While it might sound intimidating, the process is often straightforward, and many counties now offer online databases that simplify the search. You are essentially hunting for specific legal filings that indicate an owner is in financial trouble.

Here is your target list of documents:

- Notice of Default (NOD) or Lis Pendens: This is one of the first documents a lender files when a borrower stops mortgage payments. It publicly signals an impending lawsuit and is your earliest sign of a pre-foreclosure.

- Tax Lien Sales: When homeowners fail to pay property taxes, the county places a lien on the property. These lists are public information and point directly to owners under significant financial pressure.

- Probate Court Filings: When a property owner dies, their real estate goes through probate court. Heirs often inherit properties they don't want or can't afford, making them highly motivated to sell for a quick, hassle-free closing.

Sourcing and Interpreting the Information

Once you have a list of addresses, the real work begins. It’s not just about collecting names; it's about understanding the context behind each filing. A notice of default filed last week represents a much hotter lead than one from six months ago, as that owner may have already found a solution.

The real skill here isn't just finding the records; it's interpreting the data to gauge motivation. A property with a recent notice of default and a tax lien signals extreme distress. That owner is likely overwhelmed and desperately needs a fast, simple solution.

You don't always need to visit the courthouse in person. Many local government websites and third-party online public record services can streamline this research.

After identifying promising leads, use skip-tracing services to find the owner's contact information for direct outreach. Remember, this research is only the first step. For a complete breakdown of what follows, our real estate due diligence checklist ensures you cover every base before making an offer. This proactive approach puts you in control, allowing you to connect with sellers at the precise moment they need help most.

Pinpointing Opportunities with Economic Clues

Distressed properties don't appear in a vacuum. They are often the direct result of larger economic forces putting pressure on property owners. To gain a true competitive edge, you must think like a market analyst, learning to read the economic indicators that point to future deal flow.

When you understand these high-level trends, you can focus on specific areas or property types that are ripe with potential—long before those deals become common knowledge. It's about predicting where the pressure will build next.

Tracking Interest Rates and Loan Vulnerabilities

One of the most significant drivers of property distress is a shifting interest rate environment. When borrowing costs rise, owners with adjustable-rate mortgages or loans nearing maturity can face a serious financial squeeze. They may suddenly be unable to afford the higher payments or find favorable refinancing terms.

This pressure creates a predictable wave of motivated sellers. For example, a sharp rise in interest rates, like the 400 basis point increase seen by 2025, can reduce property valuations and make it extremely difficult for highly leveraged owners to refinance. This exact scenario created a prime opportunity for investors watching the $500 billion in high-yield bonds set to mature through 2028, knowing many of those borrowers would struggle. You can find more details on how market strength can paradoxically lead to more defaults in this 2025 distressed market outlook from Morningstar.com.

When you know which property owners are most exposed to interest rate hikes—like those with loans coming due in a high-rate environment—you can proactively target your marketing efforts to offer a solution before they officially default.

Monitoring Regional and Sector-Specific Health

Beyond national trends, the economic health of a specific city or industry provides powerful clues for how to find distressed properties. A wave of local layoffs or the decline of a major industry often triggers a surge in both residential and commercial distressed assets.

Pay close attention to these indicators:

- Local Unemployment Rates: A sudden spike in unemployment in a city or county is often a leading indicator of a rise in mortgage defaults and foreclosures.

- Corporate Distress Indices: These reports track the financial stability of large companies. If a major corporation in your target market is struggling, it could signal future layoffs and a softening real estate market.

- Sector-Specific Vulnerabilities: Certain sectors are hit harder during economic downturns. Commercial properties like office buildings or retail centers often see vacancy rates climb, putting immense pressure on their owners.

The macroeconomic factors discussed above are crucial for identifying emerging opportunities in the distressed property market. The following table breaks down key economic indicators, what they signal for investors, and where to monitor them.

Key Economic Indicators of Property Distress

This table highlights macroeconomic signals that often precede an increase in distressed property availability, helping investors focus their search.

| Indicator | What It Signals | Where to Monitor |

|---|---|---|

| Rising Interest Rates | Increased pressure on owners with adjustable-rate mortgages or maturing loans, making refinancing difficult. | Federal Reserve announcements, financial news outlets (e.g., Bloomberg, Wall Street Journal). |

| Local Unemployment Spikes | A direct precursor to residential mortgage defaults as household incomes decline. | Bureau of Labor Statistics (BLS) local area unemployment data. |

| Corporate Layoff News | Signals potential for both residential distress (from unemployed workers) and commercial distress (vacated office/industrial space). | Local business journals, national news reports on specific companies. |

| High Commercial Vacancy Rates | Indicates stress on commercial property owners, leading to potential sales from landlords struggling to cover debt service. | Real estate market reports from firms like CBRE, JLL, or Cushman & Wakefield. |

By monitoring these indicators, you can anticipate where distress is likely to surface and position yourself to act before the rest of the market catches on.

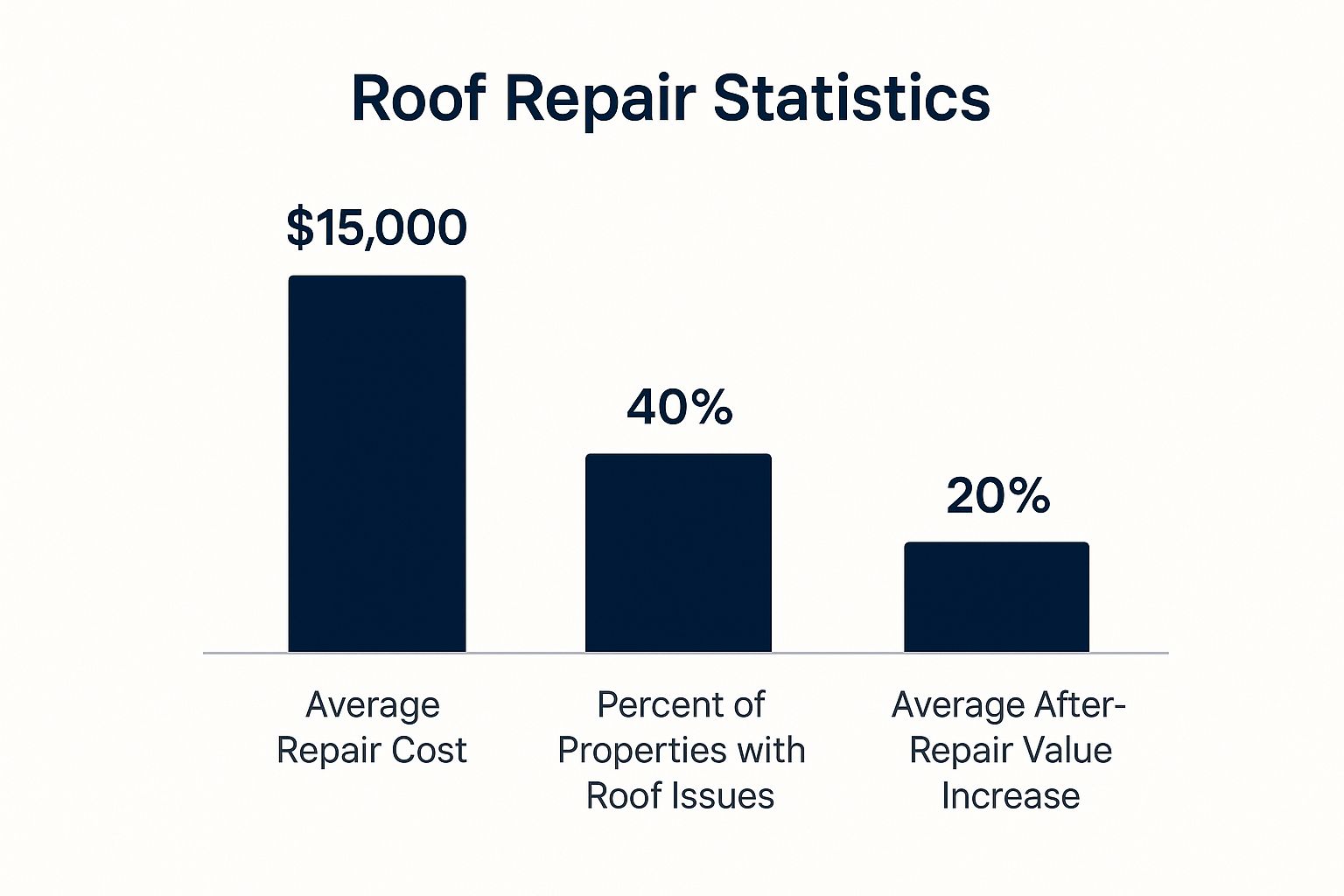

The image below provides a snapshot of the financial factors involved in these deals, illustrating the potential for a significant return on investment.

This data highlights a critical point: while repairs are always part of the equation, the potential for a substantial increase in value is what justifies the investment. Watching these economic clues is not just a theoretical exercise—it's how you strategically position yourself to acquire assets from motivated sellers and capitalize on market shifts.

Tracking Commercial Loan Maturities for Major Deals

If you're targeting larger-scale investments, the commercial real estate market offers a powerful—and often overlooked—strategy for finding distressed properties. Instead of waiting for default notices to become public, seasoned investors get ahead by tracking commercial loan maturity dates. This approach positions you in front of highly motivated sellers long before their properties are officially in trouble.

The concept is simple. When a large commercial loan is about to mature, the property owner must either pay it off or refinance. In a healthy market with rising property values, refinancing is typically straightforward. However, when credit markets tighten or property values decline, those owners can find themselves in a precarious position.

This is where the distress begins. If an owner cannot secure a new loan to cover the balloon payment on their maturing debt, they are forced to sell—and they must do it quickly. This exact scenario creates a prime off-market opportunity for an investor who can offer a fast, reliable exit.

Identifying Underwater Commercial Loans

The most compelling deals often arise from "underwater" loans, where the property's current market value is less than the outstanding debt. An owner in this position has zero equity and faces a significant financial loss. They are often desperate to negotiate a sale to avoid a foreclosure that would damage their credit and reputation for years.

So, where do you find these opportunities? You need to analyze data on commercial mortgage-backed securities (CMBS). These are large pools of commercial real estate loans that have been securitized and sold to investors. The data tied to these securities is often publicly available and contains critical details, including:

- Loan Maturity Dates: This tells you precisely when large balloon payments are due.

- Original Loan Amount: The starting point for calculating the current debt.

- Property Type and Location: This allows you to focus on specific markets or asset classes, like office or multifamily.

By tracking this data, you can build a watchlist of properties with loans maturing in the next 6 to 18 months. The next step is to analyze the current market value of those properties to identify which ones are likely underwater. This requires a solid grasp of market trends and valuation. If you need a refresher, sharpen your skills with our guide to mastering key real estate math formulas.

An owner facing a maturity date on an underwater loan is one of the most motivated sellers you will ever encounter. They aren't trying to maximize profit; they are trying to minimize their losses and avoid a default.

The Scale of the Opportunity

The volume of commercial loans facing maturity can be immense, particularly following periods of economic turbulence. Monitoring these trends is crucial. For instance, in the U.S. alone, nearly $500 billion in commercial property loans were set to mature in 2025.

Even more revealing, an estimated 14% of those loans were already underwater by Q3 2024 price levels. The office sector was hit especially hard, with nearly 30% of its maturing loans—about $30 billion—backed by properties worth less than the debt owed. You can dive deeper into these market dynamics in this MSCI report on 2025 real estate trends.

This data is not just academic; it’s an actionable roadmap. It shows you precisely where to search for large-scale commercial deals that are completely off-market. By anticipating which owners will face refinancing challenges, you can initiate contact, present a viable solution, and secure a deal with far less competition than you would ever find on the open market.

Questions I Get Asked All The Time About Distressed Properties

Diving into the world of distressed real estate is exciting, but it naturally brings up many questions, especially for those just starting out. I've heard them all over the years. Below, I’ve answered some of the most common ones I get from investors learning how to find distressed properties. Hopefully, these clear, actionable insights will help guide your next move.

"What's the absolute fastest way to find a deal right now?"

If you want to find a potential deal today, the "driving for dollars" method is your best bet. It costs nothing but time and fuel, and it puts you in direct contact with properties that show clear signs of distress.

Pick a target neighborhood and start looking for the classic visual cues: overgrown yards, peeling paint, boarded-up windows, or official notices taped to the door. Use a notes app on your phone to log addresses and snap photos. This simple, direct approach consistently uncovers off-market deals, meaning you'll face little to no competition. It's a fantastic, low-cost way to get started.

"How much cash do I actually need to buy a distressed property?"

This is the most common question, and the honest answer is: it depends. You don't always need a large amount of cash on hand, especially if you get creative with your financing strategy.

Here are a few of the most common financing routes for investors:

- Hard Money Loans: These are short-term loans from private companies that lend based on the property's after-repair value (ARV), not your personal income. They are much faster to secure than traditional mortgages but come with higher interest rates and fees.

- Private Money Lenders: Think friends, family, or other investors in your network. These are individuals willing to fund your deal in exchange for a share of the profit or a fixed return.

- Seller Financing: Occasionally, you'll find a motivated seller willing to act as the lender. You make payments directly to them, which can be a highly flexible and powerful option.

Here's the key takeaway: Your ability to find a genuinely great deal is often far more important than the cash you have on hand. If you bring a profitable project to the table, you can almost always find someone willing to fund it.

"Are foreclosure auctions a good place for beginners to start?"

Foreclosure auctions can be a source of discounted properties, but I generally advise beginners to avoid them. The auction environment is fast-paced, highly competitive, and filled with risks that can quickly overwhelm a new investor.

For one, properties bought at auction often require you to pay in full, with cash, on the same day. More importantly, you typically cannot inspect the property's interior beforehand. This means you could be unknowingly buying a house with catastrophic, hidden structural damage. A much smarter approach is to focus on pre-foreclosures, where you have time to conduct proper due diligence and negotiate directly with the homeowner.

"What's the single biggest mistake new investors make?"

Without a doubt, the biggest mistake is insufficient due diligence. I've seen it happen time and again. A new investor gets so excited about a low price that they rush through the analysis.

They end up underestimating repair costs, overestimating the after-repair value, or completely missing a hidden lien on the title. This haste can turn what looked like a home run into a financial nightmare. Always—and I mean always—take the time to run your numbers meticulously, get professional inspections, and verify all public records before you commit. Rushing is a guaranteed recipe for losing money.

Stop guessing and start analyzing. Flip Smart gives you the tools to evaluate any property in seconds, providing accurate renovation costs, ARV, and profit projections. Make your next investment decision with confidence by visiting https://flipsmrt.com.