An After Repair Value (ARV) calculator helps you estimate what a fixer-upper home could sell for once renovations are complete. Think of it like checking a car’s resale value before you install expensive upgrades. With just your comparable sales, square footage, and repair budget, you’ll get an ARV estimate in minutes—so you can screen deals faster and protect your profit margin.

Quick Takeaway: An ARV calculator is your safeguard against overpaying for a home that needs work.

Quick Steps For After Repair Value Calculator

Each step here cuts through uncertainty so you can decide quickly if a property is worth your time.

- Gather three solid comps (completed sales)

- Compute average price per square foot

- Dial in your renovation budget

- Plug everything into the ARV formula

Why Quick ARV Matters

Speed and accuracy can make or break a home-buying deal on a fixer-upper. A fast ARV check lets you:

- Instantly estimate what the home could sell for

- Spot deal risks if repair costs are too high

- Use shareable checklists when working with partners

- Keep inputs minimal: comps, size, and repair costs

ARV = (Average Comp Price per Sq Ft × Subject Property Sq Ft) − Renovation Costs

That simple formula gives you a clear target to guide your offer.

Quick Takeaway: A quick ARV snapshot flags potential money pits so you don’t waste time on unprofitable properties.

Quick ARV Steps Summary

| Step | Description |

|---|---|

| 1 | Gather comps from the past six months in your target area |

| 2 | Compute each comp’s price per sq ft and average them |

| 3 | Input your total renovation budget |

| 4 | Run the ARV formula to see projected value |

Keep this as a printable deal-screening checklist for on-site visits.

Pro Tip For Reliable Comps

- Use sales 0–3 months old for the most current data

- Match lot size, bedroom count, and finish level

- Skip outliers like extreme remodels or custom builds

- Double-check sale dates to capture real-time market shifts

Discover the full step-by-step ARV methodology on Flip Smart.

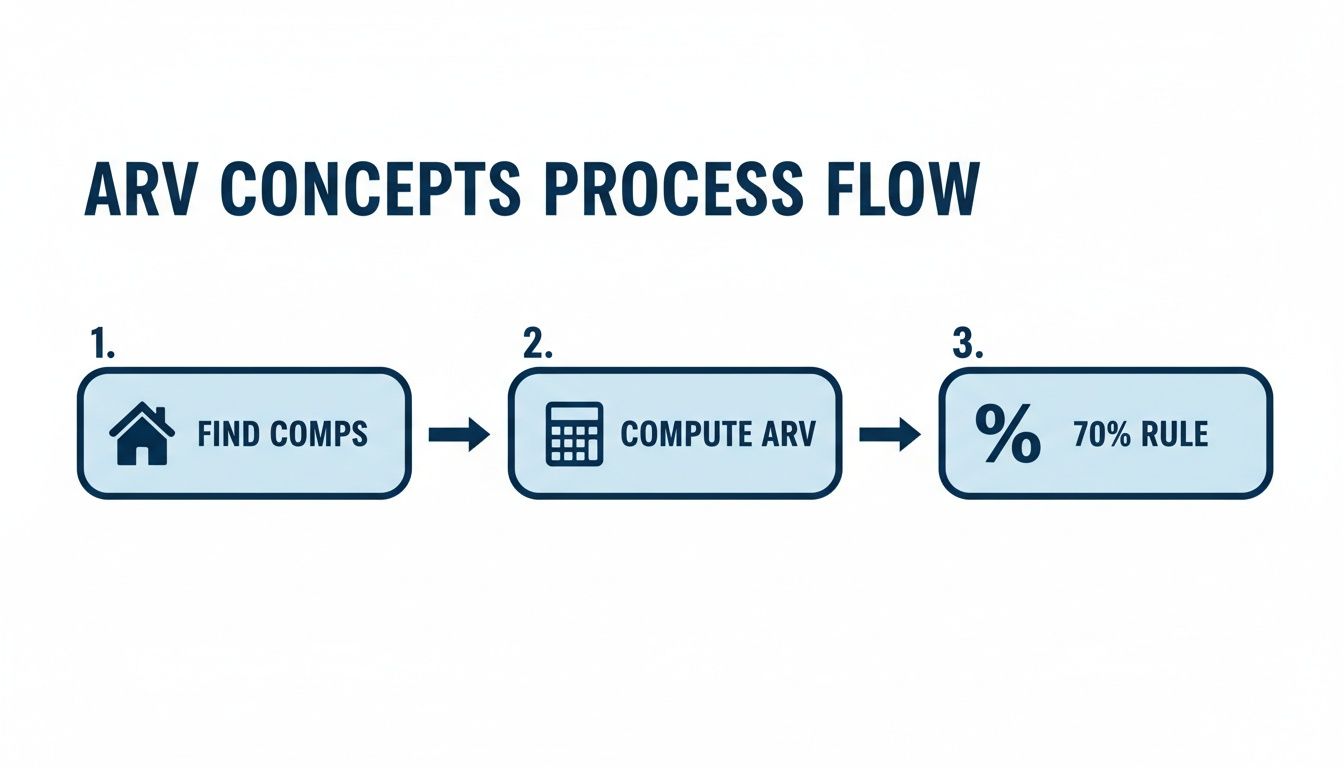

Understanding The Key Concepts

In real estate, after repair value (ARV) is simply what you expect a property to sell for after the renovations are done. It’s your guiding star before you write any checks.

“Use the 70% rule: Maximum Offer = (ARV × 70%) − Repair Costs.”

That formula helps protect your margin and cover holding costs. Stick to it, and you’ll avoid surprise overages.

Key Benefits of ARV

- Anchors your offer to a post-renovation benchmark so you don’t overpay

- Builds in a safety buffer for unexpected repairs and financing

- Aligns your projections with lender expectations

Real-World Fixer-Upper Story

Last quarter, a buyer targeted a home with a projected ARV of $400,000. With $50,000 in repairs, the 70% rule pointed to an offer around $230,000. That gave enough cushion for closing fees, holding costs, and profit.

Learn more about what ARV stands for in real estate.

Quick Takeaway: Using the 70% rule keeps your flip—and your budget—on track.

Calculating ARV With Comparable Sales

Think of this like weighing apples by price per pound instead of guessing. Savvy buyers break each sale down to price per square foot to turn gut feelings into data.

Selecting Solid Comps

Pull data from your MLS or county records. Look for homes closed in the last 3–6 months that match your property’s:

- Square footage (±10%)

- Bedroom and bathroom count

- Lot size and finished level

- Key features (garage, pool, etc.)

Avoid one-off custom builds—they skew results.

Sample Comparable Sales Analysis

| Comp | Sale Price | Size (sq ft) | Price per sq ft |

|---|---|---|---|

| A | $220,000 | 1,100 | $200 |

| B | $250,000 | 1,250 | $200 |

| C | $270,000 | 1,300 | $208 |

Average $/sq ft = (200 + 200 + 208) ÷ 3 ≈ $202.

Multiply $202 by your subject property’s size (e.g., 1,200 sq ft) = $242,400 raw ARV.

Adjusting For Market Trends And Repairs

Most calculators let you layer in:

- Market Movement (+3% if prices are rising)

- Cooling Adjustments (−4% if market slows)

- Repair Estimates from your contractor

ARV = (Average Comp PPSF × Subject Sq Ft) + Market Adjustment − Renovation Costs

Quick Takeaway: Track every comp’s address, sale date, price, and size—this audit trail builds lender confidence.

Check our Comparative Market Analysis template for a detailed CMA guide.

Step By Step Worked Example

Picture yourself at 123 Elm Street with a laser measure. You confirm 1,300 sq ft and note repair spots. This simple check sets you up for an accurate ARV.

Selecting Comparable Sales

- Comp A: $230,000, 1,150 sq ft

- Comp B: $245,000, 1,200 sq ft

- Comp C: $260,000, 1,250 sq ft

All closed within three months. Record address, date, price, sq ft, and neighborhood quality.

Calculating Price Per Square Foot

- $230,000 ÷ 1,150 ≈ $200/ft²

- $245,000 ÷ 1,200 ≈ $204/ft²

- $260,000 ÷ 1,250 ≈ $208/ft²

Average = (200 + 204 + 208) ÷ 3 ≈ $204/ft²

Cooling market at 4% downward → $204 × 0.96 ≈ $196/ft²

Reno budget = $60,000

Final ARV Calculation

- Subject size: 1,300 ft²

- Adjusted PPSF: $196

- Raw ARV: 1,300 × $196 = $254,800

- Final ARV: $254,800 + $60,000 = $314,800

ARV = (Average PPSF × Subject Sq Ft × Market Factor) + Renovation Budget

Quick Tip: If a comp spikes +3%, adjust and rerun on the spot.

Common Mistakes And How To Avoid Them

A small ARV slip can shave thousands off profits. Don’t let stale data or low repair budgets sink your deal.

Common Mistakes Investors Make

- Outdated comps over six months old

- Ignoring market swings

- Underestimating repair costs (permit fees, hidden work)

- Overvaluing cosmetics (paint won’t move the needle)

Quick Tip: Confirm each comp’s lot size, age, and renovation level.

Why Financing Hinges On ARV Accuracy

Lenders base refinance amounts on ARV. If you overestimate by 10–20%, you could miss out on $20,000+ in funds.

Learn more at Better.com.

Best Practices For ARV Accuracy

- Source closed comps with full details

- Log contractor bids and contingency buffers

- Share your model with a lender or partner

- Subtract 5–10% from final ARV for safety

| Mistake | Avoidance Tip |

|---|---|

| Stale Comps | Use comps from last 3–6 months |

| No Market Adjustment | Adjust ARV by ±3–5% based on recent trends |

| Low Reno Budget | Add 10–20% contingency to contractor estimates |

| Overvaluing Cosmet. | Prioritize structural repairs first |

Quick Takeaway: A clear audit trail is your best defense in an appraisal.

How Flip Smart Automates ARV Calculation

Flip Smart brings live data and renovation inputs together in seconds. No more spreadsheets or guesswork.

Essential Features:

- Live MLS comps for fresh data

- Automated market adjustments

- Contractor cost integration

- Full audit trail logging

Every figure links back to a data source, making your assumptions rock-solid.

Quick Tips:

- Double-check comp filters before batch runs

- Use preview to spot-check metrics

- Switch to map view to confirm nearby comps

Explore the Flip Smart Analyze tool for batch screening.

FAQ

Here are the top questions new buyers ask when using an ARV calculator:

What should I check before buying a fixer-upper?

Look at structural elements (roof, foundation), neighborhood comps, estimated permit fees, and your financing options. Use a renovation checklist to compare contractor bids side by side.How do I get the best mortgage rate for a renovation loan?

Shop lenders, compare APRs, and get pre-approved. A strong credit score and 20% down payment often secure lower rates on both purchase and renovation loans.What inspection should I arrange before making an offer?

Always get a general home inspection. For fixer-uppers, add structural, roofing, plumbing, and electrical inspections to avoid surprise repair costs.How can I negotiate seller-paid repairs?

Present your ARV-based cost estimates to justify repair credits. Ask for line-item credits rather than price reductions so you know exactly what’s covered.When should I use an ARV buffer?

Build in a 10%–15% contingency on renovation budgets and adjust ARV down by 5%–10% to cover market shifts or hidden issues.

Quick Takeaways:

- Use 3–5 comps and adjust for market swings

- Include a 10% buffer for unexpected repairs

- Keep a clear log of sources and assumptions

Ready to automate ARV calculations and streamline your fixer-upper purchase? Trust Flip Smart to power your next deal.