So, what exactly is a holding cost? Put simply, it’s the price you pay for owning a property from the day you close on it until the day you sell it or a tenant moves in.

Think of it as the property's own "rent" bill that you're on the hook for, covering everything that adds up while it’s sitting empty. These costs are way more than just the mortgage, and every home buyer and real estate investor needs to get a handle on them.

Unpacking the True Cost of Owning an Investment Property

Holding costs, which you’ll often hear called carrying costs, are all the ongoing expenses that keep a property afloat while it's not generating any income. If you're flipping a house, that’s the entire period between buying and selling. For a landlord, it’s that painful vacant stretch between tenants.

These expenses are a silent killer of profits. The longer your property sits empty, the more they chip away at your returns. Holding costs are the financial clock that’s always ticking against your investment.

The Four Main Holding Cost Categories

Getting a grip on these costs is the first step to controlling them. They generally fall into four main buckets, each one covering a different piece of the ownership puzzle.

Let's break them down.

| Cost Category | What It Covers | Common Examples for Home Buyers |

|---|---|---|

| Capital Costs | The cost of the money tied up in the property. | Mortgage interest, loan points, property taxes. |

| Space Costs | Expenses directly related to the physical property. | Utilities (water, electric), HOA fees, landscaping. |

| Service Costs | Fees for services required to maintain and protect the asset. | Homeowners insurance, security systems, legal fees. |

| Risk Costs | Potential financial losses from unforeseen events. | Vandalism repairs, unexpected maintenance, market value drops. |

This table shows how quickly the "small" expenses can add up, turning a promising deal into a financial drain if you're not careful.

A classic rookie mistake is fixating on the purchase price and rehab budget while completely ignoring these ongoing costs. New investors forget that every single day you own that property, it has a price tag attached.

Across many industries, these carrying costs can be a huge deal, often running between 20% to 30% of an asset's value each year. For instance, an investor holding a $500,000 property with a 25% holding cost rate would face $125,000 in annual carrying costs. You can find more details on how these costs are tallied on platforms like Finale Inventory.

Breaking Down the Four Components of Holding Costs

To really get a handle on what is a holding cost, you have to see it for what it truly is: not one single bill, but a collection of different expenses that quietly chip away at your profits. When you break these components down, you can see exactly where your money is going while a property sits on the market.

Think of it like the total cost of owning a car. You don’t just pay for the car itself; you also have to budget for gas, insurance, maintenance, and the fact that its value drops over time. Holding costs for a property work in a very similar way.

1. Capital Costs

This is the big one, the most obvious financial drain. Capital costs are the price of the money tied up in your property—money that could be earning a return somewhere else. It’s the direct bleed you feel every single month.

These costs almost always include:

- Mortgage Payments: The principal and interest you pay on your loan.

- Property Taxes: Your obligation to the local government, which is often paid monthly or semi-annually through an escrow account.

- Loan Points and Fees: Upfront costs you paid to get the financing, which get spread out over the life of the loan.

Every day you hold the property, these capital costs stack up. This is why a quick turnaround is so critical for maximizing your ROI.

2. Storage and Space Costs

This bucket covers all the expenses directly tied to maintaining the physical property. Even an empty house has bills that need to be paid just to keep it safe, secure, and in decent shape.

Common space costs are:

- Utilities: Even if no one is living there, you'll have bills for electricity (to keep lights and security systems on), water (to prevent pipe issues), and maybe gas or heating.

- HOA Fees: If the property is in a homeowners' association, these monthly or quarterly dues are non-negotiable. They don't stop just because the house is empty.

- Landscaping and Exterior Maintenance: Lawns need mowing and weeds need pulling. This isn't just about curb appeal; it's also about avoiding fines from the city.

An overgrown lawn or a pile of unopened mail is a neon sign that a property is vacant, making it a target for vandalism. Neglecting these small space costs can lead to much bigger, risk-related expenses down the line.

3. Inventory Service Costs

Next up are the service costs. These are the fees you pay for professional services that protect and manage your investment. Think of these as the essential costs for mitigating liability and making sure the property is legally compliant and well-maintained.

Examples include:

- Insurance: You absolutely need homeowners insurance, specifically a vacant property policy. This protects you from disasters like fire, theft, or someone getting injured on your property.

- Security: This could be a monthly fee for a monitored alarm system or the one-time cost of installing security cameras to deter intruders.

- Property Management: If you hire a company to keep an eye on things while it's vacant, their management fees fall right into this category.

4. Inventory Risk Costs

Finally, we have risk costs. This category covers the potential financial gut punches from unforeseen problems. These are the "what if" expenses that can pop up unexpectedly, and they're a direct result of the property sitting empty. Being skilled at estimating repair costs is non-negotiable for any investor, as it helps you build a buffer for these potential risks.

Risk costs often involve:

- Vandalism and Theft: Empty properties are magnets for trouble. The cost to repair broken windows, stolen copper pipes, or smashed appliances falls here.

- Unexpected Maintenance: A pipe could burst in the middle of winter or an HVAC unit could die. These things require immediate and often expensive repairs.

- Market Depreciation: The longer you hold a property, the more you're exposed to the risk of the local real estate market taking a downturn, which could sink your final sale price.

How To Calculate Your Business's Holding Cost

Alright, let's turn these abstract ideas into a hard number you can actually use. Calculating your holding cost is where the rubber meets the road—it takes a fuzzy concept and makes it a measurable, critical metric for your investment's financial health.

The standard formula is refreshingly simple. It gives you a clear percentage that shows you exactly how much it costs to carry your investment property.

Holding Cost (%) = (Total Annual Holding Costs / Total Property Value) x 100

To make this formula work, you first have to do the legwork of adding up all your expenses. That "Total Annual Holding Costs" number is just the sum of all the capital, space, service, and risk costs we just broke down.

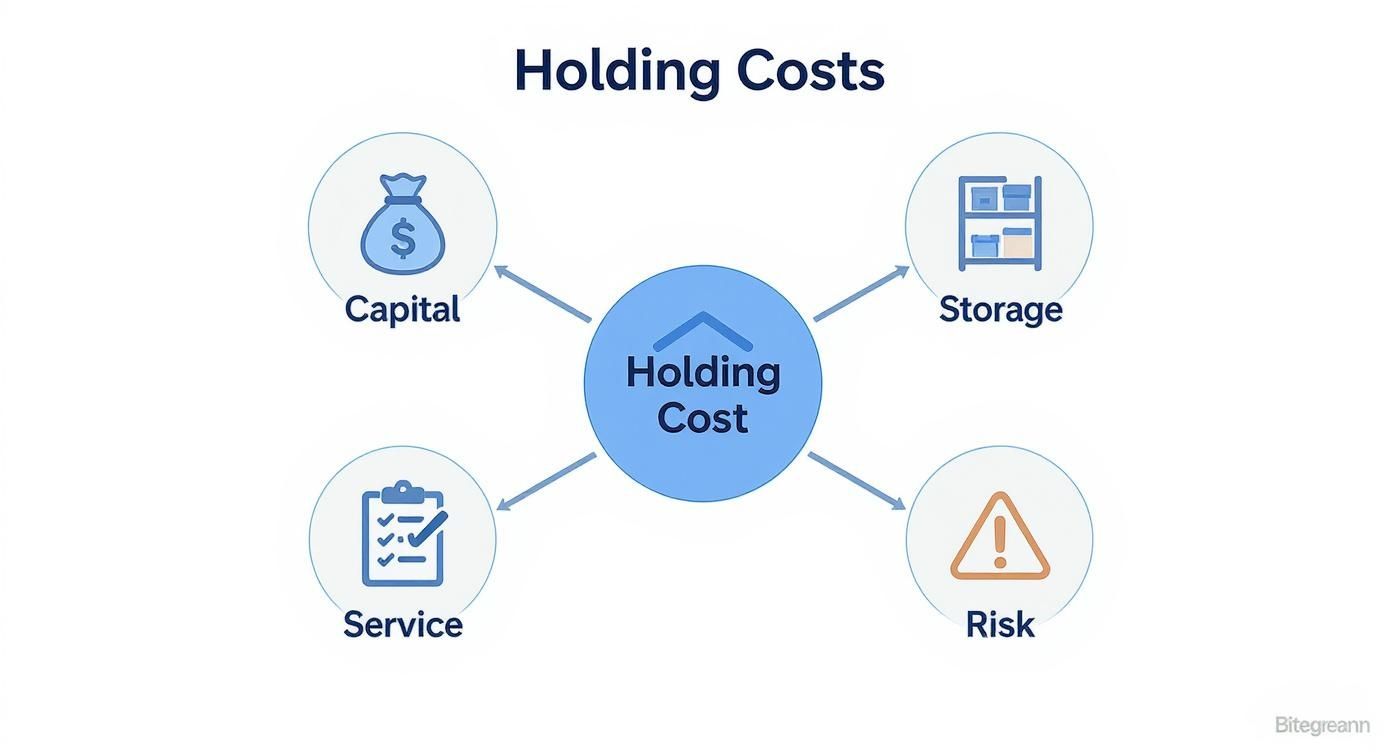

This infographic gives you a great visual of how those four core components—Capital, Storage, Service, and Risk—all feed into your total holding cost.

Seeing it laid out like this makes it obvious that holding costs aren't some single, mysterious expense. They're a collection of different financial pressures constantly working against your bottom line.

A Practical Calculation Example

Let's walk through an example to see how this plays out in the real world.

Imagine you snag a fix-and-flip property valued at $350,000. Over the course of a year, the bills start rolling in.

First, you've got your Capital Costs (mortgage interest, property taxes, loan fees) hitting you for $18,000. Then come the Space Costs like utilities, HOA fees, and landscaping, adding another $4,500. Don't forget Service Costs like insurance and a security system, which tack on $2,000. Lastly, you wisely budget $2,000 for Risk Costs to cover potential vandalism or unexpected repairs.

Let's add it up:

- Total Annual Holding Costs: $18,000 + $4,500 + $2,000 + $2,000 = $26,500

- Total Property Value:$350,000

Now, just plug those numbers into the formula:

($26,500 / $350,000) x 100 = 7.57%

Your holding cost is 7.57% of the property's value. Think of this percentage as your financial stopwatch. The lower you keep it and the faster you sell, the more profit you get to keep. If you want to get even sharper with the numbers that drive successful deals, check out our guide on essential real estate math formulas.

How Holding Costs Influence Key Business Decisions

Thinking of holding costs as just another line item on a spreadsheet is a huge mistake. This single number is more like a strategic compass for your entire operation, guiding critical decisions that can either pad your profits or slowly bleed you dry.

A solid grasp of your holding costs directly shapes how you buy. Imagine a supplier offers a massive bulk discount that seems too good to pass up. A smart investor knows that’s only half the story. You have to weigh those upfront savings against the real costs of storing all that extra inventory—higher insurance, more warehouse space, and capital just sitting on a shelf.

Often, that "great deal" gets completely wiped out by the carrying costs.

This metric is also the key to smarter production and inventory planning. If you find your holding costs are sky-high, it’s a bright red flag that you might be producing too much, too soon, leaving you with a warehouse full of idle assets.

Optimizing Production and Capital

Take a look at your production schedule—optimizing it can have a massive impact. Let's say you need 100 units of a product each month. If you produce a batch of 400 every four months, your average inventory at any given time is around 200 units.

Now, what if you switched to smaller batches of 200 units every two months? Just like that, you’ve sliced your average inventory in half to 100 units. This move directly cuts your holding costs and, just as importantly, frees up a ton of cash.

This is where your cash flow really comes into play. The longer your money is tied up in an empty investment property or unsold inventory, the less you have to pounce on the next great opportunity. Managing your holding costs is one of the best ways to improve your financial efficiency. You can learn more about how to manage your cash flow for real estate in our related guide.

A high holding cost is often a symptom of a deeper issue, such as inefficient supply chains, poor demand forecasting, or even a sluggish sales process. It's a red flag that prompts you to look closer at your operations.

Justifying Strategic Investments

When you start viewing holding costs as a strategic lever, it becomes much easier to justify important investments. That new inventory management software or a more efficient warehouse layout doesn't look like an expense anymore.

Instead, it becomes a smart business decision. When you can prove that the investment will significantly lower your carrying costs over time, the upfront expense is a no-brainer.

Calculating your holding costs is really about understanding how efficiently your capital moves through the business. For a deeper look at this, consider mastering the cash conversion cycle, a metric that measures exactly how long your cash is tied up in your operations.

By actively managing this number, you transform holding cost from a passive expense into a powerful tool for building a more resilient and profitable business.

Proven Strategies to Reduce Your Holding Costs

Knowing what holding costs are and how to run the numbers is half the battle. Now comes the important part: taking control. Slashing these carrying costs is one of the most direct ways to fatten your profit margins, freeing up cash you can pour back into your next deal or business growth.

Thankfully, you don’t have to just sit there and watch the meter run. There are several tried-and-true strategies you can use to get these expenses under control. Each one tackles a different piece of the puzzle, from how you buy your assets to how you manage them day-to-day.

Fine-Tune Your Acquisition and Inventory Strategy

The fastest way to cut holding costs is brutally simple: hold the asset for less time. For businesses dealing with physical products, this often means adopting a Just-in-Time (JIT) inventory system. Instead of stockpiling materials, they arrive right when they’re needed for production, which drastically cuts down on warehouse space and tied-up capital.

For real estate investors, the equivalent of JIT is all about speed and efficiency. It means having your entire game plan—contractors, materials, marketing, and financing—locked in before you even sign the closing papers. Your goal is to crush the "sitting period" where the property is just a cash drain instead of moving toward a sale or lease.

Improve Your Forecasting and Management

Bad predictions are a primary cause of sky-high holding costs. It doesn't matter if you're overestimating demand for a product or misjudging a renovation timeline; getting it wrong leaves you with expensive, idle assets bleeding you dry.

The antidote is data. Dive into your historical sales trends, study local market absorption rates, and get realistic timelines from your contractors. Better data fuels smarter purchasing decisions and project schedules, which translates directly into lower carrying costs.

Don't let an obsolete product or a stagnant property become an anchor. Proactively selling off a slow-moving asset—even if it's for a small loss—is almost always more profitable than letting its holding costs pile up month after month.

Smart management also means leveraging every financial advantage you have. For example, thoroughly exploring rental property tax deductions can significantly ease the burden of property taxes, which are often one of the biggest chunks of your carrying costs.

Optimize Your Physical Space and Operations

How you manage your physical space has a surprisingly large impact on your bottom line. If you run a business with a warehouse, this is about pure efficiency. Think about organizing inventory so your fastest-moving items are closest to the shipping docks. It's a small change that shaves off labor and handling costs on every single order.

For property investors, this same principle applies to securing and maintaining your asset as cost-effectively as possible. This includes things like:

- Shopping for better insurance: Don't just renew your vacant property or landlord policies without question. Get fresh quotes regularly.

- Negotiating with service providers: Get multiple bids for everything from landscaping and security to routine maintenance.

- Controlling utility usage: In a vacant property, smart thermostats and light timers are your best friends for minimizing electricity and heating bills.

Finding the right mix of these cost-saving measures is key. Below is a comparison to help you decide which strategies might be the best fit.

Comparing Inventory Cost Reduction Strategies

| Strategy | Primary Benefit | Implementation Difficulty | Best For |

|---|---|---|---|

| Just-in-Time (JIT) | Drastically reduces storage needs & capital costs | High | Businesses with predictable demand & reliable suppliers |

| Improved Forecasting | Prevents over-purchasing & dead stock | Medium | Any business or investor with access to historical data |

| Space Optimization | Lowers labor & operational costs | Low to Medium | Businesses with warehouses or investors managing properties |

| Tax Optimization | Directly reduces a major fixed expense (taxes) | Low | Real estate investors and property owners |

| Proactive Liquidation | Frees up capital from non-performing assets | Low | Businesses with slow-moving inventory or investors with stagnant properties |

Each of these small adjustments adds up, contributing to a much lower overall holding cost and putting more money back where it belongs—in your pocket. By weaving these strategies into your operations, you can systematically turn a potential financial drain into a well-managed, profitable asset.

Frequently Asked Questions About Holding Costs

Understanding holding costs is a key step in making a smart home purchase or investment. Here are answers to some common questions that come up.

What are the biggest holding costs I should plan for?

For most home buyers and investors, the "big three" holding costs are the mortgage payment (principal and interest), property taxes, and homeowners insurance. These are often bundled together in one monthly payment called PITI. However, don't forget other significant costs like HOA fees, utilities (even in a vacant house), and basic maintenance like lawn care, as these can add up quickly.

How can I lower my holding costs when buying a house?

The best way to lower your holding costs is to reduce the time the property is vacant. If you're renovating, have your contractors and materials lined up before you close. If you're renting it out, start marketing for a tenant immediately. You can also shop around for the best mortgage rate and homeowners insurance policy. Negotiating with service providers for things like landscaping can also help trim these ongoing expenses.

How do I budget for unexpected repairs?

Unexpected repairs are one of the biggest risks that can inflate your holding costs. The best defense is a good offense: a contingency fund. A standard rule of thumb is to set aside 5-10% of your total renovation budget specifically for surprises like a hidden leak or a faulty electrical panel. For a rental property, aim to save 1% of the property's value annually for maintenance. This buffer prevents a single unexpected issue from derailing your entire budget.

Are holding costs tax-deductible?

Yes, many holding costs can be tax-deductible, but it depends on your situation. If you own a rental property, expenses like mortgage interest, property taxes, insurance, and maintenance are generally deductible against your rental income. For a fix-and-flip, these costs are typically added to the property's cost basis, reducing the capital gains tax you owe when you sell. Always consult with a tax professional to understand what applies to your specific circumstances.

Ready to stop guessing and start analyzing properties with precision? Flip Smart gives you the tools to calculate potential profits, estimate renovation costs, and understand the true holding costs of any property in seconds. Make your next investment your best investment.