Trying to figure out what a house is really worth can feel like a guessing game. You see the list price, but how do you know if it’s fair? Is it a great deal, a total ripoff, or somewhere in between? This is where understanding a home's value becomes your most powerful tool as a home buyer.

In the past, you had to rely on your real estate agent or spend hours digging through public records. Today, technology known as real estate valuation software does the heavy lifting for you. Think of it as your personal property expert, giving you the confidence to know when to make an offer and when to walk away.

What is Real Estate Valuation Software?

At its heart, real estate valuation software is a tool that helps determine a property's current market value. It works by instantly analyzing huge amounts of information, like recent sales of similar homes in the area (often called "comps"), local market trends, and property details from public records.

This isn't just about getting a quick online estimate, which can sometimes be out of date. This technology gives you a more complete picture, helping you understand if the seller's asking price is realistic.

The main problem this solves for you as a buyer is uncertainty. In a fast-moving market, you don't have time to second-guess yourself. This software replaces gut feelings with solid data, allowing you to quickly check if a home is priced fairly. This means you can avoid overpaying for a property and spot a potentially good deal before other buyers do.

A Buyer's Secret Weapon

Imagine you're looking at two different houses. They have similar list prices, but one needs a lot of work. How do you compare them? Manually, this would take a lot of research. Valuation software does the comparison for you in minutes.

- Saves You Time: It reduces the time you spend researching a property from hours to a few minutes, letting you focus on homes that are a good fit.

- Data-Backed Decisions: It helps you make offers based on facts, not emotions. You can see what other homes nearby have sold for and use that information in your negotiation.

- Reduces Your Risk: By giving you a clear idea of a home's value, it helps you avoid the biggest home-buying mistake: paying too much.

As a home buyer, making a confident offer is key. Having data to back up your offer price gives you a huge advantage during negotiations and provides peace of mind.

It's More Than Just a Price Tag

It's important to know that professional valuation tools are more advanced than the free estimators you see on big real estate websites. Those are great for a quick ballpark figure, but they don't tell the whole story.

More advanced real estate analysis software can also help you understand a home's future potential. For example, some tools can estimate what a home might be worth after you complete renovations (this is often called the After-Repair Value, or ARV).

This level of detail helps you see the bigger picture. Is this home just a place to live, or is it also a smart financial investment? Knowing the answer gives you the confidence to make the right choice for your future.

How Key Features Help You Understand a Home's Value

To really appreciate how real estate valuation software can help you, it's useful to know what it's actually doing. These tools aren't just calculators; they are smart systems designed to answer the most important questions you have as a buyer. They take all the confusing market data and present it in a clear, simple way.

The demand for this technology is growing fast. The global market for this software is expected to reach $2.3 billion by 2028. Why? Because in a market where home prices can change quickly—like when U.S. home values jumped 40% between 2020 and 2022—buyers need reliable information more than ever.

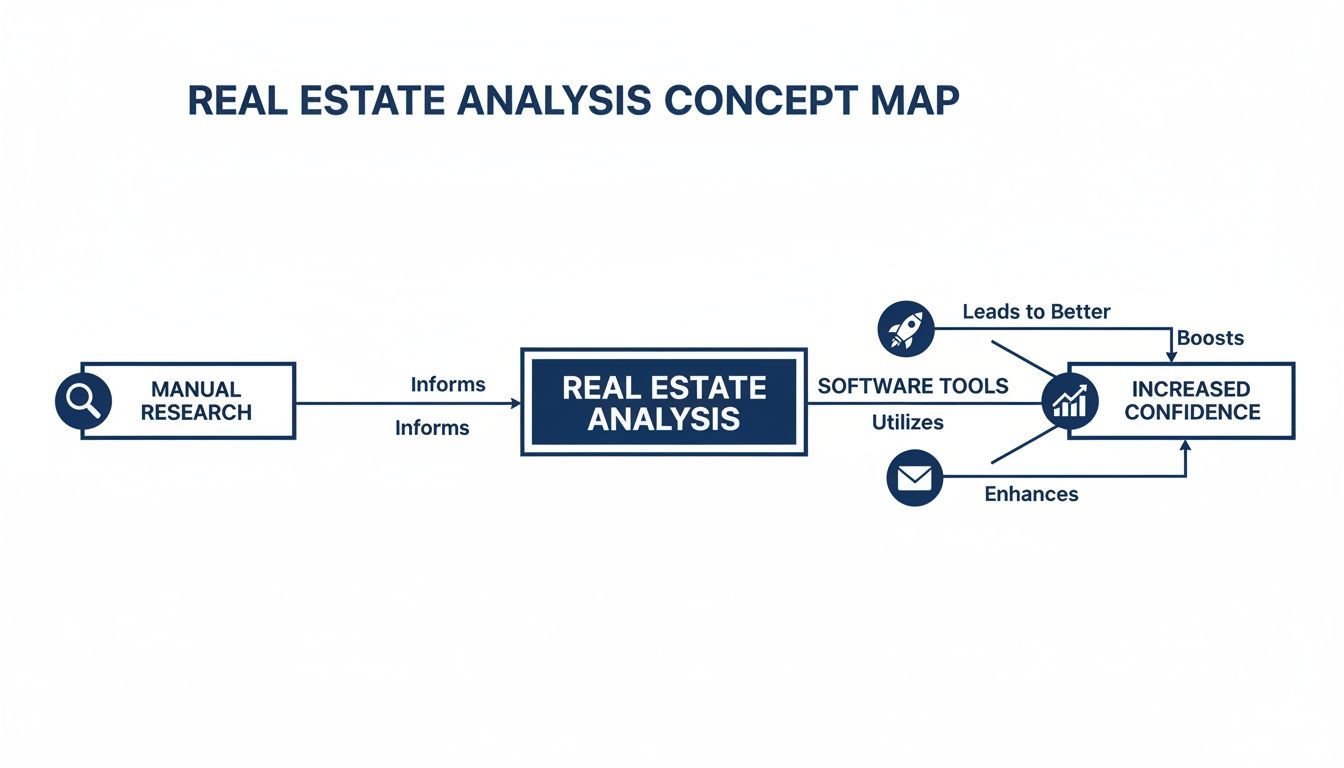

The image below shows the basic idea: moving from confusing manual research to clear, confident decisions powered by software.

As you can see, the software helps you quickly move from basic research to the confidence you need to make a smart offer. Trying to do that with just a few online listings is much harder.

Let's look at the key features that make this possible.

Key Features of Real Estate Valuation Software

The table below explains the most important features you'll find in these tools. It breaks down what each one does and why it’s so helpful for a home buyer.

| Feature | What It Does | Why It Matters For Home Buyers |

|---|---|---|

| Automated Valuation Model (AVM) | Instantly estimates a property's current market value by analyzing recent comparable sales, public records, and market trends. | Gives you an immediate, data-backed starting point to judge if the asking price is fair. |

| After Repair Value (ARV) Calculator | Projects the future market value of a property after planned renovations are completed. | Perfect for buyers looking at fixer-uppers. It helps you see if your renovation plans add real value. |

| Rehab Cost Estimator | Provides an itemized breakdown of renovation costs based on local labor and material prices for specific projects (e.g., kitchen, roof). | Helps you create a realistic budget for renovations so you don't have any surprise expenses later. |

| Cash Flow & Risk Analysis | Forecasts a rental property's long-term financial performance, including income, expenses, and overall return. | Essential if you're thinking of buying a home to rent out (or renting out a room). |

These features work together to give you a complete financial picture, helping you understand both the home's current worth and its future potential.

Automated Valuation Models (AVMs)

The first thing you’ll use is the Automated Valuation Model (AVM). Think of it as a super-fast property researcher. AVMs analyze data on recently sold homes in the area to give you a quick estimate of a property’s current market value.

They look at:

- Recent Comparable Sales (Comps): What did similar homes nearby sell for in the last few months?

- Public Records: Official data on the home’s size, age, and tax history.

- Market Trends: Is the local housing market getting hotter or colder?

This gives you a solid starting point for your research and answers that first big question: "What is this house worth right now?"

After Repair Value (ARV) Calculation

If you’re considering buying a fixer-upper, the After Repair Value (ARV) calculator is your best friend. It doesn't just tell you what a property is worth today; it predicts what it will be worth after you finish your planned renovations.

For example, you can tell the software you plan to update the kitchen and bathrooms, and it will estimate a new, higher value based on what renovated homes in the area have sold for. This helps you figure out if the effort and cost of renovating will pay off.

Detailed Rehab Cost Estimation

Guessing how much renovations will cost is a recipe for disaster. A good rehab cost estimator helps you avoid this by creating a realistic budget.

This feature gives you a detailed list of what different projects might cost, using local prices for materials and labor. So instead of a vague "kitchen budget," you get a real-world estimate:

- Kitchen Remodel: $15,000 - $25,000

- Roof Replacement: $8,000 - $12,000

- Interior Painting: $3,000 - $5,000

Knowing these costs upfront is crucial for making sure you don't end up spending more than you planned.

Cash Flow and Risk Analysis

If you're thinking about buying a property to rent out, either as a full-time rental or just renting a spare room, cash-flow analysis is essential. These tools help you predict if the property will actually make you money over time.

They calculate key numbers like:

- Net Operating Income (NOI): Your total rental income minus all your expenses (like taxes, insurance, and repairs).

- Cash-on-Cash Return: The annual return you get on the actual cash you invested.

- Capitalization (Cap) Rate: A popular metric used to compare the profitability of different rental properties.

Many platforms include tools similar to a comprehensive rental property ROI calculator to help with these calculations.

Quick Takeaway: Some of the best software also includes risk assessment. These tools can flag potential issues, like being in an area with declining property values or unusually high taxes, helping you avoid a bad investment.

The Role of AI and Data in Modern Property Valuation

What makes today's best real estate valuation software so powerful? It's a combination of artificial intelligence (AI) and access to huge amounts of data. This technology acts like a team of market experts working for you around the clock to analyze property values.

AI algorithms can look at millions of data points instantly. They don't just check a few recently sold homes; they analyze every relevant property listing, public record, and local market trend all at once. This provides a level of detail that would be impossible for a person to gather on their own, and you get the results in seconds.

Making Powerful Technology Accessible

A few years ago, this kind of advanced analysis was only available to large investment companies with big budgets. Today, online platforms have made these tools accessible to everyone.

Because the software is cloud-based, you don't need to install anything or have a super-powerful computer. You can access these tools from any device with an internet connection, whether you're at home on your laptop or at an open house on your smartphone. This has made data-driven home buying a reality for everyone.

This combination of AI and cloud technology is changing how people buy homes. The real estate software market is expected to grow by $7.2 billion between 2023 and 2028, mostly because of these advanced tools. For buyers, this means you can get instant, reliable information on a home's value and potential renovation costs, all backed by data.

From Simple Estimates to Smart Predictions

The real benefit of AI-powered analysis isn't just speed; it's the quality of the information. Basic online estimators give you a single, static number. Modern real estate valuation software, however, can provide a more dynamic, forward-looking view.

This is where predictive analytics come in. Instead of just telling you what a property is worth today, AI can forecast how its value might change in the future based on market trends. It can help you spot up-and-coming neighborhoods or warn you about potential risks that aren't immediately obvious.

The Bottom Line: AI-driven analysis helps you move from just reacting to the market to anticipating it. This proactive approach can give you a major advantage, helping you find a great home at a fair price before it gets snapped up.

Gain an Edge with Speed and Information

In today's competitive housing market, speed is everything. The best-priced homes often receive offers within hours. If you're still relying on slow, manual research, you could miss out.

Technology allows you to evaluate multiple properties in the time it used to take to research just one. This lets you quickly filter out overpriced homes and focus your energy on the ones with real potential. For a deeper look at how this works, check out our guide on data analytics in real estate.

This efficiency doesn’t just save you time—it fundamentally improves your chances of finding and buying the right home for you.

Choosing the Right Software for Your Home Buying Journey

Just like a chef needs the right knife for a specific task, a smart home buyer needs the right tools for their search. The world of real estate valuation software isn't one-size-fits-all. A tool that’s perfect for someone buying a fixer-upper might not be the best fit for a first-time buyer looking for a move-in ready home.

So, how do you choose? You need to think about your specific goals. What are you looking for in a home? Answering this question will help you find a tool that truly helps you.

Matching Software Features to Your Goals

Different types of home buyers need different information. Let's break down some common buyer scenarios and the software features that are most helpful for each.

The First-Time Home Buyer: Your main goal is to find a great home without overpaying. The most important feature for you is a reliable Automated Valuation Model (AVM). This will help you quickly check if the asking prices of the homes you like are fair compared to the rest of the market.

The Fixer-Upper Buyer: You're looking for a home you can improve to build equity. For you, the software must have an accurate After Repair Value (ARV) calculator and a detailed rehab cost estimator. These tools will help you figure out if your renovation ideas will be a smart financial move.

The Aspiring Landlord: You're buying a home with the intention of renting it out, or perhaps renting out a spare room. You'll need a platform with strong cash flow analysis. This will help you predict your rental income, account for expenses, and see if the property will be profitable long-term.

Quick Tip: Don't get distracted by features you don't need. If you're not planning to renovate, you don't need the most advanced rehab cost estimator. Focus on finding a tool that excels at what's most important for your home search.

To help you find the right fit, here’s a simple checklist matching buyer types to their most important software features.

Software Feature Checklist by Buyer Type

| Buyer Type | Must-Have Features | Nice-to-Have Features |

|---|---|---|

| First-Time Buyer | • Accurate AVM • Easy-to-understand market comps • Simple user interface | • Rehab Cost Estimator • Long-term appreciation forecasts |

| Fixer-Upper Buyer | • Accurate ARV Calculator • Detailed Rehab Cost Estimator • Professional Report Generation | • Rental comps analysis • Long-term cash flow tools |

| Aspiring Landlord | • Robust Cash Flow Analysis (NOI, CoC) • Rental Comps & Market Trends • Long-Term Appreciation Projections | • Detailed Rehab Cost Estimator • Quick property screening tools |

This table should help you narrow down your options. Look for platforms that are strong in your "Must-Have" column, and you'll be on the right path.

Your Evaluation Checklist

When you're trying out a new tool, it's easy to get overwhelmed by all the options. Use this checklist to stay focused on what really matters for your home search.

Data Accuracy and Sources: Ask the question: Where does the data come from? The best tools get their information from multiple reliable sources, like the official Multiple Listing Service (MLS) and public property records. Make sure the data is updated frequently. A valuation based on old sales data isn't very helpful.

Ease of Use: You shouldn't need a degree in finance to understand a property's value. Look for a tool with a simple, clean interface that gives you a clear report just by typing in an address. The most important numbers should be easy to find.

Report Quality: Can you save or share a professional-looking report? This can be very helpful when discussing a property with your real estate agent or a family member.

Pricing: Does the pricing fit your needs? Some tools charge for each report, while others offer a subscription for unlimited use. Choose a plan that makes sense for how many homes you plan to look at.

Of course, even the best analysis software is useless if you don't have good properties to evaluate. To find potential homes, you might also look into real estate lead generation software or work closely with a great real estate agent. Finding the right homes to analyze is just as important as the analysis itself.

How to Check a Home's Value with Software

Knowing about the features of real estate valuation software is one thing, but using it is where it gets exciting. Let's walk through a simple example of how a smart buyer can analyze a potential home in just a few minutes, turning a "For Sale" sign into a clear action plan.

Imagine you've found a home you love online. It's in the right neighborhood and has the right number of bedrooms, but you're not sure about the price. Instead of spending hours searching for comparable sales, you just open your software and type in the address.

From Address to Actionable Report

The first thing you'll see is an Automated Valuation Model (AVM), which gives you a solid estimate of the home's current market value. This is your starting point. From there, the process is simple:

Consider the After Repair Value (ARV): If the home needs work, you can tell the software what you plan to do—like update the kitchen or finish the basement. The system will then look at recently sold homes in the area that have had similar upgrades and calculate a new, higher value (the ARV). This helps you see if your potential sweat equity will pay off.

Estimate Renovation Costs: Next, you can use the rehab cost estimator. You can select the projects you have in mind, and the software will create a detailed budget based on local costs. This helps you avoid the common mistake of underestimating how much renovations will cost.

See the Big Picture: With the asking price, potential ARV, and renovation budget, the software can give you a complete financial overview. For buyers, this helps you understand if you're making a sound investment and not just buying a home.

Visualizing the Financials

A good software tool won't just throw a bunch of numbers at you. It will display the information in a clean, easy-to-read report, giving you a clear "yes" or "no" signal on whether the home is a good value.

This report shows you clear financial projections that tell the whole story. This kind of visual clarity helps you understand a home's potential in seconds. A powerful real estate deal analyzer is the key to making these kinds of confident, data-backed decisions.

The entire process—from typing in an address to getting a complete financial picture—can take less than five minutes. Trying to find all this information on your own could easily take an entire afternoon, and in a hot market, the best homes don't wait around.

This combination of speed and accuracy gives you a major advantage. It means you can evaluate more homes, make smarter offers, and feel more confident in your decisions. Most importantly, it gives you the data you need to walk away from an overpriced property—which is often the smartest move a buyer can make.

Frequently Asked Questions (FAQ)

Jumping into the world of real estate can bring up a lot of questions. Here are answers to some common concerns buyers have about valuing a home.

How accurate is this software compared to a professional appraisal?

Real estate valuation software is very accurate for giving you a quick, data-driven estimate of a home's value. It often comes within a few percentage points of a formal appraisal. However, it's a tool for your initial research, not a legal substitute for a licensed appraiser. An appraiser will physically inspect the home's condition, which software cannot do. Use the software to decide if a home is worth pursuing, but you will still need a formal appraisal to secure a mortgage.

What are the most important things to check before buying a house?

Beyond the price, focus on the "big ticket" items. Your home inspection is critical here. Pay close attention to the roof, foundation, HVAC system (heating and air conditioning), plumbing, and electrical systems. Problems with these can be very expensive to fix. Also, check for any signs of water damage, look at the age of major appliances, and consider the home's location and neighborhood.

How can I get the best mortgage rate?

To get the best mortgage rate, start by improving your credit score, as lenders offer the best rates to borrowers with high scores. Save for a larger down payment—putting down 20% or more can help you avoid private mortgage insurance (PMI) and may get you a better rate. Finally, shop around and compare offers from at least three to five different lenders, including banks, credit unions, and online mortgage brokers. Don't be afraid to negotiate the terms.

What is a good "rule of thumb" for a fixer-upper?

A popular guideline for investors buying fixer-uppers is the 70% Rule. It states that you should pay no more than 70% of the home's After Repair Value (ARV) minus the cost of the repairs. For a regular home buyer, this rule can still be a helpful check. For example, if a home could be worth $300,000 after $40,000 in repairs, the 70% rule suggests a target purchase price around $170,000 ($300,000 x 0.70 = $210,000, then $210,000 - $40,000 = $170,000). While you may not get a deal that good, it helps you be realistic about costs and potential equity.

Ready to stop guessing and start analyzing homes with data-driven confidence? Flip Smart gives you the power to evaluate any property in seconds, providing accurate valuations, detailed rehab costs, and clear profit projections. Reduce your analysis time from hours to minutes and make smarter, faster investment decisions.

Discover how Flip Smart can transform your investing strategy today!