Before you pop the champagne and start picking out paint colors, there's a crucial step in the home-buying process called due diligence. Think of it as doing your homework on what is likely the biggest purchase of your life. It's the detective work you do before signing on the dotted line to make sure the house is everything it appears to be.

This critical investigation protects you from costly surprises and ensures you're making a confident, informed decision. It's your single best tool for turning a house you like into a home you'll love for years to come.

Your Foundation for a Smart Purchase

Long before you get the keys, the real work begins. Finding the right home has very little to do with luck and everything to do with a disciplined, systematic investigation.

This process, known as due diligence, is your chance to vet the property thoroughly. It's how you move past the beautiful listing photos and into the hard facts that will impact your life and finances.

Think of yourself as an investigator building a case for your future home. Your job is to verify claims, ask tough questions, and uncover any hidden details that could cause headaches down the road. You should approach every property with a healthy dose of curiosity.

Why Due Diligence is Non-Negotiable

Cutting corners on due diligence is one of the quickest ways to turn your dream home into a financial nightmare. It's the safety net that catches problems the seller either didn't disclose or, sometimes, didn't even know existed. A proper investigation is what confirms a home's true condition and protects your hard-earned savings.

Thorough real estate due diligence helps you:

- Verify the Home's Condition: Find costly surprises—like a failing roof, an ancient furnace, or foundation cracks—that can wipe out your budget.

- Confirm Legal Standing: Check for a clean title and any weird zoning restrictions or easements that might limit how you can use your property.

- Understand What You're Buying: Get a clear picture of property lines, homeowners' association (HOA) rules, and any local regulations.

- Gain Negotiating Power: The information you uncover can be used to negotiate a lower price or ask the seller to make repairs before you close.

When you complete your due diligence, you’re not just buying a house; you're making a sound investment in your future. You're replacing assumptions with facts, which is the only way to buy a home with complete confidence.

The Core Components of Your Investigation

A truly comprehensive due diligence process looks at every part of the property. While the specifics might change—a condo in the city has a different checklist than a house in the suburbs—the core principles are always the same. You need to scrutinize the physical structure, the legal paperwork, and the neighborhood with equal intensity.

This goes way beyond just a quick walkthrough. It's a 360-degree review designed to give you a complete picture of the asset you're about to buy.

You’ll be looking at inspection reports, the property's title history, and local zoning rules. Each document is another piece of the puzzle, helping you build an accurate picture of the home's health. Armed with this knowledge, you can negotiate from a position of strength and make decisions based on confidence, not hope.

Mastering the Financial Analysis

The asking price is just the starting point. The real story of a home's affordability is in its total cost of ownership. This is where you put on your financial detective hat and start verifying every number to make sure the home fits your budget long-term. Your job is to look past the monthly mortgage payment and build an accurate, evidence-based forecast of what the property will actually cost to own.

This is the absolute heart of your real estate investment due diligence. It’s how you confirm a home isn’t just beautiful on paper but is affordable in the real world. Skip this, and you're just gambling.

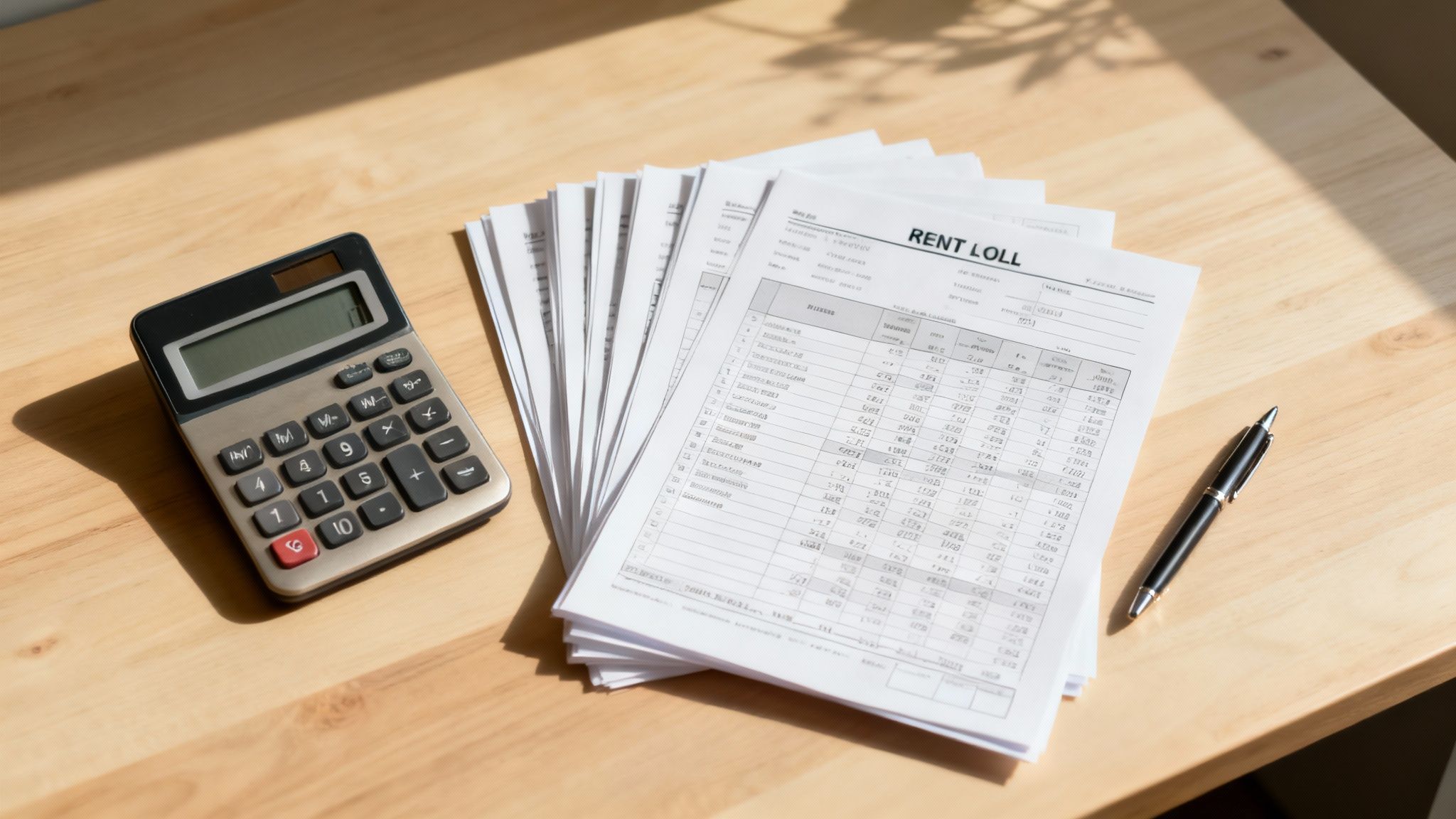

Deconstructing the Rent Roll

First things first: get your hands on the rent roll. This document is way more than a list of tenants and their payments; it’s a direct snapshot of the property’s income stability. A proper rent roll will show you tenant names, unit numbers, lease start and end dates, security deposits, and any late or unpaid rent.

What are you looking for? Patterns. Are there a bunch of vacancies? Do you see the same tenants consistently paying late? A high number of month-to-month leases can be a red flag, signaling instability since those tenants can pack up and leave with very little notice. These details tell you everything about the quality and reliability of the income stream you're about to take over.

A clean rent roll with long-term, on-time tenants is a huge green light. On the flip side, a report showing high turnover and delinquencies means you need to dig much deeper into the property’s management and how they screen tenants.

Verifying Operating Expenses

A property’s income is only half the equation—the expenses are what determine your actual profit. Never, ever take the seller’s expense sheet at face value. You need to request and comb through actual utility bills, maintenance records, property tax statements, and insurance policies for at least the last 12-24 months.

This is non-negotiable for sniffing out hidden costs. For instance, a suspiciously low maintenance budget might just mean the current owner has been putting off necessary repairs, leaving you with a massive bill right after you close. Another great move is to compare their stated expenses to industry averages for similar properties in the area. That can expose some major discrepancies.

For a more detailed walkthrough, check out our guide to real estate investment analysis.

Before you go any further, it's a good idea to create a simple checklist of the key financial documents you need to review. This keeps you organized and ensures you don't miss anything critical.

| Key Financial Due Diligence Checklist |

|---|

| Document/Metric |

| Rent Roll |

| Operating Statements (P&L) |

| Utility Bills |

| Property Tax Statements |

| Maintenance Records |

| Insurance Policies |

Having this checklist handy ensures you're asking the right questions and looking at the right documents, which is crucial for building an accurate financial picture of the investment.

Calculating Key Performance Metrics

Once you have verified income and expense numbers, you can start calculating the metrics that really matter. Two of the most important are Net Operating Income (NOI) and Cash-on-Cash Return.

- Net Operating Income (NOI): This is your property's total income minus all operating expenses (but not your mortgage). A healthy, stable NOI is the bedrock of a profitable operation.

- Cash-on-Cash Return: This metric tells you how hard your actual down payment and closing costs are working for you. It measures the annual cash flow you get back relative to the total cash you put into the deal.

Calculating these figures yourself with verified numbers gives you a clear, unbiased look at the property’s financial health. It cuts through the marketing fluff and shows you the raw performance.

With the global real estate fundraising market seeing renewed confidence in early 2025—hitting $110.54 billion, a 16% jump from the previous year—there's more capital chasing deals. This makes your financial analysis even more critical. You have to be absolutely sure your numbers are solid to protect your returns in a competitive market.

This is where a tool like Flip Smart becomes your secret weapon. It automates a ton of this number-crunching. You plug in the data you've gathered, and it instantly generates reports on potential cash flow and profitability. This saves you hours of fiddling with spreadsheets and helps you make sharp, data-driven decisions much faster.

The Physical Property Inspection Deep Dive

The listing photos tell you how a property looks. The physical inspection tells you what it's going to cost. This is where the rubber meets the road. You move from the neat world of online galleries into the messy reality of foundations, wiring, and plumbing.

Every house has a story, and a proper inspection lets you read the chapters the seller may have left out. A fresh coat of paint can hide a multitude of sins, from old plumbing to a roof that's one storm away from disaster. Your job is to look past the surface and get to the home's core systems.

Honestly, this part of your real estate due diligence is non-negotiable. Missing one major issue can vaporize your savings for years.

Assembling Your Inspection A-Team

You should absolutely do your own walkthrough first. Get a feel for the place. But you can't stop there. You need to bring in the pros.

A licensed home inspector is your first and most important call. These professionals are trained to spot hundreds of potential red flags, from the foundation right up to the shingles. They see things you won't.

But sometimes, you need to call in specialists for a closer look:

- Structural Engineer: If the inspector mentions "significant foundation cracks" or "bowing walls," you call an engineer. Period. They'll tell you if it's a minor settlement issue or a deal-killing structural failure.

- HVAC Technician: An old furnace or AC unit is a ticking time bomb for your budget. A tech can give you an honest assessment of its remaining life and efficiency.

- Master Electrician: Old wiring or an outdated electrical panel isn't just an expense; it's a serious safety hazard. You need an expert's opinion here.

- Roofing Contractor: An inspector can guess the roof's age, but a roofer can give you a hard quote for replacement and a detailed report on its current condition.

Never, ever rely solely on the seller's disclosures. A professional, third-party inspection is your objective truth. It gives you the cold, hard facts you need to negotiate from a position of strength or walk away before it's too late.

Your Big-Ticket Inspection Checklist

During the inspection, you’re hunting for the big game—the systems that cost thousands, not hundreds, to fix or replace.

Focus your attention on these four critical areas:

- The Roof and Exterior: Look in the attic for water stains. On the outside, check for curling shingles or damaged flashing. Walk the perimeter and look for cracks in the foundation and make sure the ground slopes away from the house.

- The HVAC System: Find the manufacturing date on the furnace, AC unit, and water heater. Anything over 15 years old is on borrowed time and represents a major future expense you need to budget for.

- Plumbing and Electrical: Look under every sink for signs of leaks. Check the electrical panel for old wiring and make sure it has enough capacity for modern appliances—no one wants flickering lights.

- Structural Integrity: This is where you look for the really scary stuff. Are the floors uneven? Do doors stick or not close properly? These are classic signs of deeper, more expensive foundational problems.

Getting a handle on these potential costs is everything.

Uncovering Hidden Problems and Gaining Negotiating Power

The inspection report isn't just a list of what's broken; it's your single most powerful negotiation tool.

Let's say the inspector confirms the 20-year-old HVAC system is on its last leg. You can now get a replacement quote from a technician, take it back to the seller, and negotiate a price reduction or credit to cover that exact cost. It’s no longer your opinion; it’s a documented fact.

This strategy scales up, too. For commercial real estate (CRE), a smart, consolidated approach to due diligence can save millions. One CRE firm managing over 130 properties saved a staggering $3.5 million by streamlining their inspection process. They combined environmental assessments with energy audits, which helped them make faster decisions and align their spending with the building's actual needs.

The principle is the same for a single-family rental or a massive apartment complex. The more you know about the physical asset, the more leverage you have. A detailed report with repair estimates gives you the data to make a final decision based on the property’s true, all-in cost.

Navigating Legal and Regulatory Hurdles

A home can look perfect and pass a physical inspection with flying colors, but an unseen legal issue can sink the entire deal. This is where you dig into the legal and regulatory side of due diligence—it’s the step that makes sure no hidden claims, restrictions, or compliance headaches are waiting for you after closing.

This process is all about protecting you from inheriting someone else’s problems. A thorough legal review confirms that what you think you’re buying is exactly what you’ll own, free and clear. Overlooking this part of your real estate due diligence is a mistake no savvy home buyer can afford to make.

Unpacking the Title Report

The first document you'll dive into is the title report. Think of it as the property's official biography. A title insurance company digs through public records to prepare this report, confirming the seller is the legal owner and identifying any claims against the property.

These claims, known as liens or encumbrances, are essentially debts attached to the property itself. They could be from an unpaid mortgage, a contractor who was never paid for a renovation, or even overdue property taxes. If these aren't cleared before you close, they can become your problem—and your bill to pay.

The goal of a title search is simple: to ensure you receive a "clean title." This means the seller has the undisputed right to sell the property and that no other parties can lay claim to it once it’s yours.

Zoning, Codes, and Community Rules

Beyond the title, you need to investigate the rules that govern how you can actually use the property. These regulations exist at multiple levels, and ignoring them can lead to hefty fines or being forced to undo your renovations.

Your legal due diligence has to cover these three key areas:

- Zoning Laws: These are city or county rules that dictate what a property can be used for (e.g., residential, commercial, mixed-use). You have to verify that your plan—whether it's adding a deck or building a home office—is actually allowed under the current zoning. Don't assume.

- Building Codes: Every renovation or repair must comply with local safety and construction standards. An older property might not meet current codes, which could mean expensive, mandatory upgrades if you plan on doing any significant work.

- HOA Rules (Homeowners' Association): If the property is in a community with an HOA, you need to get a copy of the covenants, conditions, and restrictions (CC&Rs). These can govern everything from what color you can paint the house to whether you're allowed to have a fence.

Understanding Easements and Encroachments

During your review, two words you'll likely see are easement and encroachment.

In plain English, an easement gives someone else the right to use a part of your property for a specific purpose. A classic example is a utility company having an easement to run power lines across your backyard.

An encroachment is when a neighboring structure, like a fence or a shed, crosses over your property line. Both can limit how you use your land and are critical to identify before you close the deal.

It's worth noting how much technology has changed this part of the game. In 2025, investors are using AI-powered tools to spot red flags that were once easy to miss—things like inconsistent financial records or hidden regulatory issues. Enhanced Due Diligence (EDD) is now standard for high-value deals to comply with Anti-Money Laundering (AML) and Know Your Customer (KYC) rules. As technology makes this proactive risk detection possible, missing these red flags is no longer a simple mistake; it's a choice. You can find more insights on due diligence red flags investors still miss on Business Screen.

This legal deep dive ensures you won't face any surprises that restrict your plans or cost you a fortune down the road. It solidifies your ownership and gives you the confidence that your investment is secure from every legal angle.

Understanding Market and Tenant Dynamics

Let’s be honest: a fantastic property in a terrible market is just a well-decorated money pit. Once you've run the numbers and kicked the tires on the building itself, your next move is to zoom out. You have to analyze the world around the property.

The long-term health of your investment hinges just as much on the neighborhood's vitality as it does on the condition of the roof. You aren’t just buying brick and mortar; you're buying into a local economy. This is where seasoned pros separate themselves from the amateurs—they dig into the forces that drive rental demand and future appreciation.

Assessing the Health of the Local Market

First things first: you need to become a mini-expert on the property's submarket. What makes people want to live right there? A strong local economy provides a stable foundation for your investment, keeping vacancies low and giving you the power to raise rents over time.

Get your hands on hard data for these key metrics:

- Job Growth & Major Employers: Is the area attracting new companies or watching them leave? A diverse mix of stable employers is a massive green light.

- Population Trends: Are people moving in or heading for the hills? Local government and chamber of commerce sites are great sources for this.

- Upcoming Developments: Are new shopping centers, transit lines, or parks in the works? These are the kinds of projects that can seriously boost property values.

- Neighborhood Vibe: This one is old-school but critical. Drive the area at different times of the day and on the weekend. Do you see pride of ownership? Are public spaces well-kept? Does it feel safe?

- Schools and Amenities: For residential rentals, especially single-family homes, the quality of the local school district is a huge demand driver. Proximity to grocery stores, parks, and restaurants makes a property infinitely more attractive.

Gathering this intel builds a clear picture of the area's long-term potential. This is where the powerful role of data analytics in real estate comes into play, helping investors move beyond gut feelings to make predictions based on actual trends.

Conducting Thorough Tenant Due Diligence

If you're buying a property with tenants already in place, you're inheriting their financial habits—good or bad. This part of your due diligence is non-negotiable. It ensures the income stream you're buying is real and not a collection of headaches waiting to happen.

Never, ever take the seller's word that "all the tenants are great." You have to verify everything.

Your first step is a deep dive into the legal paperwork. Get a copy of every single lease agreement and read them.

A common rookie mistake is to just skim the rent roll. The real story is in the lease documents. That’s where you’ll find hidden details like renewal options, weird landlord responsibilities, or special deals the last owner cut.

With the leases in hand, lock in on these critical verification steps:

- Analyze the Tenant Payment History: Demand a detailed report showing every single payment from each tenant for at least the last 12-24 months. This is the single best indicator of reliability. A pattern of late payments is a massive red flag.

- Verify Security Deposits: Confirm the exact amount of each security deposit and, crucially, where that money is right now. Those funds belong to the tenant, not you or the seller. Make sure that cash is transferred to you at closing.

- Send Out Estoppel Certificates: An estoppel certificate is a simple but powerful legal document. The tenant signs it to confirm the core terms of their lease (rent amount, lease end date, deposit amount). This prevents a tenant from coming back later and claiming their rent was lower or their deposit was higher than what the seller told you.

This level of scrutiny is your shield. It protects you from inheriting a portfolio of non-paying tenants and future legal battles, ensuring the income you projected is the income you’ll actually collect.

Making Your Final Investment Decision

Okay, you've done the heavy lifting. The financial models are built, the inspector has walked the property, you've waded through the legal docs, and you know the local market inside and out. Now it’s time to put it all on the table.

This is the moment where all that real estate investment due diligence comes down to one simple question: Is it a deal, or not?

All the work you've done was about one thing: replacing gut feelings and assumptions with cold, hard facts. You now have the clarity to make a decisive move. You've uncovered the risks, and you can weigh them directly against the potential rewards.

The infographic below really nails the core areas you should have covered.

Think of it this way: the market, the property itself, and the financials are the three legs of the stool. If one is weak, the whole deal can wobble.

Putting It All Together

It's time for the final weigh-in. I like to create a simple summary sheet—a final "pros vs. cons" list.

On one side, list all the strengths. Maybe it's in a killer rental market with low vacancy rates. That's a huge plus. On the other side, list every single weakness you found. A 15-year-old HVAC system that’s on its last legs? That’s a clear con that needs a line item in your budget.

The goal isn't to find a perfect property—they don't exist. The goal is to understand every imperfection and confirm that the numbers still work after accounting for them.

This is what separates seasoned investors from amateurs. Having this level of detail gives you the confidence to either walk away from a money pit without a second thought or to move forward on a genuine opportunity with total conviction.

Frequently Asked Questions (FAQ)

What's the most important part of due diligence for a first-time home buyer?

For a first-time buyer, the professional home inspection is the most critical step. It provides an objective, expert opinion on the home's physical condition and uncovers potentially major expenses, like a faulty roof or an old furnace. This report is your best tool for understanding the true cost of the home and for negotiating repairs with the seller.

How long does the due diligence period usually last?

The due diligence period, often called the "inspection period" or "contingency period," is negotiable. For a standard single-family home purchase, it's typically between 10 to 17 days. This gives you enough time to schedule a home inspection, get reports back, and decide if you want to ask for repairs, renegotiate the price, or walk away from the deal.

What should I do if the inspection reveals major problems?

Don't panic! An inspection report with issues is very common. You have a few options:

- Ask for Repairs: You can request that the seller fix specific items before closing.

- Negotiate a Credit: Ask the seller for a credit at closing to cover the cost of future repairs. This allows you to control the quality of the work.

- Renegotiate the Price: Request a price reduction to account for the cost of the needed repairs.

- Walk Away: If the problems are too big or the seller is unwilling to negotiate, your inspection contingency allows you to cancel the contract and get your earnest money back.

Ready to stop guessing and start analyzing with confidence? Flip Smart automates your financial modeling, repair cost estimation, and profitability analysis, turning hours of tedious work into a few clicks. Make smarter, data-backed decisions on your next deal.

Analyze your first property for free at https://flipsmrt.com.