In today's competitive real estate market, relying on gut instinct and manual spreadsheets is a high-risk strategy. The crucial difference between a profitable acquisition and a financial misstep often boils down to the speed and accuracy of your deal evaluation. This is precisely where dedicated real estate investment analysis tools become indispensable. They automate complex calculations like cash-on-cash return, cap rate, and ROI, providing the data-backed insights needed to vet more opportunities with greater confidence.

This comprehensive guide is designed to cut through the noise, offering actionable insights into the top platforms available. We move beyond generic feature lists to provide a detailed breakdown of each tool, complete with screenshots, direct links, and practical use-case scenarios. You will discover the specific strengths and honest limitations of each option, helping you identify the right solution for your unique investment strategy. Whether you're a house flipper needing quick rehab estimates, a rental investor forecasting long-term cash flow, or an analyst modeling complex commercial properties, this resource will help you streamline your workflow and make more informed, profitable decisions.

1. Flip Smart

Flip Smart establishes itself as a premier, all-in-one real estate investment analysis tool, engineered to deliver comprehensive property insights with remarkable speed. Its core strength lies in its ability to condense hours of manual due diligence into a streamlined, sub-five-minute process. By simply inputting a property address, you gain immediate access to a wealth of data-driven calculations, making it an indispensable asset for those who value both precision and efficiency in their deal analysis. The platform's AI-powered engine is the key differentiator, providing instant valuations, detailed renovation cost estimates, and multi-strategy profit projections.

Key Features and Use Cases

The platform excels in its versatility, offering robust support for various investment strategies.

- Multi-Strategy Analysis: Whether you're a house flipper, a buy-and-hold landlord, or employing the BRRRR (Buy, Rehab, Rent, Refinance, Repeat) method, Flip Smart generates tailored reports. This flexibility allows you to pivot strategies and compare potential outcomes for a single property, ensuring you select the most profitable path forward.

- Comprehensive Reporting: Each analysis produces a professional-grade report that includes the After Repair Value (ARV), estimated rehab costs, holding costs, and potential profit margins. This is invaluable for securing financing, as the reports provide lenders with a clear, data-backed overview of the investment's viability.

- Risk Assessment: The tool goes beyond simple profit calculation by incorporating a risk assessment metric. This helps you identify potential red flags and make more informed, risk-averse decisions.

Why It Stands Out

Flip Smart's primary advantage is its synthesis of speed, accuracy, and depth. While many tools focus on one aspect, Flip Smart integrates everything into a single, cohesive dashboard. The AI-driven renovation estimates are particularly powerful, saving you the complex task of manually pricing out repairs. This feature alone significantly lowers the barrier to entry for new investors and provides a critical sanity check for seasoned professionals. For those looking to scale their operations, learning how to leverage such tools is a crucial first step. You can delve deeper into this topic by exploring Flip Smart's guide on starting a house flipping business.

Website:https://flipsmrt.com

| Feature | Details |

|---|---|

| Best For | Fix-and-flip investors, BRRRR strategists, and rental property owners needing rapid, all-inclusive analysis. |

| Pricing | Offers a free tier for basic analysis, with paid plans starting from monthly subscriptions for more reports. |

| Key Advantage | AI-powered automation that delivers a complete investment report in under five minutes. |

| Limitations | The credit-based system on lower tiers may restrict high-volume users. |

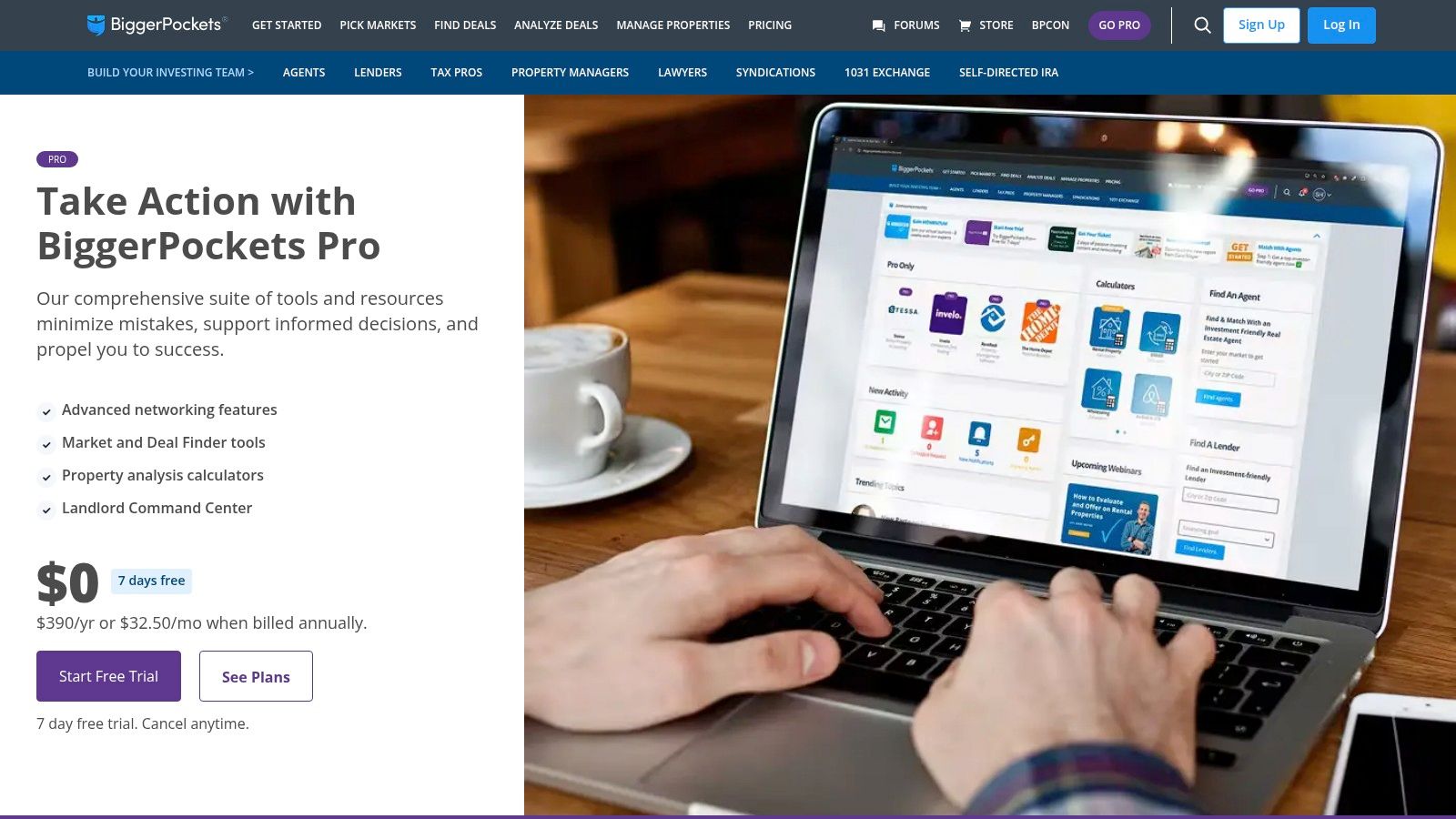

2. BiggerPockets Calculators (and Pro membership)

BiggerPockets has built its reputation as a central hub for real estate education and community, and its suite of analysis calculators is a cornerstone of that ecosystem. While many of its basic tools are free, the platform truly shines as one of the best real estate investment analysis tools for members with a Pro subscription. It offers specialized calculators for various strategies, including rental properties, BRRRR (Buy, Rehab, Rent, Refinance, Repeat), and house flipping, making it incredibly versatile for residential investors.

The platform’s strength lies in its integration with a vast community and educational content, which helps you refine your assumptions and underwriting skills. The interface is user-friendly, guiding you through inputs like purchase price, financing, and operating expenses to generate comprehensive reports. These professional, brandable PDF reports detail key metrics like cash flow, cash-on-cash return, and ROI, which are invaluable for presenting a deal to partners or lenders.

Key Features & Use Cases

| Feature | Best For |

|---|---|

| Strategy-Specific Calculators | Investors focusing on rentals, flips, or BRRRR who need tailored analysis. |

| Printable PDF Reports | Creating professional financing proposals or sharing deal analyses with partners. |

| Community Integration | New investors looking to get feedback on their deal assumptions from experienced pros. |

Actionable Insight: Use the calculator to run multiple scenarios on a single property. For example, model a deal as both a traditional rental and a potential flip to determine the most profitable exit strategy before making an offer.

- Pros: Very approachable for beginners, excellent educational support, generates clean reports for lenders.

- Cons: Key features are behind the Pro paywall, not designed for complex commercial property analysis.

- Access: A Pro membership is required for full access, currently priced around $390 per year.

- Website:https://www.biggerpockets.com/pro-membership

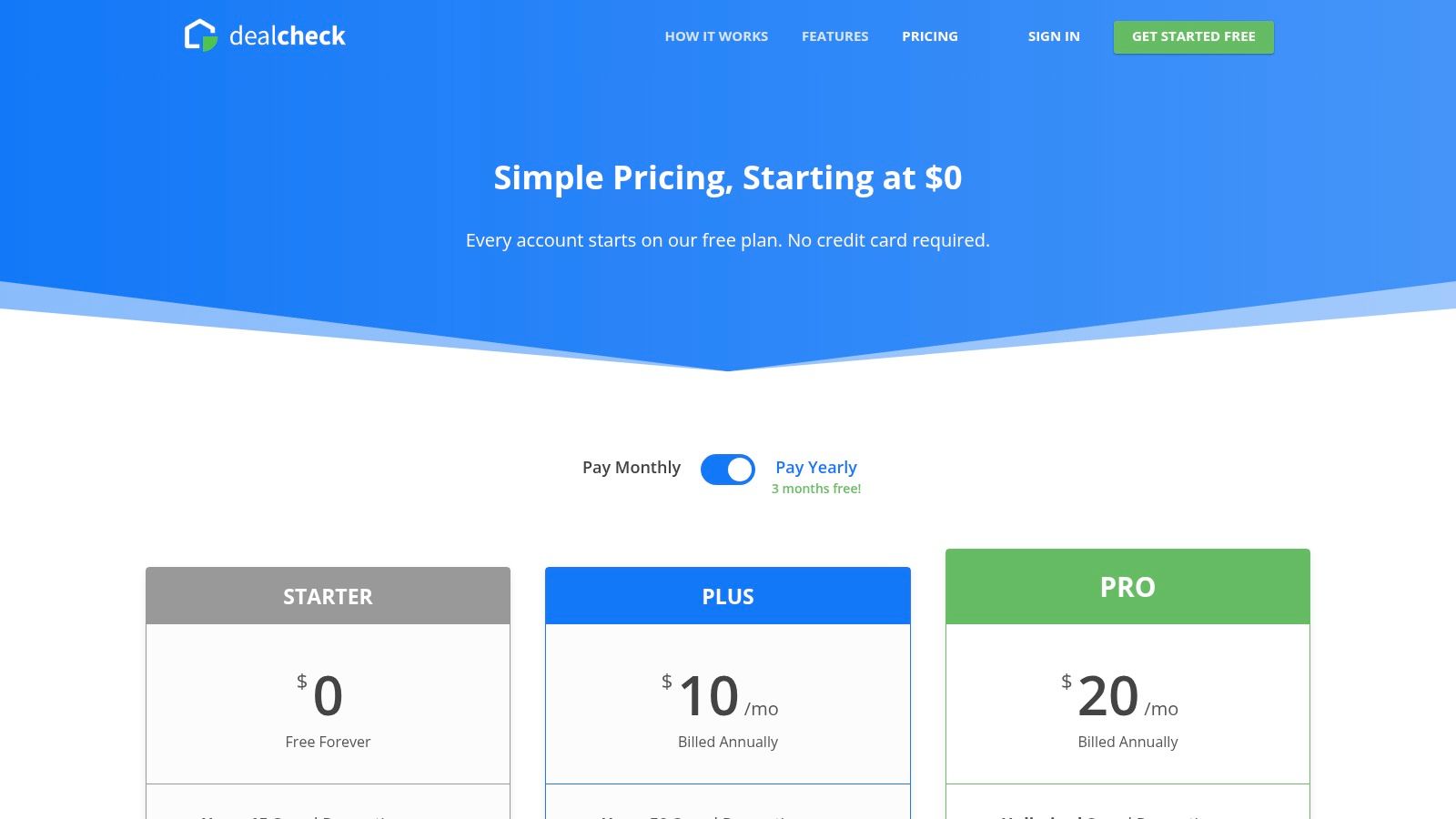

3. DealCheck

DealCheck is built for speed and accessibility, empowering investors to analyze rental properties, BRRRRs, flips, and even small multifamily deals in minutes. Its key strength lies in its mobile-first design and intuitive user interface, making it one of the most popular real estate investment analysis tools for on-the-go analysis. You can import property data directly from listings and run a comprehensive analysis right on your phone before even leaving a showing.

The platform guides users through every necessary input, from purchase details and financing to closing costs and operating expenses. It streamlines the underwriting process with integrated sales and rental comps, an offer calculator, and customizable property templates. This allows you to quickly compare potential investments against your personal buying criteria and generate professional, branded reports to share with partners or lenders, all from a single, easy-to-use dashboard.

Key Features & Use Cases

| Feature | Best For |

|---|---|

| Mobile-First Workflow | Investors who analyze deals on the go and need quick, reliable numbers. |

| Sales & Rent Comps Import | Validating ARV (After Repair Value) and market rent assumptions quickly. |

| Offer Calculator | Determining a maximum allowable offer based on your desired profit or return metrics. |

| Branded PDF Reports | Newer investors who need to present a professional deal analysis to secure funding. |

Actionable Insight: Set up your custom "Purchase Criteria" template with your minimum required cash flow, cash-on-cash return, and cap rate. DealCheck will then instantly show you a "Go" or "No-Go" recommendation on every property you analyze, saving significant time.

- Pros: Very quick to onboard and use on desktop and mobile, transparent, low pricing with a free tier.

- Cons: More oriented toward residential investors, less suited for complex commercial real estate lease modeling.

- Access: A robust free plan is available; paid plans start around $14 per month.

- Website:https://dealcheck.io/pricing/

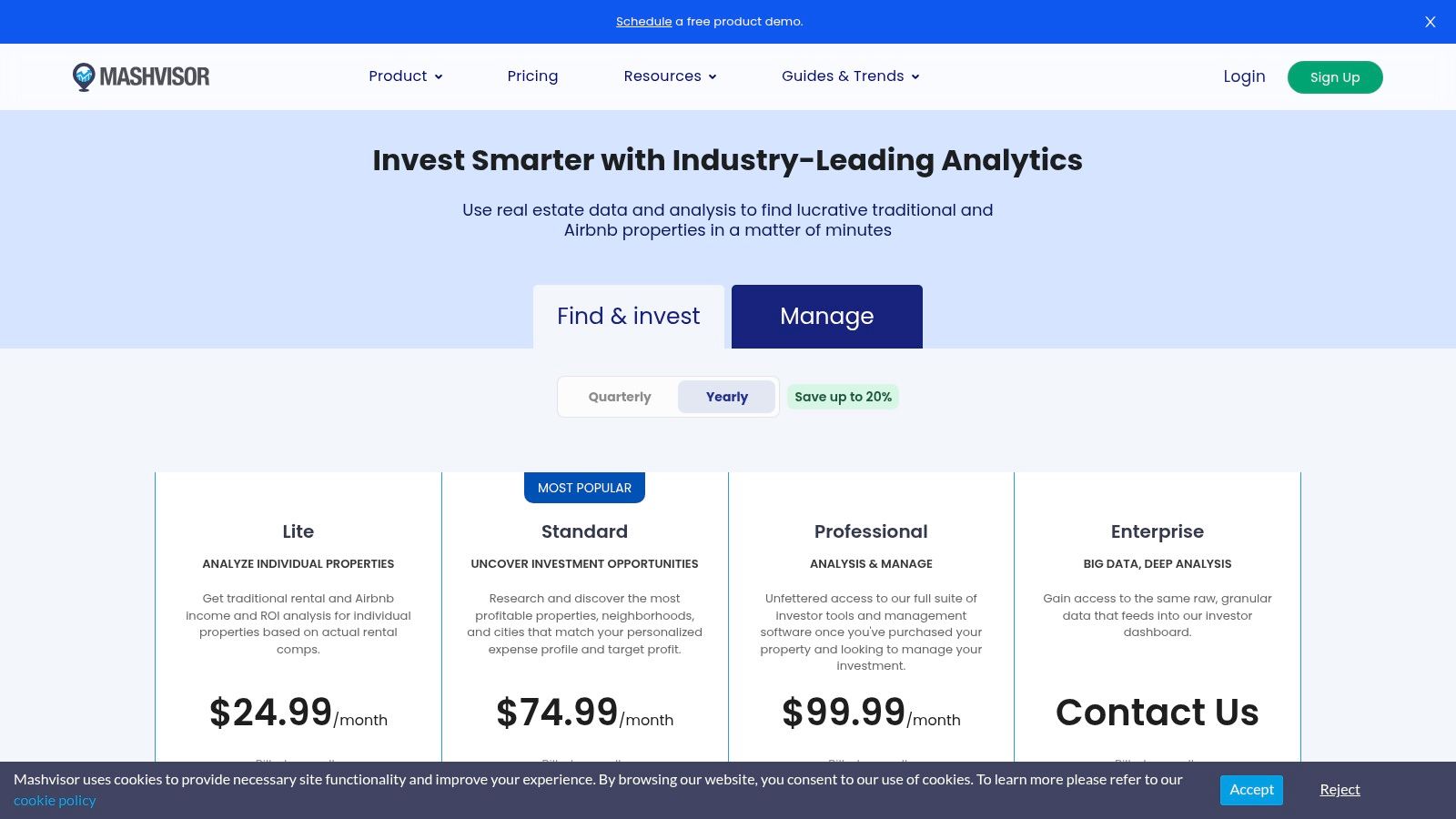

4. Mashvisor

Mashvisor excels as a data-driven platform designed to help investors quickly identify and analyze residential investment properties, with a unique focus on both traditional and short-term (Airbnb) rental strategies. It streamlines the market research and property screening process by consolidating neighborhood data, rental comps, and profitability projections into one interactive interface. For investors weighing different rental strategies, Mashvisor is one of the most effective real estate investment analysis tools for comparing potential cash flow and ROI side-by-side.

The platform's strength is its ability to provide AI-powered "Opportunity Scores" and predictive analytics that forecast metrics like cash-on-cash return, cap rate, and potential occupancy rates for thousands of properties across the U.S. This data-first approach saves you countless hours of manual research, allowing you to quickly zero in on markets and individual listings that align with your investment criteria, including crucial short-term rental regulatory information.

Key Features & Use Cases

| Feature | Best For |

|---|---|

| Short-Term Rental Analytics | Investors evaluating Airbnb potential and comparing it directly against traditional rental income. |

| AI-Powered Opportunity Scores | Quickly screening entire neighborhoods or cities to find high-potential investment zones. |

| Rental Regulations Data | Understanding local short-term rental laws to avoid compliance issues before investing. |

Actionable Insight: Use the "Property Finder" feature with your specific financial criteria (budget, financing, desired cap rate) to generate a targeted list of properties. This automates the initial search phase, letting you focus only on analyzing pre-vetted deals.

- Pros: Speeds up market screening for both short and long-term rentals, consolidates various rich data sources in one interface.

- Cons: Full feature set requires higher-tier subscription plans, data accuracy can vary by market.

- Access: Subscription plans are required, starting at around $49.99 per month for the Lite plan.

- Website:https://www.mashvisor.com/pricing

5. Stessa

Stessa shifts the focus from initial deal underwriting to ongoing asset management and portfolio analysis, making it an essential tool for landlords who have already acquired properties. It excels at simplifying the accounting and performance tracking for rental property owners. By connecting your bank accounts, Stessa automates income and expense tracking, categorizing transactions to give you a real-time view of your portfolio’s financial health. It's a powerful platform for monitoring existing investments rather than finding new ones.

The platform's strength is its ability to centralize all property-related financial data, generating key reports like cash flow statements and tax-ready documentation. This makes it one of the best real estate investment analysis tools for long-term hold investors who need to optimize operations and maximize returns over time. While its core features are free, the paid Pro plan unlocks advanced capabilities like budgeting and pro forma planning, allowing for more strategic forward-looking analysis.

Key Features & Use Cases

| Feature | Best For |

|---|---|

| Automated Financial Tracking | Landlords wanting to streamline income and expense management for their portfolio. |

| Tax-Ready Reporting | Simplifying year-end accounting and preparing documents like Schedule E. |

| Budgeting & Pro Forma (Pro Plan) | Investors looking to forecast future performance and set financial goals for their properties. |

Actionable Insight: Use the automated transaction categorization to create a detailed expense history. This data is invaluable for accurately budgeting future capital expenditures and identifying opportunities to reduce operating costs across your portfolio.

- Pros: Generous free tier is very powerful, excellent for day-to-day portfolio management, simplifies tax preparation.

- Cons: Not designed for initial deal sourcing or complex underwriting, advanced forecasting requires a paid plan.

- Access: A robust free plan is available, with paid plans offering more advanced features.

- Website:https://www.stessa.com/pricing/

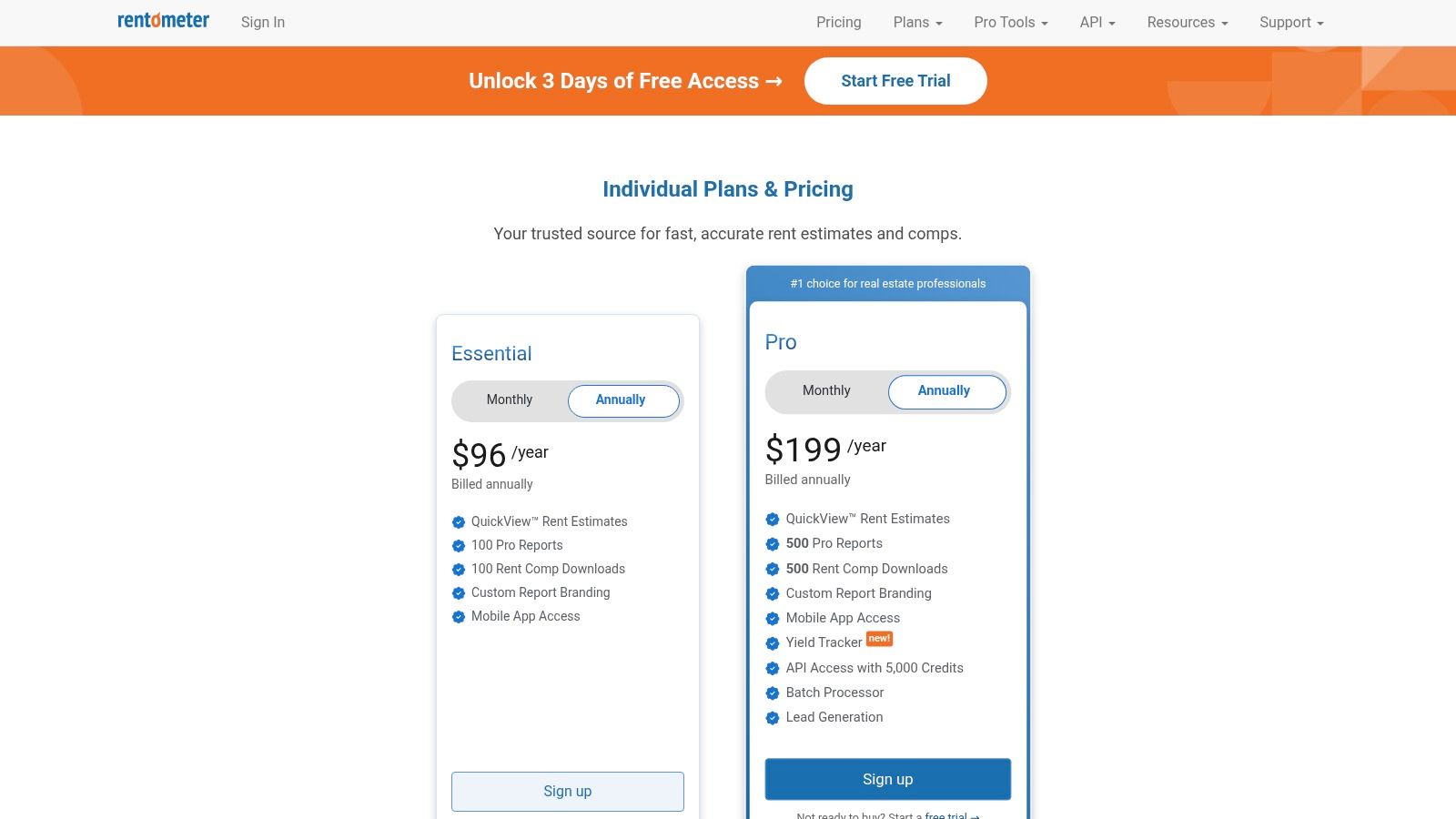

6. Rentometer

While many platforms offer broad investment analysis, Rentometer specializes in one of the most critical variables for any rental property investor: rent. It serves as a focused and reliable tool for pulling rent comparables, validating your underwriting assumptions, and ensuring your projected income is grounded in reality. Rather than trying to be an all-in-one solution, it excels at providing fast, data-driven rent analysis, making it an essential complementary tool in your investor toolkit.

Its strength is its simplicity and directness. You can quickly input an address and property details to get a rent estimate and view comparable listings in the area. The Pro version unlocks detailed reports that can be branded and shared with partners or lenders, adding a layer of data-backed confidence to your financial projections. For investors and property managers who need to accurately set and adjust rents to optimize property cash flow, this tool is indispensable.

Key Features & Use Cases

| Feature | Best For |

|---|---|

| QuickView Rent Estimates | Quickly validating rental income assumptions during initial deal screening. |

| Pro Reports with Comps | Creating detailed, brandable rent analyses for underwriting or asset management. |

| CSV Export & API Access | Power users and teams needing to integrate rent data into their own systems. |

Actionable Insight: Use the historical rent trend data available in Pro reports to understand market direction. This can help you forecast future rent growth more accurately and justify your projections to potential lenders.

- Pros: Simple, focused, and effective for its core purpose; flexible plans for individuals, teams, and API users.

- Cons: Not a comprehensive investment modeling tool; its value is limited to the rental income side of the equation.

- Access: A Pro membership starts at $29/month or $199/year for full access to detailed reports and features.

- Website:https://www.rentometer.com/pricing/

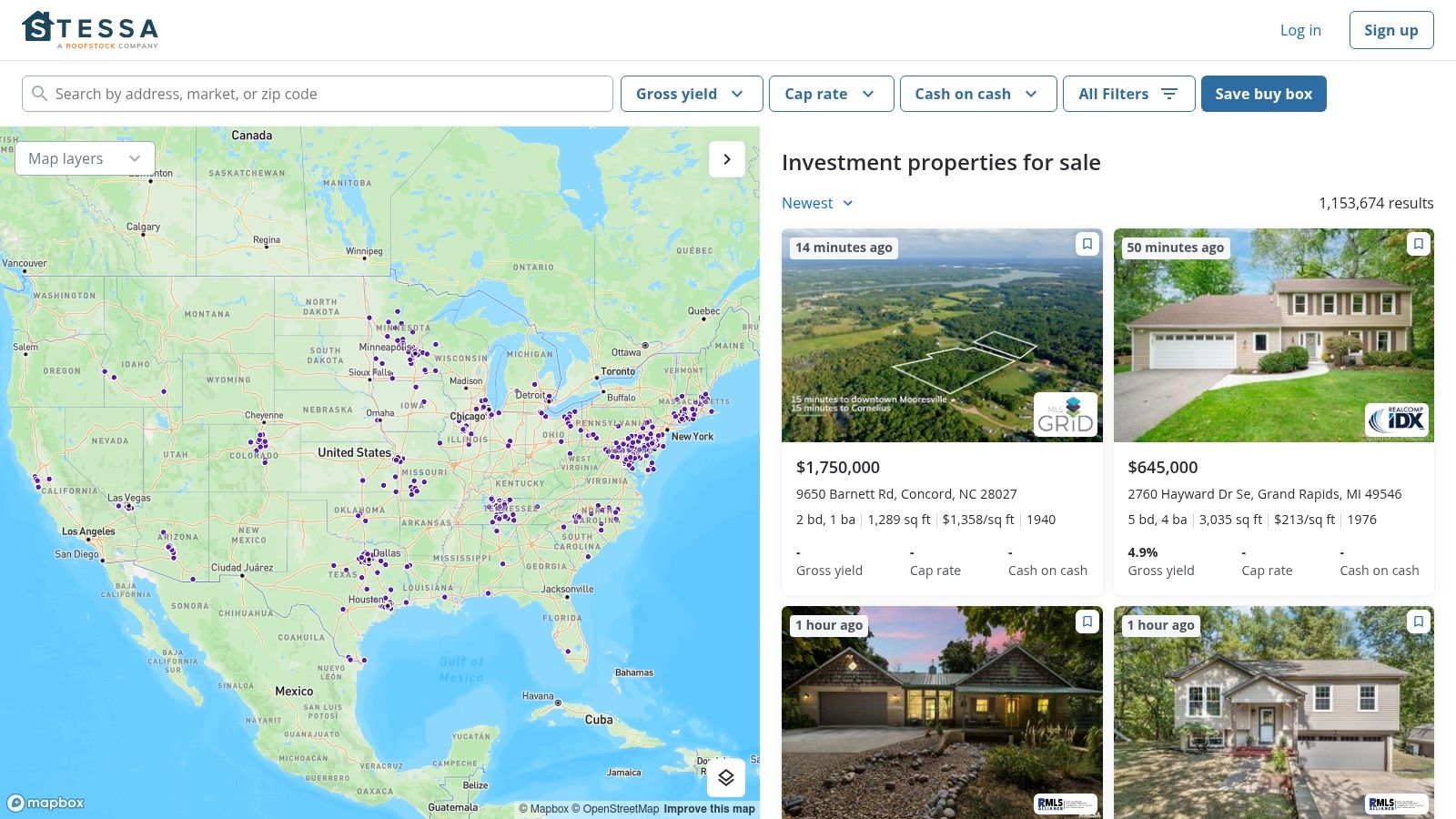

7. Roofstock Marketplace

Roofstock is an online marketplace designed for buying and selling single-family rental (SFR) properties, many of which are already tenant-occupied. Its core strength as one of the top real estate investment analysis tools is that the analytics are embedded directly into the listings. This transforms the platform from a simple property database into an active analysis environment where you can evaluate deals on the fly. Key financial metrics like cap rate, gross yield, and estimated annual return are calculated for each property, providing a standardized baseline for comparison.

The platform streamlines the initial underwriting process by allowing you to filter listings by these very metrics. You can instantly narrow down thousands of properties to those that meet your specific cash flow or return criteria. Additionally, Roofstock provides its own neighborhood rating, rent estimates, and property inspection reports, giving you a comprehensive data package to begin your due diligence. This integration of analysis and transaction makes it uniquely powerful for remote or out-of-state investors.

Key Features & Use Cases

| Feature | Best For |

|---|---|

| Embedded Financial Analytics | Investors who want to quickly screen a high volume of properties using standardized metrics. |

| Neighborhood Ratings | Out-of-state investors needing a simplified, data-driven assessment of a property's location. |

| End-to-End Transaction Support | Individuals looking for a streamlined platform to both analyze and purchase investment properties. |

Actionable Insight: While the platform's numbers are a great starting point, always download the diligence documents provided and run the financials through your own separate spreadsheet or calculator. Use Roofstock's data as the baseline but verify key assumptions like property taxes, insurance, and potential maintenance costs.

- Pros: Seamlessly combines property discovery, analysis, and transaction; standardized metrics make comparing properties easier.

- Cons: Both buyers and sellers pay platform fees; investors must independently verify the platform’s financial assumptions.

- Access: Browsing and analysis are free; a 0.5% marketplace fee (or $500 minimum) applies to buyers.

- Website:https://www.roofstock.com/investment-property-marketplace

8. PropStream

PropStream is less a traditional calculator and more of a powerful data engine, making it one of the most effective real estate investment analysis tools for sourcing off-market deals. Its core strength is providing nationwide property data, allowing you to search for properties using over 120 unique filters, such as pre-foreclosures, high equity, or vacant homes. This makes it an indispensable tool for investors who need to find opportunities before they hit the open market.

While not a full-fledged financial modeling platform, PropStream provides instant access to property details, tax information, mortgage data, and comparable sales (comps). This data is crucial for the initial underwriting and due diligence phase, helping you quickly validate a property's potential value. Its integrated marketing suite also allows you to reach out to property owners directly from the platform, streamlining the entire acquisition funnel from lead generation to preliminary analysis.

Key Features & Use Cases

| Feature | Best For |

|---|---|

| Nationwide Data & Filters | Investors and wholesalers looking to build targeted lists for off-market acquisitions. |

| Built-in Comps & Property Details | Quickly running a preliminary After Repair Value (ARV) analysis on a potential deal. |

| Lead Generation & Marketing Add-ons | Creating and executing direct mail or email campaigns to property owners. |

Actionable Insight: Use the "List Automator" feature to get daily notifications of new properties that match your saved search criteria. This keeps your deal pipeline full without needing to manually run searches every day.

- Pros: Robust data and generous export allowances at a competitive price point, excellent for acquisition marketing and initial analysis.

- Cons: Primarily focused on lead generation and data aggregation; comprehensive investment modeling requires other tools.

- Access: A monthly subscription is required, with a 7-day free trial available.

- Website:https://www.propstream.com/pricing

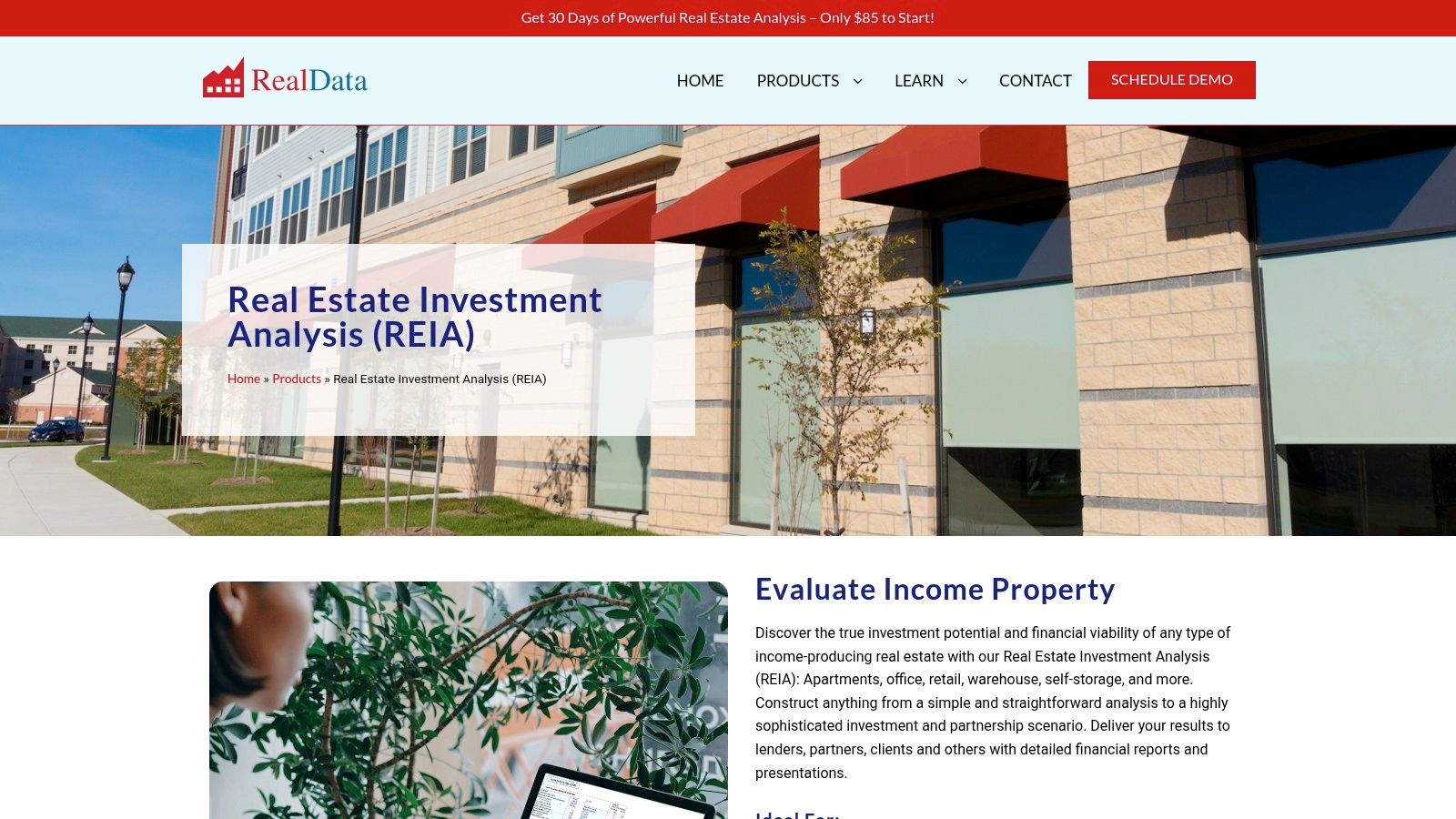

9. RealData (REIA and calculator suite)

RealData has been a long-standing, trusted name in the industry, offering robust, Excel-based software for serious investors. Unlike modern SaaS platforms, RealData focuses on deep financial modeling through its Real Estate Investment Analysis (REIA) suite. This makes it one of the most powerful real estate investment analysis tools for those who prefer the detailed control of a spreadsheet environment and require in-depth discounted cash flow (DCF) and IRR analysis for both commercial and residential properties.

The platform stands out by offering one-time purchase licenses rather than recurring subscriptions, appealing to investors who want to own their software. Its strength is in its comprehensive, traditional approach to financial underwriting, which is essential for complex deals. This detailed approach is a key part of many real estate property valuation methods, ensuring a thorough analysis before committing capital. RealData provides extensive documentation and training resources, helping users master its powerful features.

Key Features & Use Cases

| Feature | Best For |

|---|---|

| Detailed DCF & IRR | Sophisticated investors analyzing commercial or multi-family properties. |

| Add-On Modules | Portfolio managers needing to compare multiple properties side-by-side. |

| One-Time Purchase | Investors who prefer to own software outright and avoid monthly fees. |

Actionable Insight: Take advantage of the 30-day free trial for Windows to thoroughly test the REIA software. Prepare a real-world deal you're analyzing to see if its deep, spreadsheet-based workflow aligns with your investment analysis style before purchasing a license.

- Pros: Deep and traditional real estate finance modeling, no subscription required, strong training resources.

- Cons: Excel-based workflow may be less user-friendly, Windows-first trial licensing.

- Access: One-time purchase licenses start at $495 for the Express edition.

- Website:https://www.realdata.com/products/real-estate-investment-analysis-reia/

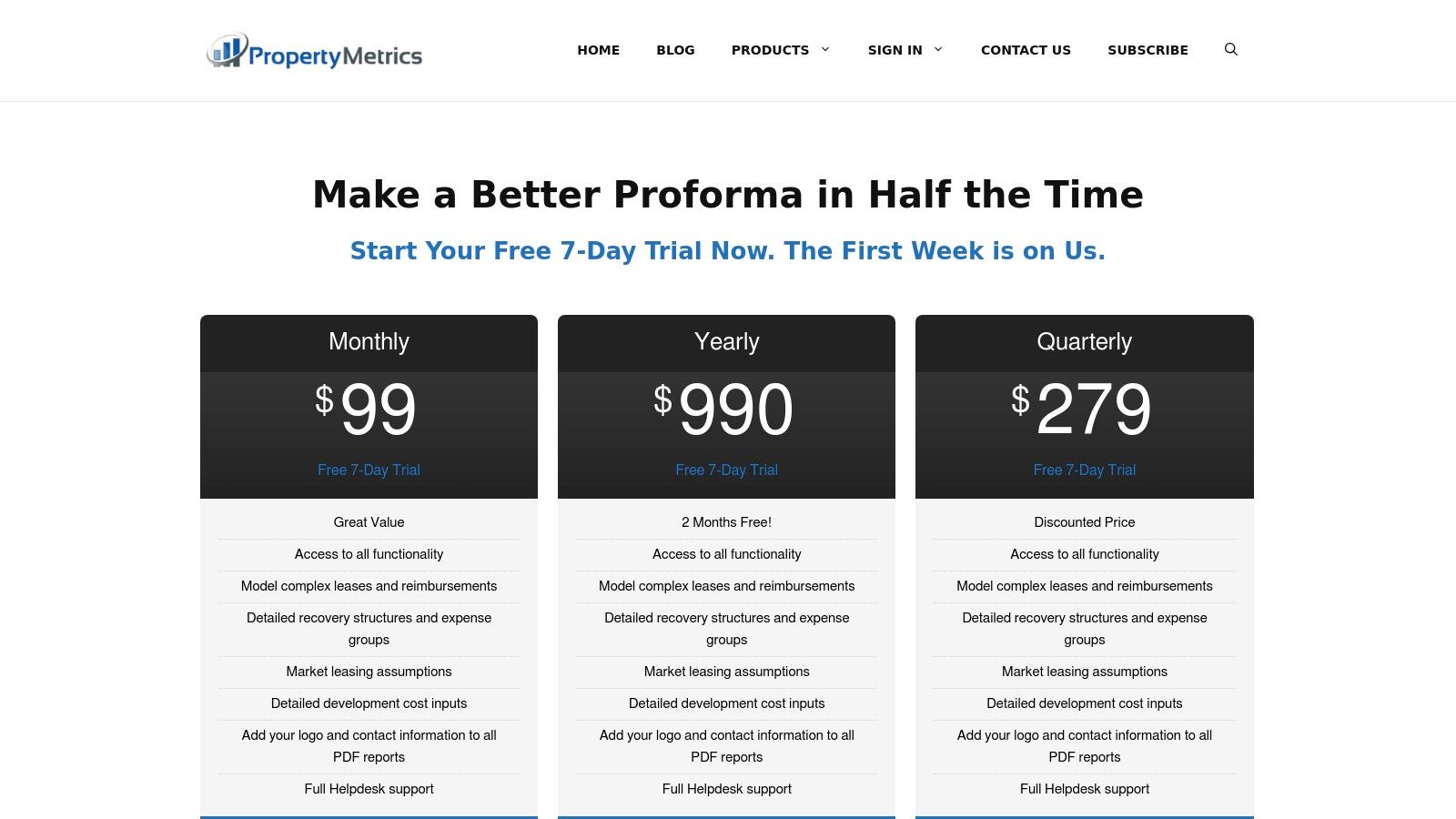

10. PropertyMetrics (Proforma App)

For commercial real estate (CRE) professionals who find ARGUS overly complex or expensive, PropertyMetrics offers a streamlined, powerful alternative. This web-based platform excels at pro forma creation and discounted cash flow (DCF) modeling for income-producing properties like office, retail, and industrial spaces. It stands out as one of the top real estate investment analysis tools for its ability to handle complex lease structures and detailed market leasing assumptions without the steep learning curve of enterprise-level software.

The platform is built to generate institutional-quality reports that can be branded and exported to both PDF and Excel. This functionality is crucial for analysts and investors who need to present sophisticated financial models to lenders, partners, or investment committees. By focusing purely on the analysis, it provides a clean, input-driven experience where you bring your own data and assumptions to build a robust financial forecast from the ground up.

Key Features & Use Cases

| Feature | Best For |

|---|---|

| Complex Lease Modeling | Analysts modeling commercial properties with multiple tenants and expense reimbursements. |

| Development Cost Inputs | Developers forecasting costs and returns for ground-up construction or value-add projects. |

| Branded PDF & Excel Exports | Creating professional investment memoranda and performing deeper analysis offline. |

Actionable Insight: Use the Excel export feature to integrate the PropertyMetrics cash flow model into your own custom dashboards or sensitivity analysis templates, combining its power with your unique presentation style.

- Pros: CRE-focused modeling in a clean UI, more accessible than ARGUS, offers a free trial.

- Cons: Users must supply all their own data and assumptions, pricing is higher than residential tools.

- Access: A free 7-day trial is available; paid plans start from around $49 per month.

- Website:https://propertymetrics.com/software/real-estate-analysis/pricing/

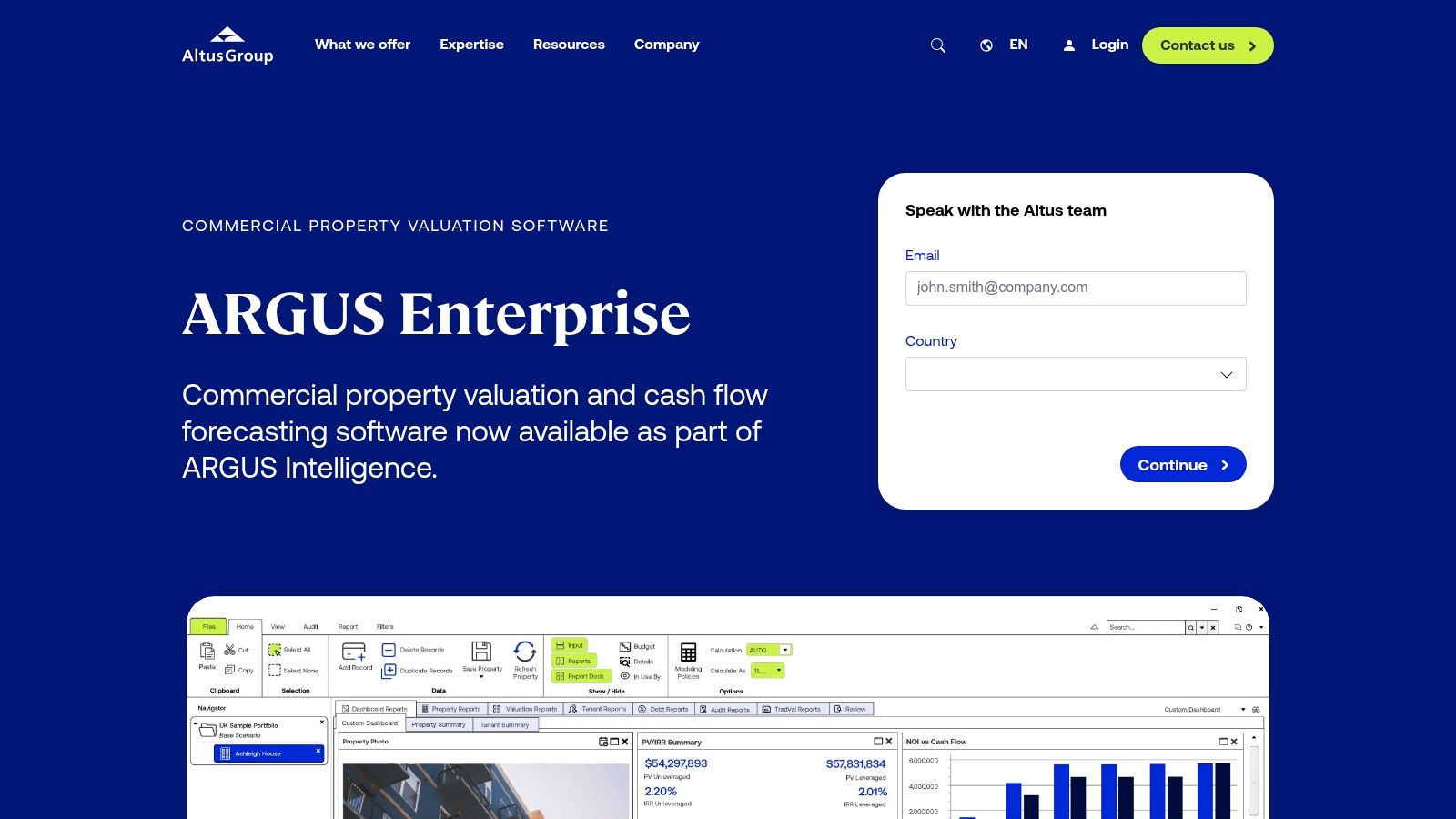

11. ARGUS Enterprise (Altus Group)

For institutional-grade commercial real estate, ARGUS Enterprise is the undisputed industry standard. It’s less of a simple calculator and more of a powerful valuation and cash flow forecasting engine trusted by asset managers, appraisers, and large-scale investors. This platform is one of the most sophisticated real estate investment analysis tools available, designed to model complex lease structures, intricate capital stacks, and multi-property portfolio scenarios with unparalleled detail.

The strength of ARGUS lies in its universal acceptance; submitting an ARGUS-generated report to a commercial lender or institutional partner lends immediate credibility to your underwriting. The software allows for deep dives into asset and portfolio performance, with dashboards that facilitate comparisons and benchmarking. It is built to handle the nuances of commercial properties, from retail lease reimbursements to office building expense recoveries, making it essential for serious CRE professionals.

Key Features & Use Cases

| Feature | Best For |

|---|---|

| Multi-Property Cash Flow Engine | Institutional investors managing and analyzing complex CRE portfolios. |

| Asset and Portfolio Dashboards | Asset managers who need to benchmark property performance against market data. |

| Industry-Standard Reporting | Analysts and brokers seeking financing or presenting deals to institutional capital partners. |

Actionable Insight: Proficiency in ARGUS is a highly sought-after skill in the commercial real estate industry. If you plan to work in CRE acquisitions or asset management, becoming certified can be a significant career advantage.

- Pros: Widely accepted by lenders and institutional investors, deep functionality for complex leases and scenarios.

- Cons: Enterprise-grade onboarding and cost, pricing is not publicly available and requires a sales consultation.

- Access: Requires a subscription obtained through the Altus Group sales team.

- Website:https://www.altusgroup.com/argus/argus-enterprise/

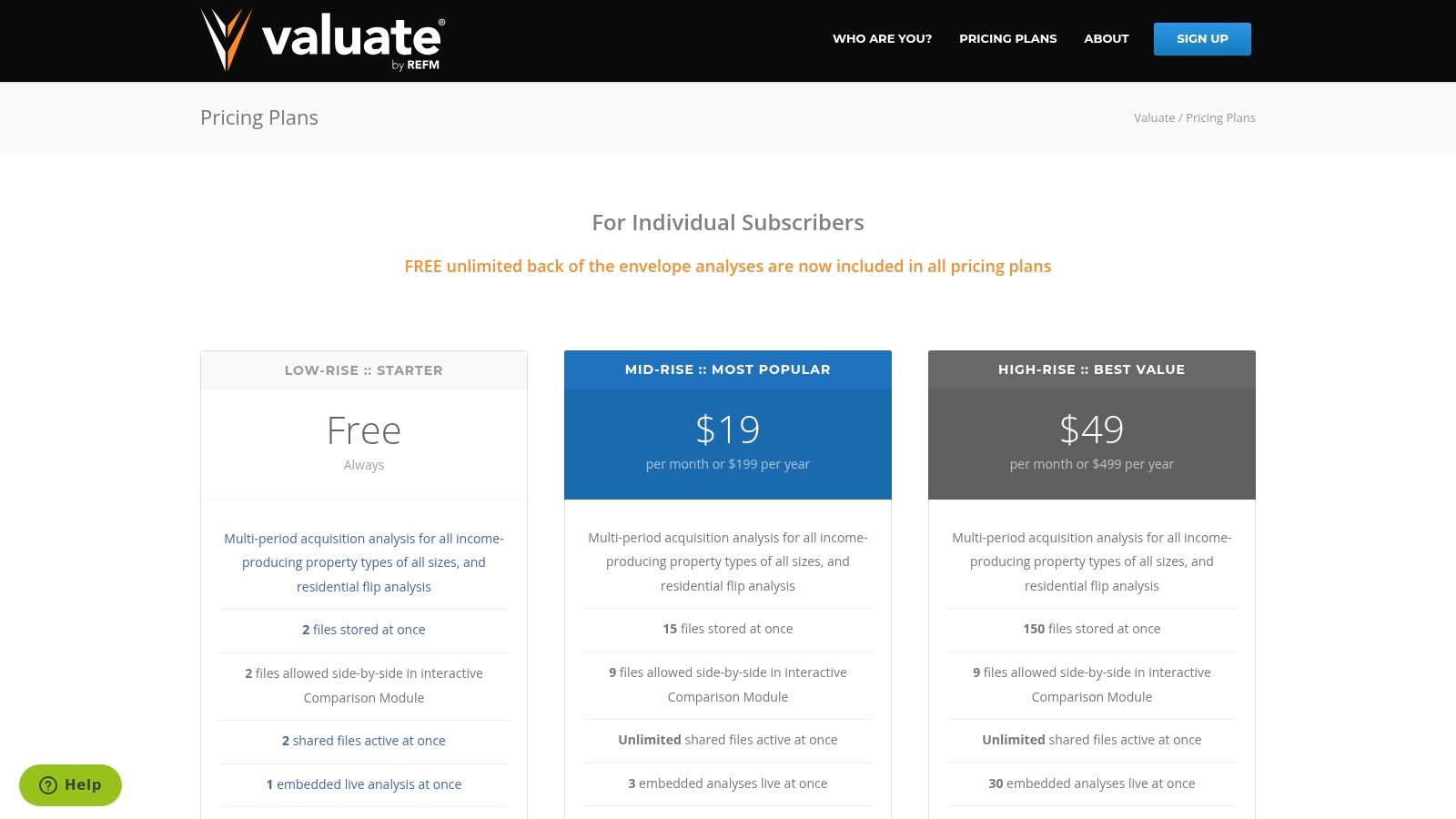

12. Valuate by REFM

Valuate by REFM offers a sophisticated yet accessible browser-based platform designed for rapid acquisition and disposition analysis across all types of income properties. It stands out by blending robust modeling with powerful collaboration features, making it a highly efficient tool for analysts and dealmakers. As one of the more versatile real estate investment analysis tools, Valuate simplifies complex financial projections into clear, presentation-ready formats that can be easily shared or embedded.

The platform's core strength is its ability to conduct side-by-side deal comparisons, allowing users to evaluate up to nine different scenarios simultaneously. This feature is invaluable for quickly identifying the most promising opportunities or modeling various outcomes for a single asset. With a focus on speed and clarity, Valuate empowers you to move from initial underwriting to a professional proposal in a fraction of the time it would take with traditional spreadsheets.

Key Features & Use Cases

| Feature | Best For |

|---|---|

| Comparison Module | Analysts needing to quickly vet multiple deals or underwriting scenarios against each other. |

| Sharing & Embedding Tools | Teams collaborating on acquisitions or brokers presenting deals directly to investors online. |

| Multi-Period Modeling | Projecting returns for both short-term flips and long-term holds for any income property type. |

Actionable Insight: Use the sharing feature to send a live, interactive model of a deal to potential partners or lenders instead of a static PDF. This allows them to adjust minor assumptions themselves, increasing transparency and trust in your analysis.

- Pros: Low cost of entry with robust free and affordable paid tiers, fast and presentation-friendly modeling with collaboration features.

- Cons: Not a full portfolio management platform, focused primarily on deal-level analysis.

- Access: A free plan is available; paid plans offer more functionality.

- Website:https://valuate.getrefm.com/pricing-plans/

Real Estate Investment Tools Feature Comparison

| Platform | Core Features / Analysis | User Experience / Quality ★ | Value Proposition 💰 | Target Audience 👥 | Unique Selling Points ✨ |

|---|---|---|---|---|---|

| 🏆 Flip Smart | Instant valuations, renovation & profit estimates, multi-strategy reports | ★★★★★ Fast, AI-powered, user-friendly | Flexible pricing: free to enterprise | Beginner to pro investors | Automates analysis in under 5 mins, 95% time savings, detailed, multi-strategy reports |

| BiggerPockets Calculators | Rental, flip, BRRRR calculators, pro formas, community & education | ★★★★ Approachable, solid educational support | Pro membership for advanced features | New & intermediate investors | Large community, printable reports, market & deal finder tools |

| DealCheck | Mobile/web app, offer/calcs, comps import, branded PDFs | ★★★★ Fast onboarding, intuitive mobile/desktop | Transparent, low pricing with free tier | Residential investors | Quick use, branded reports, good value for casual users |

| Mashvisor | Short/long-term rental ROI, machine learning scores, regulations info | ★★★★ Data-rich platform, speeds market screening | Higher-tier plans unlock full features | Rental property investors | Combines multi-source data, opportunity scoring, rental regulations |

| Stessa | Portfolio tracking, accounting, budgeting, tenant tools | ★★★★ Practical tools for rental management | Generous free tier, scalable plans | Landlords & rental managers | Automated bank feeds, Schedule E reports, tenant screening |

| Rentometer | Rent comps, quick rent estimates, API & team plans | ★★★★ Focused rent analysis tool | Flexible plans for individuals & teams | Rental underwriters | Simple rent estimates, historical trends, API access |

| Roofstock Marketplace | Marketplace + embedded analytics & filters | ★★★★ Easy property comparison & transaction | Buyer/seller fees apply | Rental property buyers | End-to-end marketplace with financial filters & neighborhood ratings |

| PropStream | Nationwide data, lead gen, mobile/web access | ★★★★ Robust data export & team add-ons | Competitive pricing | Investors sourcing leads | Extensive data, marketing automation, lead tracking |

| RealData (REIA & calculators) | Excel-based DCF, IRR modeling, portfolio add-ons | ★★★★ Deep finance modeling, strong training | One-time purchase, no subscription | Advanced residential & commercial investors | Traditional detailed modeling, portfolio comparisons |

| PropertyMetrics | CRE pro formas, DCF, lease modeling, PDF/Excel output | ★★★★ CRE-focused, accessible UI | Free trial, higher pricing than residential | Commercial real estate pros | Complex lease modeling, branded professional reports |

| ARGUS Enterprise (Altus Group) | Multi-property cash flows, portfolio benchmarking | ★★★★★ Industry-standard, extensive features | Custom pricing, enterprise-grade | Institutions & asset managers | Deep CRE functionality, widely accepted by lenders & appraisers |

| Valuate by REFM | Acquisition & flip analysis, side-by-side comparisons | ★★★★ Fast modeling, collaboration tools | Affordable, free training resources | Deal-level investors | Multi-file comparison, embedding/sharing features, low cost |

Choosing the Right Tool to Build Your Real Estate Empire

Navigating the crowded market of real estate investment analysis tools can feel overwhelming, but the journey from data overload to decisive action starts with a single, crucial step: understanding your unique investment strategy. As we've explored, the ideal platform isn't about having the most features; it's about having the right features that align perfectly with your goals, scale, and day-to-day workflow. The era of cumbersome spreadsheets and gut-feel decisions is over, replaced by powerful, specialized software designed to sharpen your competitive edge.

The key takeaway is that there is no one-size-fits-all solution. A house flipper requires rapid, accurate rehab cost estimations and ARV analysis, a need met by platforms like Flip Smart. A buy-and-hold investor managing a growing portfolio will find immense value in the streamlined income and expense tracking offered by Stessa. Meanwhile, a commercial real estate professional analyzing multi-tenant properties with complex lease structures will need the institutional-grade power of ARGUS Enterprise or Valuate. Your choice should directly address your primary bottleneck, whether it's finding deals, underwriting them quickly, or managing them efficiently.

Actionable Steps to Select Your Perfect Tool

To move from reading to doing, follow this simple framework to select the best real estate investment analysis tools for your business:

Define Your Core Need: Pinpoint the single biggest challenge in your investment process. Is it sourcing viable leads? Is it analyzing deals fast enough to beat the competition? Or is it managing your existing portfolio for maximum cash flow? Your primary pain point dictates your top software priority.

Match Strategy to Specialization: Review the tools we've covered and align their core strengths with your investment niche.

- Flippers & Wholesalers: Prioritize tools with strong comp analysis, rehab estimation, and deal-finding capabilities like Flip Smart or PropStream.

- Rental Investors (1-4 Units): Look for platforms with robust cash flow calculators, rental comps, and long-term projection features, such as DealCheck or the BiggerPockets suite.

- Commercial & Multifamily Investors: Focus on sophisticated proforma modeling, lease analysis, and financial reporting tools like PropertyMetrics or ARGUS.

Leverage Free Trials: Nearly every tool offers a free trial or a freemium version. Commit to testing your top one or two candidates with a live deal. This hands-on experience is the only way to truly assess if a tool’s workflow, interface, and reporting outputs fit your operational style.

Final Thoughts on Implementation

Remember, the most advanced software is useless if it isn't integrated into your process. Once you choose a platform, commit to mastering its core functions. The goal isn't just to analyze deals; it's to build a repeatable, scalable system that consistently produces profitable outcomes. By selecting a tool that becomes a natural extension of your strategy, you transform a simple software subscription into a cornerstone of your real estate empire, enabling you to make smarter, faster, and more confident investment decisions.

Ready to eliminate guesswork and analyze deals with unparalleled speed and accuracy? Flip Smart uses advanced AI to generate comprehensive investment reports, including precise ARV, rehab costs, and profit projections, in under a minute. See how the right tool can revolutionize your flipping or rental business by trying Flip Smart today.