For decades, real estate investors relied on spreadsheets. In today's market, that’s like bringing a paper map to a car race—you’ll get left behind. The best real estate investment software automates complex calculations, pulls live market data, and delivers predictive insights that a static spreadsheet can't touch. This isn't just about convenience; it's about giving yourself a decisive competitive edge.

This guide will give you actionable insights to help you choose the right platform, integrate it into your workflow, and use it to make smarter, faster, and more profitable decisions.

Why Spreadsheets Are a Liability in Modern Real Estate Investing

If you're still wrestling with complex spreadsheets and gut instinct, you're fighting an uphill battle. Let's be honest: the old way is broken. It’s a minefield of manual data entry, hidden formula errors, and a total disconnect from what’s happening in the market right now. This old-school approach makes it nearly impossible to vet deals quickly and, more importantly, accurately.

Dedicated platforms transform messy, overwhelming data into clear, actionable intelligence, helping you make confident decisions in minutes, not hours.

The Hidden Costs of Manual Analysis

Picture this: you're analyzing a potential flip. With a spreadsheet, you manually dig for comps, guess at rehab costs, and plug numbers into a template you just hope is correct. A single typo in a formula could skew your After Repair Value (ARV), turning a potential home run into a significant financial loss.

This manual grind isn't just slow—it's dangerously prone to human error. I've seen investors get burned by inaccurate cash flow projections or lose track of their portfolio performance because they were stuck using outdated tools. You end up spending more time fighting with data than finding deals.

Actionable Insight: The core problem with spreadsheets is their static nature. They can't adapt to market shifts, pull live rental comps, or automatically update expense projections. In a market where speed wins deals, that's a fatal flaw.

The Shift to Smarter Tools

This isn't just a trend; it's an industry-wide migration. The global real estate software market was valued at USD 3.8 billion in 2023 and is projected to more than double to USD 8.5 billion by 2032.

This boom tells a clear story: serious investors are abandoning manual methods for the efficiency and precision modern tools provide. Before diving deeper, let's examine the specific problems that dedicated software is built to solve.

Core Problems Solved by Investment Software

| Investor Challenge | Traditional Method | Software Solution |

|---|---|---|

| Slow Deal Analysis | Spending hours or days manually gathering data and running numbers in spreadsheets. | Instantly pull property data, comps, and run a full analysis in under 5 minutes. |

| Inaccurate Calculations | Relying on complex, error-prone spreadsheet formulas and gut-feel estimates. | Automated, standardized calculations based on real-time data ensure accuracy. |

| Missed Opportunities | By the time analysis is complete, the best deals are already under contract. | Analyze dozens of properties daily to find and act on opportunities immediately. |

| Uncertain Rehab Costs | Guessing renovation budgets or waiting days for contractor quotes. | AI-powered rehab estimators provide detailed cost breakdowns instantly. |

| Poor Risk Assessment | Overlooking market trends, hidden costs, or bad comps due to limited data. | Comprehensive risk analysis using neighborhood data and predictive analytics. |

This table highlights the night-and-day difference. It's about working smarter, not harder. Here’s how this software provides a distinct edge:

- Speed and Efficiency: Analyze a property's potential in seconds. Simply enter an address, and the software instantly pulls comps, estimates rehab costs, and calculates your potential profit.

- Data-Driven Accuracy: Stop guessing. Your decisions are backed by calculations using real-time market data, so you can trust your numbers. Mastering the math is crucial; you can review the core real estate math formulas every investor must know.

- Risk Mitigation: The best platforms flag potential red flags—from negative neighborhood trends to property-specific issues—helping you dodge costly mistakes before you make an offer.

Ultimately, using specialized software isn't just a time-saver. It's about making smarter, faster, and more profitable investment decisions that let you scale your portfolio with confidence.

What Really Matters in Real Estate Investment Software

When you start evaluating real estate investment software, it’s easy to get lost in marketing jargon. Every platform promises everything. But from experience, the difference between a game-changing tool and a glorified calculator comes down to a few critical features.

These aren't just bells and whistles. They are the essential functions that turn a mountain of property data into a clear financial picture, letting you vet deals with the speed and confidence of a seasoned pro.

Let's cut through the noise and focus on exactly what you should demand from your software.

Robust Deal Analysis and Financial Modeling

At its core, any software worth considering must crunch the numbers—and I mean really crunch them. This goes far beyond a simple ROI. You need a tool that can model different scenarios, whether you’re planning a fix-and-flip, a BRRRR, or a long-term rental.

Imagine analyzing a potential duplex. A winning platform won't just show the list price. It should instantly break down the deal's vitals:

- Cash on Cash Return: Your real-world annual return on the actual cash you've invested.

- Cap Rate: The property's rate of return based on its income, a key metric for comparing investments.

- Maximum Allowable Offer (MAO): The absolute highest price you can pay to hit your target profit. No guesswork.

This level of detailed modeling lets you stress-test your assumptions and see the deal's true potential before you even think about writing an offer.

Accurate Cash Flow Forecasting

One of the fastest ways to kill a deal is by underestimating expenses. It's a rookie mistake that sinks cash flow quickly. The best software protects you from this by automating realistic projections for everything—property taxes, insurance, vacancy rates, and maintenance reserves.

Think of your software as your most cynical, numbers-obsessed partner. It reminds you about the leaky faucet, the tenant who might pay late, and the surprise property tax hike. It keeps your projections grounded in reality, not wishful thinking.

Actionable Insight: A great tool doesn't just show you potential profits; it exposes potential problems. Accurate cash flow forecasting is your first line of defense against a bad investment.

Instant Comparative Market Analysis (CMA)

In a competitive market, speed is paramount. Top-tier software provides an instant Comparative Market Analysis (CMA) by pulling real-time data on recently sold properties (comps) and current rental listings. This is non-negotiable for determining a property's After Repair Value (ARV) and setting rental rates that are both competitive and profitable.

This need for comprehensive data management is why many platforms are evolving. The global real estate software market shows that customer relationship management (CRM) tools made up the largest share by type, at 27.2% of the market in 2022. This trend indicates a clear demand for software that manages the entire investment lifecycle. You can read more about the growth of real estate software tools.

When these features work in tandem, a single platform can take you from spotting a property to building a full financial projection in minutes. It becomes your essential checklist for evaluating any opportunity that comes your way.

How to Choose the Right Software for Your Strategy

Picking the right real estate investment software is a decision that directly impacts your bottom line. The right tool sharpens your strategy and helps you make smarter, faster decisions. The wrong one becomes another regrettable monthly expense.

This isn't about finding the single "best" platform. It's about finding the one that fits your specific goals as an investor, like a key in a lock.

So, where do you begin? Start with your investor profile. Are you a BRRRR strategist focused on cash flow and equity? A house flipper chasing quick profits? Or a buy-and-hold investor building long-term wealth? Each strategy has unique demands. A flipper needs a top-notch rehab estimator, while a rental investor lives and dies by long-term cash flow projections.

Once you’re clear on your strategy, you can start evaluating platforms.

Aligning Features With Your Investor Profile

The features that truly matter are those tied directly to your strategy. It’s easy to get distracted by flashy tools and dashboards you’ll never use. My advice: create a "must-have" checklist based on your daily workflow.

- For Flippers: Your non-negotiables are an accurate After Repair Value (ARV) calculator and a detailed renovation cost estimator. Software that pulls real-time comps for sold properties is the only way to confidently predict your final sales price.

- For Rental Investors: Look for rock-solid cash flow forecasting. The platform should automatically factor in all operating expenses—property taxes, insurance, vacancy rates, and maintenance reserves—to give you a realistic picture of your monthly and annual returns.

- For Wholesalers: Your world is all about speed and deal-finding. Tools that help you uncover off-market properties and calculate a Maximum Allowable Offer (MAO) in seconds are essential.

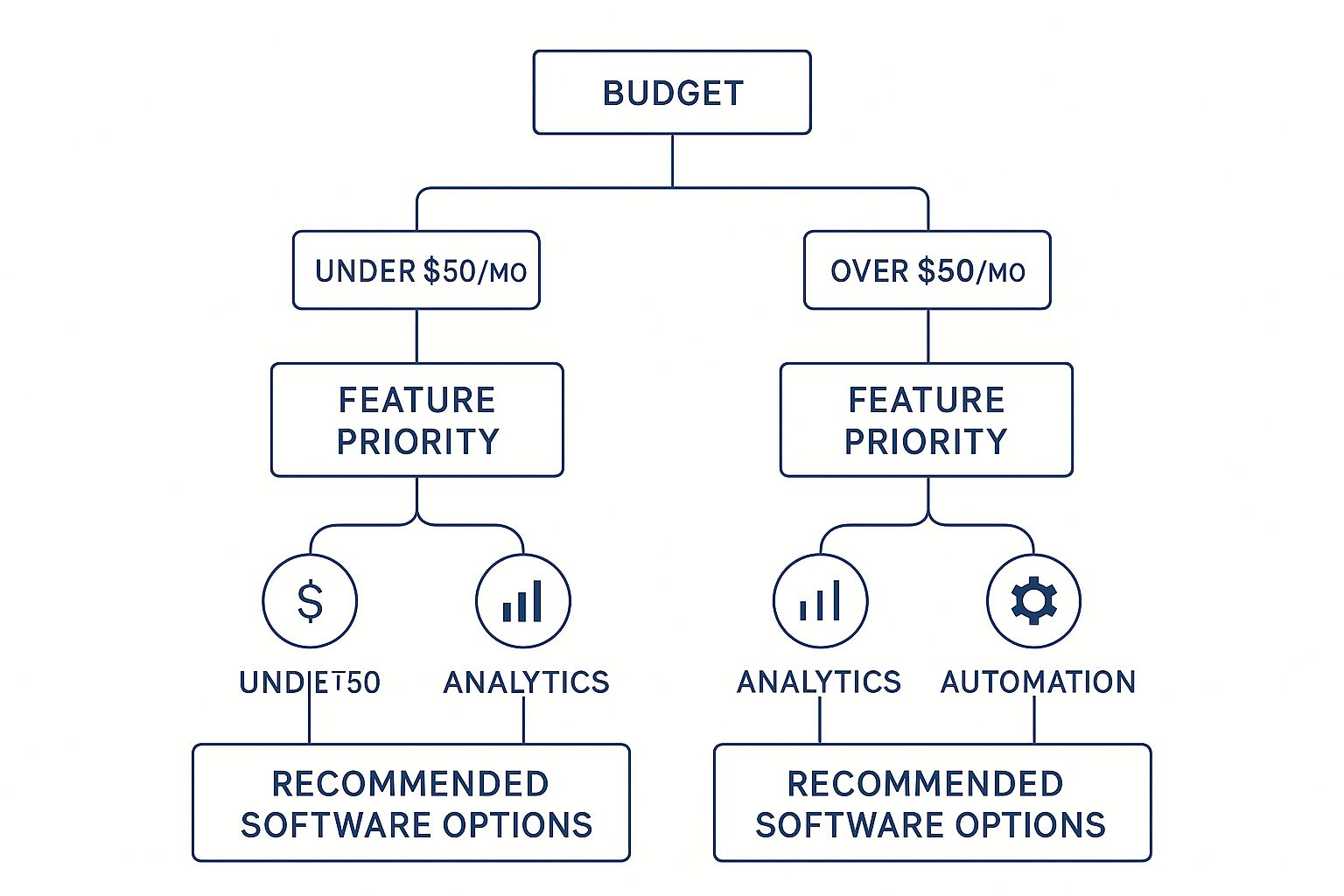

This decision tree helps visualize how different priorities, like budget and core features, can point you toward the right type of software.

As the chart shows, you need to first nail down your budget, then decide if you need deep analytics or workflow automation to find a solution that truly fits.

Pressure-Test With Free Trials

Marketing promises are one thing; real-world performance is another. Never commit to a subscription without taking full advantage of a free trial or demo. This is your chance to put the software through its paces with a real property you’re actively considering.

Actionable Insight: The goal of a trial isn't just to see what the software can do, but to see how it fits into your process. If it doesn't save you time or give you clearer insights on a live deal, it's not the right tool for you.

Pick a property and run the numbers. Does it pull accurate data? Are the calculations transparent, or is it a "black box" you don't understand? Can you generate a professional-looking report to share with a partner or private money lender? A hands-on test will reveal usability quirks and data gaps that a feature list could never show.

You can learn more about what to look for by checking out our guide on the modern real estate deal analyzer.

To keep your evaluation objective, use a simple checklist to score each platform you're testing. This forces you to compare apples to apples instead of just going with the one that has the slickest marketing.

Here’s a basic template you can use:

Software Evaluation Checklist

| Evaluation Criterion | Software A Score (1-5) | Software B Score (1-5) | Notes |

|---|---|---|---|

| Accuracy of Comps/ARV | How close are its numbers to my own research? | ||

| Ease of Use (UI/UX) | Is it intuitive or do I need a manual? | ||

| Rehab Cost Estimator Detail | Does it allow for detailed, custom line items? | ||

| Cash Flow Analysis Depth | Does it account for all expenses (CapEx, vacancy)? | ||

| Reporting Quality | Are the reports professional enough for a lender? | ||

| Integration Capabilities | Does it connect with my other tools? | ||

| Customer Support | How responsive and helpful were they during the trial? | ||

| Overall Value for Price | Is the cost justified by the time/money it saves? | ||

| Total Score |

Tally up the scores at the end. The numbers often reveal a clear winner that your gut feeling might have missed.

Evaluate Scalability and Integrations

Finally, think about your future. A tool that works for your first property might become a bottleneck when you’re managing ten. The best real estate investment software is built to grow with your portfolio.

Ask yourself these questions:

- Portfolio Management: Can the software track the performance of multiple properties from a single dashboard? Or will you be stuck analyzing one property at a time?

- Team Collaboration: If you work with partners, agents, or a virtual assistant, can you add other users and set different permission levels?

- Integration Capabilities: Does it connect with other tools you rely on, like your accounting software or CRM? A platform that integrates with your existing systems saves you from endless manual data entry.

Choosing your software is a serious investment of money, time, and trust. By matching features to your strategy, pressure-testing them on real deals, and planning for your future growth, you can make a confident decision that pays for itself many times over.

The Advantage of Cloud-Based Real Estate Platforms

Let's be honest: the days of being chained to a desktop computer to run your real estate business are over. If your software lives on a single machine, you're already behind. The move to the cloud isn't just a trend; it's a fundamental shift in how savvy investors operate, giving you the agility to work smarter, not harder.

This is about having your entire portfolio accessible right from your pocket, wherever you are.

Imagine standing inside a potential flip, pulling up comps on your phone, running the numbers, and then sending a professional report to your lender from your tablet before you even get back to your car. That’s the speed and flexibility the cloud delivers. It's no longer a luxury—it’s a competitive necessity.

Access and Collaboration from Anywhere

The single biggest game-changer with cloud platforms is universal access. Your data isn't trapped on one hard drive. You can be at a coffee shop analyzing a deal on your tablet, at home reviewing financials on your laptop, or in the field making adjustments from your phone.

This completely transforms collaboration. When you're working with partners, agents, or lenders, everyone is looking at the exact same up-to-the-minute information. No more emailing outdated spreadsheets back and forth. This simple change reduces the confusion and costly miscommunications that can sink deals. Everyone is on the same page, all the time.

Actionable Insight: A centralized, cloud-based platform becomes your single source of truth. It ensures every decision, whether made in the office or on-site, is based on the same accurate, real-time data.

The industry's growth confirms this shift. The real estate software market is projected to hit USD 34.1 billion by 2032, a surge driven by investors demanding cloud solutions that offer centralized data and true mobility. The message is clear: on-demand access isn't just a feature; it's how modern investing gets done.

Hassle-Free Updates and Scalability

With old-school desktop software, you were always behind. Manual installations, compatibility issues, and outdated data were just part of the deal. With a cloud platform, you’re always using the latest and greatest version.

Updates, new features, and crucial security patches are rolled out automatically by the provider. You don't have to do anything except enjoy the benefits.

This model is also built to grow with you. As your portfolio expands from your first property to your twentieth, the software scales effortlessly. You don't have to worry about outgrowing your tools, hitting server limits, or experiencing performance lag. Just add the next property, and the platform handles the rest. For investors with big ambitions, understanding why smart investors use automated property analysis is the first step in using these powerful, scalable tools to their full potential.

Integrating Software Into Your Daily Workflow

Choosing the right real estate investment software is a major win, but the real value is unlocked when it becomes an integral part of your daily operations. If the tool just gathers digital dust, you're wasting money on a subscription. The goal is to weave it so deeply into your process that you can't imagine analyzing a deal without it.

Your first practical step? Centralize everything. Block out an hour and get every property you own loaded into the system. This immediately populates your dashboard, giving you a live, high-level view of performance, equity, and cash flow across your entire operation. This is your new command center.

Create Your Analysis Blueprint

Once your current assets are in the system, build out custom templates for analyzing new deals. Any decent software will let you save specific criteria that match your investment strategy. A flipper’s template, for example, will focus on ARV accuracy and rehab costs. A buy-and-hold investor’s template will prioritize long-term cash flow, vacancy rates, and CapEx reserves.

Setting up these presets does two critical things:

- Keeps You Consistent: Every potential deal is measured against the exact same yardstick. This removes emotional bias from the equation.

- Makes You Faster: No more building your analysis from scratch every time. Just load your template, plug in the property details, and get answers in seconds.

This process turns a manual chore into a quick, repeatable system. It’s about building a machine that lets you vet more properties with less effort—a non-negotiable advantage in a fast-moving market.

Automate Your Reporting and Tracking

Top-tier software is more than just a fancy calculator; it's a portfolio management engine. Dive into the automation features to reclaim your time. For example, set up automatic monthly financial reports that consolidate income, expenses, and net operating income for each property.

Actionable Insight: Treat your software as your personal data analyst. It should be working in the background, tracking your Key Performance Indicators (KPIs) and flagging trends you'd otherwise miss. True integration means the software does the monitoring for you.

You can also set up alerts for crucial dates like lease renewals or property tax deadlines. This proactive approach prevents costly mistakes and frees up your mental bandwidth for what actually grows your business: finding the next great investment. When the software handles the tedious admin, you can focus on growth.

Use Data to Refine Your Strategy

Finally, make it a habit to regularly review the aggregate data your software produces. Is one specific neighborhood consistently delivering higher cash-on-cash returns? Are your rehab estimates consistently coming in 15% over budget?

This portfolio-level view is where the real strategic insights are found. The platform's data can reveal powerful patterns in your own investing habits and highlight market trends. You might discover that three-bedroom rentals in a particular zip code are outperforming everything else in your portfolio. That’s not just an interesting fact; it's a clear signal of an opportunity to double down.

When you treat your software as a strategic feedback loop, it stops being just a tool. It becomes a core driver of your investment decisions, helping you adapt, pivot, and fine-tune your approach for maximum profitability.

Common Questions About Real Estate Investment Software

Even with a solid plan, choosing the best real estate investment software can feel overwhelming. Questions always come up, and getting clear answers is key to moving forward with confidence. Let’s tackle the questions I hear most often from other investors.

Can I Find a Good Platform for Free?

Everyone loves free, but when it comes to serious deal analysis software, "free" almost always has a catch. You’ll find plenty of basic calculators or limited free trials, which are great for testing the waters.

However, a fully-featured, genuinely free platform is practically non-existent. These free versions lack the deep, real-time data, accurate comps, and powerful forecasting needed to properly vet a deal. Think of it this way: a free tool can do basic math, but a professional platform acts like an experienced partner, pointing out the risks and opportunities you’d never spot on your own.

What Is the Difference Between Real Estate Software and a CRM?

This distinction trips up a lot of people. It’s simple when you break it down by purpose.

Real estate investment software is for deal analysis. Its core job is to help you find and vet properties by crunching critical numbers—cash flow, ARV, rehab costs, and profit potential. The entire focus is on the financial health of the asset.

A Customer Relationship Management (CRM) tool is for managing people and communication. It’s for tracking your leads, follow-ups with sellers, and organizing marketing efforts.

While some platforms try to do both, their primary strengths differ. If you’re a flipper or a landlord, you need deal analysis first. If you’re a wholesaler juggling hundreds of leads, a CRM might be your priority.

Actionable Insight: To tell them apart, ask yourself: "Does this help me analyze the property or manage my contacts?" Your primary business goal will point you to the right tool.

How Accurate Are the Financial Projections?

This is the million-dollar question. The truth is, the accuracy of any projection depends on the quality of the data powering it.

The best platforms don't rely on a single source. They blend MLS data, public records, and proprietary algorithms to build a comprehensive picture. For rental properties, for instance, a good machine-learning-powered forecast should land within a 5% to 10% variance of actual performance.

However, remember that no software can predict the future with 100% certainty. These tools provide a highly educated, data-backed estimate. They're designed to replace back-of-the-napkin math and gut feelings with data-driven confidence. The goal isn't to be a crystal ball—it's to dramatically reduce your margin of error and save you from those deals that look great on paper but are money pits in reality.

Ready to stop guessing and start analyzing deals with precision and speed? Flip Smart gives you the power to evaluate any property in seconds, providing accurate valuations, detailed rehab estimates, and clear profit projections. Start making smarter investment decisions today.