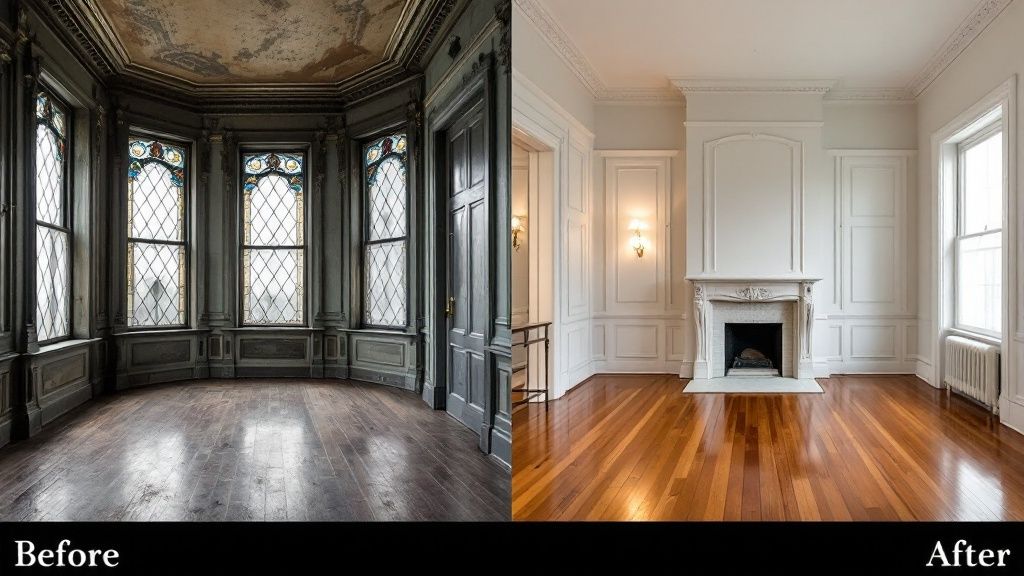

The allure of a dramatic transformation is undeniable, but successful real estate investing goes far beyond impressive before and after house flips. The real story lies in the strategic decisions, calculated risks, and meticulous financial management that turn a neglected property into a highly profitable asset. This article moves past the surface-level glamour to provide a detailed tactical breakdown of eight distinct house flip case studies. We will dissect the entire process, from initial acquisition strategy to final sale, revealing the specific choices that drove success.

You will gain a comprehensive understanding of how experienced investors approach different types of projects. We’ll analyze everything from budget allocation and contractor management to design choices and marketing angles. Each example serves as a practical lesson, complete with cost breakdowns, profit analysis, and actionable takeaways you can apply to your own ventures.

This isn’t just a gallery of renovations; it's a strategic playbook. We’ll explore a range of scenarios, including a 1970s ranch overhaul, a complex Victorian restoration, a quick cosmetic flip, and even a challenging hoarder house cleanout. By examining these real-world examples, you'll learn to identify hidden potential, avoid common pitfalls, and maximize your return on investment. Prepare to see exactly how seasoned flippers convert rundown houses into market-ready masterpieces, providing you with a replicable framework for your next project.

1. The Dated 1970s Ranch Transformation

The 1970s ranch is a quintessential subject for many of the most dramatic before and after house flips. These single-story homes, often found in established suburban neighborhoods across the Midwest and Sun Belt, boast solid construction but suffer from dated aesthetics like wood paneling, shag carpets, and highly compartmentalized layouts. The core strategy is to unlock the home's latent potential by creating an open-concept floor plan and infusing it with modern, high-demand finishes.

This type of flip focuses on high-impact cosmetic and structural changes rather than complex additions. By removing non-load-bearing walls between the kitchen, dining, and living areas, investors can completely transform the home’s feel and functionality. This creates the bright, airy space that today's buyers crave, instantly boosting perceived value.

Strategic Analysis & Financials

The appeal of the 1970s ranch lies in its predictable formula. Investors can reliably forecast renovation needs, which almost always include gutting the kitchen and bathrooms, removing popcorn ceilings (after asbestos testing), and updating flooring. A typical renovation budget for a standard 3-bed, 2-bath ranch can fall between $80,000 and $150,000, leading to impressive profit margins. For example, an investor might purchase a dated ranch for $250,000, invest $95,000, and resell for $450,000, capturing a significant return.

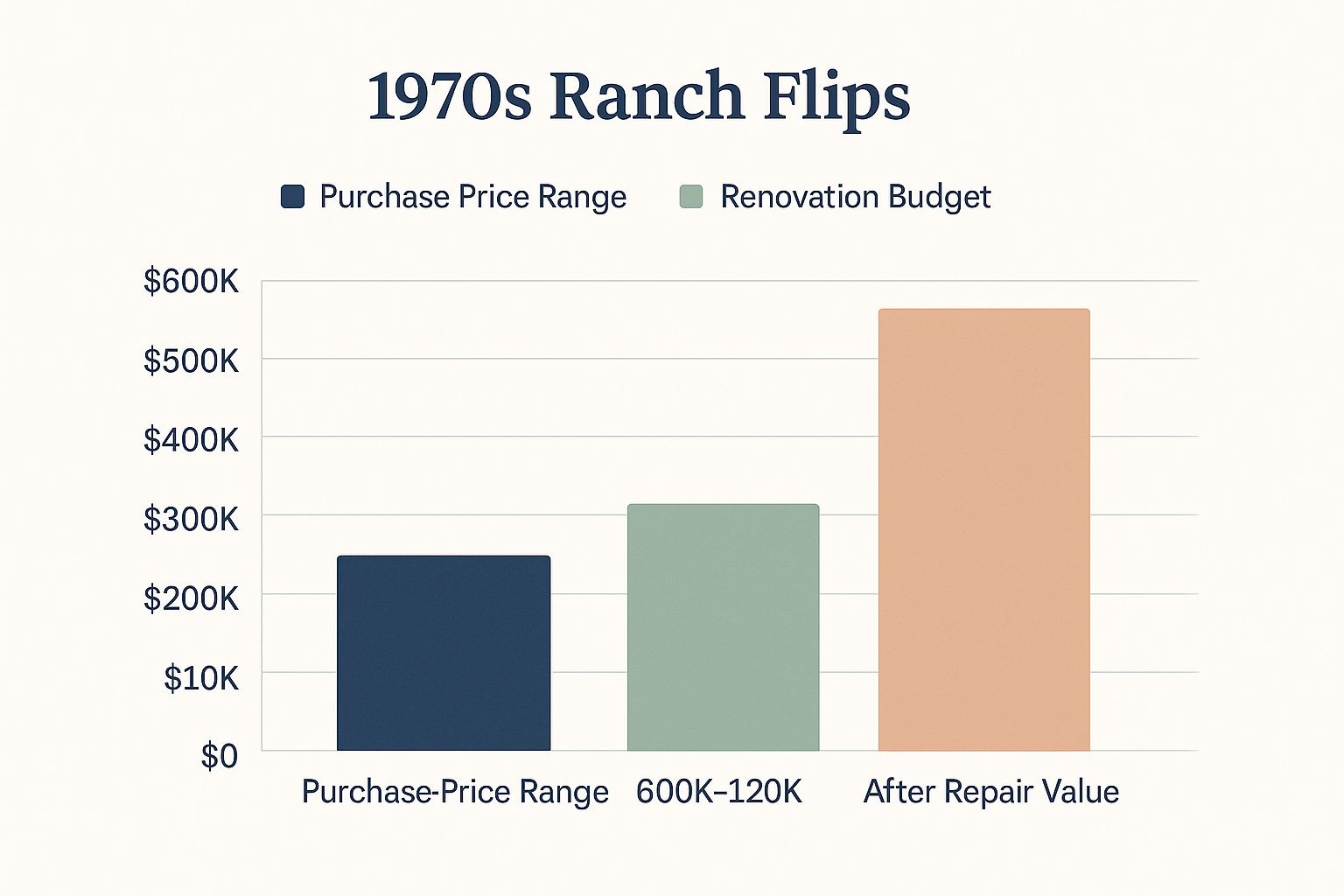

The following chart illustrates the typical financial breakdown for a 1970s ranch flip, highlighting the potential for significant value creation.

This bar chart clearly shows that the renovation investment can nearly double the initial equity, positioning the property to achieve a high After Repair Value (ARV).

Actionable Takeaways

To successfully execute this flip, focus on these key tactics:

- Prioritize the Floor Plan: The single most impactful change is creating an open concept. Budget for engineering consultations and wall removal, as this delivers the highest return on investment.

- Test for Hazards: Always budget for potential asbestos in popcorn ceilings and lead paint. Professional abatement costs around $1,500 to $3,000 but is a non-negotiable safety and legal requirement.

- Preserve Character: Don't erase all of the home's original charm. Refinishing existing hardwood floors found under old carpet is far cheaper ($3-$5 per sq. ft.) than installing new ones ($8-$12 per sq. ft.). A brick fireplace, once cleaned and modernized, can become a stunning focal point.

- Focus on Curb Appeal: Replace dated aluminum-frame windows with energy-efficient vinyl versions. Consider painting the exterior brick a modern, neutral color to instantly update the home's look and attract buyers.

2. The Neglected Victorian Restoration

The neglected Victorian is a challenging yet highly rewarding niche within the world of before and after house flips. These architectural gems, built between 1850 and 1900, often possess irreplaceable character like ornate woodwork, stained glass, and intricate moldings. The primary challenge is to completely overhaul failing systems (plumbing, electrical, HVAC) and modernize kitchens and bathrooms while painstakingly preserving the home’s historical integrity.

Unlike a cosmetic flip, this type of project is a full-scale restoration. Success hinges on a delicate balance: infusing modern comforts that buyers demand without erasing the very soul of the property. This often requires navigating historical district guidelines and employing specialized craftsmen who understand period-specific techniques.

Strategic Analysis & Financials

The financial allure of a Victorian restoration lies in its high-end market appeal and significant value appreciation. These projects are capital-intensive and carry higher risk due to unforeseen structural issues common in older homes. The budget must account for specialized labor and materials. For example, a San Francisco Victorian flip might involve a $1.2M purchase and a $400K renovation, but could resell for over $2.1M.

Profit margins of 40-60% are achievable for experienced investors who manage budgets meticulously. The key is understanding that the investment goes beyond standard updates; it's about selling a piece of history. The After Repair Value (ARV) is heavily influenced by the quality of the restoration and the authenticity of the preserved details.

Actionable Takeaways

To master the art of the Victorian flip, adopt a preservation-first mindset with these tactics:

- Secure Specialized Inspections: Before purchasing, hire a structural engineer experienced with 19th-century homes. They can identify critical issues like foundation settling, knob-and-tube wiring, and water damage that a standard inspection might miss.

- Budget a Large Contingency: Plan for the unexpected. A contingency fund of at least 30% of your total renovation budget is non-negotiable for Victorian projects, as hidden problems are almost guaranteed.

- Source Authentic Materials: Utilize architectural salvage yards to find period-appropriate doors, hardware, and fixtures. This adds authenticity and is often more cost-effective than custom reproductions.

- Partner with Historical Experts: Engage with local historical societies for guidance on regulations and potential grant opportunities. Their expertise can save you from costly mistakes and add credibility to your restoration.

- Seek Historical Designation: After the renovation, applying for a historical designation can significantly increase the property's value and offer tax benefits to the new owner, making it a powerful selling point.

3. The Cosmetic Lipstick Flip

The "lipstick flip" is one of the most accessible strategies for seeing dramatic before and after house flips without the high costs and risks of a full gut renovation. This approach targets properties that are structurally sound but suffer from deferred maintenance or seriously dated aesthetics. The core principle is to maximize visual impact through high-ROI cosmetic upgrades while avoiding expensive changes to the layout, plumbing, or electrical systems.

This type of flip is all about speed and efficiency. By focusing on paint, flooring, fixtures, landscaping, and staging, an investor can transform a tired-looking house into a move-in ready home in just a few weeks. The goal is to appeal to the broadest segment of homebuyers who want a fresh, modern space without undertaking any projects themselves. This strategy is ideal for beginners or investors in hot markets where minimizing holding costs is paramount.

Strategic Analysis & Financials

The financial appeal of a lipstick flip lies in its low renovation budget and predictable scope. Investors favor this method because it minimizes surprises and streamlines the process. The focus is on surface-level changes that create the biggest "wow" factor for the least amount of money. For example, a flipper in a Phoenix suburb could turn a $235,000 purchase into a $289,000 sale in under six weeks with just an $18,000 cosmetic investment, netting a quick $36,000 profit.

These projects often see renovation budgets between $15,000 and $30,000. The key is allocating funds where they make the most visual difference, allowing for rapid value creation. This method proves that a massive overhaul isn't always necessary to achieve a profitable outcome in real estate flipping.

Actionable Takeaways

To execute a successful lipstick flip, concentrate on these high-impact, low-cost tactics:

- Focus on the Core Cosmetics: Allocate the majority of your budget (around 70%) to new paint and flooring. Use a neutral, widely appealing paint color like Sherwin-Williams' Agreeable Gray. For flooring, luxury vinyl plank (LVP) offers the best return, providing a high-end wood look for just $3-$5 per square foot installed.

- Modernize Fixtures and Hardware: The quickest way to update a kitchen or bathroom is by replacing old fixtures. Swap out dated brass ceiling fans, light fixtures, and cabinet hardware for modern brushed nickel or matte black options. This small expense creates an immediate, contemporary feel.

- Don't Neglect Curb Appeal: A buyer's first impression is formed in seconds. Budget at least $2,000 for landscaping essentials like fresh mulch, new plants, a painted front door, and a new mailbox. Pressure washing the driveway and siding can make the entire property look brand new.

- Stage for Success: Professional staging can increase a home's sale price by 5-10% and significantly reduce its time on the market. At a minimum, stage the main living areas to help buyers envision themselves living in the space. The investment of a few thousand dollars pays for itself.

4. The Outdated Builder Grade to Modern Luxury Upgrade

Homes built in the 1990s and 2000s represent a goldmine for some of the most profitable before and after house flips. These properties often have sound structures, modern electrical systems, and functional layouts, but are visually stuck in the past with builder-grade finishes. The quintessential "before" picture includes honey oak cabinets, laminate countertops, brass fixtures, and a sea of beige paint. The flipping strategy here is less about structural overhaul and more about a high-impact aesthetic transformation.

This type of flip focuses on replacing dated materials with modern, luxury finishes that buyers see in new construction. By upgrading key areas like the kitchen and bathrooms with quartz countertops, contemporary lighting, and on-trend color palettes, an investor can elevate a standard tract home into a desirable, move-in-ready property. This approach allows a flipper to command a premium price without the cost and complexity of a full gut renovation.

Strategic Analysis & Financials

The appeal of the builder-grade flip is its high return on cosmetic investment. The "bones" of the house are typically solid, meaning the budget is allocated almost entirely to value-adding finishes rather than fixing foundational or systemic issues. This formula is highly replicable. For instance, a flipper can purchase a 2002 tract home for $295,000, invest $55,000 in modernizing the kitchen, bathrooms, and flooring, and achieve an After Repair Value of $415,000.

The key is to spend money where it has the most visual impact. Knowing precisely how much to allocate to each area is crucial for maximizing profit. Understanding how to estimate renovation costs for these specific upgrades ensures you don't over-improve for the neighborhood while still meeting buyer expectations for a modern home.

Actionable Takeaways

To successfully execute this flip, focus on these key tactics:

- Attack the Oak: Honey oak is the biggest indicator of a dated home. To save $10,000 or more, professionally paint existing cabinets a modern white or gray instead of replacing them. This provides an 80% visual upgrade for 20% of the cost.

- Invest in Countertops: Buyers in this market expect stone. Budget for quality quartz countertops ($45-$75 per square foot). This single upgrade can make the entire kitchen feel high-end and is a major selling point.

- Unify Fixtures: Replace all dated brass or chrome plumbing and lighting fixtures with a single, cohesive finish. Matte black or brushed nickel are popular, modern choices that instantly unify the home's design.

- Maximize Kitchen Height: If the kitchen has dated soffits above the cabinets, remove them. This allows you to install taller upper cabinets or add a decorative crown molding, creating a more spacious and custom look that mimics new construction.

5. The Hoarder House Clean Out and Restoration

Among the most challenging yet potentially profitable before and after house flips is the hoarder house restoration. These properties suffer from extreme neglect, often filled with years of accumulated belongings, trash, and biohazards. The core strategy involves a high-risk, high-reward approach: acquiring the property far below market value and executing a complete top-to-bottom remediation and renovation to restore it to a habitable, marketable condition.

This type of flip is not for the faint of heart. It goes far beyond cosmetic updates, requiring specialized clean-out crews, hazmat-level precautions, and extensive repairs to systems and structures damaged by moisture, pests, and neglect. The transformation from an uninhabitable hazard to a beautiful, safe home is one of the most dramatic in real estate investing.

Strategic Analysis & Financials

The financial appeal of a hoarder house lies in the massive discount at purchase. These properties are unfinanceable for traditional buyers and repel most investors, creating an opportunity for those equipped to handle the cleanup. The forced equity gain is substantial. For instance, a Los Angeles investor purchased a hoarder house for $425,000, invested $125,000 (including an $18,000 clean-out), and sold it for $795,000.

The key is to accurately budget for the unknown. After the initial clean-out, which can involve dozens of dumpsters and cost upwards of $30,000, hidden structural damage, mold, and pest infestations are often revealed. A successful budget must include significant contingency funds to address these discoveries.

Actionable Takeaways

Successfully flipping a hoarder house requires a meticulous, safety-first approach:

- Prioritize Professional Remediation: Do not attempt the initial clean-out yourself. Hire specialized services that handle biohazards. This critical first step costs between $3 and $8 per square foot but is essential for safety and efficiency.

- Budget for Deep Cleaning: Factor in costs for professional odor removal, such as ozone treatments ($500-$2,000), and pest extermination. All porous materials like carpet, insulation, and affected drywall must be removed and replaced.

- Inspect After the Clean-Out: A true assessment of the property's condition is only possible after it's empty. Budget for post-clean-out inspections for mold ($400-$800), structural integrity, and electrical and plumbing systems.

- Seal and Encapsulate: Before installing new flooring and drywall, use a heavy-duty primer like Kilz on subfloors and framing to seal in any remaining stains and odors. This is a non-negotiable step to prevent issues from resurfacing.

6. The Fire or Water Damaged Insurance Claim Flip

Few transformations are as dramatic as those in before and after house flips involving fire or water damage. These properties, often sold at deep discounts by distressed owners or insurance companies, present a unique high-risk, high-reward opportunity. The damage, whether from a kitchen fire, a burst pipe, or a major flood, typically scares off conventional buyers, creating a niche for savvy investors who can see beyond the initial devastation.

The core of this strategy involves extensive remediation and reconstruction. Unlike a cosmetic flip, this requires a specialized team to address structural issues, mold, smoke damage, and complete system overhauls. The goal is to take a property deemed uninhabitable and restore it to pristine, modern condition, capturing a massive increase in value by solving a complex problem that most of the market avoids.

Strategic Analysis & Financials

The financial appeal of a damage flip is rooted in the significant discount on the acquisition price. Properties are often purchased for 40-60% of their After Repair Value (ARV). For example, a California investor could purchase a fire-damaged home for $380,000 that had a pre-incident market value of $850,000. After a $245,000 remediation and renovation, it could sell for $925,000, showcasing the immense profit potential.

However, these projects carry substantial financial risk due to unforeseen issues. It is standard practice to budget a contingency fund of at least 30-40% of the total renovation cost, as hidden structural damage, widespread mold, or compromised electrical systems are common. Financing is also a hurdle, as conventional lenders will not finance uninhabitable homes, making private or hard money loans the typical funding route.

Actionable Takeaways

To navigate the complexities of a damage flip, a meticulous, expert-led approach is critical:

- Assemble a Specialized Team: Before making an offer, engage a structural engineer ($500-$1,500) and a certified mold inspector ($300-$700). Their reports are non-negotiable for accurately scoping the project and avoiding a catastrophic investment.

- Secure All Documentation: Request the complete insurance claim file. This documentation provides a professional, third-party assessment of the damage scope, which is invaluable for creating a realistic budget and timeline.

- Prioritize Safety and Permitting: Fire can release asbestos fibers, and water damage leads to toxic mold. Always test for hazardous materials. Use HEPA air scrubbers during demolition and pull all required permits; city inspections are crucial for ensuring the home is safe and for protecting you from future liability.

- Replace, Don't Repair, Key Systems: In a fire-damaged home, always plan to replace the entire HVAC system. Soot and toxic particles can remain deep within the ductwork, posing health risks. Similarly, any electrical wiring exposed to extreme heat or water should be fully replaced, not spliced.

7. The Foreclosure/Short Sale Modernization Flip

Foreclosed and short-sale properties represent the bread-and-butter of many flipping businesses, offering consistent opportunities for dramatic before and after house flips. These homes often suffer from significant deferred maintenance and neglect as previous owners faced financial hardship. The core strategy is to acquire these distressed assets at a steep discount and systematically bring them up to modern market standards, forcing appreciation through targeted renovations.

This type of flip focuses on correcting neglect and modernizing finishes rather than complete structural overhauls. Common issues include missing copper pipes, stolen HVAC units, damaged drywall, and severely outdated kitchens and bathrooms. By addressing these functional and cosmetic flaws, investors can quickly transform a neglected property into a highly desirable, move-in-ready home.

Strategic Analysis & Financials

The appeal of the foreclosure flip lies in the built-in equity achieved at purchase. Investors typically acquire these properties well below market value, creating a solid foundation for profitability. The model relies on a precise calculation of After Repair Value (ARV) and a disciplined renovation budget. For example, an investor might purchase a bank-owned property in Las Vegas for $185,000, invest $52,000 in repairs, and sell it for $285,000.

The key is adhering to a strict financial formula, often the "70% Rule," where the purchase price plus renovation costs do not exceed 70% of the ARV. This discipline protects profit margins against unforeseen expenses, a common occurrence in properties that have sat vacant. Learning how to find distressed properties is the critical first step in this process.

Actionable Takeaways

To successfully execute this flip, focus on these key tactics:

- Budget for the Unknowns: Always allocate a contingency fund of 10-15% for unexpected issues. Assume that vandals or previous owners have stripped valuable components. Budget for replacing copper plumbing ($3,000-$8,000) and entire HVAC systems ($5,000-$12,000) from the start.

- Secure the Property Immediately: Upon closing, the first step is to secure the asset. Change all locks, board up broken windows if necessary, and in cold climates, immediately winterize the plumbing to prevent costly burst pipes.

- Leverage Cash and Speed: In short sale negotiations or at auctions, cash is king. A fast, all-cash offer with no contingencies is often more attractive to a bank or distressed seller than a higher-priced offer with complex financing.

- Build an REO Network: Establish relationships with real estate agents who specialize in REO (Real Estate Owned) listings. These agents are often the gatekeepers to off-market deals and can provide valuable insights into a property's condition before it hits the open market.

8. The Teardown and Rebuild Flip

The teardown flip is one of the most ambitious and capital-intensive before and after house flips, representing a shift from renovation to new construction. This strategy involves purchasing a property not for its existing structure but for its valuable land in a prime location. The old, often functionally obsolete house is demolished to make way for a brand-new, modern home tailored to the high end of the local market.

This approach is most effective in desirable, established neighborhoods where vacant lots are nonexistent. Investors capitalize on the massive value gap between an outdated property and new construction, meeting the demand of affluent buyers who want a contemporary home without moving to a new subdivision. The transformation is absolute, replacing a relic with a premium, high-demand asset.

Strategic Analysis & Financials

Unlike cosmetic flips, the teardown strategy is a full-scale development project. Profitability hinges on acquiring the lot at the right price and managing construction costs meticulously. The high barrier to entry due to significant capital requirements also means less competition. For example, a Denver investor could turn a $425,000 lot purchase and a $375,000 build into a $1.2 million sale, netting a profit of around $300,000.

The financial model is complex, with "soft costs" like architectural plans, permits, and financing fees playing a major role alongside hard construction costs. Getting a handle on the initial demolition expenses is a critical first step in budgeting. You can learn more about the complete costs of demolition to build a more accurate financial forecast.

Actionable Takeaways

Executing a successful teardown requires precision and extensive due diligence:

- Master Local Zoning: Before purchasing, verify that local zoning laws, setback requirements, and height restrictions allow for the size and style of home you plan to build. An architect familiar with the local permit process is an invaluable partner.

- Build to the Market Ceiling: Research comparable new builds in the area to determine the market's upper limit. Your goal is to build a premium home that fits the neighborhood's character but doesn't overbuild to a point where you can't recoup your investment.

- Secure Accurate Bids: Obtain detailed construction bids from at least three reputable builders. This is the largest line item in your budget, and locking in a reliable builder with a fixed-price contract can protect you from significant cost overruns.

- Plan for a Long Timeline: A teardown and rebuild project can take 12 to 18 months or more. Factor in carrying costs for this extended period and secure a construction loan that accommodates a phased draw schedule. Have a robust contingency fund (15-20%) for unexpected delays and expenses.

Before and After House Flip Comparison

| Flip Type | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| The Dated 1970s Ranch Transformation | Moderate - involves cosmetic and some system upgrades; 3-5 months | Moderate budget: $60K-$120K renovation; mid-range skill | Profit $40K-$80K; improved flow, modern aesthetics | Buyers seeking updated mid-century homes; Midwest, Sun Belt markets | Solid bones, strong market demand, single-story appeal |

| The Neglected Victorian Restoration | High - requires specialized craftsmen, historical compliance; 6-18 months | High budget: $200K-$500K renovation; advanced skills | Profit $100K-$300K+; luxury finish, historical value preservation | Experienced flippers targeting upscale buyers in historic urban areas | Unique architecture, tax credits, high premiums |

| The Cosmetic Lipstick Flip | Low - purely cosmetic; 2-6 weeks renovation | Low budget: $15K-$40K; beginner-friendly | Profit $15K-$40K; fast turnaround | Beginner flippers; hot markets; low capital | Low risk, fast sales, minimal surprises |

| The Outdated Builder Grade to Modern Upgrade | Moderate - mainly finish upgrades; 2-4 months | Mid-range budget: $55K-$100K renovation; intermediate skill | Profit $40K-$75K; modern luxury appeal | Suburban family markets; buyers wanting updated but affordable homes | Solid structure, predictable scope, strong ROI |

| The Hoarder House Clean Out and Restoration | High - intensive clean-out plus repairs; 4-8 months | High budget: $60K-$150K plus clean-out $5K-$25K; advanced skill | Profit $60K-$150K; dramatic transformation | Distressed properties with severe neglect; strong project managers | Below-market purchase, compelling marketing story |

| The Fire or Water Damaged Insurance Claim Flip | High - extensive remediation & repairs; 4-10 months | High budget: $60K-$180K plus remediation; advanced skill | Profit $70K-$180K; fully modernized, rare buyer appeal | Fire/flood-damaged properties; requires specialized knowledge | Deep discounts, motivated sellers, large upside |

| The Foreclosure/Short Sale Modernization Flip | Moderate - deferred maintenance & updates; 2-5 months | Moderate budget: $40K-$90K; all experience levels | Profit $35K-$80K; steady opportunity | Foreclosure markets; investors with cash or hard money loans | Steady supply, moderate scope, lower competition |

| The Teardown and Rebuild Flip | Very High - demolition plus new build; 8-18 months | Very high budget: $350K-$700K+ construction; expert level | Profit $150K-$500K+; custom new home | Lots with high land value; markets needing new construction | Highest profit, no hidden surprises, modern home |

Turning These Insights Into Your Next Profitable Flip

The dramatic transformations showcased in these before and after house flips are more than just visually satisfying; they are masterclasses in strategy, market analysis, and disciplined execution. From the methodical restoration of a neglected Victorian to the high-stakes teardown and rebuild, each project serves as a detailed blueprint for turning distressed properties into desirable, profitable assets. As we've dissected these eight distinct case studies, several core principles have emerged as the common denominators of success.

The most critical lesson is the paramount importance of data-driven decision-making. The "lipstick flip" succeeded because the investor recognized that a light cosmetic touch was all the market demanded, avoiding over-improvement. Conversely, the builder-grade upgrade thrived because the flipper accurately identified a buyer pool willing to pay a premium for luxury finishes in that specific neighborhood. These decisions were not based on gut feelings; they were rooted in a deep understanding of comparable sales, renovation costs, and target buyer demographics.

Synthesizing the Core Strategies

Across all these successful before and after house flips, from the overwhelming hoarder house to the structurally compromised fire-damaged property, a consistent pattern of strategic thinking is evident. Aspiring and seasoned flippers alike should internalize these replicable frameworks to mitigate risk and maximize returns on their own projects.

Here are the most vital takeaways synthesized from the examples:

- Know Your Exit Strategy First: Before making an offer, define your end goal. The strategy for the 1970s ranch (targeting a first-time homebuyer) was vastly different from the high-end rebuild, which catered to a luxury market. Your entire renovation plan, budget, and timeline must align with this predetermined exit.

- Budget for the Unexpected: The water damage and foreclosure flips underscored the necessity of a robust contingency fund. Successful investors don't just hope for the best; they plan for the worst. A contingency of 15-20% of the total renovation budget is not a luxury, it's a critical safety net.

- Focus on High-ROI Upgrades: Every dollar spent must contribute to the After-Repair Value (ARV). As seen in multiple examples, kitchens and bathrooms consistently deliver the highest return on investment. Prioritizing these areas over less impactful changes is key to a profitable outcome.

- Solve Big Problems for Big Profits: Projects like the hoarder house or the fire-damaged property come with significant challenges, which scare away less experienced investors. By developing the expertise and team to solve these complex problems, you can acquire properties at a deep discount and unlock substantial profit margins.

Putting Knowledge into Action

Mastering these concepts transforms you from a speculator into a strategic real estate investor. It’s about building a repeatable system that you can apply to any potential deal. The true value of studying these before and after house flips lies not in copying a specific design, but in adopting the analytical mindset that underpinned each successful transaction.

Your next step is to move from theory to practice. Begin by analyzing your local market. Identify which of these flip types are most prevalent and profitable in your area. Is your market dominated by older homes ripe for modernization like the Victorian, or is there a high demand for cosmetic updates on newer properties? Start building your team of contractors, agents, and lenders who understand the unique demands of investment properties.

Ultimately, success in house flipping is a numbers game won before the demolition even begins. The ability to quickly and accurately analyze a deal is the single most important skill you can develop. By embracing these strategies and leveraging the right tools, you can confidently navigate the complexities of any project and turn your next investment into a stunning and profitable success story.

Don't leave your profit margins to chance. Flip Smart empowers you with the data-driven tools used by top investors to analyze deals in minutes, providing accurate ARVs, detailed renovation estimates, and clear profit projections. Take the guesswork out of your next project by visiting Flip Smart and start making smarter, more confident investment decisions today.