When you're buying a house, the asking price is just the beginning. The real, ongoing cost of owning that property comes from something called carrying costs.

Think of them as the monthly subscription fee for your house—all the recurring expenses you'll pay just to own and maintain it. Getting a handle on these numbers is one of the most important steps in the home-buying process.

Beyond the Price Tag: The True Cost of Homeownership

It’s a lot like buying a car. You don’t just pay for the car once and call it a day, right? You’re constantly paying for gas, insurance, and maintenance to keep it on the road. Homeownership works the same way, just on a larger scale. The purchase price gets you the keys, but carrying costs are what you'll live with for years to come.

These ongoing expenses are the most critical numbers for any home buyer to understand because they determine the true affordability of a property. Getting this part wrong can quickly turn a dream home into a financial headache.

Quick Takeaway: As a general rule, you can expect annual maintenance costs to be between 1% and 4% of your home's value. For a $400,000 house, that’s an extra $4,000 to $16,000 a year you need to have set aside, completely separate from your mortgage payment.

What Expenses Are Included?

So, what exactly are we talking about here? While every property is a little different, the main carrying costs are pretty standard. Once you understand these, you'll have a much clearer picture of what you're signing up for.

- Mortgage Payment: This is the big one. It covers the amount you borrowed (principal) plus the interest you owe the lender.

- Property Taxes: Your annual tax bill, which is usually broken down and paid monthly into an escrow account as part of your mortgage payment.

- Homeowners Insurance: This protects your investment from things like fire, theft, or other damage.

- Utilities: All the essentials—electricity, water, gas, internet, and trash pickup.

- Maintenance and Repairs: This covers everything from a leaky faucet to a new roof. It's not a fixed monthly bill, but you absolutely have to budget for it.

- HOA Fees: If your property is in a managed community, these monthly or annual fees are non-negotiable.

Why Budgeting for Carrying Costs Matters

Understanding your carrying costs lets you build a realistic budget and avoid the "sticker shock" that many new homeowners feel a few months after closing. It forces you to look past a tempting list price and evaluate a home based on its total cost of ownership.

This is especially true when a property needs work. A house might look like a great deal, but if it needs a lot of updates, those expenses become part of your real cost. This is why properly estimating repair costs is such a crucial step before you buy.

By planning for these numbers from the start, you can make sure your new home remains a source of joy, not a source of stress, long after you get the keys.

Breaking Down the Core Components of Carrying Costs

To get a real grip on carrying costs, you have to look at all the pieces that make up the whole. Think of it like a recipe: your total monthly payment is the final dish, but it’s made up of several key ingredients, each with its own price tag. Nailing down these components is the first step to building a budget that actually works.

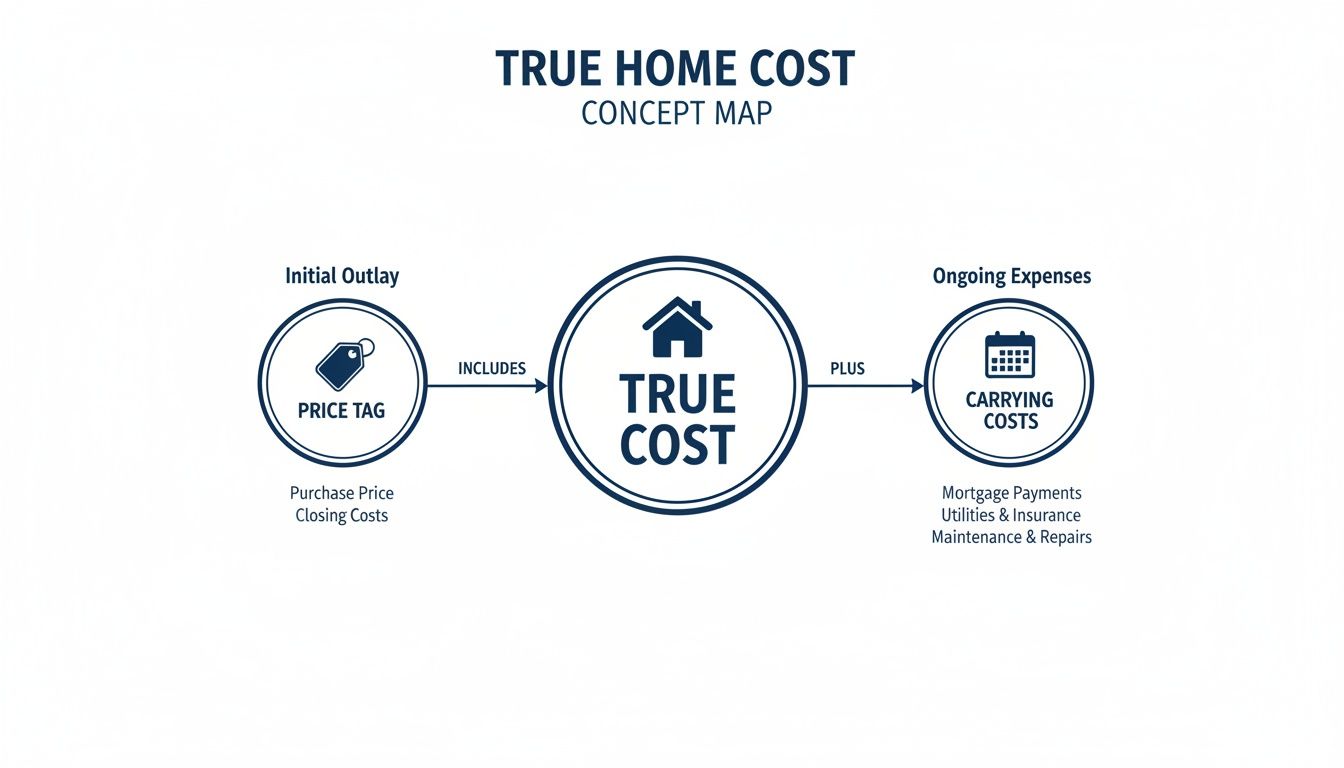

The sticker price on a house is just the beginning. This visual shows how that one-time cost combines with all the ongoing expenses to form the true cost of ownership.

As you can see, the purchase price is a single event. Carrying costs are the relentless, recurring payments that will define your financial life as a homeowner.

The Big Four: PITI

For most homeowners, the core of their carrying costs is bundled into a handy acronym: PITI. This stands for Principal, Interest, Taxes, and Insurance, and it makes up the bulk of your monthly mortgage payment.

- Principal: This is the part of your payment that actually pays down what you borrowed. Every dollar of principal builds your equity.

- Interest: This is the fee you pay the lender for the privilege of borrowing their money. Especially in the early years of a loan, a huge chunk of your payment goes right here.

- Taxes: These are the property taxes your local government collects to fund schools, roads, and emergency services. Your lender usually collects this from you monthly in an escrow account and pays the bill for you.

- Insurance: This refers to homeowners insurance, which protects your property from disasters like fires or major storms. Just like taxes, this is typically paid into your escrow account each month.

And if you put down less than 20% on your home, get ready for a fifth letter: PMI (Private Mortgage Insurance). This is an extra fee tacked onto your monthly payment that protects your lender—not you—in case you can't make your payments.

Beyond the Mortgage Payment

PITI is the foundation, but it’s far from the whole story. Several other recurring expenses are just as critical to your budget, and ignoring them is a recipe for financial stress.

First up, utilities. These are the essentials that make a house a home: electricity, water, gas, sewer, and trash collection. In today’s world, you’d better budget for internet and maybe cable, too.

Then there are Homeowners Association (HOA) fees. If your property is in a condo complex, townhouse community, or a planned neighborhood, you're likely responsible for monthly or quarterly dues. These cover the upkeep of shared spaces like pools, landscaping, and clubhouses.

Heads up: HOA fees are not optional. If you don't pay, the association can charge fines and even place a lien on your property.

The Ever-Present Costs of Maintenance and Repairs

This is the one that trips up so many new homeowners. Maintenance and repairs are the most unpredictable—but absolutely inevitable—carrying costs you'll face. A water heater doesn't give you two weeks' notice before it breaks. A roof leak doesn't wait for a convenient time.

A good rule of thumb is to set aside 1% to 4% of your home's value every single year for these surprises. For a $350,000 home, that’s a savings goal of $3,500 to $14,000 annually. A smart budget also includes regular contributions to a reserve fund for big-ticket items down the road. It’s worth your time to do some reading on understanding reserve funds to truly prepare.

To help you keep track of it all, here's a quick summary of the most common carrying costs.

A Quick Look at Typical Homeowner Carrying Costs

This table breaks down the main components, how often you'll pay them, and what to keep in mind for your budget.

| Cost Component | Typical Frequency | What It Covers | Key Consideration |

|---|---|---|---|

| Mortgage (P+I) | Monthly | Repaying the loan principal and interest charges from the lender. | Your largest fixed cost; interest is highest in the early years. |

| Property Taxes | Monthly (in escrow) | Local services like schools, roads, and public safety. | Can increase over time based on property value assessments. |

| Home Insurance | Monthly (in escrow) | Protection against damage from fire, storms, and other covered events. | Premiums can change based on claims history and location risks. |

| Utilities | Monthly | Essential services like electricity, water, gas, and internet. | Varies by usage and season; can be a significant variable cost. |

| HOA Fees | Monthly/Quarterly | Maintenance of common areas and community amenities. | Not optional and can increase annually. |

| Maintenance | Ongoing | Routine upkeep like lawn care, HVAC servicing, and pest control. | Budget 1% of home value annually for these predictable costs. |

| Repairs | As Needed | Unexpected fixes like a broken appliance or a leaky roof. | An emergency fund (separate from maintenance) is crucial. |

| PMI | Monthly | Insurance protecting the lender if you have less than 20% equity. | Can eventually be removed once you reach 20% equity. |

By breaking down each of these components, you move from a vague idea of "housing costs" to a concrete, actionable budget that reflects the true financial reality of owning a home.

How to Calculate Your Estimated Monthly Carrying Costs

Alright, let's move from theory to practice. Understanding the components of carrying costs is one thing, but being able to run the numbers yourself is what separates savvy home buyers from everyone else. This is a core skill every home buyer needs.

Think of it as looking under the hood of a property's finances. This hands-on approach will let you look at any home and see its true monthly cost, not just the sticker price. The math is simple, but the insight it provides is powerful.

The Simple Formula for Total Carrying Costs

At its core, calculating your total monthly carrying cost is just simple addition. You're just gathering all the individual pieces we talked about and adding them up to get your all-in number.

Your Simple Formula:

Monthly Mortgage (P+I) + Monthly Property Taxes + Monthly Home Insurance + Monthly Utilities + Monthly HOA Fees + Monthly Maintenance Savings = Total Estimated Monthly Carrying Costs

This final number is what really matters. It’s a far more honest look at what you’ll actually be paying each month to own the property, making it the most reliable figure for judging affordability.

A Step-by-Step Calculation Example

Let's walk through a realistic scenario to see this in action. Imagine you’re looking at a home with a purchase price of $400,000. You plan to put down 20% ($80,000), leaving you with a 30-year fixed-rate mortgage of $320,000 at a 6.5% interest rate.

Here’s how you’d break down the monthly expenses:

Mortgage (Principal & Interest): Using a mortgage calculator, your P+I payment comes out to roughly $2,023 per month. This is your biggest fixed cost and the easiest to figure out.

Property Taxes: Let's say the local tax rate is 1.25% of the home's value each year.

- $400,000 x 1.25% = $5,000 per year

- $5,000 / 12 months = $417 per month

Homeowners Insurance: A standard policy for a home of this value might run about $1,800 annually.

- $1,800 / 12 months = $150 per month

Utilities: Based on local averages and the home's size, you can budget around $300 per month for the essentials: electricity, water, gas, and internet.

HOA Fees: This property happens to be in a community with a $75 per month HOA fee.

Maintenance Savings: We’ll use the conservative 1% rule since the home is in good shape.

- $400,000 x 1% = $4,000 per year

- $4,000 / 12 months = $333 per month to stash away for future repairs.

Now, let's add it all up:

- $2,023 (Mortgage) + $417 (Taxes) + $150 (Insurance) + $300 (Utilities) + $75 (HOA) + $333 (Maintenance) = $3,298 Total Monthly Carrying Cost.

Notice the massive gap? The true monthly cost is over $1,200 more than the mortgage payment alone. This is the number that can make or break a budget.

For real estate investors, these calculations get even more granular. To see how it's done on a fix-and-flip or rental, you can learn more about how to calculate holding costs for an investment property in our specialized guide.

Where to Find Your Numbers

A good estimate relies on good data. Here’s where to find accurate local figures:

- Property Taxes: Your best bet is the local county tax assessor’s website. You can often look up the tax history for a specific property or find the current rates for the area.

- Homeowners Insurance: Don't guess. Get actual quotes from a few insurance providers. They’ll give you a precise number based on the home's specifics.

- Utilities: Your real estate agent can often get past utility bills from the seller. If not, call the local utility companies directly for an estimate based on the home's square footage.

For a typical homebuyer, carrying costs are just part of the monthly budget—a predictable expense for the roof over their head. But for a real estate investor, they're a direct assault on your profit.

These ongoing expenses, often called holding costs, are the meter that’s always running. Every single day, they're ticking away at your potential return on investment (ROI).

Time is literally money, whether you're tackling a fix-and-flip or managing a rental property. The longer a project drags on or a unit sits empty, the more these costs pile up. They can shrink your profit margin down to nothing, or worse, put you in the red.

Mastering these costs isn't just a "nice-to-have" skill. It's non-negotiable for any investor who wants to stay in the game.

The Investor-Specific Expense Sheet

While investors and homeowners both pay for things like taxes, insurance, and utilities, an investor's expense sheet has a few unique—and often much more aggressive—line items. These are costs tied directly to the business of making money from a property, not living in it.

Here are a few costs that hit investors the hardest:

- Loan Payments (Hard Money or Private Lenders): Forget a standard 30-year mortgage. Investors frequently use short-term, high-interest loans to fund deals. A hard money loan might carry a 10-15% interest rate, making each monthly payment a significant cash drain.

- Property Management Fees: For rental owners, hiring a management company is a common way to scale. But that fee, typically 8-12% of the monthly rent, is a carrying cost that you pay whether the unit is occupied or vacant.

- Business Utilities: This isn't just about keeping the lights on. It's the electricity needed to run power saws during a renovation or the basic utilities required to keep a vacant rental secure and showable.

- Marketing and Staging Costs: For a flip, these are the expenses to advertise the property and stage it to attract top-dollar offers. For a rental, it's the cost of listing the unit and showing it to potential tenants.

These expenses are all about the clock. The faster you can finish a renovation and sell, or the quicker you can place a great tenant, the less damage these holding costs can inflict on your bottom line.

Carrying Costs in Action: A Tale of Two Investments

To really see the impact, let's look at two common investment scenarios. The difference in how carrying costs eat into profits shows exactly why speed and efficiency are everything.

Example 1: The Fix-and-Flip

An investor snags a property for $250,000 using a hard money loan. Their monthly carrying costs break down like this:

- Loan Interest Payment: $2,500

- Taxes & Insurance: $400

- Utilities: $150

- Total Monthly Carrying Cost: $3,050

The project was scheduled for three months, but a delay with the contractor pushes it to four. That one extra month just added $3,050 in costs, which comes directly out of the final profit. Delays are the number one enemy of a successful flip.

Example 2: The Rental Property

An investor owns a rental where the mortgage, taxes, and insurance (PITI) come to $1,600 per month. After a tenant moves out, the property sits vacant for two months while they make minor repairs and find a new renter.

- Lost Rent: $4,000 (assuming rent is $2,000/month)

- Carrying Costs (PITI + Utilities): $3,500 (for the two vacant months)

- Total Loss Due to Vacancy: $7,500

In this scenario, the carrying costs during the vacancy just wiped out more than three months of potential rental income. The name of the game for rental investors is minimizing that turnover time.

For investors, the math is brutally simple: Every day a property isn't generating income, it's actively losing you money. The mission is always to shrink the holding period to the absolute minimum.

Understanding the true cost of holding an investment property is fundamental. It forces you to look beyond the purchase price and rehab budget and focus on the entire project timeline. This is exactly what platforms like Flip Smart are built for. They let you plug in all these variables and see a clear projection of how carrying costs will hammer your profits before you even write an offer. By accounting for these expenses upfront, you can build a smarter, more resilient investment strategy.

How Global Trends Can Secretly Hike Your Carrying Costs

It’s tempting to think your carrying costs are a purely local affair—something decided by your city’s property tax assessor and the regional power company. But in our interconnected world, major economic shifts can reach right into your monthly budget. What happens in a shipping port halfway across the globe can eventually dictate the price of fixing your leaky roof.

Grasping this bigger picture is key to understanding why your costs never seem to sit still. When global supply chains get snarled, it suddenly costs more to get raw materials from point A to point B. This isn't just a news headline; it directly bumps up the price of everything from lumber and copper wiring to new appliances and paint, making your maintenance budget a lot less predictable.

The Ripple Effect of Logistics on Your Home

Just think about all the physical stuff that goes into maintaining a house. Shingles, siding, windows, and flooring don’t appear out of thin air. They all have to be manufactured, stored in a warehouse, and shipped across the country. When the cost of those logistics goes up, the price you pay at Home Depot is sure to follow.

And this isn’t a minor issue. In fact, carrying costs in the warehousing and logistics world have shot up. This spike is fueled by huge economic trends like companies moving manufacturing closer to home ("nearshoring") and the absolute explosion of e-commerce, both of which create insane demand for storage space. To see a detailed breakdown of these trends, you can read the full analysis on EAWLogistics.com.

A 7% year-over-year jump in U.S. warehousing costs means that simply storing the materials needed for home repairs is more expensive than ever. That cost gets passed down the line until it lands on you, the end consumer, inflating your carrying costs for maintenance and future renovations.

How Global Economics Shake Up Your Mortgage Rate

Beyond the cost of physical goods, global trends are a huge driver of inflation and the interest rates set by central banks. When the global economy runs hot, central banks often tap the brakes by raising interest rates. That decision directly influences the mortgage rate a lender will offer you.

Even a tiny shift in interest rates can have a massive impact on your single largest carrying cost:

- Higher Interest Rates: This one is simple. Higher rates mean bigger monthly mortgage payments, dramatically increasing your total carrying cost over the life of the loan.

- Economic Uncertainty: A shaky global outlook can make lenders nervous. They might tighten their lending standards, making it harder to get financing in the first place.

By keeping an eye on these larger trends, you're not just watching the news—you're getting crucial context for your own financial planning. It helps you anticipate where costs might be headed and understand the "why" behind the numbers on your statements. This turns you from a passive homeowner into a much more informed and prepared buyer.

Practical Strategies to Lower Your Carrying Costs

Here's the good news: you have more control over your carrying costs than you might think. While some expenses like property taxes feel set in stone, many others have wiggle room. With a smart, proactive approach, you can seriously trim your monthly financial burden—both before you even buy and long after you've moved in.

These strategies aren't just about saving a few bucks here and there. They're about actively managing your finances to keep more money in your pocket each month, making savvy moves that pay dividends for years.

Pre-Purchase Tactics for Long-Term Savings

The decisions you make before signing on the dotted line have the biggest impact, locking in your costs for the next 15 to 30 years. This is where you should focus your energy first.

- Boost Your Credit Score: Think of this as your financial superpower. A higher credit score signals to lenders that you're a low-risk borrower, which unlocks better interest rates. Even a tiny rate reduction can save you thousands over the life of your loan.

- Make a Larger Down Payment: Aiming for a 20% down payment is the gold standard for a reason. It lets you completely sidestep Private Mortgage Insurance (PMI), a costly fee that only protects your lender, not you. More money down also means a smaller loan and, you guessed it, a lower monthly payment.

- Shop Around for Your Mortgage: Never accept the first loan offer you get. Compare rates and terms from multiple lenders—banks, credit unions, online mortgage companies. This simple step can lead to massive savings.

Post-Purchase Tips to Keep Costs in Check

Once you have the keys, your opportunity to save doesn't end. Regularly reviewing your expenses and taking action can stop your carrying costs from creeping up over time.

One of the most effective ways to trim your monthly budget is by tackling your utility bills. As you look for ways to cut down on costs, don't overlook your home's energy efficiency. Implementing effective strategies to reduce energy consumption in your home can lead to a significant drop in what you pay each month.

Key Insight: Many homeowners just accept their property tax bill, but assessments can be wrong. If you think your home is overvalued compared to similar properties, you have the right to appeal your property tax assessment. A successful appeal could lower your annual bill.

Here are a few more actionable tips for homeowners:

- Re-Shop Your Homeowners Insurance Annually: Insurance rates and your coverage needs can change. Get new quotes every year or two to make sure you're not overpaying for the same coverage.

- Perform Preventative Maintenance: Fixing a small leak is way cheaper than dealing with major water damage down the road. Regular maintenance on your HVAC system, roof, and appliances helps prevent those expensive, surprise repairs that can blow up your budget.

- Refinance When Rates Are Favorable: If interest rates drop significantly after you buy, refinancing your mortgage could lower your monthly payment and slash the total interest you pay over the loan's term.

Frequently Asked Questions About Carrying Costs

What's the difference between carrying costs and closing costs?

This is a common point of confusion for new buyers. Closing costs are one-time fees you pay to finalize the purchase of the home (like appraisal fees, title insurance, and loan origination fees). Carrying costs are the recurring, ongoing expenses you pay every month to own the home (like your mortgage, taxes, and utilities).

How do I get an accurate estimate of property taxes for a house I want to buy?

The best source is the local county or city tax assessor's website, where you can often look up a property's tax history by address. Your real estate agent can also provide a solid estimate. Just be aware that property taxes can sometimes be reassessed and increase after a home is sold.

Will my monthly carrying costs stay the same over time?

Not likely. While your principal and interest payment on a fixed-rate mortgage will remain the same, other costs will probably rise. It's common for property taxes and homeowners insurance premiums to increase gradually. It's smart to budget for a small annual increase to avoid surprises.

Ready to stop guessing and start analyzing properties with precision? Flip Smart demolishes the complexity of calculating carrying costs, rehab budgets, and potential profit. Get crystal-clear, data-backed insights in seconds so you can make smarter, more confident investment decisions. Analyze your first deal for free at flipsmrt.com.