The single most important tax question you'll face as a flipper is this: does the IRS see your profit as a capital gain or as business income?

Getting this right is a huge deal. It’s the difference between paying a lower tax rate versus the much higher rates you pay on a regular paycheck. Understanding this distinction from day one is the key to protecting your bottom line and keeping more of your hard-earned profit.

Capital Gains Versus Business Income

When you’re starting out, it’s easy to get caught up in the exciting parts of flipping—hunting for deals, demo day, and seeing that final sale price. But the most critical financial moment happens behind the scenes, and it all comes down to how the IRS classifies your flipping activity.

Simply put, the IRS wants to know: are you a casual investor, or is this your full-time business? The answer completely changes your tax picture.

Think of it like selling a personal car. If you sell the family minivan after a few years, any profit is typically a capital gain. But if you own a used car lot and sell vehicles for a living, that’s just regular business income. The IRS applies that same logic to flipping houses.

Why This Distinction Matters So Much

The difference boils down to one thing: the tax rate.

Profit treated as business income is taxed at your ordinary income tax rate, which can be as high as 37%. On top of that, you’ll likely owe self-employment taxes for Social Security and Medicare, which adds another 15.3%.

In contrast, long-term capital gains get special treatment with much lower tax rates—often 0%, 15%, or 20%. For most people, that’s a massive saving.

This one classification decision impacts everything:

- The tax rate you pay: Potentially saving you tens of thousands of dollars on a single flip.

- The deductions you can take: Businesses and investors play by different rules.

- The complexity of your tax return: Business income requires more detailed reporting.

Quick Takeaway: The IRS is trying to figure out your intent. Did you buy the property to hold as an investment, hoping it would appreciate over time? Or did you buy it with the primary goal of renovating it and selling it for a quick profit?

Flipping one house every couple of years might look like an investment. But completing three or four flips in a single year sends a clear signal to the IRS that you’re running a business. As we'll see, factors like how often you flip, how much time you put in, and even how you market your properties all help the IRS make its decision. Getting this right from the start is the foundation of a profitable house-flipping career.

Defining Your Role: The IRS View of Investor vs. Dealer

When it comes to taxes on your house flips, the first question to answer is how the IRS sees you. Your entire tax situation hinges on one crucial classification: are you an investor or are you a dealer? These aren't just labels; they represent two completely different tax realities that will directly impact your profits.

An investor is like a classic car collector who buys a rare vehicle, holds onto it for a few years hoping its value goes up, and then sells it. A dealer, on the other hand, is the person running the busy car lot, buying and selling cars every week as their primary business. The IRS applies this same logic to real estate flippers.

Key Factors That Determine Your Status

So, how do you know which category you fall into? Unfortunately, there isn't a simple, black-and-white rule. Instead, the IRS looks at the "facts and circumstances" of your flipping activity to figure out your primary intent.

Here are the key factors they consider:

- Frequency of Sales: How many properties are you selling each year? Flipping several houses annually looks more like a business (dealer) than selling one every couple of years (investor).

- Holding Period: How long do you own the properties? A dealer’s goal is to renovate and sell as quickly as possible. An investor might hold a property for over a year to capture long-term market appreciation.

- Extent of Improvements: Were the renovations massive and essential to make the house sellable? Substantial, transformative work often points toward dealer status.

- Your Level of Effort: How much of your own time and energy are you putting into these projects? A hands-on, full-time commitment suggests you're a business owner.

- Marketing and Sales Efforts: Are you actively advertising, hiring real estate agents, and running a professional sales process? That’s classic dealer behavior.

This visual guide can help you see where your activities might place you.

Ultimately, your actions and intent are what guide the IRS's decision, which in turn dictates your tax bill.

Key Differences Between Dealer and Investor Status

The IRS looks at a variety of factors to determine whether you're operating a business or simply making an investment. There's no single deciding factor; instead, they consider the totality of your circumstances. This table breaks down the most common considerations.

| Factor | Typical Dealer (Business) Profile | Typical Investor Profile | Primary Tax Consequence |

|---|---|---|---|

| Frequency | High volume of flips per year (e.g., 3+) | Infrequent sales (e.g., 1 every few years) | Frequent sales point to ordinary income. |

| Holding Period | Short-term (typically under 1 year) | Long-term (typically over 1 year) | Long-term holds can qualify for capital gains. |

| Effort | Substantial, personal, and continuous effort | Passive management or minimal involvement | High personal effort suggests a trade or business. |

| Improvements | Extensive renovations to prepare for sale | Minor repairs or none at all | Major improvements suggest inventory for sale. |

| Intent | Profit from quick resale in the ordinary course of business | Profit from long-term market appreciation | Intent is the core of the dealer vs. investor test. |

| Marketing | Active advertising, listings, and sales operations | Little to no active marketing efforts | Professional marketing signals a business. |

Understanding these distinctions is the first step in aligning your flipping strategy with your desired tax outcome. Your behavior, not just your stated intent, is what truly matters to the IRS.

The Major Tax Differences

Why is this classification such a big deal? Because it completely changes how your profits are taxed. The financial consequences are massive and can take a huge bite out of your earnings.

The core difference is that a dealer's profit is treated as ordinary business income, subject to both income tax and self-employment taxes. An investor's profit, however, is treated as a capital gain, which is not subject to self-employment tax and may qualify for lower long-term tax rates.

This distinction is everything. For anyone flipping houses, understanding the distinctions between passive and active investor status is absolutely essential for tax planning.

Being classified as a dealer means your profit gets added to your other income (like your day job salary) and is taxed at your highest marginal rate. On top of that, you get hit with an additional 15.3% for self-employment taxes (Social Security and Medicare).

An investor who holds a property for more than a year, however, gets to take advantage of long-term capital gains rates. These rates are significantly lower than ordinary income tax rates. Getting this right is the cornerstone of a smart tax strategy for your flips.

Capital Gains Explained for House Flippers

If you've managed to structure your flipping activities to qualify as an investor, your next mission is to master the concept of capital gains. This is where smart timing can literally slash your tax bill.

Think of it as the IRS rewarding you for holding onto an asset long enough to be considered a real investment, not just a quick trade. The most important rule in this world is the one-year holding period. That single 365-day timeline creates a massive fork in the road for your tax outcome.

Short-Term vs. Long-Term Capital Gains

The difference sounds simple, but the financial impact is huge. The IRS treats profits from assets held for different lengths of time in completely different ways.

- Short-Term Capital Gains: This is the profit you make if you sell an asset you've owned for one year or less. The profit is taxed at your ordinary income rate, which can be as high as 37%.

- Long-Term Capital Gains: This is the goal. Sell an asset you’ve held for more than one year, and the profit gets taxed at much friendlier rates—often 0%, 15%, or 20%, depending on your income.

This isn't a small difference; we're talking about thousands of dollars in potential tax savings. For any serious house flipper, understanding Capital Gains Tax on property is non-negotiable if you want to maximize what you actually take home.

The Holding Period Calculation

So, how do you calculate that all-important year? It’s precise. The clock starts ticking the day after you officially take ownership and stops on the day you sell it.

Let's say you close on a house on April 15, 2024. Your holding period officially begins on April 16, 2024. To lock in those lower long-term capital gains rates, you must sell the property on or after April 16, 2025. Selling it even one day sooner—on April 15, 2025—means your profit gets hit with the much higher short-term rates.

Key Takeaway: The one-year holding period is the single most powerful tool an investor-flipper has to legally lower their tax bill. Patience isn’t just a virtue here; it’s a highly profitable tax strategy.

A Practical Example of Tax Savings

Let’s run the numbers to see what this looks like in the real world.

Imagine you're a single flipper who earns $80,000 a year from your day job. This puts you in the 22% federal income tax bracket. You just made a $50,000 profit on a flip.

- Scenario 1 (Short-Term): You sell the house after 11 months. That $50,000 profit is taxed just like your regular income. Your tax bill on that flip? A hefty $11,000 ($50,000 x 22%).

- Scenario 2 (Long-Term): You wait and sell after 13 months. Now, that same profit qualifies for the long-term capital gains rate. At your income level, that rate is 15%. Your tax bill is now just $7,500 ($50,000 x 15%).

By holding on for just two more months, you put an extra $3,500 back in your pocket from a single deal. This simple math shows the immediate power of timing your sales.

Maximizing Your Profits with Tax Deductions

Knowing your tax classification is half the battle. The other half is legally reducing your taxable income.

This is where deductions become a flipper's best friend. Think of every legitimate business expense as a small victory, putting more of your hard-earned profit back into your own pocket instead of the government's.

The key to all of this is simple but non-negotiable: meticulous record-keeping. Every dollar you spend on a project, from the initial appraisal to the final staging couch, can potentially lower your tax bill. Without a receipt or a clean record, that expense might as well have never happened in the eyes of the IRS.

Key Deduction Categories for House Flippers

To make sure nothing slips through the cracks, you need to get organized from day one. A great practical tip is to create separate folders—digital or physical—for each expense "bucket" the moment you acquire a property. It turns tax time from a nightmare into a simple review.

Here are the main expense categories you can write off:

- Acquisition Costs: These are all the upfront fees to get the keys. This includes expenses like title insurance, appraisal fees, inspection costs, and any legal fees you paid at closing.

- Renovation and Repair Costs: This is the big one. Every penny spent on materials—from lumber and drywall to paint and fixtures—is deductible. This also covers the labor costs for your contractors, electricians, and plumbers.

- Holding Costs: These are the expenses you pay while you own the property. Our guide on the cost of holding a flip property dives deep into how insurance, utilities, property taxes, and loan interest add up.

- Selling Costs: Once the work is done, you'll have another round of expenses to sell the property. This includes real estate agent commissions, professional staging, marketing fees, and the legal fees for the closing.

Practical Tip: Keeping a separate bank account for each flip is one of the smartest organizational moves you can make. It creates a clean record of all income and expenses for that specific project, simplifying your accounting and providing a clear audit trail.

To help you stay organized, here's a quick rundown of the essential deductions you should be tracking for every single project.

Essential Tax Deductions for House Flippers

Here’s a summary of the most common deductible expenses that house flippers can claim. Diligent tracking in these categories is the foundation of a healthy, profitable flipping business.

| Expense Category | Examples of Deductible Items | Record-Keeping Tip |

|---|---|---|

| Acquisition Costs | Appraisal Fees, Title Insurance, Legal Fees at Closing, Inspection Costs | Keep the final closing statement (HUD-1 or Closing Disclosure) as your primary record. |

| Renovation & Repairs | Materials (lumber, paint, fixtures), Contractor Labor, Equipment Rentals | Get itemized invoices for every job. Use a dedicated project credit card for all material purchases. |

| Holding Costs | Property Taxes, Mortgage Interest, Homeowners Insurance, Utilities (electric, water, gas) | Set up auto-pay from your project-specific bank account to create a clear digital trail. |

| Selling Costs | Real Estate Agent Commissions, Staging Fees, Marketing & Advertising, Closing Costs | Collect receipts for staging and marketing. The final closing statement will detail commissions. |

| Professional Fees | Accountant Fees, Legal Advice, Real Estate Mentorship or Coaching | Pay for professional services directly from your business account; keep all retainer agreements. |

| Business Operations | Home Office Expenses, Vehicle Mileage, Phone Bill (business use), Software Subscriptions | Use a mileage tracking app. Allocate a percentage of shared bills (like your phone) to business use. |

Remember, the goal is to capture every single legitimate expense. Small costs add up to significant tax savings over the course of a year.

Repairs vs. Capital Improvements: A Critical Distinction

The IRS doesn't view all renovation expenses the same way. You have to understand the difference between a repair and a capital improvement, because it directly impacts when you get to deduct the cost.

A repair is an expense that simply keeps the property in its original operating condition. Think of it as basic maintenance. Fixing a leaky faucet or patching a hole in the drywall are classic repairs. You can deduct 100% of their cost in the year they happen.

A capital improvement, on the other hand, is an expense that adds significant value, adapts the property to a new use, or substantially extends its life. These are the big-ticket upgrades.

Examples of capital improvements:

- Replacing the entire roof

- Adding a brand-new bathroom or deck

- Installing a new HVAC system

- Completely upgrading the electrical wiring

Unlike repairs, the cost of capital improvements must be depreciated. This means you deduct a portion of the cost over several years according to IRS schedules. While less beneficial upfront, these improvements increase your property's "cost basis," which reduces your total taxable profit when you finally sell.

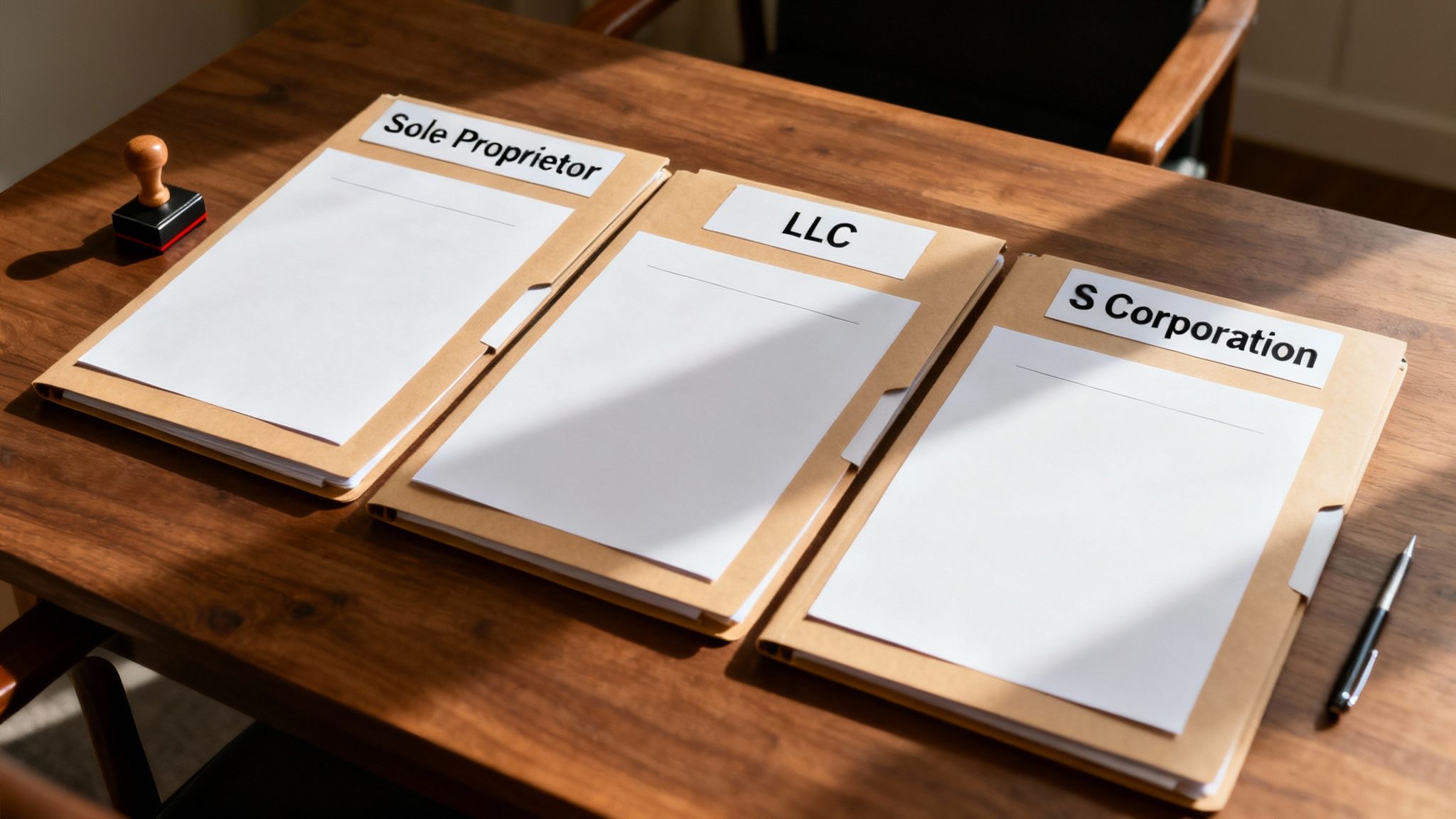

Choosing the Right Business Structure for Your Flips

How you legally set up your flipping operation is one of the most impactful decisions you'll make. This goes way beyond just picking a name for your business—it dictates your personal liability, asset protection, and how much you keep after taxes.

Think of it like choosing the right vehicle for a job. A pickup truck and a sedan both get you down the road, but they serve different purposes and have different costs. Each business entity offers its own unique blend of protection, tax implications, and paperwork.

Picking the right structure from day one is a foundational step. If you're serious about turning flipping into a real business, our guide on how to start flipping houses as a business will help you build that solid framework.

Comparing Common Business Entities

For house flippers, the decision usually boils down to three main structures: the Sole Proprietorship, the Limited Liability Company (LLC), and the S Corporation.

Sole Proprietorship: This is the default if you just start doing business on your own. It's simple and requires no formal setup, but it offers zero liability protection. Your business assets and your personal assets are seen as one and the same, putting your home and savings on the line if a deal goes south.

Limited Liability Company (LLC): An LLC creates a legal wall between you and your business. If your company gets sued, your personal assets are generally protected. For tax purposes, an LLC is a "pass-through" entity, meaning profits flow directly to you to be taxed on your personal return. This neatly sidesteps the "double taxation" that hits some corporations.

S Corporation (S Corp): An S Corp is a tax election (you can have your LLC taxed as one). It gives you the same liability protection as an LLC. Its real power for high-volume flippers is the potential to save on self-employment taxes by paying yourself a "reasonable salary" and taking the rest of the profits as a distribution.

Key Takeaway: The number one reason to form an LLC or S Corp is liability protection. In a high-stakes business like real estate—with contractors, materials, and potential lawsuits—shielding your personal assets isn't a luxury. It's a necessity.

Making the Right Choice for Your Goals

Your choice really depends on how often you plan to flip. If you're just testing the waters with one or two projects, a simple LLC might be the perfect fit. But if you're consistently completing several flips a year, the tax savings from an S Corp election could be massive.

Ultimately, this isn't a decision to make alone. It’s best made with professional guidance. A good CPA or attorney can look at your specific situation—your income, state laws, and long-term goals—to pinpoint the structure that gives you the best balance of protection and tax efficiency.

Beyond Federal Taxes: State and Local Considerations

Focusing only on federal taxes is one of the most common—and costly—mistakes a new house flipper can make. State and local tax laws are a completely different beast, and they can dramatically shrink your bottom line. These rules vary wildly across the country.

Flipping a house in a high-tax state like California creates a totally different financial outcome than flipping the exact same property in Florida or Texas, which have no state income tax. A $50,000 profit in California could see thousands more shaved off the top compared to that same profit earned elsewhere.

The Overlooked Costs That Eat Your Profits

Beyond state income tax, you have to budget for a handful of other location-specific costs that quietly eat into your profit margin.

Be ready to account for these:

- Real Estate Transfer Taxes: Many states and cities charge a tax every time a property changes hands. This fee, usually a percentage of the sale price, gets paid at closing and can add up fast on both the purchase and the sale.

- Sales Tax on Materials: Every can of paint, sheet of drywall, and new appliance you buy for the renovation is subject to state and local sales tax. Across an entire project, this can become a significant line item.

- Local Business Permits and Licenses: Running a flipping business isn't a hobby; you'll likely need to register locally and pull the right permits. Skipping this step can lead to hefty fines and work stoppages that throw your timeline into chaos.

Think of your total tax picture as a three-layer cake. The IRS gets the biggest piece, but the state and city each get a slice, too. Forgetting to serve them can spoil the whole party.

This complex tax landscape is exactly why where you flip is so critical. You can see how your local market stacks up by exploring this state-by-state breakdown of home flipping trends. A real financial analysis has to include a deep dive into all state and local tax obligations to build a realistic budget and accurately project your true net profit.

Frequently Asked Questions (FAQ)

1. How can I avoid paying high taxes when flipping a house?

The best strategy is to aim for long-term capital gains. If you hold the property for more than one year before selling, your profit will be taxed at a lower rate (0%, 15%, or 20%) compared to the higher ordinary income tax rates. Also, be meticulous about tracking every single expense—from materials to closing costs—to maximize your deductions and lower your taxable profit.

2. What's the difference between a repair and an improvement for tax purposes?

A repair (like fixing a leaky pipe) maintains the property's condition, and its cost can be fully deducted in the year you pay for it. An improvement (like adding a new bathroom) adds significant value, and its cost must be deducted over several years through a process called depreciation. While you don't get the full deduction upfront, improvements increase your property's "cost basis," which reduces your taxable gain when you sell.

3. Do I need an LLC to flip houses?

While you don't legally need an LLC, it is highly recommended. An LLC (Limited Liability Company) creates a legal separation between your business and your personal finances. This means if your business is sued, your personal assets like your home and savings are generally protected. For the relatively low cost of setting one up, it provides crucial peace of mind.

4. Can I use a 1031 exchange on a house flip?

This is a common question, and the answer is almost always no. A 1031 exchange is designed for investment properties you intend to hold and rent out, not for properties you intend to sell quickly for a profit. The IRS considers houses held for flipping as "inventory," which makes them ineligible for this tax-deferral strategy.

Ready to stop guessing and start analyzing deals with confidence? Flip Smart gives you the power to evaluate any property in seconds, providing accurate valuations, renovation cost estimates, and profit projections. Make smarter, data-driven decisions on your next flip. Analyze your first property with Flip Smart today!