Flipping houses can be a highly profitable venture, but it's also a high-stakes game where small oversights lead to significant losses. Many aspiring investors jump in with passion but without a plan, only to find themselves overwhelmed by unexpected costs, project delays, and a property that refuses to sell. The difference between a six-figure profit and a financial nightmare often comes down to one thing: a systematic approach. This is not just another list of tips; it is a meticulously detailed checklist for flipping houses designed to serve as your strategic blueprint from start to finish.

We will break down the entire process into seven distinct, manageable phases, each packed with actionable insights and pro-tips. This guide moves beyond generic advice to provide the specific details you need to navigate the complexities of property acquisition, renovation management, and a successful final sale. Whether you are executing your first flip or looking to refine the systems for your tenth, this comprehensive checklist provides the structure needed to make smarter, data-driven decisions. Following this blueprint will help you minimize critical risks, control your budget, and ultimately maximize your return on investment.

1. Phase 1: Property Acquisition and Due Diligence

The foundation of a profitable house flip is built long before the first wall comes down. This initial phase is about identifying, evaluating, and securing properties with significant profit potential. It involves rigorous market analysis, meticulous property inspections, and strategic negotiation. Proper due diligence is your primary defense against costly surprises, ensuring the property you buy has the numbers to back up your investment thesis.

This stage is arguably the most critical step in any checklist for flipping houses because it's where you make your money. A successful purchase sets the stage for profit, while a poor one can lead to a financial loss regardless of how well you renovate. Successful flippers often use the 70% rule as a foundational metric: your purchase price plus the estimated repair costs should not exceed 70% of the After Repair Value (ARV).

How to Approach Property Acquisition

Finding the right property requires a multi-pronged strategy. You cannot rely on a single source. Instead, build a robust deal-finding pipeline that includes:

- Real Estate Agents: Partner with agents who specialize in investment properties and understand the speed required to close on distressed deals.

- Wholesaler Networks: Connect with local wholesalers who can bring you off-market opportunities.

- Auctions: Explore foreclosure auctions, but be prepared for the fast-paced, high-risk environment.

- Direct Mail: Target owners of distressed or inherited properties with a targeted marketing campaign.

Key Due Diligence Actions

Once you have a property under contract, your work truly begins. This is when you validate your assumptions and uncover any hidden issues.

Key Takeaway: Never skip professional inspections. The few hundred dollars you spend on a qualified home inspector, plumber, electrician, and roofer can save you tens of thousands in unexpected repairs down the line.

A comprehensive due diligence process ensures every aspect of the investment is sound. For a detailed breakdown of what to look for, you can learn more about crafting a complete real estate due diligence checklist. This will help you systematically evaluate everything from the foundation to the title history, ensuring no stone is left unturned.

2. Accurate Budget Planning and Cost Estimation

Once a property is secured, the financial success of your flip hinges on a meticulously planned and rigorously managed budget. This phase is about transitioning from broad estimates to a detailed financial roadmap. It involves breaking down every conceivable expense, from the purchase price and renovation materials to holding costs and selling fees. A well-constructed budget is the primary tool that keeps a project profitable and prevents a dream investment from turning into a financial nightmare.

This step is an indispensable part of any checklist for flipping houses because it dictates your every move and defines your potential profit margin. Miscalculating your costs by even a small percentage can erase your gains. Experienced investors always build in a contingency fund, typically budgeting 15-20% of the total renovation cost for unexpected issues like hidden mold, foundation problems, or outdated wiring discovered after demolition begins.

How to Approach Budgeting

A successful budget is not a single number but a detailed, itemized spreadsheet. You need to break costs down into distinct categories to maintain control and clarity.

- Acquisition Costs: Purchase price, closing costs, inspection fees, and initial legal expenses.

- Renovation Costs: Create separate line items for materials and labor for every part of the project (e.g., kitchen, bathrooms, flooring, paint, electrical).

- Holding Costs: These are the expenses you incur while you own the property, including mortgage payments, property taxes, insurance, utilities (water, electricity, gas), and HOA fees.

- Selling Costs: Factor in realtor commissions, closing costs for the sale, staging expenses, and potential buyer concessions.

Key Budgeting Actions

Your budget is a living document that requires constant attention and real-time tracking. Precision here is non-negotiable for maximizing your return on investment.

Key Takeaway: Always get a minimum of three detailed, written quotes from licensed contractors for any significant work. This not only helps you find a competitive price but also provides a more accurate cost basis for your budget and reveals potential red flags if one quote is drastically different from the others.

To ensure your financial projections are as accurate as possible, it is essential to use the right tools. For a comprehensive approach, you can learn how to use a fix and flip calculator to model different scenarios and account for all variables. This allows you to stress-test your numbers and confirm the deal's viability before committing significant capital.

3. Financing Strategy and Cash Flow Management

Without a sound financing and cash flow strategy, even the most promising flip can quickly become a financial nightmare. This phase is about securing the capital needed for both the property purchase and the renovation budget, while meticulously managing funds throughout the project's lifecycle. It involves evaluating different lending options, understanding all associated costs, and maintaining enough liquidity to handle unforeseen expenses and holding costs.

This step is a cornerstone of any comprehensive checklist for flipping houses because your financing structure directly impacts your profit margins. The type of loan, interest rate, and repayment terms can make or break a deal. Real estate experts often emphasize leveraging other people's money (OPM) to scale, but this requires a disciplined approach to borrowing and budgeting to ensure profitability.

How to Approach Project Financing

Securing capital is not a one-size-fits-all process. The best option depends on your experience, financial situation, and the deal itself. Successful flippers often build a network of funding sources, including:

- Hard Money Lenders: These companies offer short-term, asset-based loans designed for flips, providing fast funding based on the property's ARV.

- Private Money Lenders: These are individuals in your network who lend their own capital in exchange for a return, often offering more flexible terms than institutions.

- HELOCs: Using a Home Equity Line of Credit on your primary residence or another investment property can provide a revolving line of credit for purchases and rehab costs.

- Conventional Loans: While slower and more difficult to obtain for distressed properties, they can be an option for certain types of flips or experienced investors with strong financials.

Key Cash Flow Management Actions

Once funded, the focus shifts to disciplined cash management. Every dollar must be tracked to protect your budget and timeline.

Key Takeaway: Always budget a contingency fund of 10-20% of your total renovation costs. This buffer is your safety net for unexpected repairs, delays, or market shifts, preventing a cash crunch that could derail the project.

Properly managing your funds means accounting for all expenses, not just the obvious ones. To protect your profits, you must understand and plan for every expense incurred while you own the property. You can gain deeper insights by mastering the cost of holding an investment property, which includes taxes, insurance, utilities, and loan interest.

4. Renovation Planning and Project Management

With the property secured, the next phase transitions from analysis to action. Renovation planning and project management are where your vision for the property comes to life. This stage involves creating a detailed scope of work, hiring and managing contractors, and navigating the complexities of permits and inspections. A well-managed renovation is the engine that drives value creation, ensuring the project stays on budget, on schedule, and meets the quality standards necessary to attract top-dollar offers.

This part of the checklist for flipping houses separates seasoned investors from amateurs. It’s a dynamic process of balancing costs, timelines, and quality to maximize the After Repair Value (ARV). The focus is on high-impact upgrades that resonate with today's buyers. Investors often use project management software like Buildertrend or Monday.com to track every task, from demolition to the final coat of paint, ensuring nothing falls through the cracks.

How to Approach Renovation Planning

Effective planning begins with a clear, written scope of work for every contractor. This document should detail the exact materials, finishes, and quality expectations, leaving no room for ambiguity. This clarity prevents budget overruns and timeline delays caused by miscommunication.

- Prioritize ROI: Focus your budget on the "money rooms" - kitchens and bathrooms. Upgrades here, along with enhancing curb appeal, consistently deliver the highest return on investment.

- Create a Master Schedule: Develop a project timeline that sequences tasks logically. For example, rough-in plumbing and electrical work must be completed and inspected before drywall can be installed.

- Build a Contractor Network: Have primary and backup contractors for critical trades like plumbing, electrical, and HVAC. A reliable team is your greatest asset.

- Permitting: Identify all required permits early and submit applications as soon as possible, as municipal delays are common and can derail your schedule.

Key Project Management Actions

Active management is crucial once work begins. This means regular site visits, clear communication, and meticulous documentation. Treat the renovation like a business operation, not a hobby.

Key Takeaway: Document everything. Take daily photos of the progress, keep a written log of all communications with contractors, and get all change orders in writing. This documentation is invaluable for quality control and resolving any potential disputes.

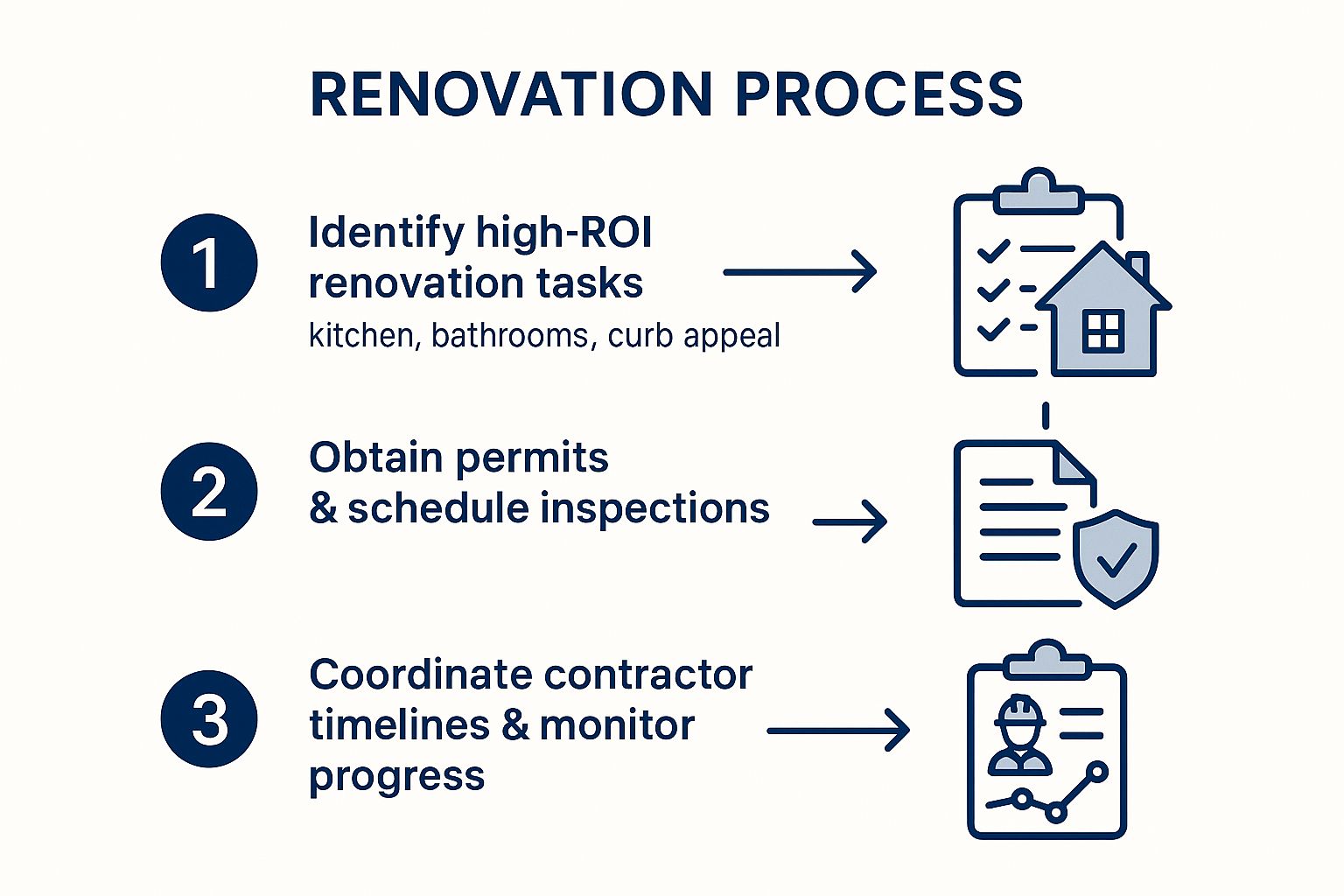

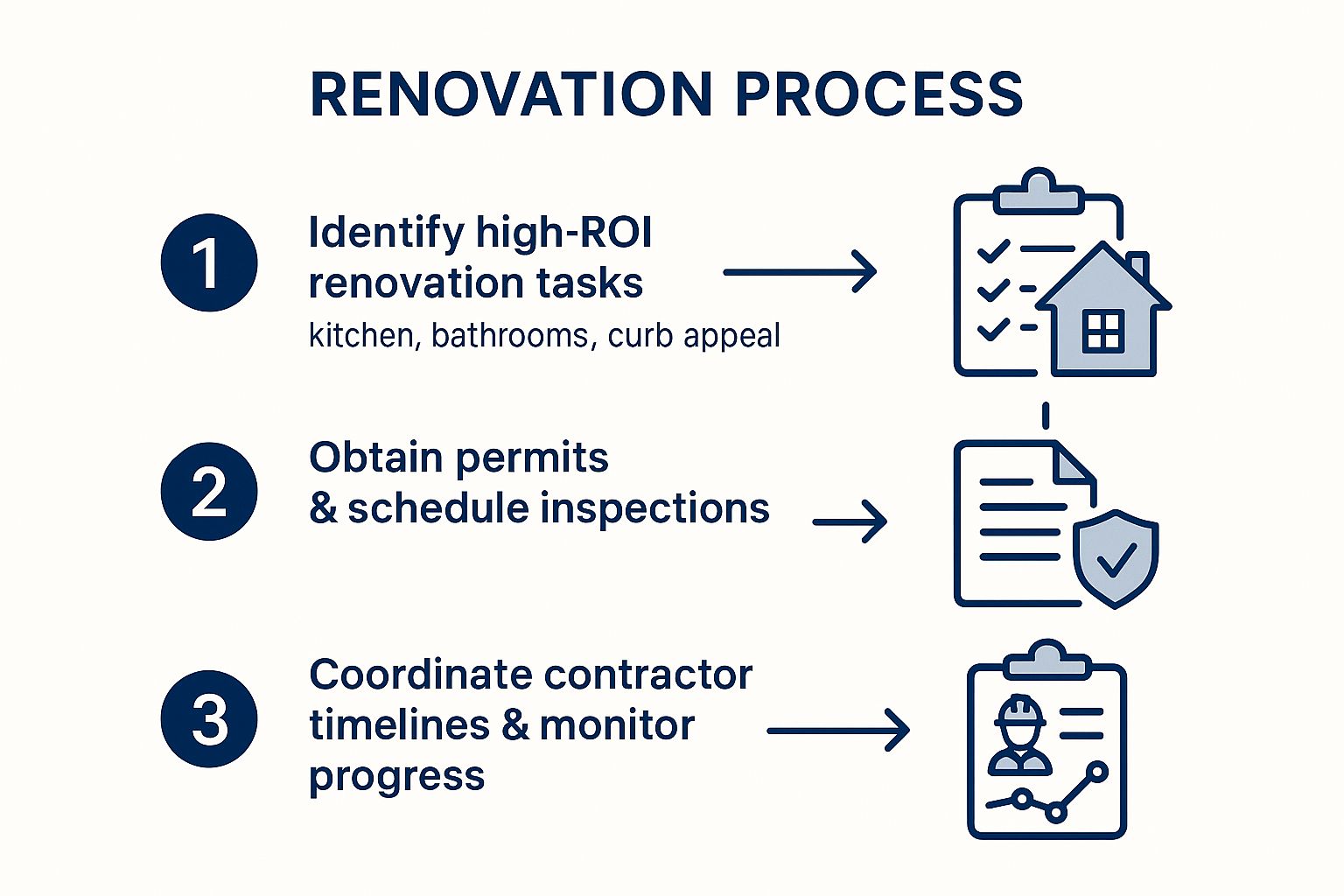

The infographic below illustrates the essential workflow for a streamlined renovation.

Following this logical sequence-identifying high-ROI tasks, securing necessary permits, and then managing the hands-on work-creates a predictable and efficient renovation process that minimizes costly delays.

5. Market Analysis and Pricing Strategy

A successful flip is a data-driven enterprise, not a speculative guess. This phase involves a deep dive into local real estate market conditions, buyer preferences, and pricing trends to inform every decision. It’s about understanding the specific economic and social factors that influence property values in your target area, allowing you to set a purchase price, renovation scope, and final listing price with confidence. Proper analysis minimizes risk and maximizes your potential return on investment.

This step is a non-negotiable part of any checklist for flipping houses because it dictates profitability from start to finish. Without a firm grasp of the market, you risk overpaying for a property, over-improving for the neighborhood, or listing at a price that alienates buyers. Industry leaders have built empires on methodologies that prioritize hyperlocal market knowledge. It’s this granular understanding that separates amateur flippers from seasoned professionals who consistently generate profits.

How to Approach Market Analysis

A robust analysis requires you to synthesize data from multiple sources to create a complete picture of the market landscape. Your strategy should be comprehensive and ongoing.

- Comparable Sales (Comps): Use the MLS, Zillow, or Redfin to analyze at least six comparable properties that have sold within the last six months and are within a half-mile radius. Adjust for differences in square footage, condition, and amenities.

- Market Trends: Monitor key metrics like Days on Market (DOM), list-to-sale price ratio, and inventory levels. A low DOM and high list-to-sale ratio indicate a strong seller's market.

- Buyer Demographics: Work with local real estate agents to understand the target buyer for your neighborhood. Are they young families who need an open floor plan or professionals seeking a home office?

Key Pricing Strategy Actions

Your analysis directly informs your pricing strategy at both the acquisition and exit stages. This is where you translate raw data into a concrete financial plan.

Key Takeaway: Your renovation budget should be dictated by market demand, not personal taste. Focus on updates that provide the highest ROI for your specific neighborhood's buyer pool, such as modern kitchens and updated bathrooms.

A well-defined pricing strategy acts as your financial guardrail throughout the project. It ensures you purchase the property at a price that leaves room for a healthy profit margin after accounting for all renovation, holding, and selling costs. This disciplined, data-first approach is the hallmark of a sustainable and scalable house-flipping business.

6. Legal Compliance and Risk Management

Beyond the physical labor of demolition and renovation lies a critical, often-overlooked framework of legal and financial safeguards. This phase is about operating your flip as a legitimate business, ensuring every action complies with local laws and regulations while proactively protecting your investment from potential liabilities. From obtaining the correct permits to structuring your business entity, proper legal and risk management separates professional flippers from amateurs.

Ignoring this part of your checklist for flipping houses can lead to disastrous consequences, including stop-work orders, hefty fines, lawsuits, or the inability to sell the property. Managing risk is as important as managing the renovation budget. For instance, forming an LLC to hold the property can shield your personal assets from business-related lawsuits, a standard practice for seasoned investors.

How to Approach Legal and Risk Management

A proactive, systematic approach is essential. Instead of reacting to problems, you should build a protective layer around your project from the start. This involves professional consultations and meticulous documentation.

- Business Structure: Consult with a real estate attorney to determine the best entity structure, such as an LLC, to protect your personal assets.

- Insurance Coverage: Work with an insurance broker specializing in real estate investments to secure appropriate policies, including general liability and a builder's risk or vacant property policy.

- Permitting: Before any work begins, identify all necessary permits required by your local municipality for electrical, plumbing, structural, and other significant changes.

Key Compliance and Protection Actions

Every decision should be made with compliance and liability in mind. This means verifying credentials, maintaining records, and ensuring every aspect of the project is above board.

Key Takeaway: Always verify that every contractor you hire carries their own valid license and liability insurance. Ask for their certificate of insurance (COI) and call the provider to confirm it's active before they set foot on your property.

This simple verification step protects you if a worker is injured on-site or causes damage to the property. Maintaining a comprehensive file with all permits, contractor agreements, insurance policies, and inspection reports is non-negotiable. This documentation is your primary defense in any potential dispute and provides peace of mind throughout the flip.

7. Marketing and Sales Strategy

After months of demolition, renovation, and meticulous finishing, the final and most crucial phase begins: selling the property. A well-executed marketing and sales strategy is what transforms your hard work and investment into actual profit. This isn't just about putting a "For Sale" sign in the yard; it's a calculated effort to attract qualified buyers, create emotional connections, and secure the highest possible price in the shortest amount of time.

Your sale strategy directly impacts your holding costs and overall return on investment. The longer a finished property sits on the market, the more you pay in taxes, insurance, and utilities, which erodes your profit margin. This is why a proactive marketing plan is a non-negotiable part of any comprehensive checklist for flipping houses. Successful flippers understand that marketing creates the perception of value and drives demand, which is essential for a fast and profitable exit.

How to Build a Winning Sales Strategy

Your marketing should begin before the last paintbrush is cleaned. A successful approach layers several key tactics to maximize exposure and appeal.

- Professional Staging: Partner with a professional stager to furnish key areas. Staging helps buyers visualize themselves living in the space, creating an emotional attachment that often leads to higher offers.

- High-Quality Visuals: Invest in professional photography and, for larger properties, drone footage. Most buyers begin their search online, and stunning visuals are the single most important factor in getting them to book a showing.

- Strategic Pricing: Work with an experienced agent to set a competitive price from day one. Overpricing to "test the market" can lead to stagnation, price reductions, and a lower final sales price.

- Optimized Online Listings: Ensure your listing on the MLS and other platforms like Zillow and Redfin features a compelling description that highlights all the new upgrades and key features of the home.

Key Sales and Marketing Actions

Executing the sale requires precision and partnership. The goal is to create a sense of urgency and desirability around the property.

Key Takeaway: Your real estate agent is your most valuable sales partner. Choose an agent with a proven track record of selling renovated or flipped properties in your target neighborhood, as they will understand how to market the unique value you have created.

By investing in a robust marketing plan, you control the narrative and position the property to attract the right buyers willing to pay a premium. This strategic final step ensures you don't leave money on the table and successfully completes the flip cycle, freeing up your capital for the next project.

7-Step House Flipping Checklist Comparison

| Aspect | Property Acquisition and Due Diligence | Accurate Budget Planning and Cost Estimation | Financing Strategy and Cash Flow Management | Renovation Planning and Project Management | Market Analysis and Pricing Strategy | Legal Compliance and Risk Management | Marketing and Sales Strategy |

|---|---|---|---|---|---|---|---|

| Implementation Complexity 🔄 | Medium to High: Extensive research and inspections required | Medium: Detailed budgeting, requires multiple quotes | Medium: Managing loans and cash flow, multiple financing options | High: Coordinating contractors, permits, and timelines | Medium: Ongoing market research and analysis | Medium: Navigating regulations, permits, and legal requirements | Medium: Coordinating marketing efforts and agent partnerships |

| Resource Requirements ⚡ | High: Professional inspections, market data, negotiation effort | Medium to High: Contractor quotes, tracking tools, contingency funds | Medium: Access to lenders, financial documentation | High: Skilled project management, contractor oversight | Medium: Access to market data and local expertise | Medium: Legal counsel, insurance, and permit costs | Medium: Photography, staging services, marketing expenses |

| Expected Outcomes 📊 | ⭐⭐⭐⭐ Prevents costly mistakes, realistic profit projections | ⭐⭐⭐⭐ Controls costs, prevents overruns, accurate profits | ⭐⭐⭐ Enables larger projects, preserves liquidity | ⭐⭐⭐⭐ Maximizes value, controls timelines and quality | ⭐⭐⭐⭐ Informs pricing and market timing, boosts sales efficiency | ⭐⭐⭐⭐ Reduces legal risks, protects assets, ensures compliance | ⭐⭐⭐⭐ Maximizes sale price, reduces time on market |

| Ideal Use Cases 💡 | Early-stage property evaluation and purchase decision | Budgeting renovation and holding costs before project start | Securing funds and managing cash flow during projects | Managing renovations, coordinating contractors and permits | Setting purchase and sale prices based on market conditions | Throughout project to ensure legal compliance and risk mitigation | Preparing property for market and optimizing sales process |

| Key Advantages ⭐ | Identifies profit potential, avoids surprises, negotiation leverage | Prevents financial shortfalls, aids financing, tracks expenses | Provides financial flexibility, enables multiple flips | Ensures quality work, controls costs/delays, maximizes ROI | Reduces risk of overpricing or underpricing, market-aware flipping | Avoids costly fines, protects investor personally and financially | Enhances appeal, speeds sale, attracts qualified buyers |

Turning Your Checklist into a Profitable Reality

The journey from identifying a potential property to cashing the final check is a complex maze of interconnected decisions. This comprehensive checklist for flipping houses provides the essential framework, guiding you through the critical phases of due diligence, financing, renovation, and sales. It serves as your strategic map, ensuring no crucial step is overlooked.

However, a map is only as good as the person reading it. The most successful investors don't just follow a list; they master the execution of each item. They understand that a small miscalculation in the budget (Phase 2) can dismantle a brilliant financing strategy (Phase 3), or that poor project management (Phase 4) can erode the profits anticipated from a savvy market analysis (Phase 5). Each step is a domino, and precision is paramount.

From Framework to Financial Success

The true power of this checklist is realized when you move from simply "completing" tasks to strategically optimizing them. The difference between a break-even project and a highly profitable one often comes down to the quality of your upfront analysis and the efficiency of your execution.

Three core principles separate amateur flippers from seasoned professionals:

- Data-Driven Decisions: Every choice, from the initial offer to the final listing price, must be rooted in solid data, not emotion or guesswork. This means meticulous ARV calculations, detailed rehab cost breakdowns, and an objective understanding of market comparables.

- Systemization: Profitability in house flipping is born from creating repeatable systems. By turning this checklist into your standard operating procedure, you minimize errors, streamline your workflow, and gain the ability to manage multiple projects simultaneously, scaling your business effectively.

- Contingency and Adaptability: No flip goes exactly as planned. The best investors build robust contingency plans into their budgets and timelines, allowing them to adapt to unforeseen challenges like hidden structural issues or shifts in the housing market without derailing the entire project.

Ultimately, mastering this checklist for flipping houses is about more than just renovating a property; it's about building a resilient, predictable, and profitable business model. It transforms a high-risk venture into a calculated investment strategy. By internalizing these phases and committing to disciplined execution, you equip yourself with the tools needed to navigate the complexities of the market and consistently turn distressed properties into desirable, high-return assets. Your checklist is not just a guide; it is the blueprint for your real estate investing career.

Ready to elevate your property analysis and streamline your due diligence? The Flip Smart platform automates the most critical parts of your checklist, from accurate ARV calculations to detailed rehab cost estimations, helping you find and fund profitable deals faster. Stop guessing and start analyzing with data-backed confidence by visiting Flip Smart today.